Skift Take

AWS and Skift’s 2021 Digital Transformation Report offers an important guide for the travel and hospitality industry as it embraces emerging digital realities and opportunities. This article takes a closer look at the report’s findings regarding strategies for digital transformation among travel companies in the Asia-Pacific region.

This sponsored content was created in collaboration with a Skift partner.

The Covid-19 pandemic placed new digital demands on travel and hospitality companies, creating an urgent need for solutions to address them. Yet even prior to recent events, a clear mandate was already emerging: Digital transformation, a philosophy that promotes digital-first business practices, toolsets, analytics, and ways of working, will be critical for companies to adopt in order to weather changes caused by the pandemic and ensure their long-term success.

Much like the pandemic itself, the travel and hospitality industry’s progress with digital transformation is not evenly distributed across the world. Various markets illustrate diverging business priorities, consumer cultural differences, and technology investment strategies. To help better understand some of these differences, this article examines key highlights from Amazon Web Services (AWS) and Skift’s recent 2021 Digital Transformation Report, with a more detailed focus on trends in Asia-Pacific in comparison to other geographic regions when it comes to digital transformation strategies for travel companies in different parts of the world.

After bearing the brunt of the initial wave of Covid-19, Asia-Pacific was under heavy travel restrictions for most of 2020 and continues to be today. In response, travel companies in the region have taken the time to revamp customer experience initiatives as they recalibrate digital transformation strategies for a post-Covid world. Survey data from the report shows that they are on the leading edge of using cloud technology, artificial intelligence and machine learning solutions.

2020’s Impact on Digital Strategies

The pandemic created a difficult business environment for travel and hospitality companies around the world, but perhaps nowhere was this more true than in Asia-Pacific. The region’s fast-growing travel sector was hit hard by the extensive restrictions on international flights that were in place for much of 2020.

For instance, across Asia-Pacific, 36 percent of travel executives said Covid-19 had a large, negative impact on digital transformation plans for technology investment and deployment within their businesses, in comparison to 27 percent of global respondents who reported feeling similarly robust impacts.

The silver lining to this disruption is that it seems to have accelerated digital readiness among travel and hospitality organizations in the region, with local leaders mentioning significant enthusiasm for investment in digital analytics capabilities and cloud computing strategies. These strategies are likely to bear greater fruit in the years ahead as the global travel industry undergoes a more significant rebound.

Even if it’s been an unprecedented year for travel and hospitality businesses in Asia-Pacific, leaders in the region say they are confident they have the digital capabilities to compete in a digital world. Responses from Asia-Pacific executives were essentially the same as their counterparts at the global level. Thirty percent of Asia-Pacific respondents said their organization was “ahead of the curve (nearly equal to the percentage of global respondents who said the same), while 61 percent said they “keep pace” (also in line with the global response).

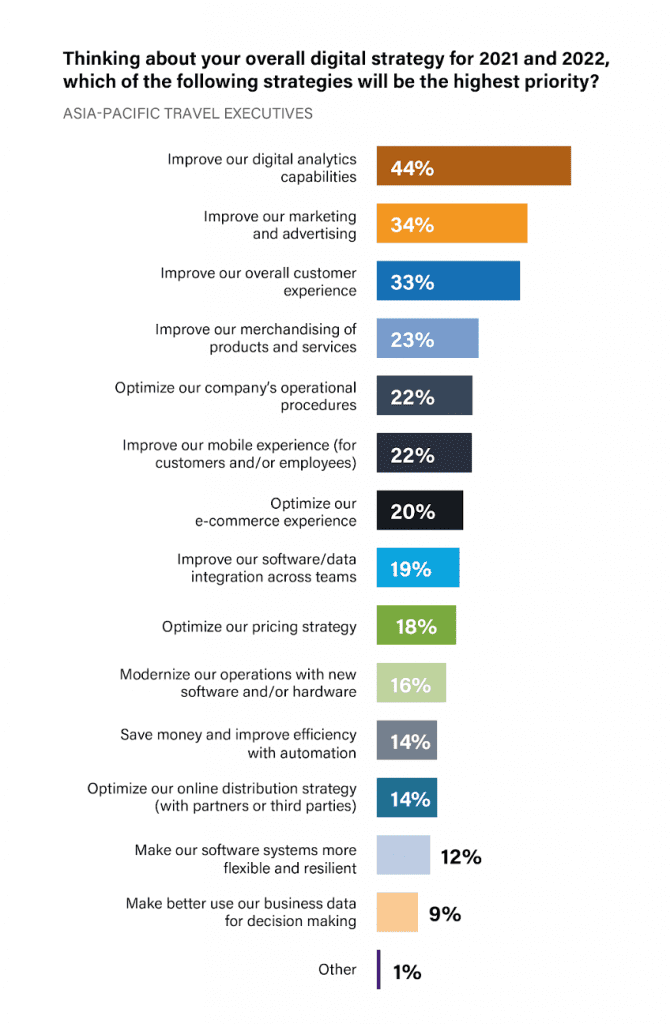

However, when digging deeper into the digital priorities of executives in the region, a number of key differences emerged. One example is in the realm of digital strategies for 2021 and 2022. Forty-four percent of Asia-Pacific executives said they plan to invest in improving their digital analytics capabilities, 13 percentage points higher than the same response among global travel and hospitality executives. This sentiment aligns with the desire to remain competitive in the digital world, as the proper maintenance and improvement for digital operations and customer experience relies upon quality data that’s easy to access.

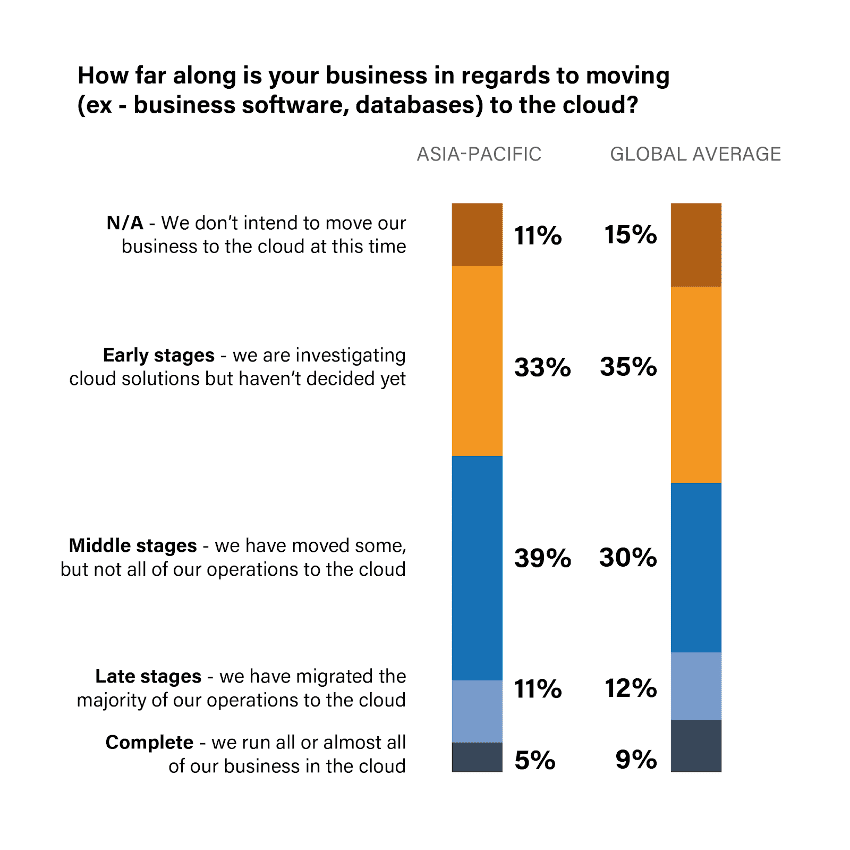

In addition to prioritizing digital analytics, executives in Asia-Pacific said their companies are further along in their development of cloud computing resources than the global average. Thirty-nine percent of respondents said their businesses were in the “middle stages” of moving their business to the cloud, compared to 30 percent globally.

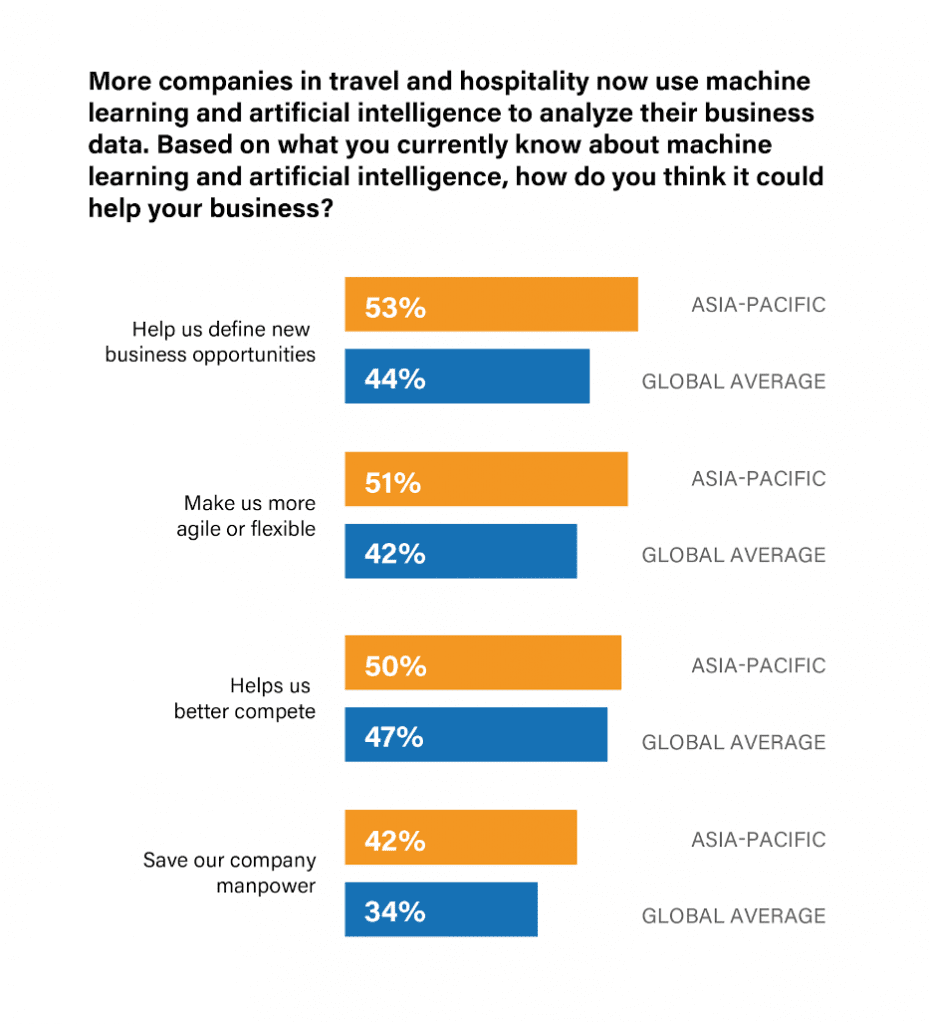

When it comes to data processing, travel companies in Asia-Pacific are more confident in certain aspects of artificial intelligence and machine learning as well. Fifty-three percent of executives in Asia-Pacific said that they believe these advanced technologies could help them define new business opportunities, 51 percent said this tech could make their companies more agile or flexible, and 42 percent believe that they would save manpower. Compare those responses to the global averages of 44 percent regarding new business opportunities, 42 percent with respect to flexibility and 34 percent sharing the belief that AI and ML will create more efficient workforces.

“Machine learning is absolutely becoming a differentiator for travel and hospitality companies,” said David Peller, global head of AWS Travel & Hospitality. “It’s really in a couple of areas: the personalized experience, recommendations and offers area, and then particularly around forecasting and using data to help drive a clearer understanding of demand potential for your business. And then also how to satisfy that demand and how to resource that demand in your business.”

Privacy and Security Remain a Major Concern

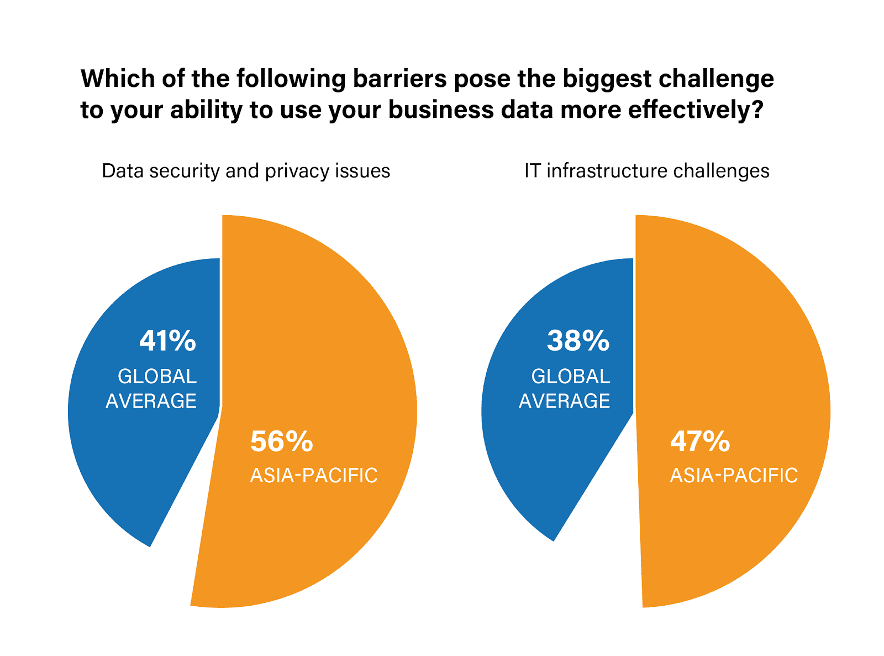

Despite the willingness to pursue and invest in advanced technologies, data privacy and the IT infrastructure required to manage data securely are a major concern for executives in Asia-Pacific — much more so than executives in other regions of the world.

Fifty-six percent of survey respondents in the region said data security and privacy was the biggest challenge in using business data more effectively, in comparison to just 41 percent of respondents in the rest of the world. Meanwhile, 47 percent of Asia-Pacific executives said that IT infrastructure challenges stood in the way of their ability to use data effectively, in contrast to 38 percent of companies in other regions.

Meanwhile, 27 percent of Asia-Pacific executives said data and security was the biggest barrier to investing in cloud-based IT and software solutions, the number one concern among these firms. Just 14 percent of travel executives across the survey said that this was one of their top three issues.

The good news is that cloud technology is actually the solution for many of these concerns, rather than being the source of them.

“There are five core advantages of cloud computing,” said Peller. “First, it’s the agility that the cloud provides, with the ability to deploy services very quickly. Then comes cost savings that come from paying only for the services you need and use. Elasticity, the ability to scale up and scale down as needed, enables customers to provision what they need to meet demand. And from there, customers tell us they are able to innovate much faster. Then finally, as it’s relevant to many in travel and hospitality, to really go global in moments—which in a traditional, on-premises environment would be very challenging to do.”

Transforming the Customer Experience

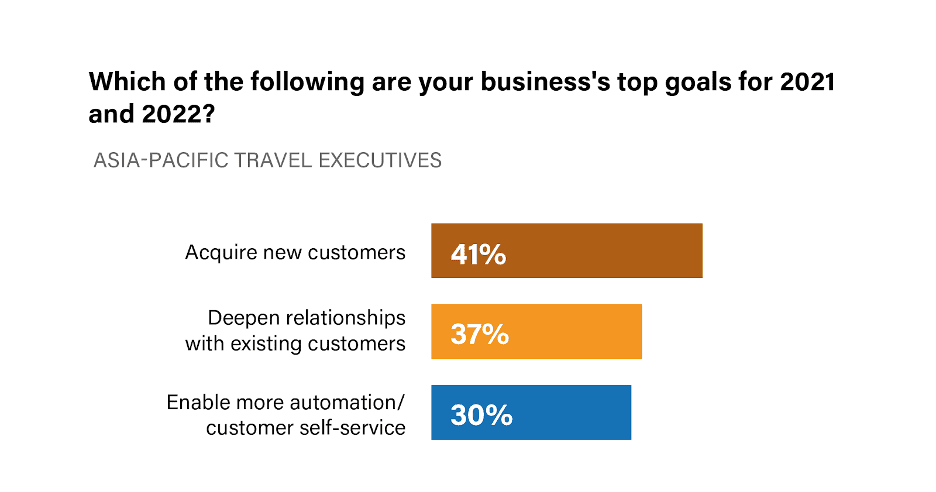

Across the survey, acquiring new customers was the number one business goal for companies throughout the world in 2021 and 2022. However, a focus on existing customers was a higher priority in Asia-Pacific than in the rest of the world. For example, 37 percent of executives in the region said deepening existing customer relationships was among their top three business goals, in contrast to the global average of 30 percent. Thirty percent of Asia-Pacific respondents also said that enabling more automation and customer self-service was a top-three priority, compared to 23 percent globally. The latter response among global executives was only the seventh-highest business priority across the survey.

These sentiments translated to the areas of the customer experience that will be the most important areas of focus in 2021 and 2022. Among Asia-Pacific executives, 48 percent said developing new products and services was their number one priority in the next two years, in comparison to 41 percent in the rest of the world. This objective was just the third-highest priority in the survey at large.

Ultimately, these results show that the travel industry across the world is enthusiastic about digital transformation initiatives, which increasingly is becoming synonymous with migrating systems to the cloud. Those trends are amplified in Asia-Pacific, where the pandemic has pushed companies to invest further in data-driven customer experiences.

To learn more about how digital transformation is impacting travel brands worldwide, make sure to download the full Skift and AWS report.

This content was created collaboratively by AWS and Skift’s branded content studio SkiftX.

Have a confidential tip for Skift? Get in touch

Tags: AWS, digital experience, digital transformation, skiftx, SkiftX Showcase: Technology