Lufthansa Frequent Flyer Program Tests a Direct-to-Consumer Warby Parker Model

Skift Take

Since the pandemic started, Lufthansa and other airlines have been desperate to get customers back in the air. But they've been attempting to revive travel without having loyal customers redeem miles for free flights — a practice that's less lucrative than persuading travelers to redeem miles for non-flight rewards instead.

One of Lufthansa Group's attempts this year to innovate in mileage redemption involves a fresh twist on consumer database marketing. The German company has encouraged members of its Miles & More loyalty program to sign up for a deals site called Dezerved, which loyalty tech vendor Loylogic Group launched earlier this year. The members-only online shop lets Lufthansa's elite members buy luxury goods and services at a discount with a mix of miles redemptions and payments.

"Travel and luxury brands have a huge interest in building direct relationships with consumers, given the success of companies like Warby Parker with direct-to-consumer models," said Dominic Hofer, CEO of Dezerved and Loylogic. "We give these brands a platform to acquire proven loyal customers. We call it a direct-to-loyal-consumer model."

While Lufthansa officially joined earlier this year, Dezerved, privately owned and based in Zurich, has only recently filled out its marketplace. Brands that have signed up include carmaker Aston Martin, watchmakers Omega and Parmigiani Fleurier, electronics manufacturers such as Bang and Olufsen (B&O) and Sennheiser, fashion houses Gucci and Prada, and five-star resorts from the Six Senses group.

Join Us at Skift Global Forum in NYC September 21-23

To be sure, it's not new for Lufthansa and other carriers to do mileage redemption partnerships with retailers. For instance, last month Lufthansa used its WorldShop e-commerce site to offer batches of whiskey and rum made exclusively for its mileage members by the distiller Sansibar Sylt.

What's different with Dezerved is that it provides luxury brands with a few ways to create a direct relationship with consumers, avoiding third-party acquisition channels.

The platform isn't a store itself, unlike duty-free shops such as Heinemann. Once a member makes a purchase, the platform hands off the customer to the brand for the fulfillment of the order. Dezerved alternatively lets brands sell vouchers, sort of like a pre-paid gift card, that shoppers can then use at a brand's own site or shop to complete a purchase directly. Brands can also run contests that similarly end in forming a direct relationship with loyal consumers.

Other airlines have run similar experiments this year. American Airlines teamed up with wine club Vinesse to cross-promote to its database of customers selected wines for delivery by mail.

Appealing to Luxury Brands

Dezerved does a bit more than what's typical to encourage a customer hand-off to a retailer in ways that make high-end luxury brands comfortable. That's partly because it's the creation of Loylogic, a tech vendor with experience since 2005 in helping both travel and non-travel brands with loyalty solutions. Loylogic offers branded (white-labeled) points commerce solutions for companies, such as American Express's Centurion cards, Nestle, and Procter & Gamble.

Dezerved is a members-only site that disguises the precise value of the discounts offered by requiring all purchases to include miles or at least partial mileage redemption. For instance, a watch that sells elsewhere at a retail price of $13,000 might be available for $9,000 plus, say, 1,600 Lufthansa frequent flier miles. The opaque offers let luxury retailers avoid price wars against their retail rates advertised elsewhere. Brands can also limit their offers to customers in specific countries. Individuals who don't belong to a partner reward program have to pay a fee, currently $72 a year, to join.

For Lufthansa, the partnership with the e-commerce platform offers a way for it to get rid of many outstanding air miles in a more cost-effective manner than issuing reward travel itself.

"While flying an additional passenger for free might only be a nominal cost for an airline, accounting requirements typically make flight-based redemptions costlier than the alternative of redemptions for non-flight rewards through retail partners," Hofer said.

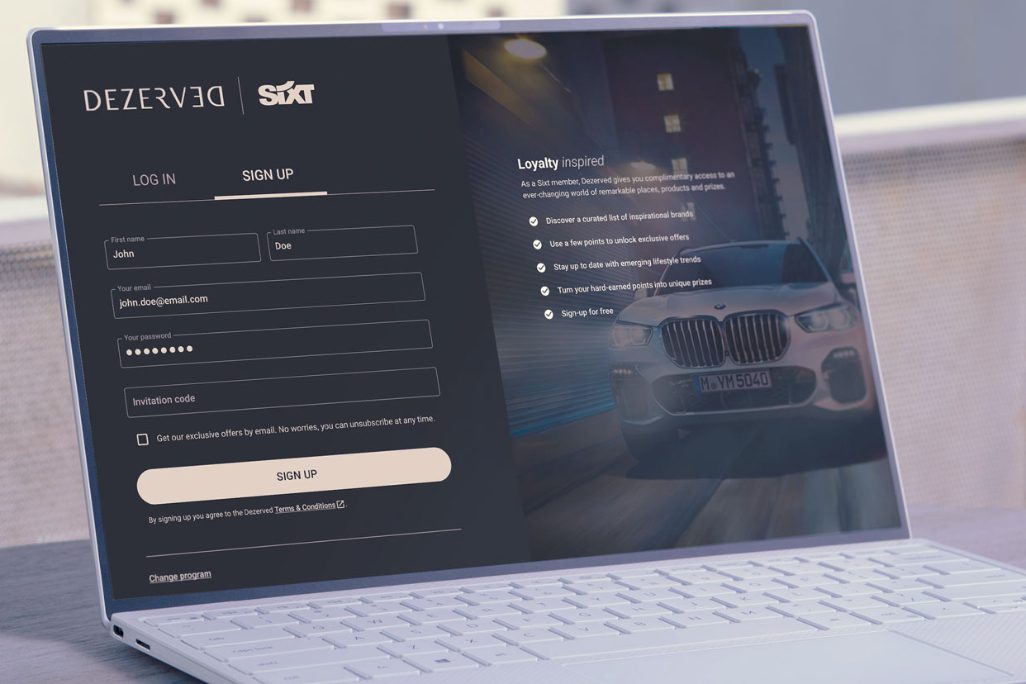

Travel brands can use Dezerved to engage with their most profitable customers even if they lack a full-fledged loyalty program. For example, Sixt, the Germany-based rental car company, began last week to alert its most valuable customers that they qualify for a free membership to the deals site. While Sixt does have a loyalty program, it's pretty basic compared with Lufthansa's.

The landing page for members of the Sixt loyalty program on Dezerved, a members-only deals site. Source: Loylogic.

Dezerved also can control what members of a loyalty program can see in terms of relevant offers.

"The hotel group Jumeirah is in the process of joining Dezerved and letting its loyalty program members have free access," Hofer said. "We will obviously steer the content those members see. No Jumeirah member will find any offers from Jumeriah hotels or offers from competitors like Shangri-La on the platform."

Other programs in talks to join include a real estate group in Dubai and two "very large" credit card brands, Hofer said.

Dezerved is a small project that may not pan out, given the odds against most small projects. But its underlying concept illuminates a broader opportunity.

Promises of Brand Control

For travel brands, control is one promised advantage of working with Dezerved. Because all deals require the use of at least some miles or points to work, a brand can cut participation at any time it wants by shutting off the ability for members to sign in to Dezerved with their rewards program loyalty credentials. The travel brands also avoid sharing the customer databases with any outside party because customers voluntarily provide their personal information only at the point they're making a purchase so that they can receive their item.

One reason why eyewear maker Warby Parker gained traction over the past decade of direct-to-consumer sales was how it marketed itself as a "challenger" brand, offering consumers something new in the market.

"We feel there's a real opportunity to offer the classic brands in luxury while also informing members about challenger brands in specific categories that are up and coming," Hofer said. "Dezerved could really add value then for consumers by helping to introduce fresh brands in the premium segment."

The CEO declined to reveal any early numbers on success so far.

"All I can say is that it's still early but after a couple of months in the making we have a community that's about half the size of one of the banking magazines," Hofer said, alluding to publications such as Credit Suisse's Bulletin — and coyly implying it has at least 20,000 members so far.

Dezerved earns revenue from a cut of transactions but also sales of advertising, treating listings of products or prize promotions as marketing or ad placements.

Dezerved's parent company Loylogic has been on the scene for a while. Loylogic also offers an online button for online merchants that lets consumers pay for purchases by either redeeming miles — or points or earn miles and points through shopping.

Rival tech vendors included CTM Loyalty, iSeatz, Points.com, and Switchfly.

The "direct to loyal consumer" model offers the promise of selling to upper-tier customers that have demonstrated their interest in loyalty and exclusivity by belonging to the rewards programs.

Travel brands with substantial loyalty programs have databases of exactly these kinds of desirable customers. Expect to see more attempts to help bridge the gap emerge as the pandemic slowly recedes and travel brands seek fresh ways to monetize their assets.

"Luxury brands know that Generation Z isn't very loyal, on average," Hofer said. "They're looking for innovative ways to connect with consumers who are actually loyal. They want shoppers who have the 'loyalty gene,' so to speak, which is what elite members of travel loyalty programs have and need to make better use of."