Skift Take

The conventional wisdom is that hotel brands are a safe harbor for owners during a storm. But has that been the case during Covid-19? Recent data suggests that the reality is far more nuanced.

In our latest report, Skift Research analyzes the U.S. hotel owner landscape to examine the key issues facings this important part of the travel sector in 2021.

The report primarily focuses on what we believe to be the most important decision a U.S. hotel owner has to make: whether to affiliate their property with a franchise brand or to distribute and market the hotel independently. This excerpt will look at the relative performance of brands vs. independent hotels as they recovered from Covid-19.

The conventional wisdom is that branded hotels perform better during downturns, but we received surprising research that show the reality is much more nuanced.

Who Performed Better During the Pandemic?

After all of this comparison between branded and independent hotels, one may be tempted to look for black and white answers about which performs better. This is ultimately an impossible question to answer definitively. Hotel performance is mostly determined on a case-by-case basis specific to each property’s location, market, and management. Nonetheless, there are some interesting insights to be gained by taking a look at broad performance differences between chain scales, across distribution types, and within brands.

Independents Held in Well Against Brands During COVID

JLL Hotels & Hospitality Research, in an analysis performed for Skift, looked at hotel performance across branded chain scales and independent properties. They found that year-to-date through May 2021, revenue-per-available-room (RevPAR) at independent properties was 76 percent recovered relative to 2019. For comparison, the average branded property’s RevPAR is only 68 percent recovered vs 2019. That means that the average independent has actually outperformed their branded peers during the crisis, though there is a lot of nuance to this conclusion.

JLL was able to slice this RevPAR performance by branded chain scales to provide us with the details of this performance. What this analysis reveals is that independents actually performed better than most branded hotels in the luxury, upper upscale, upscale, and upper midscale segments. On the other hand, the midscale and economy sectors well outperformed independents.

We can also decompose RevPAR into its two core drivers: rate and occupancy. Let’s take rate first.

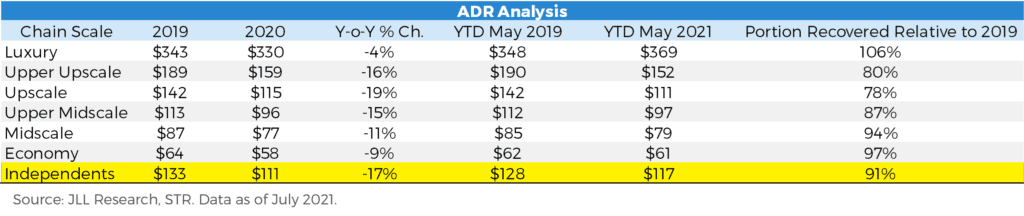

Across the board, hotel industry pricing power has held in very strongly during Covid. This is one of the biggest silver linings of this crisis that makes it different from past recessions in 2008 or 2001. Independent ADR is currently at 91 percent of 2019 levels vs. 90% at branded hotels, for all intents and purposes identical. By chain scale it’s interesting to note that luxury hotels — one of the worst on a RevPAR basis — are doing the best on an ADR basis and has not just fully recovered but even taken a 6 percent pricing power lead over 2019.

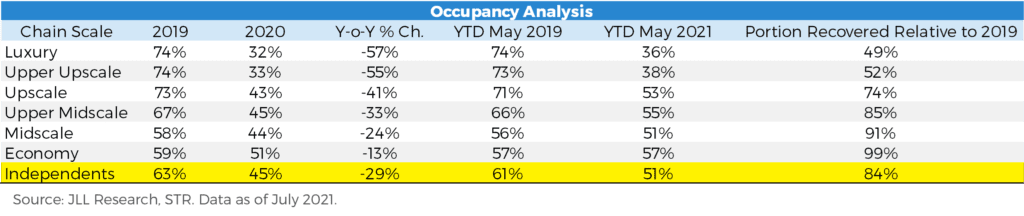

With ADR fairly consistent, it should be no surprise that occupancy is the primary driver of diverging performance. Independent hotels are 84 percent recovered on occupancy vs. 75 percent for brands. But the branded chain scales have a wide spread. Luxury has had the hardest time filling rooms, 49 percent recovered, while economy brands have done the best job, 99 percent recovered.

Why did independents seem to have a slight edge over brands? It’s hard to say as there are many factors at play. For starters, independents tend to be smaller properties with 67 rooms on average vs. 109 rooms at the average branded hotel. This means it is easier for them to refill their occupancy rates at the same level of demand, and as discussed occupancy was the main reason for average independent outperformance.

It also could have to do with how the averages themselves are calculated. In terms of pre-Covid RevPAR, ADR, and property size, the average independent was most comparable to a branded upper midscale or upscale property. Those two chain scales have recovered on a RevPAR basis 85 percent and 74 percent, respectively, that’s very similar to the independent space’s 84 percent recovery. So the appearance of independent outperformance could just be a statistical artifact of benchmarking them against non-comparable chain-scales, such as branded luxury, which dragged down the overall branded average.

Finally we note that this performance differential could easily reverse as the recovery continues. Luxury hotels have had the worst RevPAR performance year-to-date but they are the only segment with positive ADR growth. With demand coming back so quickly to the travel industry, and with consumer savings bolstered over the pandemic, we can envision a scenario where luxury occupancies quickly snap back and drive it to the top of the RevPAR charts.

Subscribe now to Skift Research Reports

This is the latest in a series of research reports, analyst sessions, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision-maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report à la carte at a higher price.

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch

Tags: hotel brands, independent hotels, revpar, skift research