Skift Take

As Covid-19 recovery continues, hotels must turn their attention back to a concern that’s been growing for years and promises to accelerate rapidly as guests come flooding back: rising cancelations.

As guests return to hotels amid the lingering coronavirus pandemic, hospitality professionals might be popping the champagne as bookings steadily climb. But the renewed energy of the travel sector comes with its own challenges.

Avvio’s new white paper, ‘We Need to Talk About Cancelations’, tracks this prominent challenge for hotel management and offers strategies to address the problem. Based on an analysis of 2.3 million direct booking transactions from 400 hotel websites in multiple countries between 2016 and 2019, the paper offers new insight that can help hotels plan for the future.

SkiftX looks at the key takeaways.

CANCELATION RATES ARE STEADILY RISING

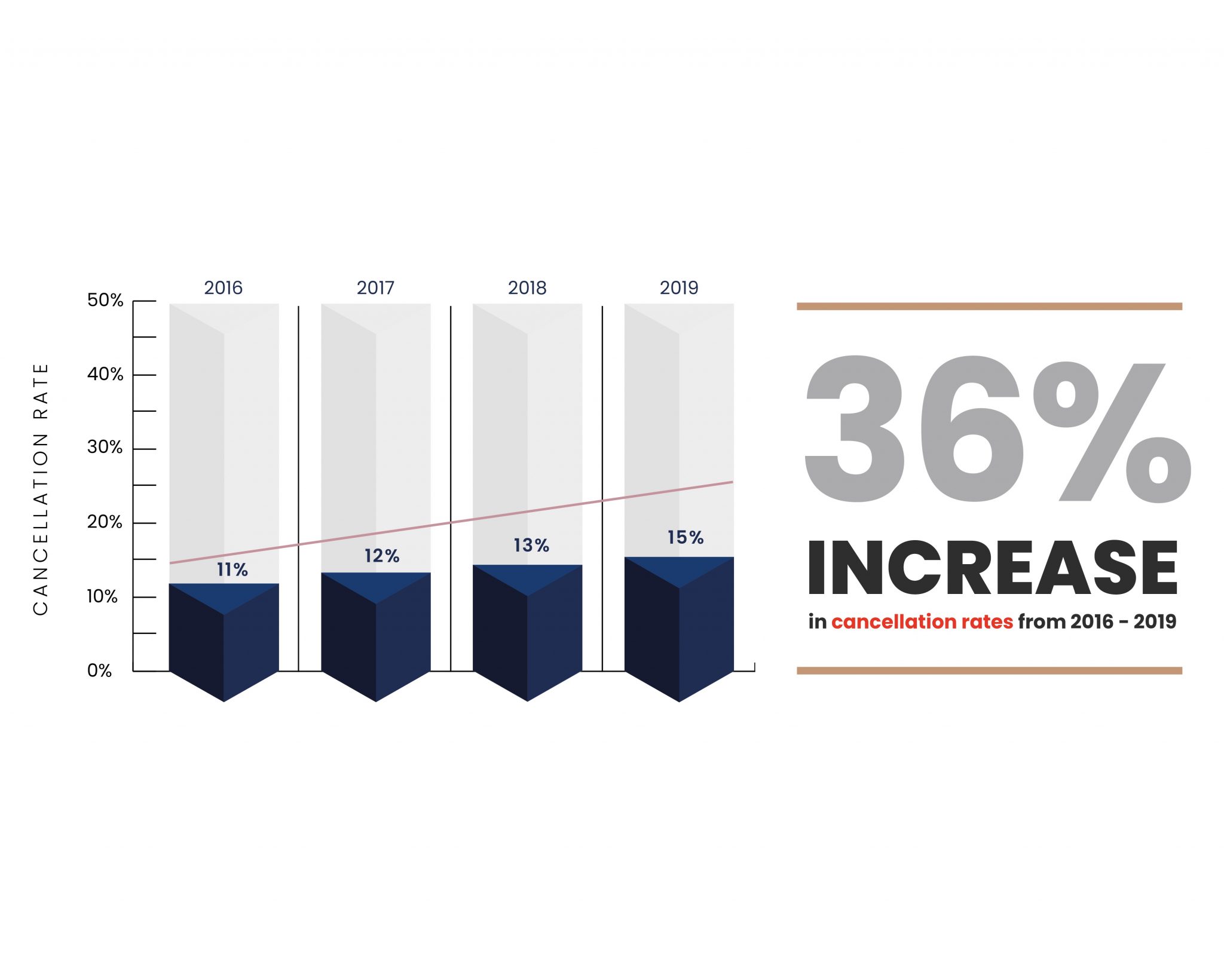

According to Avvio’s research, cancelation rates are rising steadily year upon year, with a 36 percent increase in cancelation rates from 2016 to 2019. This is, of course, costing hotels money: Cancelations were responsible for a 15 percent share of lost revenue in 2019, up from 11 percent in 2016.

The core cause of this increase is “booking infidelity” in which travelers continue researching hotel options after booking at one or several hotels. This is only possible due to the growth of penalty-free cancelations, which many hotels now offer to increase booking rates.

MARKETING ROI IS ERODED BY HIGH CANCELATIONS

Along with the revenue lost directly from cancelations, hotels also lose money when they spend on digital marketing to attract would-be guests who don’t end up staying. Digital marketing ROI is typically based on how many direct bookings a marketing effort generates, without tracking whether those bookings are later canceled.

Avvio estimates that in 2019 UK hotels spent more than £11.5 million on digital marketing that resulted in a booking cancelation with no penalty. Examples like this make it evident that assessments of marketing ROI are insufficient without comprehensive information on how many of the marketing-generated bookings are retained and how many are canceled.

CANCELATIONS WILL BE AN ACUTE PROBLEM IN 2022

Avvio predicts that hotels will face direct cancelation rates of 20 percent or more in 2022. There are a number of factors contributing to this continued rise. Covid-19 has heightened guests’ expectations of flexibility in booking. And the return of travel is creating a highly competitive market for hotels.

Another factor are online travel agencies, which are likely to increase guest loyalty programs to gain market share. According to Skift’s recent Hotel Direct Booking Outlook in 2021 report, more than half of hotel bookings come from these third-party channels despite hoteliers’ many efforts to increase direct bookings.

Additionally, new technologies are emerging that allow travelers to monitor rates post-booking and to automate rebooking to get lower rates at other hotels.

HOTELIERS SHOULD FOCUS ON BOOKING RETENTION

A booking retention strategy is now a necessity for any hotel competing for guests these days. This strategy starts with analyzing cancelation patterns to gain an understanding of the dynamics at work in a given hotel.

Booking segmentation allows for discovery of which types of guests are more likely to cancel. For example, Avvio’s research found that in general, couples have a much higher cancelation rate than families, with 66.7 percent of lost revenue from cancelations due to couples changing their plans.

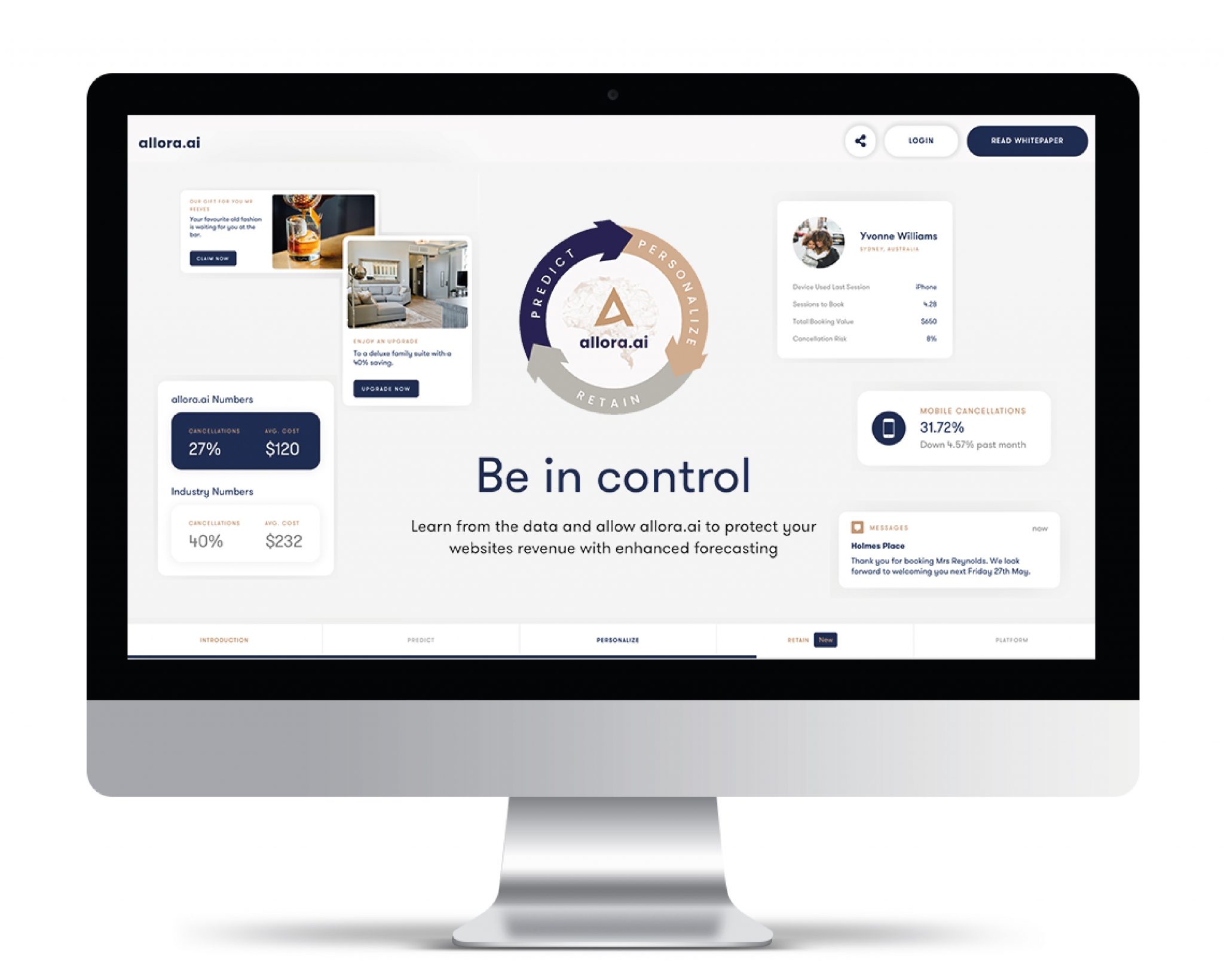

allora.ai focuses not only on the personalized booking conversion event, but also the active identification and retention of bookings at risk of cancelation.

This is a good start, but with AI-enabled tools, it’s possible for hotels to pinpoint which individual bookings within a given segment are most likely to be canceled. This analysis provides a cancelation risk score for each booking that responds to changing market conditions. It’s difficult to take a targeted approach to decreasing cancelations without tools that pinpoint which reservations are at most risk of cancelation.

Avvio tackles this industry challenge head-on with the latest evolution of its AI Booking Engine, allora.ai, which now focuses not only on the personalized booking conversion event, but also the active identification and retention of bookings at risk of cancelation.

BOOKING RETENTION SHOULD BE SEEN AS A KPI

When assessing ROI of marketing efforts, the principal success metric is often identified as booking acquisition, with a key KPI being cost per acquisition. But acquiring a booking is only half the story; whether the booking is retained is equally important.

Hotels should go beyond traditional KPIs to incorporate this element of the equation, looking not only at acquisitions but also rates of retention. One option is to move from measuring revenue per available room (Gross RevPAR) to profit per available room (Net RevPAR), a strategy that takes “hidden” costs like marketing expenditure and loss from cancelation into account.

Gaining a better understanding of cancelations and how to measure their impact will help hotels gain a better grasp of effective marketing and management. It’s important to go beyond thinking of booking acquisition as the principal metric of success. Retaining guest bookings is an equally important goal.

This content was created collaboratively by Avvio and Skift’s branded content studio, SkiftX.

Have a confidential tip for Skift? Get in touch

Tags: coronavirus, direct booking, marketing, report, SkiftX Showcase: Hospitality