Skift Take

The relative stability found in the U.S. will help companies in the online travel agency and vacation rental orbit fuel growth for the next few years — but don’t completely write off Asia and Europe. Most major hotel companies see those regions as the way to continue adding thousands of hotels to their portfolios.

The pre-pandemic U.S. was known for being a stable market for many travel sectors rather than a widespread growth opportunity like Asia. But that stability has several companies in the online travel agency and vacation rental space wanting to beef up business rather than look abroad.

Expedia is the top online travel agency in the U.S. while Airbnb is a leader for vacation home rental distribution, but Booking Holdings CEO Glenn Fogel emphasized earlier this year U.S. growth is a top priority. There are also a variety of newer ways to distribute hotels through entities like TripAdvisor Plus, Google Hotel Ads, and Costco Travel from the big-box retailer.

Add it all up, and you have what researchers at Bernstein call “Battlefield America” in a report out this week.

“[The U.S. is] the most valuable market if you can get it right. It’s been the most consolidated market, but it’s the one where we’re probably seeing the biggest shift in the structural dynamic,” said Richard Clarke, a managing director at Bernstein who covers hotels and the OTAs.

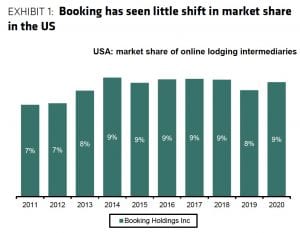

Booking Holdings wants to grow in the U.S., but its market share has hovered just under 10 percent for years. (Source: Bernstein/Euromonitor)

Upending Expedia’s dominance has been a Booking ambition for several years, but the pandemic recovery stands to be the right time to strike. Booking is offering $50 credits to Americans who book a trip by the end of the month, and Bernstein notes subscription-based competitors like TripAdvisor Plus and Costco Travel are similarly offering deals and incentives.

Much of this battle royale for the American traveler has to do with these companies craving whatever stability the U.S. economy can provide in a very uncertain global travel recovery.

Given leisure travel continues to lead the comeback, there is also the opportunity to appeal to newer customers who don’t have as much brand loyalty as road warriors and business travelers.

“You can throw a lot of money at some markets only to find that things go wrong,” Clarke said. “It’s not that the opportunity is bigger in the U.S., but the resilience of the market is much better because it’s predominantly domestic, there’s less of an infringement on civil liberties, and you’ve probably got more faith in the economy remaining strong.”

Asia Still Poised for Hotel Growth

The talk of the U.S. as the center of travel growth may seem at odds with what the executives at so many companies, particularly hotel brands, have said in recent weeks. Hotel companies especially view Asia as the next growth frontier, given soaring labor and construction costs in the U.S.

“But the good news for us is the world’s a big place, and the pressures are not the same in all places in the world, particularly recognizing that the place where we have the second-biggest chunk of our growth is Asia,” Hilton CEO Christopher Nassetta said earlier this month.

Clarke isn’t denying Asia is emerging as the next center of growth for hotels. Even Europe has plenty of growth opportunities, as both regions have significantly less branded existing hotels than the U.S., where about 70 percent of the hotels are attached to a major brand.

The fewer branded hotels in Asia and Europe present an opportunity for major brands to go in and convince those independent hotel owners to take on a flag affiliation, a deal known as a conversion.

“I don’t disagree from [the hotel company] point of view that they’ve got a much bigger opportunity in Asia and probably Europe than they do in the U.S. just because branded penetration is lower in those markets,” Clarke said. “I think that you’ve got a bigger sort of middle-market conversion opportunity in Asia and Europe.”

The Vacation Rental Distribution Conundrum

Along with OTA growth in the U.S., Clarke and the Bernstein team see shifts emerging in the vacation rental market driven by the supply-demand imbalance.

“I think you’ll potentially see the industry underneath the platforms begin to become more sophisticated, even consolidate, and begin to sort of think about the idea of self-distribution the way the hotel industry does,” Clarke said.

Just as Marriott and Hilton market their own websites as the best way to score the lowest prices on hotel rooms relative to OTAs, something similar may emerge on the management company side of the vacation rental market to combat the 15 percent fees Airbnb and other major distribution channels charge.

The summer surge, where there seems to be more travelers than there are available homes in markets from Nantucket to Santa Barbara, may cause more management companies and individual owners to realize they don’t even need the assistance of a distribution platform to connect with renters. That could be a headache on top of the growth battle between Airbnb, Vrbo, and Booking.

“Especially in a world where there is a supply-demand imbalance, why are you giving up 15 percent of your economics?” Clarke said. “In theory, there’s plenty of demand out there, you shouldn’t be leaning into those platforms to get those demand prospects.”

Have a confidential tip for Skift? Get in touch

Tags: airbnb, booking holdings, coronavirus, coronavirus recovery, expedia, hilton, vrbo

Photo credit: The U.S. will lead the world in growth and competition among online travel agencies and vacation rental platforms for the next few years, according to Bernstein. Saravarad85 / Wikimedia