Skift Take

Buying a compelling travel domain like Trip.com and thinking it ensures success is like the people who buy a restaurant and think they can run it because they are foodies. Several major travel companies squandered the Trip.com domain because it was a side hustle. Moral of the story? A brand is only as good as the real-world business behind it.

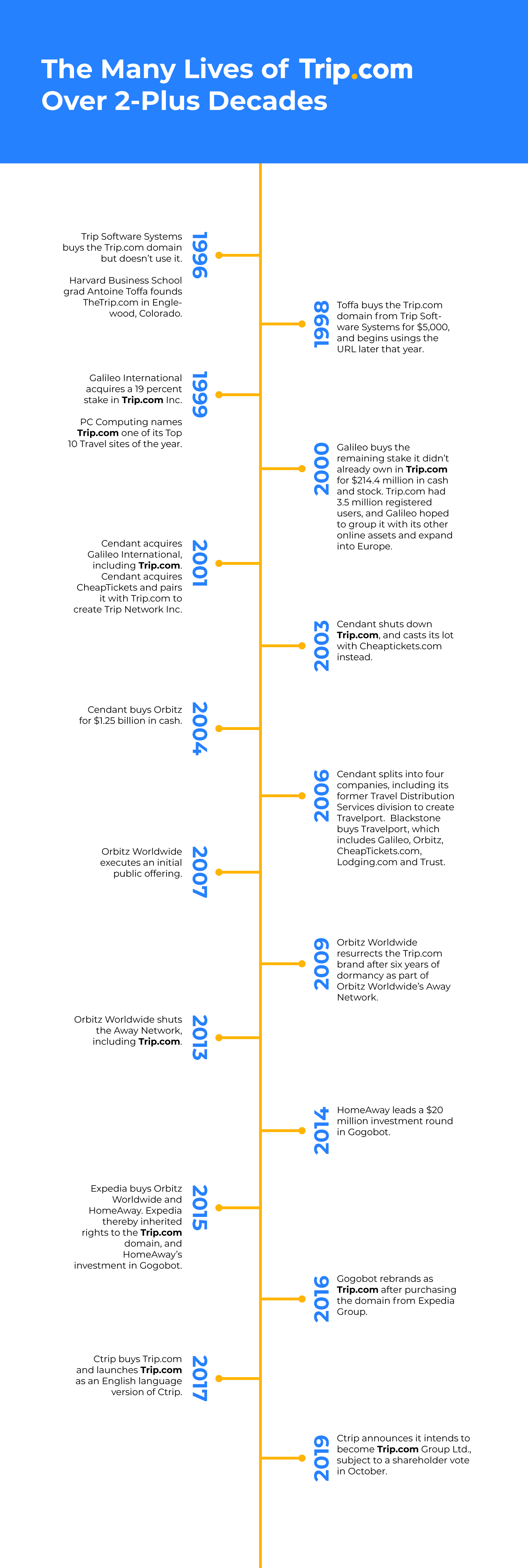

As Chinese online travel agency Ctrip gets set to change its name to Trip.com Group Ltd. next month, the company — and the world — may not be fully aware of the very hot-and-cold history of the brand under a half dozen or so owners over 23 years.

The hit-or-miss track record of companies using the Trip.com domain, of course, is not a reason in itself to abandon that brand or embrace it because history shows it’s the business behind a brand that makes or breaks it. Not just a name — and it’s a pretty good name for a travel business.

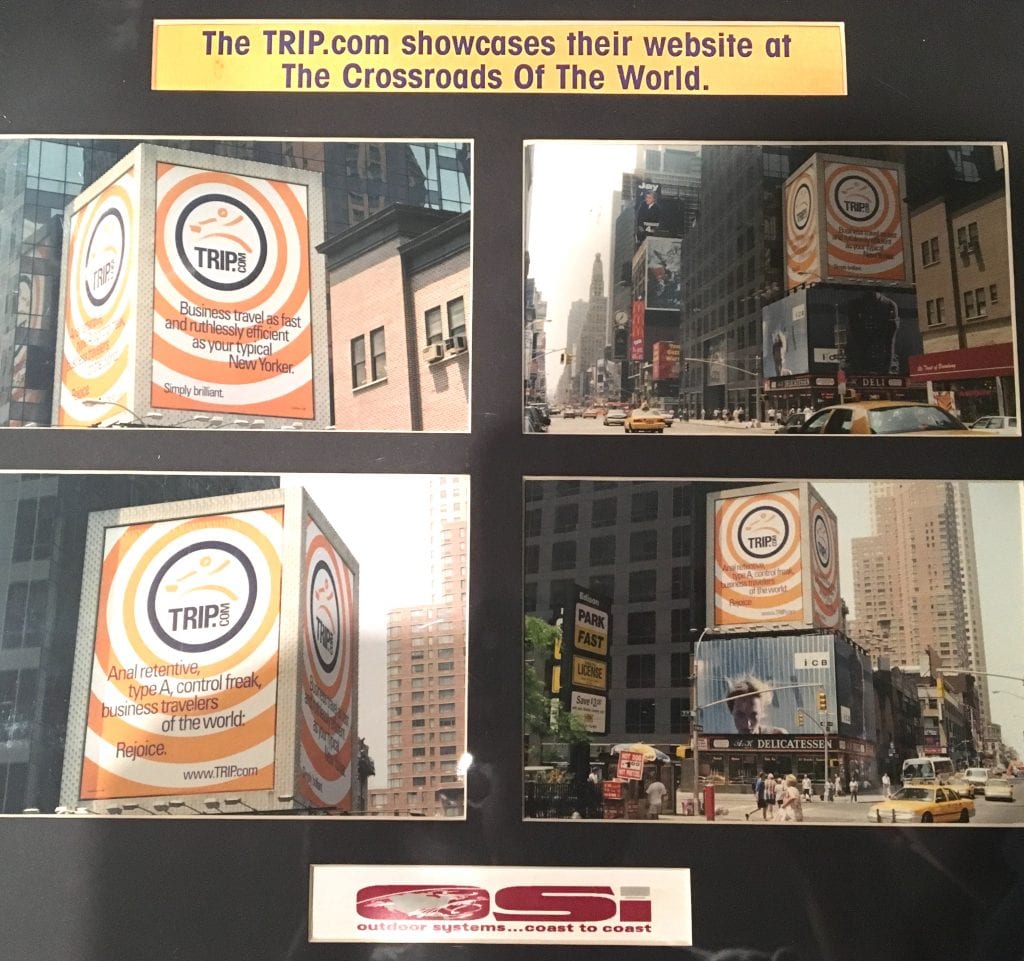

After all, incompetent executives, unwise business decisions, and half-hearted commitments can screw up the best of brands. Having a great brand name doesn’t guarantee a business win. But a short, simple, business-elucidating online brand like Trip.com that’s search engine friendly and traffic inducing sure can’t hurt, and can be worth millions of dollars.

In the history of the Trip.com domain since it was purchased by the owner of Trip Software Systems in 1996 and debuted under different ownership as a travel website in 1998, the brand helped generate an investor-friendly business acquisition by then-independent public company Galileo International in 2000. Three corporations and a venture capital firm had invested $51 million in Trip.com before Galileo bought the 81 percent it didn’t already own for $214.4 million in cash and stock, according to a financial filing.

The founder and then-Trip.com CEO Antoine Toffa claims, however, that the total value of Galileo’s investment and ultimate purchase was $326 million in cash and stock, and Crunchbase cites that figure, as well.

Either way, it was a quick and decent return for Trip.com’s investors, including serial entrepreneur Toffa, who was a minority shareholder.

A hotel and online travel powerhouse of that era, Cendant, then acquired Galileo in 2001, paired Trip.com with its CheapTickets brand, but shuttered Trip.com two years later. Orbitz Worldwide, which had likewise been acquired by Cendant and spun out later by Travelport, revived Trip.com in 2009, but mothballed it once again in 2013.

It’s too soon to determine whether Trip.com has nine lives like a cat, but Gogobot bought the Trip.com brand in 2016 from Expedia Group, and rebranded to Trip.com. Expedia had laid claim to the Trip.com brand a year earlier when it acquired Orbitz Worldwide.

Pending shareholder approval, Ctrip is slated to change its name to Trip.com Group Ltd. next month because it believes global travelers will better understand the name. Ctrip got its hands on the Trip.com brand in 2017 after it bought Gogobot-turned Trip.com.

[See the timeline of the Trip.com domain at the end of this story]

A Checkered Journey

Antoine Toffa bought the Trip.com domain in 1998 and sold the company to Galileo International two years later.

Let’s look at the meandering odyssey in more detail of the Trip.com brand over nearly a quarter of a century to dig out some lessons.

Toffa, a Harvard Business School grad, founded TheTrip.com in Englewood, Colorado in 1996; he recalls buying the domain for this travel website for $10. The Trip.com domain — as opposed to his TheTrip.com —had originally been purchased by a man that Toffa remembers as “Mr. Trip”of Trip Software Systems that same year, and Toffa purchased it from him in 1998 for $5,000, he said.

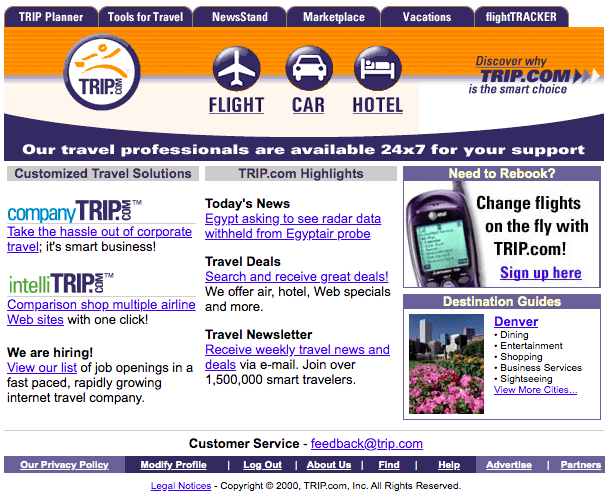

Toffa went online with the Trip.com URL in late 1998, selling flights, hotels, and cars, and offering travel tips, information, and deals. Along the way, over the next two years, Trip.com attracted $51 million in funding from US West, where Toffa had previously worked; iFAO; Hollinger Capital; and global distribution system Galileo International. Galileo bought a 19 percent stake in Trip.com in 1999, and acquired the rest of the company in 2000 for $214.4 million in cash and stock, according to Galileo.

Published reports and financial documents at the time said Trip.com did more than $70 million in sales, and attracted 3.5 million registered users. In 1999, the Interactive Travel Report newsletter named Toffa Person of the Year, and PC Computing placed Trip.com among its Top 10 Travel Sites.

When Trip.com exited to Galileo in 2000, Toffa, who ran it and was a minority investor, said it was the number four online travel agency behind Sabre’s Travelocity/Preview Travel, Microsoft’s Expedia, and Priceline.com.

In a February 2000 interview with travel consumer journalist Christopher Elliott 10 days after Galileo bought Trip.com, Toffa said he had almost acquired rival Biztravel.com the previous year.

Toffa told Skift last week that he had hoped to take the Trip.com public through an initial public offering before Galileo bought the company. “Big banks were telling me to go after the public market,” Toffa said. “It was a big board battle that I lost.”

Trip.com attracted huge traffic because in part because it got access to an Federal Aviation Administration live feed of flight delays and arrivals that were displayed on Flight Information Display Systems at airports from two sisters in Boston who owned a software company, and were working with the agency.

And while Travelocity was notching marketing deals with Yahoo and America Online, Trip.com had become the exclusive travel provider for the then-major search engine AltaVista, Toffa said.

The entrepreneur and inventor, who today serves as the founder and chairman of VideoBloom, said in the early days of the Internet he had been intrigued by domains and the power of brands.

“It’s interesting you can’t have gazillion brands in your head,” Toffa said. “The research shows consumers can hold five or six brands per category.”

A “natural” and short name like Trip.com can be very valuable, he said. Domains can sell today for tens of millions of dollars in some cases.

But it can all come to nothing if a company doesn’t champion a brand, Toffa said — as some of Trip.com’s later periods show.

Trip.com’s Short-Lived Galileo Tenure

When Galileo announced in 2000 that it would be acquiring Trip.com, Galileo boasted that the “Web travel and technology leaders [Trip.com and Galileo] would combine online strengths.” But Galileo, which was the backend flight provider to sites such as Preview Travel, never did much with Trip.com, and didn’t have a viable online strategy.

Galileo’s main U.S. global distribution system rival, Sabre, dealt a blow to Galileo when Sabre acquired Preview Travel, and merged it with the Sabre-owned online travel powerhouse of the day, Travelocity. Just as Sabre, Amadeus and Travelport power flights behind the scenes of major online travel agencies today, Galileo had powered Preview Travel before Sabre bought it, and thus lost a major account.

Trip.com’s position as a brand of an independent Galileo was short-lived because Cendant, which would eventually own such brands as Avis, Budget, Ramada, Wyndham, Howard Johnson, Days Inn, Orbitz, and CheapTickets, to name a few, acquired Galileo — and hence Trip.com — in 2001.

The Cendant Era

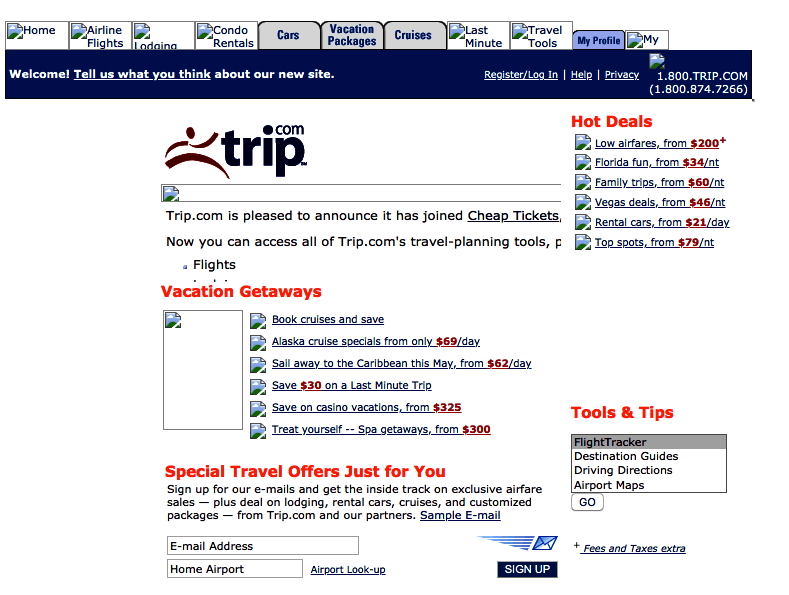

Jacob Stepan, who would pair Cendant’s newly acquired Trip.com with its CheapTickets unit and become chief operating officer of the resulting new division, Trip Network Inc., told Skift last week that Cendant’s idea was to leverage all of the company’s online businesses, including Galileo, to create a Cendant travel portal.

But the CheapTickets and Trip.com marriage didn’t work, said Stepan, who currently is executive vice president, expansion, for the real estate firm Engel & Völkers.

Stepan said unlike CheapTickets, Trip.com had little brand recognition and its faring engine “wasn’t displaying fares very well.” Like other such flight-pricing engines of the day, the fares were more appropriate for point-to-point business travel to major hubs than for vacation-minded consumers, he added.

“We liked the URL a lot,” Stepan said of Trip.com, noting that Cendant didn’t devote the money to market it adequately.

As other companies would learn in subsequent years, said one insider, Trip.com or any domain, really, won’t product stellar results if the corporation merely treats it “as a side hustle.”

With losses accumulating and overlapping inventory and customers important factors, Cendant shut down Trip.com in 2003 — the brand’s first death — to focus on CheapTickets.

Life Under Orbitz Worldwide

Like an emergency medical technician breathing life into someone who almost drowned, Orbitz Worldwide revived the Trip.com brand after six years on the shelf in 2009.

How did Orbitz get the rights to Trip.com? If you can follow along:

- Cendant acquired Orbitz for $1.25 billion in cash in 2004.

- Cendant spun out its Travel Distribution Services division, which had the rights to the then-dormant Trip.com domain, in 2006. Renamed Travelport, the company, which included Galileo, Orbitz, Cheaptickets, and Lodging.com, was was then acquired by private equity firm Blackstone.

- Orbitz Worldwide went public in 2007 with brands such as Orbitz, CheapTickets, eBookers, the Away Network, Orbitz for Business and Travelport for Business.

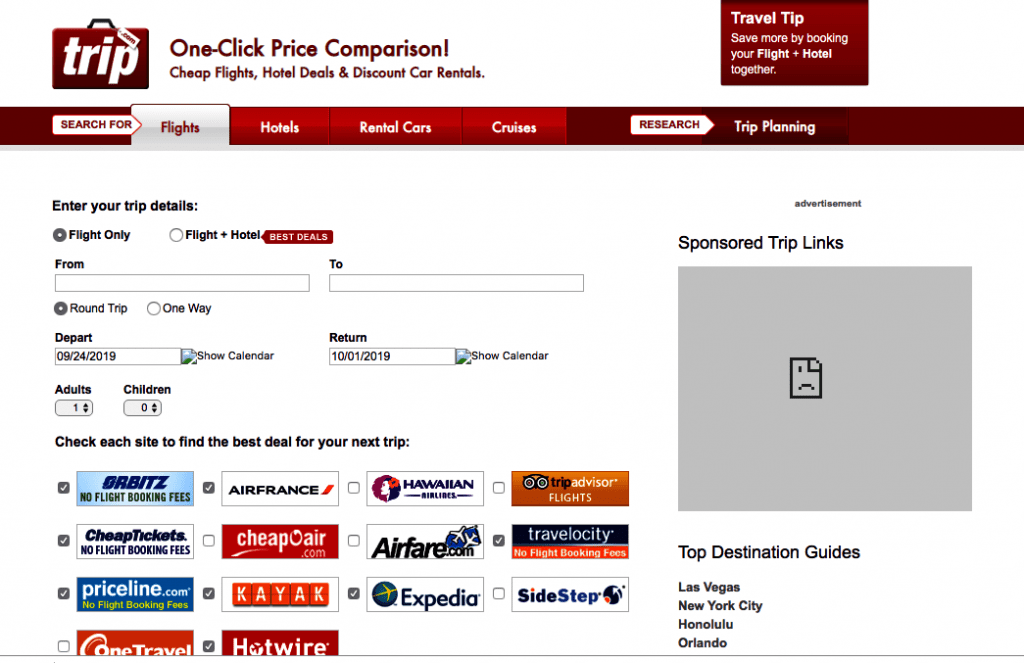

- In 2009, Orbitz Worldwide resuscitated the Trip.com brand as primarily a metasearch site that was part of its Away Network.

Orbitz Worldwide turned Trip.com into a metasearch site. Show here March 31, 2010. Courtesy Wayback Machine

The Away Network was a collection of media/advertising sites, including Trip.com, Away.com, and Gorp.com. The theory was that these media sites could generate large profit margins and scale through search engine optimization. These were the days before Google ramped up its own travel products in earnest and downplayed organic results in favor of paid AdWords.

In addition to metasearch, which refers consumers to hotel and online travel agency websites to complete their bookings, Trip.com also did some bookings on its own on behalf of partners. That’s known as a facilitated booking.

As with Cendant before it, executives at Orbitz Worldwide loved the Trip.com domain, but they didn’t sink much money into promoting it. If you can die twice, Trip.com did just that in 2013 when Orbitz Worldwide discontinued the site. Orbitz Worldwide executives never gave Trip.com the focus or resources to make it viable.

Gogobot Cozies Up to Expedia

In 2014, vacation rental site HomeAway led a $20 million Series C investment round into Gogobot, a Silicon Valley travel inspiration and metasearch site co-founded by Travis Katz and Ori Zaltzman. When Expedia Group bought HomeAway for $3.9 billion in November 2015, Expedia, which had the earned the rights to the Trip.com domain because of its acquisition of Orbitz Worldwide several months earlier, inherited the HomeAway investment in Gogobot.

Gogobot coveted the Trip.com domain like so many other entrepreneurs had before it, and bought the URL from Expedia for an undisclosed sum. Gogobot then rebranded to become Trip.com.

At least one other household name travel website was also rumored to have been interested in buying the Trip.com domain over the years.

After buying the domain in 2016, Katz told Skift he thought the Trip.com brand would boost his company’s search engine optimization bonafides, and be materially beneficial in the long term.

The Trip.com brand turned out to be materially beneficial very quickly, though, because China’s Ctrip acquired Gogobot-turned Trip.com in 2017 to enhance local recommendations for another Ctrip brand, metasearch company Skyscanner.

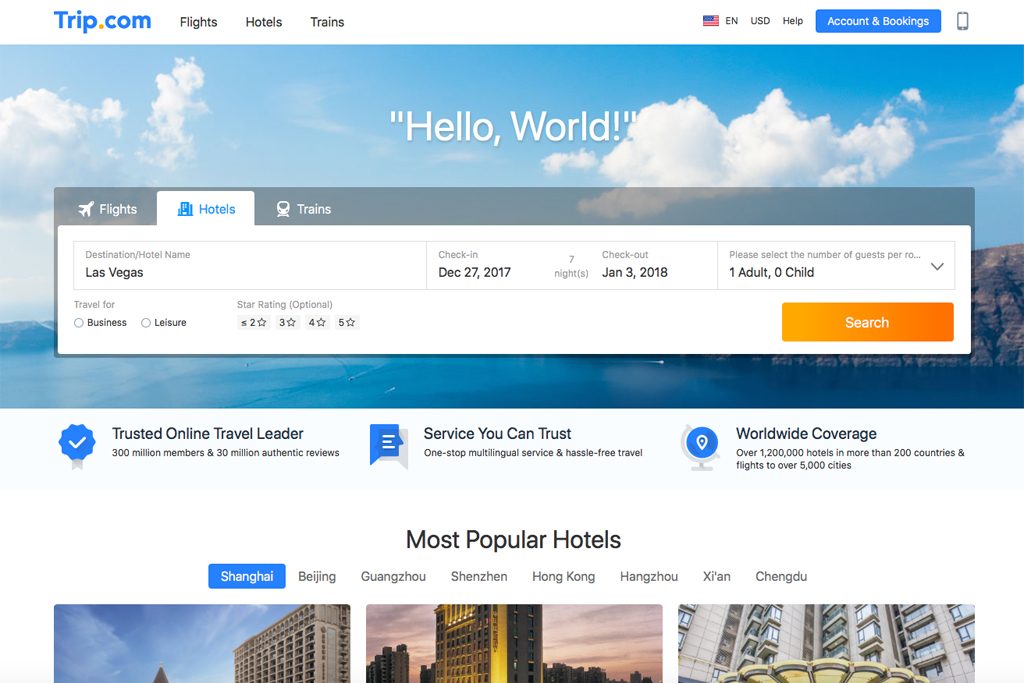

While Skyscanner may have seen value in Trip.com’s travel content and recommendations, parent company Ctrip had additional ideas about how to use the brand. Within weeks of buying Trip.com for Skyscanner, Ctrip launched an English language version of Ctrip called Trip.com.

The English language version of Ctrip, Trip.com, must indeed be working out well these days. In Ctrip’s second quarter earnings call last week, CEO Jane Sun said Trip.com’s air ticket volume jumped “triple digits” for the 11th consecutive quarter, and “hotel growth is accelerating.”

To bring the nearly quarter century legacy of Trip.com full circle — for now — Ctrip will have its shareholders vote at the company’s annual meeting in October on its proposal to change the name of Ctrip.com International Ltd. to Trip.com Group Ltd.

If shareholders, as they are expected to, approve the parent company’s rebranding, Ctrip would become the third of the three global online travel agencies to change its name since 2018. The Priceline Group became Booking Holdings in 2018, and on the heels of that Expedia Inc. took a new identity, Expedia Group.

Ctrip co-founder and Executive Chairman Jianzhang “James” Liang explained to investors the reasoning behind the company’s name change. “Today, we also announced the proposal to change the company name to Trip.com Group Ltd.,” he said. “The new name reflects the services and products we provide, and it can be easily remembered by global users. Trip.com Group includes a range of brands including Ctrip, Qunar, Trip.com, Skyscanner and many more.”

So what’s in a name? In the case of Trip.com, there are 23 years of wins, losses, false starts, and now new optimism. But there are no guarantees: Trip.com’s history shows that.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: brands, china, ctrip, expedia, gogobot, history, orbitz, trip.com

Photo credit: In 2016, Silicon Valley startup Gogobot bought the Trip.com domain from Expedia and rebranded. Trip.com