Skift Take

Ctrip has been able to spend most of its 15-year history riding a rising travel tide in China while buying out much of the competition to blunt their challenges. For 2019, Ctrip will have to stand up and get moving to recapture momentum and investor attention.

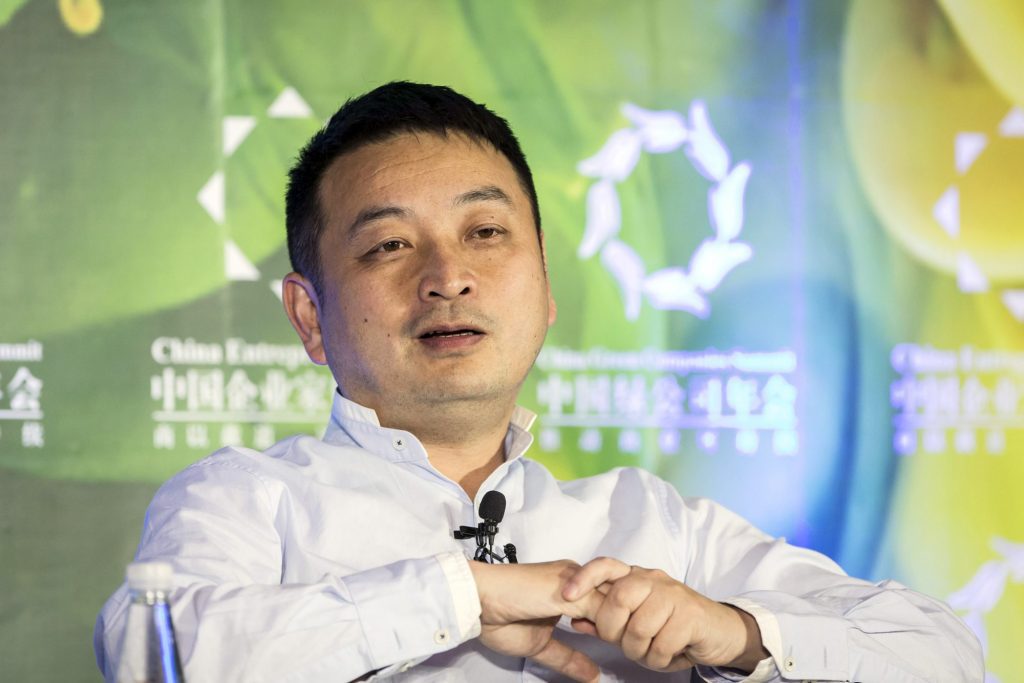

The main emphasis of Ctrip’s business is short-haul outbound trips so the impact of the U.S.-China dispute over tariffs is limited, co-founder and executive chairman James Jianzhang Liang told Skift.

“Obviously, in the long-run, it will hurt the global economy and global prosperity,” Liang said.

Skift spoke to Liang recently in Shanghai at the company’s annual partner event, which on December 10 marked the travel booking site’s 15 years as a public company. The Nasdaq-listed firm is China’s leading travel site by a wide margin, but it could face challenges as new competitors loom. For example, food delivery and online review site Meituan-Dianping fueled up this year to take on Ctrip, raising more than $4 billion in a Hong Kong listing.

The interview was wide-ranging, covering Ctrip’s relationship with investor Booking Holdings, the competitive landscape, the impact of airline commission cuts, and China’s slowing domestic economy, which doesn’t appear as though it will turn around in 2019.

An edited version of the interview follows:

Skift: In the 15 years since Ctrip went public, what’s been the biggest change in the market?

James Jianzhang Liang: The biggest change in the market is completely going from offline to online and to mobile. That’s one industry that has completely gone digital and online. Other economies, maybe now it’s 50 percent online, maybe 80 percent.

Skift: Ctrip is in so many different areas in terms of what it considers travel. Everything from selling luggage to bus tickets. On top of Ctrip’s site, there are 15 categories; Expedia only has eight. You’ve invested in a company that does supersonic air travel. What’s out of bounds for Ctrip? What’s not considered travel?

We still focus on everything related to travel. Priceline [Booking Holdings] invested in a rideshare company. I think that’s a bit outside of travel. We want to stay in everything related to travel. We are successful in upstream downstream, we successfully invested for example in hotels, and group tours. It’s not only financially very positive, but we’re able to achieve better synergy with the companies we’ve invested. Generally, it’s very positive. We know this market much better than the average investors, the potential of the players in this industry, so we naturally can generate financial results and good synergies.

Skift: Speaking of financial results, it’s been a bit of a rough year for the stock this year. Despite posting some pretty solid third-quarter results, the market did not react particularly positively. To what do you attribute that? Is that a slowdown in travel within China? Against your own positive results, what’s causing investors to doubt the stock?

Liang: I think this year has been tough for two reasons. The reduction of the commission from the airlines, just more or less a one-time decrease. Our volume has continued growing very fast. We should be able to come out of it once the full effect has been absorbed, in terms of year to year comparison. The second is just the macro environment. The general worry that the Chinese economy is going to slow down. That’s probably overblown a little bit, many industries, especially manufacturing industries, did slow down and even grew negative, but travel is going to continue to grow. Not in the high teens but still close to double-digit growth. The slowdown is much more moderate in the travel sector. We continue to see healthy growth in many segments. The outbound business has been hit harder than domestic travel is still growing. So we are more optimistic about the industry and the macro environment in the travel industry.

Skift: Do you think that any of that investor reaction – Meituan-Dianping had a big IPO this year – is there a sense that the marketplace is becoming more competitive?

Liang: It could be but the reality is that the competition has been, I wouldn’t say, becoming more favorable, but it’s at least stable. At the high end, we’re still very dominant. Particularly in the outbound market, we have more than 50 percent market share and that part of the business continues to grow pretty healthily. At the low end, we are growing very fast too. At least maintain or even gaining some share for the low-end of the market. In general the competition, the competitive situation is quite stable.

Skift: What do you consider the low end of the market?

Liang: Fourth- and fifth-tier cities. Average hotel price maybe $20 per night.

Skift: You’ve been the CEO of the company twice, now you’re the executive chairman. Under what conditions would you be the CEO again? Would you want to be the CEO again?

Liang: Well, yeah. I started as CEO then became non-executive chairman, when I went and did a Ph.D program and became a professor, six or seven years. That’s very different from today. I’m the executive chairman, I’m still a full-time employee involved with the company. So that’s obviously, Jane [Jie Sun, Ctrip’s CEO] has taken on more a lot more responsibility from her previous role as chief operating officer. Still I work with Jane very closely for the overall responsibility of the company.

Skift: Ctrip has a somewhat complex relationship with Booking.com. On one hand, it has an equity stake in Ctrip, it has a board seat, and on the other it is invested with a competitor [Meituan].

Liang: They don’t have a board seat [Booking.com CEO Gillian Tans has an observer seat on the Ctrip board], but they are an investor and a partner. We supply each other with our hotel inventories. They supply part of our inventory in Europe, United States, parts of Asia too, and we supply them vice-versa. We supply them mostly in China and Asia. Each of us have a strength in certain markets, we complement each other. Obviously we are competing on the demand side in certain markets. In China, we are very strong, and some parts of Asia. But by and large, we don’t compete. For the markets they are very strong and are not our focus yet, very low market share, and for markets, where we are strong they have very low market share. They did a lot of investment. Some of them have a travel arm. I don’t think in terms of being a partner — a travel partner for sharing inventory, we are by far their biggest partner.

Skift: Let’s talk about Ctrip as a technology company. Where is there an opportunity for Ctrip to innovate on the technology side? For example, most customers are using mobile in China. What role do you see artificial intelligence playing going forward?

Liang: AI is going to be valuable whenever people find it difficult or spend a lot of time doing travel planning, deal searching. Still if you want to plan a vacation and find the best deal it’s most time consuming. There’s still a lot of room where we can or any other player can do to raise efficiency, to save time for consumers. In terms of when the consumer wants to, now it’s just a very objective kind of search criteria, price range, geographic location, but if the customer has very limited ideas, where it will go, is just general, just going to a beach, or a good destination for family, with kids, we know a lot more about destinations, and we know something about that customer as well, from their past travel patterns and consumption patterns, so we may be able to use AI and big data to suggest the best deal and the best place to go. We may be able to save the effort of travel planning, or increase the conversion rate of travel planning, or increase incremental demand of travel planning. If you don’t provide a good deal or a good suggestion, the consumer will just do something else besides traveling.

There is still a lot of idle capacity in the travel sector, AI can find the most suitable deal, and sometimes you need the suppliers to work together for a particular type of deal for customers to give a good deal with idle capacity, then you can increase the market size. Huge potential for AI to come in and help the customer. And then it’s as if the customer hired a personal assistant to do all the research and deal searching. Most people can’t afford a personal assistant to do that, That’s going to be hugely beneficial for the whole industry.

Travel personalization is a very tough problem. That’s what makes it interesting to explore. Only big transaction companies that have the products and also the customers’ data, so we should take on this very difficult problem and try to solve it.

Skift: Does the U.S.-China trade situation, does that worry you? Does that bother you? Are you worried about it from the company’s perspective? Will it have a big impact on the company if it’s not resolved soon?

Liang: In the long term, it will be bad for the world to advance technology innovation, efficiency. For the short-term impact on travel, it’s limited because our business is mostly short-haul outbound, so U.S.-China is not a big part of our business. That part has come down a little bit earlier this year. European demand has become a bit of a substitute for the U.S. European travel is doing very well this year. Obviously in the long-run it will hurt the global economy and global prosperity.

Skift: Is it enough in your mind as a co-founder for Ctrip to be number one in China and number two in the world? Or do you still hope that one day it will be the biggest such company in the world?

Liang: We want to be the best company. Maybe the best company will naturally be the biggest company. We are just aiming for providing the best value for our customers. The Chinese customers first, we want to solve that problem, and we probably 80-90 percent there, to provide the best value for our customers. The travel products that are shared by global travelers, the places Chinese travelers go, are also the same places that Koreans and Japanese go, so as long as we provide localized service and some marketing and branding, the Japanese and Koreans can benefit for the same time of platform, the service, and the products that our platform offers.

If you want to replicate your products to other markets, and keep your product the best in the market, you will naturally be growing, if you continue to maintain that, if you maintain that you will have the best value for 10-20 years, you will naturally be the largest, travel is inherently a global business. Market share is not our goal, it is not what we are aiming at, we are aiming at the best value for customers and suppliers.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: booking holdings, ceo interviews, china, ctrip, meituan

Photo credit: Ctrip co-founder and Executive Chairman James Jianzhang Liang said the company doesn't compete too heavily with Booking.com because their market strengths are complementary. Qilai Shen / Ctrip