Skift Take

Vacationers want to experience something new and are tired of the same old tours and activities. While global tour operators are baking more customization into their products, digital distribution is changing the way local operators do business.

What, exactly, is a tour? Depending on who you ask, you’ll get a very different answer.

For some, the idea of going on a tour conjures images of a packed motorcoach bumping along the countryside somewhere or exploring a city with forty of your closest friends. Others may think back to an intimate museum tour or being led into a home of a local chef for a dinner so delicious it still makes your mouth water.

It could be access to a guided walk purchased from a booth in a city center somewhere, or an indie concert in a laundromat somewhere purchased through Airbnb.

The truth is, the tours and activities space is undergoing a radical reinvention of what exactly it means to experience something on vacation.

Projections of the absolute scope of the global tours and activities market are inconclusive, but it likely hovers around $150 billion annually, according to Skift Research estimates, and is expected to grow nine percent annually over the coming years.

Tourism is one of the largest creators of a global middle class, with millions around the world rising in their local economy by offering services to visitors. And so often, immigrants to new countries are able to get a foothold in a new community through employment connected to the travel industry. When you consider the 10 percent of the global economy that travel accounts for, tourism is one of the most vibrant and important contributors.

The vast majority of tours, however, are still sold offline either in-destination or through traditional tour operator brands and travel agents; around 80 percent of the sector’s gross bookings take place offline, according to technology provider Trekksoft, and just 13 percent of those bookings come from operators with real-time booking connectivity in the field.

The global tour operator business has evolved over time, buoyed by the democratization of travel and the rising importance of experiences to consumers. Yet, online booking has been limited mainly to simple tours that are treated like commodities on sites like TripAdvisor and Viator.

A long tail of activities, scattered in destinations all over the world, will one day be bookable online, changing the economics of the sector in a fundamental way. The way tours themselves are packaged have shifted to reflect the demands of global consumers in permutations that challenge the traditional concept of what a tour even is.

In many ways, the tours and activities sector right now resembles the challenging online booking situation for hotels before the rise of Booking.com helped connect the disparate market of independent and boutique hotels across Europe to online booking sites.

“Wasn’t this the case 15 years ago for hotels?” asked Dermot Halpin, president of attractions and vacation rentals for TripAdvisor. “There was a lot of skepticism. Would it ever work? There’s a lot of vested interest. None of that is in question now. It’s just a matter of how. Making that easier is in the industry’s interest because you get more people looking at more [products]. You get a bigger market and more liquidity in the market.”

Venture capital is flowing into the tours and activities sector, with investors betting on the future of the sector as the next great untapped market in online travel. The business rationale is there; grabbing even one percent of a $150 billion industry would bestow Unicorn status among the many emerging platforms across the industry.

Looking at it from the other side: Is the time right for an embrace of online booking and marketing by tour operators? How are the tours and activities themselves evolving in a world of digital distraction and consumers who crave choice and bespoke experiences above all else?

Over the last three months, Skift spoke to more than two dozen leaders and executives across the tours and activities sector, ranging from small-scale tour operators and destination management companies to global tour giants and distribution technologists.

What we found is an industry experiencing disruption from all sides, from the design of tours themselves to the ways products are marketed and sold. A wider shift in the business models of major global tour brands has taken place, with a digital revolution currently taking place on the fringes that has attracted big money from established travel players like TripAdvisor and Google.

In this analysis, we will examine how the tour experience has evolved in recent years, how tour operators view the shifting dynamics of their business, and the race among technology companies to bring online tour booking into the mainstream.

Experiences in a Digital World

To understand the history of the sector, it’s important to note some distinctions. Standard tour operators own inventory, are asset-heavy, and generally run multi-day tours. The tours and activities sector, though, is defined by smaller companies offering products that are more limited in scope. The sector has a bit of a nomenclature problem; small companies may consider themselves tour operators, but the industry is defined by giant players like Travel Corporation, TUI, Thomas Cook, and others who tend to sell packages and not one-off activities.

For this story, we examined both sides of the equation; while there are important distinctions between packaged tour operators and tour operators, it’s necessary to look at both sides when examining the future of the sector, especially since the distinction is lost on most consumers. In fact, the more executives and leaders across the sector that we talked to, the more the silos between these two types of tours began to break down when it comes to the intersection of consumer demands, marketing, and distribution.

Since the 1800s, packaged travel has remained mostly the same: the traveler pays the operator for a package of transportation, lodging, and usually access to activities, while the operator does the work of stringing together these different products into a cohesive experience for customers. Travel agents, either inside the tour operator or external, sell the packages to potential travelers, and receive a commission for their sale. In this way, travel agents act as a de facto sales force for tour operators and their products.

Dynamic packaging never really caught on for tours and activities, due to the complexity of these trips. You need experience, connections, and planning chops to design a packaged tour that flows seamlessly end-to-end.

Anything more complicated than an activity that lasts a few hours requires a level of coordination that can be tricky for travelers, so travel agents still act as a trusted intermediary in the sales process. In a world defined by digital distractions, there is a case that travel agents present tour operators a better chance at converting potential customers than online channels do.

Despite the structure of the sector remaining mostly the same, with a handful of dominant global tour operators operating diverse brands, what travelers want has shifted dramatically. In a world of democratized travel, variety is now king.

Data from TripAdvisor underscore the changes that have taken place to tours themselves. Historical and heritage tours jumped 125 percent in popularity in 2017 for global travelers, while sunset cruises increased 86 percent and private day tours were up 79 percent. Food experiences, though, were the fastest growing category in terms of traveler spend; spending was up 61 percent in 2017, with travelers from Canada, the UK, and Australia leading the way.

The statistics bear out the reality that the shifts in the space are being led by a shift in global consumer sentiment.

“If you step back and just look at it from a consumer proposition, forgetting the category, it is experience,” said Dan Christian, chief digital officer of The Travel Corporation, which is ostensibly the world’s largest tour operator. “It’s not necessarily the beach holiday or the cruise … They’re looking for more immersive experiences, cultural connections, and it’s all age levels, so it’s not demographic either. It’s very much the same thing with baby boomers as it is with millennials. Looking for the alternative holiday is now becoming the norm.”

More complex tours, with options and variety, are more costly to produce than the traditional bus tours, which are still prevalent because they are an efficient way to shuttle vacationers around a destination and easy for operators to make money from. They’re also easier for travelers to book while wandering a destination on a self-booked trip.

“The majority of tours out there are still large group-, charter bus-lead,” said Stephen Oddo, CEO and co-founder of Walks, a tour company founded in 2009 with dozens of tours in 11 cities in Europe and the U.S. “There are a lot of volume operators out there that are 40, 50, or 60 person groups. The margins on that are obviously excellent and if you can fill a 60 person bus up with individual ticket sellers, then that’s great. You can keep your prices down. So, if the customer wants that kind of experience then that option is out there and the margins are great on that.”

Tourists at the Giant’s Causeway in Northern Ireland in 2017.

Bigger tour operators, which operate global brands that a consumer may not deduce are connected in any way, work in a few different ways to create packages.

Some partner with destination management companies, which are essentially middlemen with connections and experience putting together group trips to specific destinations. Others, including Intrepid Travel and G Adventures, have instead installed their own staff in-destination, cutting out third-party destination management companies and crafting products more in line with specific consumer experiences.

Travel agencies, as well, have pivoted to capitalize on the consumer demand for more diverse experiences. As the component parts of travel have become commodities that are easily booked online, packaged tours remain difficult to sell digitally.

“Customization is the new luxury,” said Cece Drummond, managing director of destinations and experiences at luxury travel agency Virtuoso. “So, by booking these tours through the travel advisors, you know, you can really get something tailored precisely to the traveler’s needs…

“We have about 150 [destination management companies] on site; we have about 60 tour operators and portfolios. We work with both and it’s interesting because the lines are very blurry between the two supplier types. If you want to put each into a box, you really can’t.”

Customization has long been key to helping tour operators bolster their value proposition to travelers, but the proliferation of mobile technology has helped to take customization in a new direction. In 2017, Tauck, a 93-year-old company, launched its first mobile app for travelers that offers recommendations for what to do during free time on a tour.

Tauck’s app is available for all of the company’s tours, said Jennifer Tombaugh, president of Tauck. “The impetus for the app is for providing guests content pre- and post-tour,” she said.

Perillo Tours, which runs tours to Italy and Hawaii, is also developing an app that will let travelers download promotional videos for tours. The company started sending virtual reality headsets to travel agents last year and will have mobile booking fully available by the end of 2018.

Tours Go Online

It’s ironic that tours and activities tend to be one of the last components of a trip actually booked despite many consumers’ desires for unique and authentic experiences,

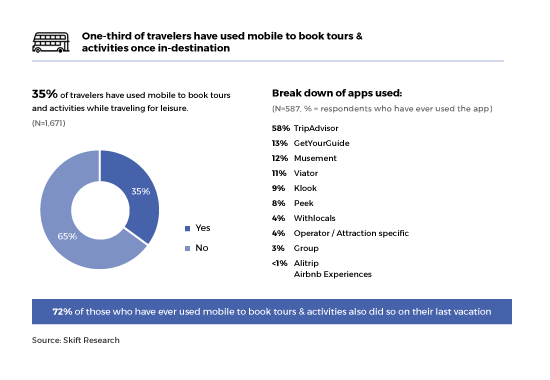

Skift Research found earlier this year that 35 percent of travelers have used mobile phones to book a tour or activity while already in destination for a vacation, with TripAdvisor dominating with just over half of the bookings. Technology provider Trekksoft also found that just 19 percent of tour bookings are made more than a month before a trip.

Taken together, these data points make it clear that there is a huge opportunity for digital platforms to revolutionize how tours are marketed and sold.

Nearly every travel sector have leveraged the internet to modernize and give consumers a more convenient booking experience during the past two decades. Tours and activities are a notable exception largely because of global fragmentation and it’s long been unclear if the web could ever fully unite the sector.

There are tens of thousands of tour operators worldwide and while platforms like FareHarbor, Bokun, and TripAdvisor have amassed a significant amount of industry partners, it’s still difficult to sell certain kinds of tour products online.

“There’s kind of general consumer interest in booking things online, and the online consumer value of proposition has not been historically strong for tours, in terms of offer, breadth, or bookability,” said TripAdvisor’s Halpin. “The offline consumer proposition has played to what consumers find most important, which is, given that I don’t really know that there’s a solid online option for me, my best bet is to leave it until I’m in the destination. There are traditional routes to market, which are hotel concierges, or guidebooks, or things that are in destination. They will discover what to do when they’re on vacation.

“And in that case, that’s also relatively underserved, because the consumer’s depending on the unbiased nature of a hotel concierge. And who knows what kind of incentives are going on there.”

Tours aren’t standardized commodities. Travelers generally know what to expect with airline seats and the product is mostly the same from carrier to carrier. Hotel rooms come in all shapes and sizes but hotels are essentially selling beds and amenities. Tours are a different animal because no two are alike even with the same operator and often depend on factors that companies have little control over.

For tour operators, distribution has a cost whether it’s online or offline, and more tour operators are taking the plunge into the uncharted waters of selling tours and activities on the internet.

Traditional retail travel agents, for instance, tend to receive a 10 to 15 percent commission when selling a packaged tour; it’s usually not worth it for them to string together individual tour products, although some do for specific clients. Selling tours through a wholesaler can cost an operator somewhere around 30 percent of a sale.

Many hotel concierges also have contracts and partnerships with tour companies to sell or recommend tours, although concierges are typically recommending companies that offer the highest commission and not necessarily the ones with the best access to an attraction.

Online distribution platforms, however, tend to charge less for operators selling commodity tours. And with about half of direct tour bookings now coming online, the promise of reaching a wider market of consumers while taking home more revenue is appealing.

BeMyGuest, a Singapore-based technology provider for tours and activities companies in Asia-Pacific, lets its suppliers name their price per day and by time slot, group size, source market, and other add-ons. “Pricing is of utmost importance in Asia, in particular for those suppliers trying to differentiate their product offerings and who are tired of the race to the bottom of discounting,” said Blanca Mencahca, COO and co-founder of BeMyGuest.

There is also now a bit of a race to the bottom on platform pricing as new entrants have proliferated in recent years. Bokun, which was recently acquired by TripAdvisor, charges a fee of just 0.1 percent on transactions. Viator itself charges a variable commission and newer entrants have a variety of different revenue models.

The Big Kahuna

Viator was the first company to bring tour bookings into online travel. The company was founded in 1995, began selling tours in 1997, and went online in 1999. Viator was acquired by TripAdvisor in 2014.

Rod Cuthbert, Viator founder and former CEO, told Skift that Viator had high brand equity and a great reputation up to the time that TripAdvisor bought it four years ago. Since then, though, the company may have lost some visibility in the marketplace.

“TripAdvisor has the approach of wanting to promote the TripAdvisor brand,” he said. “You can buy tours on TripAdvisor now, but I don’t know if you always see the Viator brand when you do that.”

Viator’s reign over the sector hasn’t been without frustration from its team, according to Cuthbert. Company executives were dismayed that no strong competitors emerged from 2000 to 2010.

“If you don’t have competitors, that raises questions in the minds of investors and potential acquirers,” said Cuthbert. “Some investors were questioning us about whether there really was a marketplace? There was a lot of resistance because there wasn’t a strong competitor to Viator. I’ve never really fully understood why since the marketplace was going to continue to expand quite rapidly and why more people didn’t get into it much earlier.”

While Viator was a game-changer at the time for many small and medium-sized tour companies, it didn’t fundamentally change the structure of the tours and activities sector. Retail agencies and wholesalers remained better, more established distribution channels.

“If you go and ask any supplier on the street about the big changes in tech that have happened in the last 15 years, they’ll probably tell you that none of those have changed the [tour] products themselves,” said Alex Bainbridge, former CEO and founder of TourCMS, a tour distribution company which sold to Swiss-based Palisis in 2015. “All they’ve done is change the distribution and marketing of the product. The tour itself has not changed all that much.”

TripAdvisor, with Viator in tow, has one major advantage over the variety of other booking sites out there right now; travelers routinely use the TripAdvisor app while on vacation to look for attraction and restaurant reviews. It’s much easier for TripAdvisor to sell tours to people once they are on vacation because travelers are already using the app.

In the second quarter of 2018, TripAdvisor’s non-hotel revenue accounted for about 27 percent of the company’s overall business, with tours and activities holding the fastest growth rate among its various products.

TripAdvisor is trying to evolve with the times, becoming something of a social network for travelers with personalized recommendations in addition to its wide array of forums and reviews. The company is also working on delivering travel packages to customers, and in time it is likely its popular tour options will play a role in how it sells these bundles to users.

Enabling Remote Bookings

Airlines and hotels have long accepted that online bookings are a key tool to grow their businesses and make it easier for the consumer to find them. But more than 80 percent of all tours and activities bookings still happen offline and many tour operators probably prefer to keep it that way.

Remote bookings, or any booking where someone doesn’t physically walk up to a tour operator on the street and buy a ticket, remain a nascent area for many companies. Many tour operators use pen, paper, calendars, and spreadsheets to check if they have availability for a same-day tour, and don’t capture much customer data as a result. In some cases, it might be more expensive for a company to take online bookings because of the cost of distribution software.

Real-time availability of tours and attractions is becoming more common but isn’t the rule. Only about 13 percent of online tours and activities bookings happen with real-time connectivity, according to Trekksoft, largely because much still depends on day-of schedules of tour guides and that of attractions. A tour operator could be waiting until the last minute to know if it can secure 10 entrances during an allocated time slot to a popular art museum or to find out if a boat will still go out if there’s a bad storm.

Some attractions are funded by governments which don’t care about growing ticket sales or see a need to sell tickets online. Check the Vatican’s online ticketing system for a blast from the past, for instance. Attractions, as well, increasingly have daily limits to how many people can visit.

Tour operators have to see that their incremental bookings are being made online if they’re going to invest more in distribution platforms, said John Weimer, co-founder and CEO of OnceThere, a tours and activities platform that offers white label solutions for destination marketing organizations, hotels, and vacation rentals. Weimer is also an ex-HomeAway executive.

“Lots of tour operators don’t want reservation software,” said Weimer. “They have a four-month business and they either feel like it costs them too much per transaction or that they have a pretty good business without it. A lot of businesses say they’re capacity constrained, but in practice, they aren’t.”

Hotel rooms and airline seats are relatively easy to sell online because the product essentially boils down to the same thing from brand to brand: a room or a seat on a plane.

“With tours and activities, it’s just so hard to do that because we’re talking about many different itinerary options for a single site,” said Oddo. “We’re talking about 130,000 tour operators globally, that’s the number I’ve heard, and with all of these operators, they might have many versions of touring the same site or doing a day trip.”

Tour operators are also up against the general fatigue of planning travel. After spending days poring through dozens of sites for the best flight and hotel deals, do they want to spend more time going through hundreds of other tour options unsure of what option is best for them?

“Do they take you on a tour of the Statue of Liberty or just bring you to the island?” said Oddo. “Because the slight variances in group size could affect that. Will the tour guide be bilingual? With this amount of variabilities, it’s very hard to aggregate that and present it in a way that was feasible for the consumer to actually understand and book.”

Oddo said some of his company’s best margin products are some of the most logistically complicated and heavily inclusion-based products. Vacationers, it seems, are willing to pay more for more complex tours. Simple tours can be profitable as well for operators, though, particularly if they take place in a popular destination.

A shorter booking window makes a stronger case for bringing bookings online, and also helps reduce no-shows from customers who decide to do something else and throw off a tour’s planning.

“The numbers show the growing demand of tourists buying tours within three days and 20 years ago you wouldn’t have had that,” said Oddo. “Five years ago I’d say the majority of operators were blocking out their tours within three days or even a week or longer or making them on-request only.”

Evolution of the Booking Experience

The consumer booking process, however, is slowly changing. A company like Airbnb is the latest example of a company that promotes instant bookings, where a traveler gets instant confirmation for a stay instead of waiting several hours or days to find out if a booking was accepted.

Klook, a Hong Kong-based tours and activities booking platform focused on Asia-Pacific that recently expanded to the U.S. and Europe, has 80 percent of its products available for instant bookings, many of which happen via its mobile app, set it apart from its competition.

This issue, which has been largely solved in hospitality, remains a problem among tour operators. If more customers are booking on their phones just hours before a particular tour is scheduled, how does the operator in the field know who has purchased a ticket? Furthermore, last minute bookings can pose a serious logistical problem; a tour may need to be tweaked at the last second to accommodate a traveler’s particular needs, while buses or vans may need to be reallocated on the fly to meet demand.

The fragmented tour operator sector now also faces the challenge of building partnerships with a perhaps equally as fragmented online booking marketplace, with more than 50 different distribution partners available.

Tao Tao, co-founder and COO of GetYourGuide, a Berlin-based tours and activities booking company founded in 2009 that’s processed 10 million bookings on its platform, said at Skift Forum Europe in April that most people don’t associate an online tour booking with a brand or website. Tao said he, and many other travelers, think of an experience to do rather than the company to do it with.

Few travelers are brand loyal to tour operators because most people take a vacation or two each year, and a Google search plays an important role in the travel discovery process. Google, though, arguably hasn’t given tours and activities the special treatment like it has with dedicated products for flights and hotels.

“Google doesn’t want to be an online travel agent, but it could be referring tours,” said Bainbridge.

Google Trips was launched in 2016 as a standalone app and got some traction with travel companies, but its potential and development is still in early stages according to the companies Skift talked to.

“We integrated with Google Trips and very soon we’ll be integrated with other Google products to facilitate the booking experience,” said Alessandro Petazzi, founder and CEO of Musement, a Milan, Italy-based tours and activities booking and software platform founded in 2012. “Even household names like Expedia or Booking.com still have a huge percentage of their traffic coming from search.”

Musement was acquired by TUI Group in mid-September 2018, in another bit of industry consolidation.

Tao agrees that Google Trips is an interesting product. GetYourGuide has a partnership with the platform. “If we can tag onto [Google Trips’] relevance it becomes very compelling,” he said. “In terms of total scale, it’s not at the scale of an Emirates or EasyJet partnership. It’s still in early stages of what we could do with a product.”

Online Travel Agency Interest

Booking sites have definitely done their part to spur the online distribution of tours. Expedia Inc. said it sold more than half a billion dollars in tours and activities in 2017 and CEO Mark Okerstrom also said the company grew its activities transactions by approximately 20 percent in the first quarter 2018.

During Booking Holdings’ second quarter 2018 earnings call on August 8, CEO Glenn Fogel said he expected his brands would eventually offer tours and activity products more prominently following its FareHarbor acquisition earlier this year.

“While the volume of attractions and other travel-related services is still very small compared to the size of our accommodation business, we are happy to report that the foundational blocks are being laid and we believe that in the long-term, providing a frictionless booking and payment experience in this area will be a competitive advantage,” said Fogel.

While the giant online travel agencies have historically partnered with outside online tour booking platforms, Booking Holdings’ recent purchase of Fareharbor shows they are taking a stronger look at tours to boost their bottom line as other product areas face increased competition and slowed revenue growth. Fareharbor, for instance, said it is on track to process $1 billion in transactions this year.

Booking sites, however, have historically been a roadblock for the sector. While many of these companies have basically figured out how to upsell travelers a flight or hotel depending on what they book first, they haven’t yet found a winning strategy for tours and activities.

“The only way they’ll [grow their tours and activities businesses] is to build apps that you’ll use while you’re traveling,” said Bainbridge. “OTAs don’t have the right data. They’re not innovators, they’re scalers. They’re very good at getting products rolled out but it’s always been that the innovators are the reservation systems.”

Booking sites haven’t yet maximized reservation systems’ potential, according to Bainbridge. “They’re only using them for availability and for making bookings and price is coming from contracts,” he said.

Tao doesn’t think Booking.com can simply flip a switch and get into tours and activities, a notion Fogel would likely take issue with. “If you look at the amount of funding that’s gone into the [tours and activities sector] relative to the size of the industry, it’s not huge,” said Tao. “It’s probably less than $1 billion invested into companies… Why would you consolidate a tiny market if you have an opportunity to grab a share of the big one?”

Viator founder Cuthbert is in the same camp. “Booking.com, for example, won’t try out some radically new way of doing something because they’re doing so well with their current model,” he said.

The past five years have seen a proliferation of companies trying to bring more tour operators online.

On the backend, FareHarbor and Bokun were scooped up in April by Booking Holdings and TripAdvisor, respectively.

Both Booking and TripAdvisor’s press releases focus on their ability to distribute the supply the acquired, not the underlying software, said Weimer. “TripAdvisor and Booking made their acquisition because it gave them access to supply, not because it helped them build out distribution,” he said. “It will be all about distribution with future acquisitions. It doesn’t matter how clever your software is, if you can’t help me as an activities supplier grow my business than you’re a commodity.”

The Airbnb Effect

While Airbnb has had a transformative effect on the hospitality sector over the last decade, it’s Airbnb Experiences play in the tours and activities space bears note in a survey of the sector.

In late 2016, Airbnb launched its experience booking platform in 55 cities, partnering with artists and hosts to provide a variety of activities that would resonate with its users. By tapping into their global network of hosts, and encouraging venues and activity companies in cities to join up, Airbnb will have grown its experiences platform to nearly 1,000 cities by the end of 2018.

“A lot of these people are doing this on Airbnb for the first time, and just have some passion that is not their day job that it turns out travelers and locals want to book,” said Joe Zadeh, Airbnb’s head of experiences and longtime employee of the company who helped spearhead the product line. “We so far have seen that this idea that hosts can be empowered for providing something that hits their passion and also makes the guest’s trip a lot better. We are seeing the growth in experiences to be even faster than the growth of our personal home visits because we already have a really engaged travel audience that wants to have a real local experience.”

Airbnb adds a 20 percent service fee on to each listing, which is high when compared to sites like Viator and potentially lucrative for the company. Nonprofits that offer activities on the platform, however, have the fee waived.

By breaking down the silos between the tour and hospitality sectors, Airbnb has tapped into the growing demand for personalized experiences. Zadeh said his team isn’t necessarily looking to the wider tours and activities space for inspiration on how to grow the platform. As the Airbnb host has become an ersatz concierge, the ability to recommend cool activities to guests holds value for both sides.

“We’re certainly seeing that and it’s is an area we actively invest in: just how we make the entire trip better and create real value for our customers,” said Zadeh. “When you do that, they will keep coming back and using the app. We also have really great suggestions of experiences. The locals are casually mentioning them to their guests. We feel that also a source of some of our bookings is coming from the endorsement of the person they’re staying with.”

Many of the experiences are extremely specialized, in contrast to the bus tours and group walks that proliferate on other activity booking platforms. Zadeh believes things like advanced surfing lessons, social impact experiences, and a diverse lineup of concerts featuring local artists will help the platform stand apart as online booking heats up among tour operators.

While not every person offering an experience is an actual Airbnb host, the plan is to avoid taking on a glut of listings that travelers can find somewhere else.

“If it’s something that you can usually find on Google, if it’s like the first pick, then the host can’t add value to the experience,” said Zadeh. “We want to make sure that the people’s time is more important than their money. They are on vacation, it’s a special time that people don’t get very much of. We want to make sure what they decide to do and spend their money with us that they get a really great value. If our host can’t provide that, then why does that experience exist?”

While Airbnb is known primarily as a leisure brand, the company’s aspirations in the business travel space include experiences as well. The need for powerful tours and activities cuts across the sectors; the staid corporate retreat has its place, but there is a sizable market of businesses out there looking to build performance through shared experiences.

Fixing What’s Broken

The big opportunity in the tour sector is to bring the space into parity with the revenue management and marketing capability of the hotel and airline sectors.

There are two challenges, though. One, big tour operators are doing well selling through agents and call centers; the complexity and price of their packaged tours doesn’t lend itself well to an online booking environment. Travelers are more likely to book a $100 guided day tour of Athens online than a $10,000 weeklong excursion across Greece.

“Everyone looks at Google and aggregated distribution now, but even when the OTAs tried to sell tours, they really struggled,” said Jeff Russill, senior vice president of marketing and product at tour operator G Adventures. “Our first touch with people outside of travel agents is almost exclusively digital, of course, but they shop on mobile and we’ve seen the switch to mobile. More than half our traffic’s mobile, but once they’re down the sales funnel people are still calling at the same rate as they used to.

“You can look at that as a problem as a business and say, ‘Well we want these people to transact online,’ but if you have great, really-well trained salespeople in your contact centers, with an involved purchase, you probably have a better chance of converting that sale offline on the phone because of the involvement.”

Skift Research data show that the percentage of travelers who use mobile for tours and activities lags behind nearly every sector across all age groups, with use coming in closer to translation software or restaurant reservations than that of air travel, ridesharing, or hotel apps. This will change over time but reflects the battle being fought to capture the attention of travelers once they’ve arrived somewhere for vacation.

Customers who go on a more expensive packaged tour are also more likely to be brand loyal and book with an operator multiple times, according to Travel Corporation’s Dan Christian.

The second problem pertains to the long tail of small tour operators around the world. A smaller operation doesn’t likely have the money to invest in new technology, or navigate a crowded online distribution marketplace. They’re doing fine selling in destination or direct through their website, and don’t necessarily have the time and manpower to negotiate with a variety of online platforms for an uptick in demand which may require another round of investment in buses or employees to meet.

Given their lack of resources, how can better automation and on-the-ground connectivity help these operators increase their margins without adding additional complexity? There are a few approaches being explored in the marketplace.

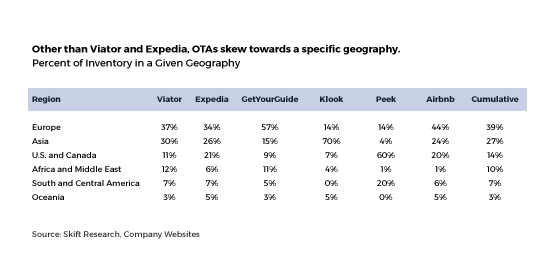

Much of the venture investment in the sector has been to spur the growth of companies that act as not just revenue and yield management solutions for small operators, but booking portals themselves. Yet, there is extreme fragmentation in this space, as well; Klook owns Asia, Rezdy is popular in Australia, GetYourGuide is thriving in Europe, and Peek is strong in the U.S.

According to Peek, operators are finally waking up to the importance of having their tours available with real-time booking on their websites.

“The average consumer books within six hours, so the need for real-time is really big here,” said Ruzwana Bashir, co-founder and CEO of Peek. “If you think about B2C companies that have existed, they’ve typically sold within constraints. A lot of things you’ll see listed are a double-decker bus tour, or a helicopter tour. By providing a software layer, we’re allowing operators to unlock inventory that hasn’t been available online on a B2C platform before.”

Peek raised $23 million earlier this year and starting testing tour bookings through Google’s Reserve reservation service that is baked into Google Maps.

Besides the online booking, Peek’s software also streamlines operations behind-the-scenes. If an operator has a bus and a van, for example, Peek Pro will figure out the optimal way for them to run tours on particular days depending on demand for specific tour products. The platform also lets operators easily sell add-ons and upsell to customers.

Then, in the field, bookings are updated in real-time on a mobile device and check-in happens seamlessly on the same device.

“As you’re moving into the mobile space, as an operator all that inventory you can’t do mobile or last minute booking if you have an employee updating spreadsheets,” said Oskar Bruening, co-founder and chief technology officer of Peek. ”It’s a much more effective way for operators to run their business. From a technology perspective, these things haven’t really existed before. Now that we have smartphones, as an operator I can hire my 16-year-old nephew for a summer job, give him a tablet, and have him start checking people in. This is why the industry is starting to wake up.”

A tour group at the Grand Palace in Bangkok, Thailand in April 2017. Dan Peltier/Skift

Offerings like this, Breuning figures, will be extremely valuable to the small operator with only a handful of staff. An operator’s products also sit on Peek’s consumer-facing website and app, where the company is hoping to curate a more unique set of tour products than sites like Viator or GetYourGuide.

There’s also the complexity of managing online distribution channels outside an operator’s website. There is a seriously tangled web here; platforms offer a variety of connections to other booking sites and distribution channels.

Some, like Bokun and BookingKit, eschew running their own storefront to focus on distribution and revenue management over a variety of platforms.

“The same shift [that happened in flights and hotels over the last thirty years] is happening right now in tours and activities,” said Lukas C. C. Hempel, co-founder and chief technology officer of BookingKit. “The operators are feeling pressure from two sides: the distribution side, and on the other side from the customers who expect them to be bookable last-minute, to be bookable online, and to be able to pay online. Someone has to help them manage this challenge because most operators are product-driven guys, they love surfing or city tours. They don’t wake up in the morning and say, ‘Wow, I want to optimize my channel booking flow and yield management criteria.’”

Much like automation can make running and managing a set of tours easier, so too can it make selling online across a variety of platforms more palatable. As marketing and revenue management tools for tour operators improve, so will competition for customers in the digital space.

“The internet has made things more transparent,” said Hempel. “The product gets more comparable than it was before and more transparent. Before, a lot of traffic was coming from hotels, either the concierge or a deck of flyers, where there was not a lot of comparison. It’s competing for the time of vacationers, and if a supplier has a really good e-commerce play, he will convert the customer. From a global business standpoint, it is not that there is a need to attract new customers; it is more defined by competition among suppliers.”

But what about bringing the packaged or multi-day tour sector online? While these tour operators do sell online, most of their transactions are still processed by call centers or travel agents.

TourRadar is perhaps the most interesting player in this area, but operates as an online travel agency, earning agency commission on sales, instead of distribution fees.

“The thing with [multi-day] touring is that the only distribution channel for them has been the travel agents,” said Travis Pittman, CEO and co-founder of TourRadar. “They’ve had to build decent commissions into their models to actually make it work. The beauty of what we’re doing is that we’re not adding a new link to the chain and trying to take another cut out of things. We’re just doing the same thing but online. When you take the cost of brochure production and all that kind of stuff out, it actually does end up being a cheaper distribution channel for them.”

The company has partnered with some of the biggest global tour operators, including Travel Corporation and G Adventures, to bring complex multi-day tour products into an online booking interface similar to Expedia or Booking.com.

TourRadar recently raised $50 million in Series C funding, bringing its total raised to $66.5 million. The business opportunity is there; a 15 percent commission on a $10,000 tour is much more valuable than the 20 percent TripAdvisor may make on a $100 museum tour. Converting a $10,000 booking, though, is much more difficult, which is leading TourRadar to experiment on the online marketing side.

They also provide call center service similar to a traditional travel agency, meaning customers can ask questions and get support when something goes wrong. After eight years, the company thinks it is close to cracking the code for travelers who want to book a complicated tour online.

“As stupid as it sounds, it’s taken us that long to piece all the parts of the puzzle together,” said Pittman. “It’s not just a commodity, click-and book-type product. And I think that’s what we see in these copycats that are coming out. They’re copying us maybe on the front end of how the site looks, but there’s so much more to the back end. Importing of all the product, and mapping of that, the content enrichment that goes behind that. The customer support, the payments, everything that people just don’t realize. And I think that’s what’s scared them off a little bit again, Expedia or maybe Booking or someone like that. Is that just as soon as they go over a two-day product, if it’s longer than two days their conversion just falls off the cliff. Their customer’s completely different and they just don’t know how to deal with it.”

The Digital Promise

An arms race of sorts is on in the sector, but the good news is that every stakeholder stands to gain from the mobile revolution fully impacting tours and activities.

Tour operators will be able to better merchandise and manage their revenue while targeting customers more effectively around the world. Consumers will have increased choice and bookability. Travel agents, too, will have access to book a wider variety of tours for clients and a strong value proposition has increased with more options that create confusion for high-spending travelers.

Some very happy venture capitalists will also emerge from this cycle of investment, although it is unclear how committed the major online booking sites will be to going up against the giant that TripAdvisor represents in the space.

“It’s way too early to know if there are definitive losers in all of this,” said TripAdvisor’s Halpin. “You know, back when I worked at Expedia and ran Europe we were king of the hill. And then Booking.com came along with a different model. We now have that as a story. One that’s worth $100 billion and one is worth $20 billion dollars.”

From the product perspective, increased differentiation and options for travelers have come to redefine the once staid idea of a tour. As travelers have come to expect more personalized offerings from hotels and airlines, they are also looking to find unique activities that are bookable online.

The problem remains, though, that most consumers still think more complex and intricate tours are the same old bus and group tours they are used to. The sector must use marketing to teach consumers that they are innovating and offering a diverse set of experiences that defy expectations.

“Airbnb, they’re amazing storytellers; what they’ve done with experiences is awesome,” said TourRadar’s Pittman. “Now I think it’s up to players like us and the tour operators we work with to collectively try and change that perception. Because if we don’t, people are always going to think you’re boring, not flexible, whatever it is.”

As the tours and activities sector fully embraces online booking and new forms of experience for customers, the old concepts of what exactly a tour is will shift.

There will always be a place for the quintessential bus tour or sightseeing cruise, but in an age defined by the escape from digital distractions, a new wave of experiences and activities will help propel the entire travel industry forward.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, experiences, tour operators, tripadvisor

Photo credit: The global tours and activities sector is going through seismic shifts. Pictured are tourists using a selfie stick at Castello di Amorosa, an attraction in California's Napa Valley. Skift