Skift Take

While brand considerations must be made on a property-by-property basis, Skift Research's proprietary Brand Matrix analysis ranks Marriott and Hilton at the top.

Choosing the right brand for a property is just one decision a hotel owner must make in an increasingly complex, and ever-changing, environment. Something that makes sense for a hotel in parts of rural Minnesota might not work for South Beach, Miami, or urban Manhattan. We also recognize that the decision analysis is complicated, subject-to-error, and at times, without an absolute, concrete answer.

Nevertheless, Skift Research developed a proprietary Brand Matrix that we hope helps hotel owners think about several key items to consider when evaluating brand portfolios. Our analysis suggests that the Marriott brand portfolio ranks the highest across 13 key quantitative metrics, but Hilton is not far behind.

As the major brands focus on expanding their footprints, strengthening their loyalty programs, and increasing their bottom lines, it will be interesting to see how brand perception for hotel owners evolves over time.

Last week we launched the latest report, A Deep Dive Into Operating & Branding Strategies for Hotel Owners, in our Skift Research service.

Below is an excerpt from our Skift Research Report. Get the full report here to stay ahead of this trend.

We recognize that, when it comes to deciding on a brand, the analysis really should be which brand will bring the most incremental revenue, relative to the fees paid. This analysis should be thought of not just in terms of additional occupancy or higher ADR, but a breakeven analysis adding in the cost of the fees relative to the incremental revenue (i.e. the brand would need to result in an ADR that is $50 higher, for instance, to simply cover the cost of the fees the owner would be paying).

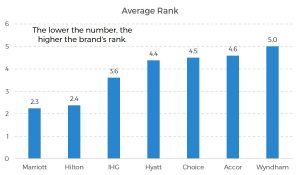

However, as a framework for the hotel owner choosing to affiliate with a brand, Skift Research has developed a proprietary ranking of the major brand chains we call our Brand Matrix. In our analysis, we ranked the largest major brands, Marriott, Hilton, Hyatt, Choice, Wyndham, IHG, and Accor based on 13 key quantitative metrics.

This analysis does not take into consideration any sort of market analysis, as a certain brand might be more successful in an underpenetrated market, or certain markets might be oversupplied with a certain type of brand. However, we hope the analysis sheds light on some ways that owners should think about deciding with which hotel brand to affiliate.

Preview and Buy the Full Report

Our quantitative metrics included items such as number of loyalty members, loyalty contribution to occupancy, a metric for market penetration, strongest Revenue Per Available Room (RevPAR) and RevPAR growth, estimated cost of franchise fees, social media engagement, customer satisfaction scores, estimated direct interaction with brand.com, and more. We provide the complete analysis, a detailed description of our metrics, and how each brand ranks on each key metric within the report.

Based on the average of each individual rank, we found the brand that ranks the highest across all of these metrics is Marriott, followed closely by Hilton. IHG, Hyatt, Choice, Accor, and then Wyndham follow.

Marriott and Hilton rank the highest in Skift Research’s Brand Matrix.

Source: Company filings, SimilarWeb, iSpot.tv, The American Customer Satisfaction Index, Skift Research

Preview and Buy the Full Report

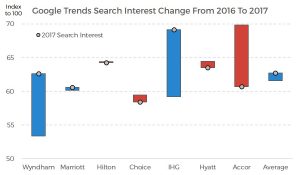

We also monitored Google Trends to assess search interest in different hotel brands. Looking at 2017 versus 2016 data, Wyndham and IHG gained the most interest, while Accor lost the most interest. Hilton and Hyatt both declined as well, but remain above the overall average search interest. Perhaps an increase in search interest could suggest a brand improving its overall rank relative to other brands over time.

On average, hotel brands search interest increased slightly in 2017 versus 2016.

Source: Google Trends

Do Your Due Diligence

We realize these types of decisions, from branding to not branding, branded operator to non-branded operator, are completely location-specific, property-specific, and market-specific. Something that makes sense for a hotel in parts of rural Minnesota might not work for South Beach, Miami, or urban Manhattan.

We also recognize that the decision analysis is complicated, subject-to-error, and at times, without an absolute, concrete answer. However, there are a few things that owners should try to focus on to make a educated, and financially sound, decision. When it comes to an acquisition, the owner should focus on the quality of the real estate, the durability of cash flows, and cash flow growth. That should be the case whether we’re talking about a REIT, another institutional owner, or a family ownership business. In many cases, a hotel owner will be able to get comfortable with a particular brand affiliated with a hotel, so long as the real estate comes at an attractive price and with opportunity for growth.

An overall view of market supply and demand dynamics is also critical. If there are already 10 properties of one brand in a market, the owner is going to be competing with its own brand to get business. In that case, it would make sense to go with a less penetrated brand, or perhaps remain independent so as to stand out. If working with a larger portfolio of hotels, the hotel owner should consider multiple types of brands across chain scales so as to mitigate financial and operational risk as well as allow for the sharing of best practices.

All of this is to say – do your own due diligence. Perform various analyses to better understand the property’s cash flow growth potential and its margin trajectory. Benchmark the property’s performance against its competitive set at all times, so as to find ongoing ways to improve operations and the overall guest experience. Continuously evaluate distribution channels and search for ways to keep costs as low as possible. Some brands will make sense, while others fall by the wayside. Remaining independent may make sense, or it may not. In the end, the focus should always be on sending the most dollars to the bottom line while still maintaining a high-quality product.

Subscribe now to Skift Research Reports

This is the latest in a series of research reports, analyst calls, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst calls, and data sheets conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch

Tags: accor, choice, hilton, hospitality, hotels, hyatt, ihg, la quinta, marriott, research reports, skift research, social media, wyndham

Photo credit: The Marriott brand ranked highest in Skift Research's proprietary Brand Matrix analysis, though we admit numerous additional factors would need to be considered in making branding decisions. 261344 / Bloomberg