Skift Take

Skyscanner is boosting Ctrip's margins, and Skyscanner's new instant booking service shows promise as a way to propel future growth.

It’s becoming apparent that Ctrip’s acquisition of Skyscanner, the flight-search engine, is beginning to pay off.

Ctrip reported Thursday that its second quarter transportation ticketing revenue, including from flights, was $441.3 million, up 46 percent from the same quarter a year earlier. However, Ctrip only acquired Skyscanner in December.

While Skyscanner also offers hotels and other travel products, most of its revenue comes selling airplane tickets — hence the importance of the transportation ticketing revenue figure.

Gross margin was 82 percent for the second quarter of 2017, improving from 72 percent for the same quarter of 2016. Chief executive Jane Sun said one key reason driving the improved margin is because of the Skyscanner acquisition.

As a referral marketplace, Skyscanner doesn’t have the cost associated with each transaction that an online travel agency like Ctrip does. “So they have a very high growth margin,” Sun said.

Instant Booking’s Early Days

Skyscanner officially launched its “direct booking” business, which Skift previewed last spring.

Ctrip’s executive chairman James Jianzhang Liang told investment analysts that the new model “accounts for only a very small part of Skyscanner’s business at this point.”

Yet the new interface is causing more people to book instead of just look. Conversion rates of mobile traffic for direct-booking partners have risen by about half, the company said.

Skyscanner’s service enables airlines like Virgin Australia to create virtual storefronts. The goal is to help carriers retain customer relationships, differentiate their brands, and upsell customers with ancillaries. (See Skift’s earlier story on Finnair’s experiment with Skyscanner’s instant booking.)

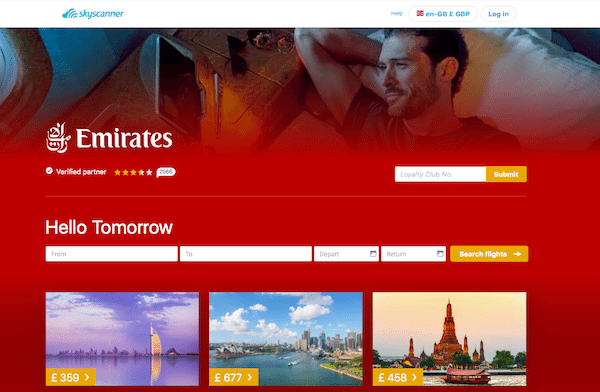

While reporting this story, Skift’s team noticed a sample Skyscanner test storefront for Emirates Airlines. While the storefront doesn’t work as smoothly as it should — and is still a test — it gives a sense of the extent to which Skyscanner is willing to hand over the branding to a partner airline for a search interface.

While the designs are still in testing, Skyscanner chief executive Gareth Williams said elsewhere this week: “Airline store-fronts mean that, for travelers, the experience on Skyscanner is then virtually indistinguishable from the experience on airline.com.”

A key sticking point for instant booking on mobile has been the need to have secure documents and specific detail information accessible to Skyscanner, such as a person’s passport number and their loyalty program information.

The company is one step closer to a smoother process with the introduction of a so-called “wallet” tool on its iOS app where travelers can store passport and loyalty card information. Thanks to a partnership with tech vendor 30k, consumers can have the updated details of their frequent flyer programs in hand. (For details, see a whitepaper released on Thursday.)

But in our tests, we found that some kinks must be worked out to reduce the amount of form-filling that needs to be done to complete a transaction.

The pressure to speed up mobile booking is getting intense for Skyscanner along with all of its competitors. Last year 61 percent of all Skyscanner visits were made on mobile devices, the company said.

Next-generation platforms are getting in the mix, too. Skyscanner says it has had more than 500,000 unique users try its bot and voice platforms across Facebook Messenger, Skype, Amazon’s Alexa, and Cortana since these services debuted last year.

That’s a validation of sorts of the company’s efforts to experiment with voice-powered Internet and chat bots — two much-hyped channels in the past couple of years.

To keep things in perspective, Skyscanner contributes only a mid- to high-single digit percentage of Ctrip’s revenue.

CEO Sun said: “We believe Skyscanner will continue to have a very healthy growth momentum. Overall its growth rate is comparable with Ctrip’s overall growth rate.”

Ctrip is looking at other initiatives to boost growth. One reported this week is that Ctrip is betting on 6,000 franchise shops to boost business in second-tier cities where most travel shopping still happens offline.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: ctrip, earnings, skyscanner

Photo credit: At Skyscanner's Edinburgh, Scotland headquarters, some of the company's 900 employees gather at various times. The company is experiencing steady growth under its new owner, Ctrip. Skyscanner