Skift Take

Disney's unique theme park experience gives the company strong pricing power in the U.S., allowing Disney to consistently raise ticket prices above the inflation rate while growing attendance at the same time. By owning hotels on its properties, Disney is able to maintain an immersive experience, leading to high occupancy rates and steady growth in spending per room. The theme parks feed the hotels with guests and the hotels reinforce the park experience. This has, and will continue to be, a lucrative cycle for Disney.

Last week we launched the latest report in our Skift Research Reports service, A Deep Dive Into Disney’s Competitive Position In Travel.

In the report we explore Disney’s strategies and positioning in travel, both domestically and internationally. A significant part of Disney’s travel business comes from their hotels, which are spread across the globe. Looking at the hotels’ growth and occupancy, we explore their performance and revenue they generate for the brand.

Below is an excerpt from our Skift Research Report. Get the full report here to stay ahead of this trend.

Disney’s hotels range from budget to ultra-high-end with everything in between. They maintain the immersive storytelling focus of the parks, where many hotels use character appearances or intellectual property-themed items to enhance the guest experience. Disney has maintained high occupancy rates, especially in the U.S., as guests at the parks tend to prefer having an entire Disney experience. In our report, retired Disney executive Randy Garfield summed up the hotels quite well:

“The one thing I would say is that the intellectual properties, theming, and the quality of service in the Disney-owned and -operated resorts provides a unique advantage. If you look at Walt Disney World, you’ve got Disney’s Magical Express, the extra Magic Hour, and there are certain benefits that come with an onsite resort guest stay. At the end of the day, it’s a completely immersive Disney experience, from check-in to check-out, and that can’t be duplicated in a non-Disney-owned and -operated lodging.”

“There’s lots of great [non-Disney-owned] lodging opportunities in every market where we operate and we’re dependent on guests, to a large degree, who stay in those lodging facilities as well. We can’t accommodate all the guests who visit Disney theme parks in the Disney-owned and -operated hotels. There’s plenty of people staying in Disney hotels, but there’s also plenty of people staying in independently-owned hotels, in timeshares, and with friends and family. The Disney hotels do very well because of the immersive experience, the attention to detail, and great cast members.”

Preview and Buy the Full Report

Domestic Hotels

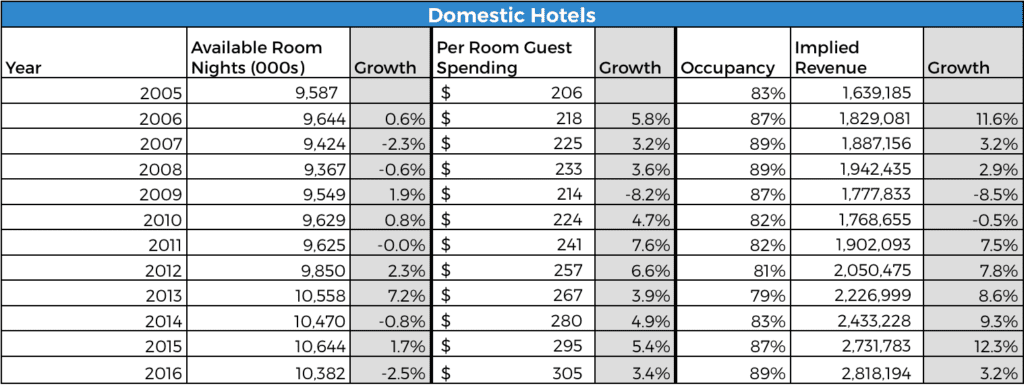

We estimate that domestic hotels contributed $2.8 billion in revenue in 2016, accounting for just under 17 percent of segment revenue. Occupancy rates have continued to improve and hit 89 percent last year. Available room nights have averaged just around one percent in growth since 2006. However, pricing power has been strong with four percent spending growth; this includes the occupancy fees plus spending on food, merchandise, etc. With improving occupancy and higher spend per guest, implied domestic hotel revenue growth has averaged five percent per year since 2006 and eight percent since 2011.

Source: Company Filings, Skift Estimates

Source: Company Filings, Skift Estimates

The company has 18 resort hotels with 23,000 rooms and 3,000 vacation club units at Walt Disney World Resort in Lake Buena Vista, Florida. Additionally, nine independent hotels lease property and have another 6,000 rooms.

Below is an overview of one of the Disney-owned properties.

Preview and Buy the Full Report

Disney Contemporary Resort: This high-end property is classified as deluxe by Disney. It costs $785 for a standard room per night; we searched mid-week in March for all properties. This is walking distance to Magic Kingdom and has a Monorail stop at the hotel for easy access to Epcot. There are two pools, a waterslide, and water playground in addition to a wide array of dining options.

TripAdvisor ranked this property at four out of five stars and the resort has a certificate of excellence.

To Read More, Subscribe Now to Skift Research Reports

This is the latest in a series of twice-monthly reports aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 100 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch

Tags: disney, hotels, research reports, theme parks

Photo credit: Disney's Contemporary Resort at Walt Disney World Resort in Florida. A significant part of Disney's travel business comes from their hotels. QuesterMark / Flickr