Skyscanner Leads Europe's Record Year for Venture Capital Funding in Travel

Skift Take

This year's roller coaster ride of global travel tech startup funding is on track to break records with more than $2.5 billion invested in travel startups and more mature companies.

But European venture capital funding may be in for a cool down, as other regions and sectors experienced, if setbacks in demand on the back of terrorism incidents persist.

Scotland-based flight metasearch site Skyscanner led the pack in European funding, according to data from CB Insights, a New York City-based venture capital and investment data firm.

CB Insights’ analysis excludes any rounds of ride-share companies such as BlaBlaCar or Uber. The data include disclosed funding rounds of travel companies that offer products and services focused on tourism, booking services, search and trip-planning platforms, on-demand travel and recommendation sites.

Skyscanner, valued at $1.6 billion and mulling an IPO, picked up $192 million in January, the largest funding round for a European travel company this year, although part of the round went to buy out existing investors. Skyscanner has raised about $197 million in total funding since it was founded in 2003, with its previous disclosed round in 2007.

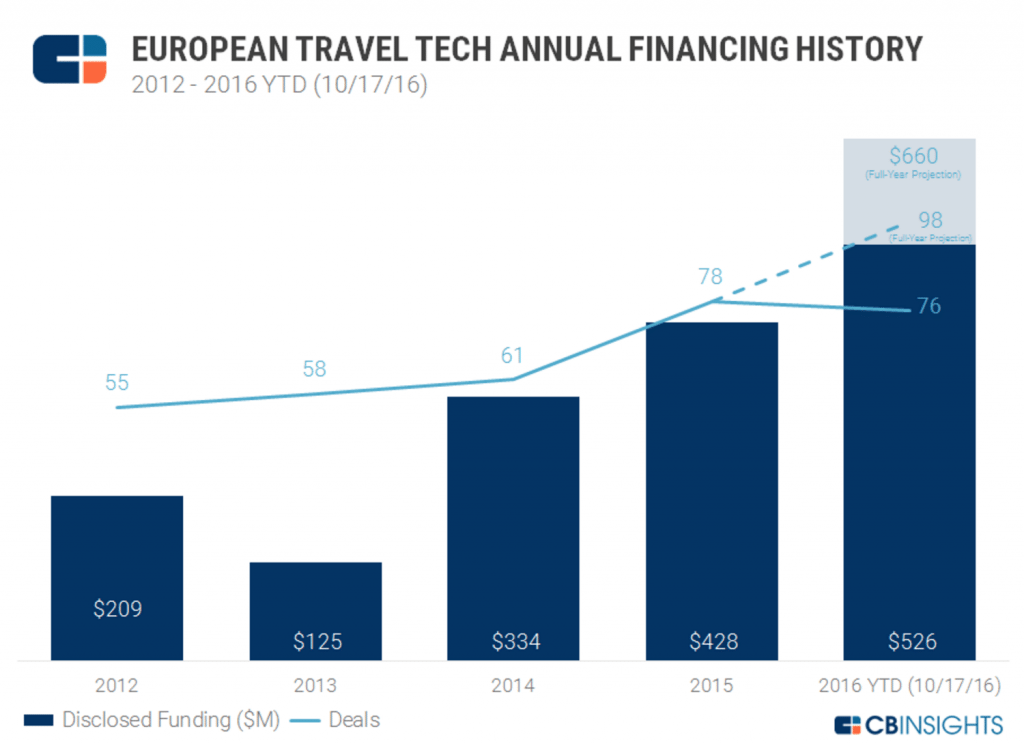

Overall, investors have given about $526 million to travel companies and early-stage travel startups across the continent so far in 2016 -- already a record high.

The Priceline Group has flirted with aquiring Skyscanner over the years but walked away; Skyscanner also views itself as an acquirer. Most of Skyscanner's revenue comes from airline-ticket referrals but it also offers hotels and cars across its 12 localized sites for various markets, which are available in 30 languages and 70 currencies.

The site, like other metasearch players, is starting to take direct bookings. Skyscanner currently has more than 800 employees in 10 offices, and is focused on expanding its base in China, Japan and the Americas.

To be clear, trends for Skyscanner, as a 13-year-old company, don't necessarily reflect what's going on with early-stage startups in Europe.

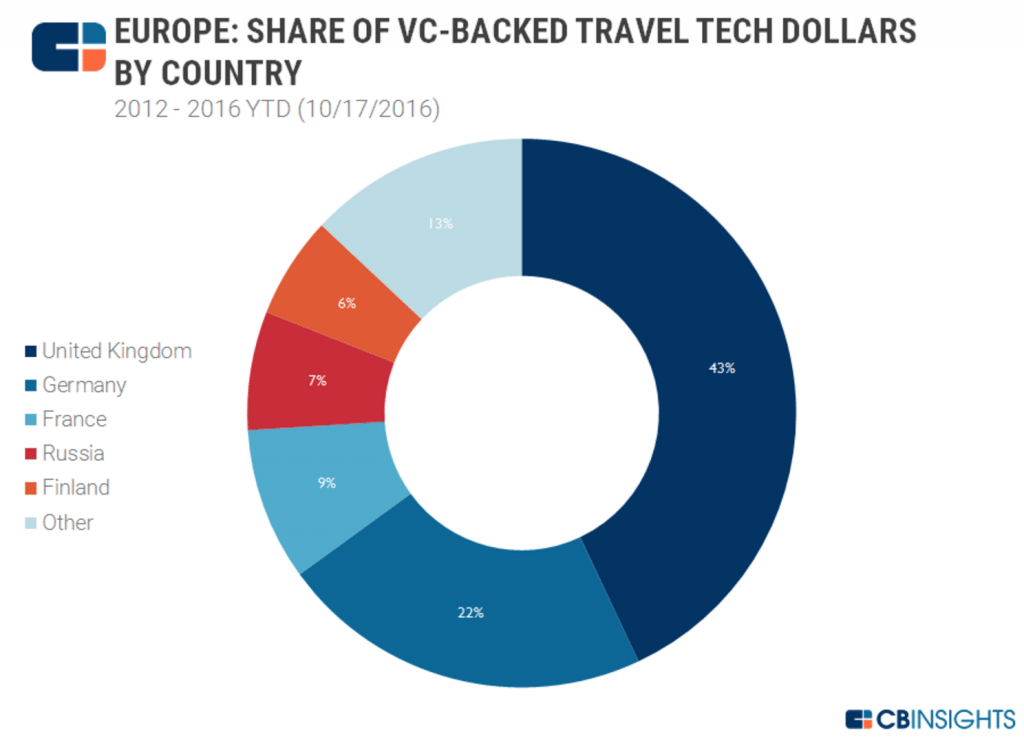

The runners-up for venture capital funding in the region are GoEuro, a Berlin, Germany-based airline, bus, car and rail booking site, which raised $70 million in October, for a total of $146 million in funding and Berlin-based tours and activities booking site GetYourGuide's $96 million. It's easy to see why Germany is a hotbed for travel startups as the country claimed some 22 percent of European travel tech funding this year (see chart below).

While some European travel startups basked in investors' attention this year, funding was much brighter in the U.S. where at least one-third of global travel startup funding has landed since January, CB Insights found.

GetYourGuide is one of the top-funded travel startups in Europe despite not raising any money in 2016 as its last disclosed round was in November 2015.

Skift's own analysis of travel startup funding shows that most European startup rounds since at least June were a fraction of Skyscanner and GoEuro's. More typical were a $15.7 million funding round for Dreamlines, a Hamburg, Germany-based cruise booking site, and a $4.3 million Series A for London-based restaurant tech company Flypay.

Brexit's Impact on Startup Funding

The UK, which voted to leave the European Union in June, accounted for 43 percent of European travel tech funding from January to October 17 -- the most of any European country -- and grabbed about 10 percent of global travel startup funding so far this year.

But given 58 percent of startup funding in Europe came in the first quarter it's likely many UK and other European travel startups have been impacted by Brexit or will feel it later this year and into 2017. Funding aside, weaker demand from travelers in Europe has already hurt some companies.

CB Insights credits a strong first quarter for Europe's record year for startup funding as deals and euros have dropped in the last two quarters. This signals that "investors may be pulling back," CB Insights' said.

Still, European low-cost carrier and London-based easyJet, for example, announced a "multimillion pound" investment in October in UK startup accelerator Founders Factory, CBNC reported. Founders Factory will work with startups from several industries, including travel, and was founded last year by Brent Hoberman and Henry Lane Fox, both of whom were part of Lastminute.com's founding team.

UK-based IAG, parent company of British Airways, Iberia and Aer Lingus, also announced its own accelerator that starts in January and will be based in London.

The Financial Times also reported that venture capitalists invested about 125 million pounds ($200 million in 2015 dollars) in UK startups across multiple industries in the weeks after Brexit. Albeit, that's still a slowdown from the same period last year when UK startups raked in $338 million.

While startup funding goes in booms and busts, a weaker European economy and terrorism and Brexit fears will be top-of-mind for investors during the next year as the UK figures out how to exit the European Union.

Source: CB Insights