Skift Take

This is not immaterial to UK travel. They need Americans to (continue to) come flocking and spend as much as they can. As much as it may hurt, VisitBritain and other interests will need to pitch the potential big savings of their destination in the months ahead.

The vote last week by citizens of the United Kingdom to exit the European Union in favor of a sort of independence has dominated political and financial headlines since Friday.

What this departure means to England, Scotland, Wales, and Northern Ireland in regards to inbound tourists from the United States and elsewhere in the short term is a more friendly currency exchange rate — today we saw the most favorable pound-to-dollar rate in over three decades. But long-term effects of the vote are harder to project.

The choices of U.S. travelers considering travel to the UK are not a minor matter. According to VisitBritain, 3.3 million U.S. travelers went there in 2015 and spent nearly $4.4 billion, a spending record for any overseas tourism market.

“2015 was an excellent year for American travel to Britain and marks the best visitor numbers we have seen since 2007, before the global financial downturn,” Paul Gauger, Interim Executive Vice President, Americas for VisitBritain, said in a statement just two weeks ago.

The UK is no joke for inbound tourism to the U.S. either: The UK is currently the largest source of overseas visitors to the U.S.

Post-Brexit

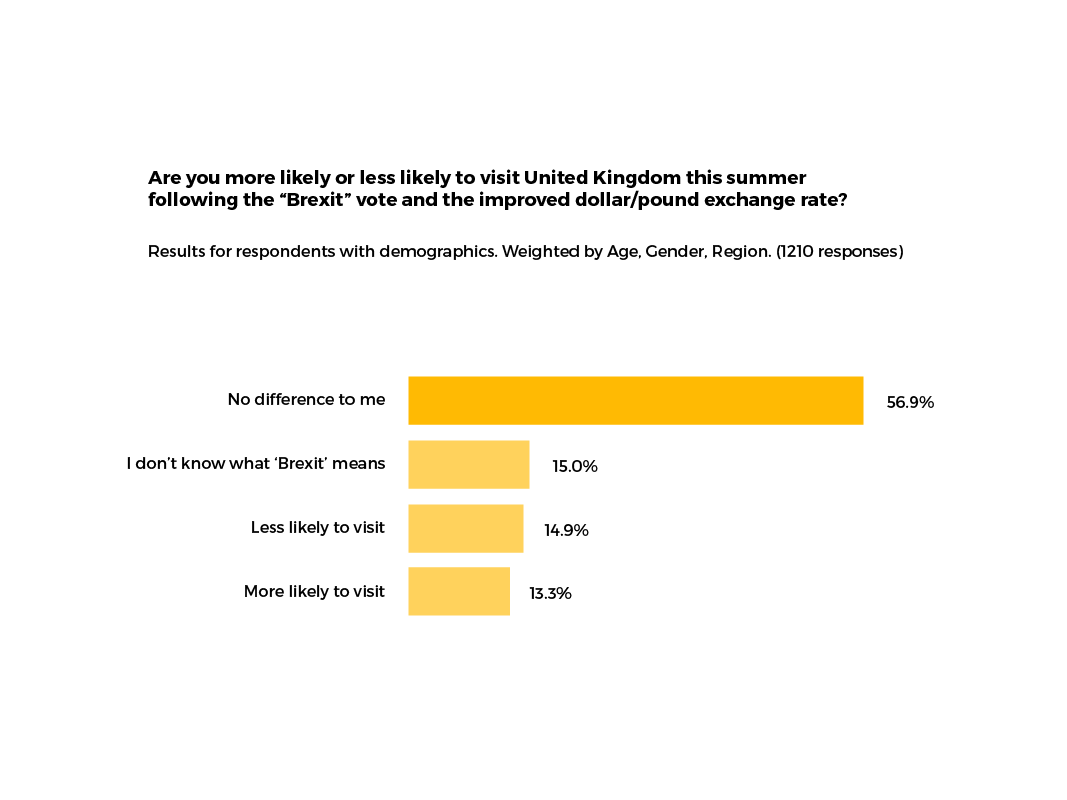

In a survey conducted June 24-26, 2016 we asked over 1,500 members of the general Internet population that were U.S. residents a question about travel intent as it relates to the departure of the UK from the EU. The question we asked was relatively simple: “Are you more likely or less likely to visit the United Kingdom this summer following the ‘Brexit’ vote and the improved dollar/pound exchange rate?”

Important: This survey — not served to Skift users — was administered to 1,515 members of the U.S. adult internet population in June 2016, through Google Consumer Surveys. The methodology is explained here.

Unsurprisingly, a majority of respondents (57%) answered that it was “no difference,” owing to a lack of travel plans, preexisting plans, or a general unfamiliarity with the destination.

That’s still a high possible number of visitors interested in the UK this summer when one considers the outbound international U.S. traveling population as a whole.

Outside of the number of respondents for whom the Brexit and travel were in the “no difference” category, the largest number (15%) of respondents did not know what the Brexit was. The “less likely” numbers were next (14.9%), followed in last place by the “more likely” visitors (13.3%)

More takeaways from the survey:

- Women were nearly twice as likely as men (19.3% vs. 10.3%) to answer “I don’t know what Brexit means.” Men were also the more likely to visit (16.7%) than women (10.2%)

- Age was significant in determining interest. The 18-24 set were the most likely (23%) to say they didn’t know what the Brexit was, and they were also the least likely to visit (17.6%).

- The older you are, the more you know in many cases. Only 10.7% of 65+ respondents said “I don’t know what ‘Brexit’ means,” the best score on the ignorance metric.

- The relatively rich ($100-$140 K in earnings) are more likely to be interested in traveling, with a 24% positive response, the highest in the survey results.

- Regionally, the U.S. West scored highest in the “more likely” category with 14.7%.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: brexit, politics, surveys, tourism, uk

Photo credit: Supporters of leaving the EU celebrate at a party hosted by Leave.EU in central London as they watch results come in from around the country after Thursday's EU referendum, Friday, June 24, 2016. Stefan Rousseau / PA via Associated Press