Skift Take

Travel acquisitions have been humming along this year and we've seen several deals that will have a lasting impact on consumer behavior. Marriott-Starwood dominated headlines for months although Expedia and Priceline largely have been largely inactive in mergers and acquisitions so far in 2016. We still have a few months left, though.

While Expedia Inc.’s buying spree created most of the mergers and acquisitions buzz last year, 2016 has been a quieter year for mega online travel agency acquisitions and the focus has shifted to hotel and other hospitality tech company acquisitions so far this year.

There have been at least six hotel acquisitions since January totaling more than $16 billion, with the bulk of that amount coming from the Marriott International-Starwood Hotels & Resorts deal that closed last month. Other deals included AccorHotels $2.7 billion buy of Fairmont Raffles Hotels International and SBE Entertainment’s $794 million grab of Morgans Hotel Group.

AccorHotels also waded into alternative accommodations when it bought onefinestay for $170 million and also acquired hotel software company John Paul. Two other hotel software exits include Trivago buying Base7booking and TrustYou buying CheckMate (terms of both deals were undisclosed).

Still, there has been plenty of smaller acquisition activity in other sectors and among travel startups in 2016. Some 71 travel companies have been acquired, including both startups and more established players, so far in 2016, according to Mike Coletta, managing director of Travel Startups Incubator.

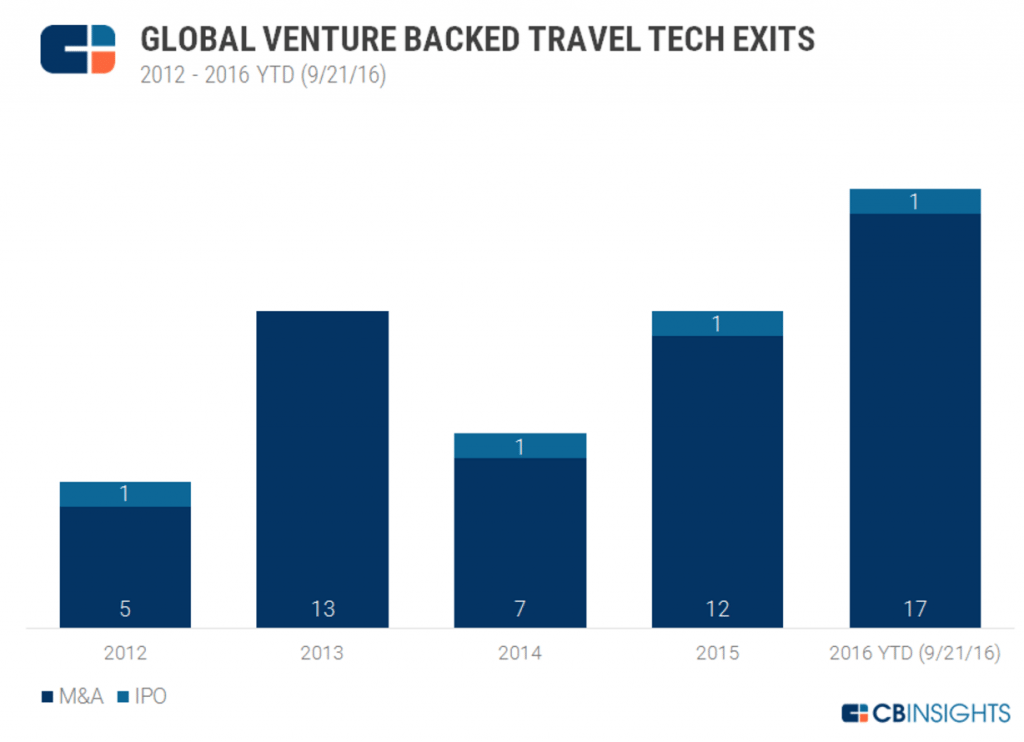

CB Insights, a New York City-based venture capital and investment data firm, has tracked 17 travel tech deals so far this year. That number includes acquisitions of companies that provide travel booking services, search and planning platforms, on-demand travel, and recommendation sites. Car-hailing services are excluded from CB Insight’s analysis, as are any major hotel company acquisitions, for example. Compare that to 13 travel tech acquisitions in 2015 and CB Insights found this year so has seen a record high for venture-backed travel tech acquisitions in terms of the number of exits (see chart below).

The relatively high number of exits of venture-backed companies so far in 2016, though, doesn’t necessarily mean it was a windfall for investors. Many of these exits, from WAYN to Hipmunk, for example, were undoubtedly subpar from an investor standpoint.

Travel acquisitions we’ve identified added up to about $20.1 billion this year in terms of those where the deal prices were disclosed. Last year the total for the entire year was about $6.9 billion. But if you exclude the $13 billion Marriott-Starwood deal, for example, the totals for all of 2015 versus the first half of 2016 would be about the same — the size advantage definitely goes to 2016 so far.

The number of acquisitions has been greater in the first half of 2016 versus all of 2015 but excluding Marriott-Starwood, which closed in September 2016, the blockbuster-like announcements of online travel acquisitions were greater last year.

Source: CB Insights

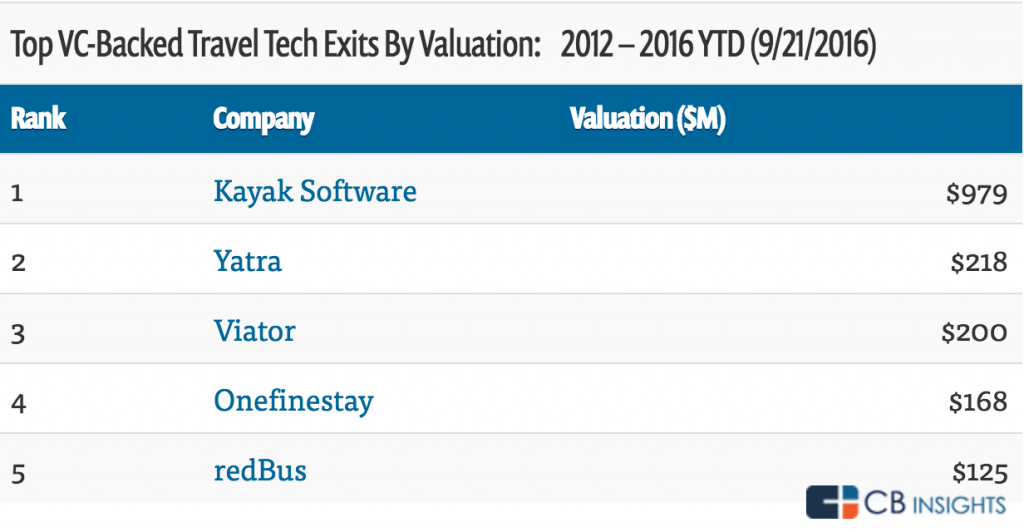

Source: CB Insights

Expedia and Major OTAs’ Quieter Year

Expedia, Inc’s acquisition activity is much less dramatic this year than in 2015. The company didn’t make any acquisitions during the first six months of this year but has made smaller investments in startups such as hotel tech app Alice, for which Expedia led a $9.5 million Series A round in January. Likewise, the Priceline Group paid $75 million to acquire businesses in 2015, according to its annual report filing with the U.S. Securities and Exchanges Commission. But this year Priceline has only doled out $795,000 on acquisitions and other investments as of June 30.

TripAdvisor, which has made nine acquisitions since 2012 such as Viator, FlipKey and Jetsetter, acquired HouseTrip in April and Citymaps in August. Terms of both deals were undisclosed although TripAdvisor’s second quarter SEC filing shows the company has paid $1 million for acquisitions during the first six months of 2016, down nearly $30 million for the same period in 2015. TripAdvisor’s investing activity was down $31 million for the first half of 2016.

Coletta of Travel Startups Incubator feels travel acquisition activity in 2016 hasn’t rocked the industry the way Expedia’s acquisitions did last year. “The usual suspects — Expedia, Priceline and TripAdvisor — have been relatively silent with only one or two acquisitions each,” said Coletta. “We attribute this to the work they are doing to acclimate and integrate acquisitions from the spree that has occurred over the last few years.”

Expedia, however, may be struggling to make all of those integrations as the company’s network infrastructure “wobbled a little bit,” said CFO Mark Okerstrom during the company’s second quarter earnings call on July 28. Regardless of what caused the wobble it’s likely to have some impact on how the company views acquisitions, and how frequently it makes them, moving forward.

Below is a look at the top five most well-funded and top five VC-based travel tech company exits since 2012. Kayak takes the top position on both charts and onefinestay, which was acquired by AccorHotels in April, was valued at $168 million with $81 million in funding at the time it was scooped up.

Source: CB Insights

A Year of Many Smaller Travel Acquisitions

To be sure, Expedia and Priceline being more trigger shy in 2016 than in recent years shouldn’t imply a bad year for travel acquisitions. Acquisition activity goes in cycles and there were still several notable deals for both startups and legacy companies.

The median for the total amount raised for companies acquired this year is about $10 million, according to Coletta, based on acquisitions that were disclosed. More than half of acquisitions so far in 2016 have occurred outside of the U.S. with Chile, Berlin and Southeast Asia becoming beehives for travel acquisitions and startups in general. And given hype this year around companies working with artificial intelligence, acquisitions activity in this area for travel hasn’t followed suit.

But there’s been plenty of investment in artificial intelligence startups.

These areas are still novel for travel, though, and Coletta expects acquisitions to pan out in coming years. “It’s very difficult to get the booking experience right with bots and artificial intelligence. We’re probably still about five to 10 years away from when artificial intelligence really truly seems like magic. But for customer service I think AI is much more efficient and there are a lot of great uses there.”

Online travel agency acquisitions were most common this year, such as ZO Rooms and Hipmunk, with seven booking site buys compared to six last year. We also count at least three alternative accommodations acquisitions such as HouseTrip and at least three corporate travel management company purchases (see charts below for full break-downs).

Travel tech acquisitions have been heavier on the B2B side this year, said Coletta. It’s generally more difficult for consumer-facing startups to get acquired versus those serving other businesses because those models often aren’t scalable, for example. “Nobody’s going to be able to do [things like travel planning] better than Google.”

Speaking of Google, the search engine and technology company released its Google Trips app last month. It also has Google Maps, hotel metasearch and Google Flights in its arsenal. “[Google’s] moving more into travel,” said Coletta. “There are a lot of different areas that are going to continue to converge for them and that’s an advantage that nobody can really catch up to, certainly not a startup.”

Adding up Travel Acquisitions so Far in 2016

Below are two charts outlining acquisitions so far this year. They depict acquisition activity across a variety of sectors. We’ve also included a chart on travel acquisitions in 2015 to help compare the scope and type of deals for both years.

These lists aren’t exhaustive. The 2016 list includes acquisitions ranging from Alaska Airlines’ $2.6 billion buy of Virgin America in April — although it hasn’t closed yet — to Zhonghong Holdings Group’s snag of Abercrombie & Kent to AccorHotels scooping up onefinestay for $170 million.

The acquisition of Abercrombie & Kent and Concur’s acquisition of Hipmunk earlier this month are among the more surprising buys in travel this year, with Concur hoping Hipmunk can invigorate business travel and travel management.

There are also still three months left in 2016 and it’s anyone’s guess whatever additional merger and acquisition activity may spring up, though we’ve already mused about that.

Coletta said acquisition and investment activity involving bus companies around the world has also grown this year. Megabus was acquired by Flixbus and TailBus was acquired by Rally this year, for example. “There’s a lot of dollars being spent on bus transportation but across the world it’s still extremely fragmented and a lot of it is still offline,” said Coletta. “It’s a big market and I’m not surprised that it’s getting more attention this year.”

Top Notable Travel Acquisitions So Far in 2016

| COMPANY | ACQUIRED BY | ACQUISITION AMOUNT | TOTAL FUNDING AS OF ACQUISITION | B2B OR B2C | Sector |

|---|---|---|---|---|---|

| Starwood Hotels & Resorts* | Marriott International | $13 billion | N/A | B2C | Hotels |

| Trip4real | Airbnb | undisclosed | $3.1 million | B2C | Tours and Activities |

| Fairmont Raffles Hotels International | AccorHotels | $2.7 billion | N/A | B2C | Hotels |

| Hipmunk | Concur | undisclosed | $54.9 million | B2C | Online Travel Agency |

| Hailo | Intelligent Apps | undisclosed | $100.6 million | B2C | Ride-share |

| Citymaps | TripAdvisor | undisclosed | $12 million | B2C | Mapping |

| FlightCar | Mercedes Benz | undisclosed | $40.4 million | B2C | Ride-share |

| onefinestay | AccorHotels | $170 million | $80.9 million | B2C | Alternative Accomodations |

| HouseTrip | TripAdvisor | undisclosed | $59.7 million | B2C | Vacation Rentals |

| ZO Rooms | Oyo Rooms | undisclosed | $47 million | B2C | Online Travel Agency |

| FlightStats | Flightglobal | undisclosed | $3 million | B2C | Flight Data |

| Voyat | Intent Media | undisclosed | $2.8 million | B2C | Hotel SaaS |

| Bucket | Galavantier | undisclosed | $1 million | B2C | Trip-planning |

| Vantage Hospitality Group | Red Lion Hotels | $27.8 million | N/A | B2C | Hotels |

| CheckMate | TrustYou | undisclosed | unknown | B2B | Hotel SaaS |

| Hyper Travel | Tradeshift | undisclosed | unknown | B2C | Virtual Travel Agent |

| Base7booking | Trivago | undisclosed | unknown | B2C | Hotel SaaS |

| Hotelbeds Group | Cinven | undisclosed | unknown | B2B | Corporate Hotel Booking |

| ITC Luxury Travel Group | NorthEdge Capital | undisclosed | unknown | B2C | Online Travel Agency |

| Morgans Hotels Group | SBE Entertainment | $794 million | N/A | B2C | Hotels |

| Heritage Tours Private Travel | JG Black Book | undisclosed | unknown | B2C | Tour Operator |

| Hotel Hotline | HotelPlanner.com | undisclosed | unknown | B2C | Online Travel Agency |

| SMT Travel Agency | American Express Global Business Travel | undisclosed | N/A | B2C | Travel Agents |

| Carlson Rezidor Hotel Group | HNA Tourism Group | undisclosed | unknown | B2C | Hotels |

| Megabus | Flixbus | undisclosed | unknown | B2C | Online Travel Agency |

| Travizon Travel | Corporate Travel Management | $28 million | unknown | B2C and B2B | Corporate Travel Management |

| Abercrombie & Kent | Zhonghong Holdings Group | undisclosed | unknown | B2C | Tour Operator |

| Trampolinn | GuestToGuest | undisclosed | unknown | B2C | Alternative Accomodations |

| TailBus | Rally | undisclosed | unknown | B2C | Online Travel Agency |

| Virgin America** | Alaska Airlines | $2.6 billion | N/A | B2C | Airlines |

| GetGoing | BCD Travel | undisclosed | unknown | B2B | Online Travel Agency |

| Navitaire | Amadeus IT Group | $830 million | unknown | B2B | Airline SaaS |

| John Paul** | AccorHotels | undisclosed | unknown | B2B | Hotel SaaS |

| KDS** | American Express Global Business Travel | undisclosed | $13.3 million | B2B | Corporate Travel Management |

| Wayn | Lastminute.com | undisclosed | unknown | B2C | Trip-planning |

*Some acquisitions, such as Starwood and Fairmont Raffles, are included in the 2016 list because those deals closed in 2016 and were announced in 2015.

**The Virgin America and John Paul deals are still pending.

Top Travel Acquisitions in 2015

| COMPANY | ACQUIRED BY | ACQUISITION AMOUNT | TOTAL FUNDING AS OF ACQUISITION | B2C VS. B2B | Sector |

|---|---|---|---|---|---|

| HomeAway | Expedia, Inc. | $3.9 billion | $495.5 million | B2C | Vacation Rentals |

| Pricematch | The Priceline Group | undisclosed | $10.3 million | B2B | Hotel Revenue Management |

| Rocketmiles | The Priceline Group | $20 million | $8.5 million | B2C | Airline Tech |

| Dwellable | HomeAway | undisclosed | $2.1 million | B2C | Vacation Rentals |

| Orbitz Worldwide | Expedia, Inc. | $1.6 billion | N/A | B2C | Online Travel Agency |

| Acteavo | TrekkSoft | undisclosed | $97,000 | B2B | Tours and Activities |

| BookitNow | Quicket | undisclosed | $260,000 | B2C | Online Travel Agency |

| Voyagin | Rakuten | undisclosed | unknown | B2C | Tours and Activities |

| TripScanner | Coupa Software | undisclosed | unknown | B2B | Business Travel SaaS |

| Travelfusion | Ctrip | $160 million | unknown | B2B | Global Distribution System |

| FlightView | OAG | undisclosed | unknown | B2C | Flight Data |

| Abacus International | Sabre Holdings | $411 million | N/A | B2B | Corporate Travel Management |

| Direct Travel | ABRY Partners | undisclosed | unknown | B2B | Corporate Travel Management |

| Teldar Travel | HLD | undisclosed | unknown | B2B | B2B Hotel Online Travel Agency |

| World Nomads Group | Nib Health Funds | $95 million | unknown | B2C | Travel Insurance |

| Fairmont | Mirae Asset | $450 million | unknown | B2C | Hotels |

| StudentUniverse | Flight Centre | $28 million | unknown | B2C | Online Travel Agency |

| Lastminute.com | Bravofly Rumbo Group | 1 UK Pound and $43 million in debt | N/A | B2B | Online Travel Agency |

| Travelocity | Expedia, Inc. | $280 million | N/A | B2C | Online Travel Agency |

Source: Crunchbase and Skift

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: expedia, mergers and acquisitions, priceline, startups, tripadvisor

Photo credit: There have been 71 acquisitions of travel companies, including both startups and more established players, so far in 2016. Pictured is the Expedia.com desktop site. So far it's been a quiet year for Expedia acquisitions.