IPO-Bound Trivago Is Growing Fast Because of Its Massive Marketing Spend

Skift Take

A financial analyst's research note says Expedia's Trivago unit is "the fastest growing travel metasearch asset," and one of the reasons why is because it spends 68 to 87 percent of revenue on sales and marketing.

That's "not a typo," states the investor note from Raymond James, referring to the massive marketing spend.

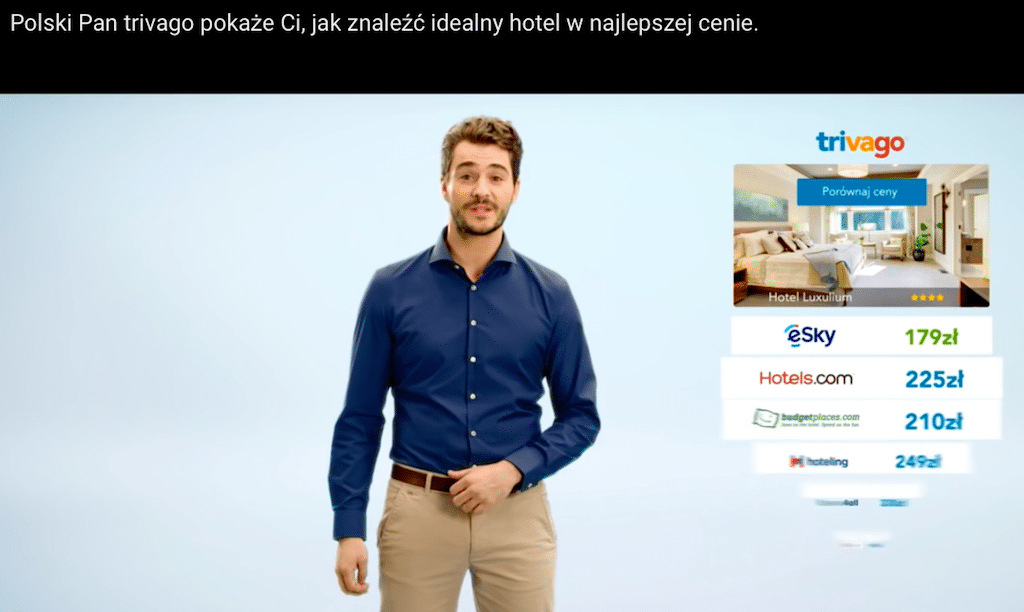

Yeah, all of that television advertising around the world doesn't come cheap.

Expedia recently announced that it and its majority-owned and Germany-based Trivago hotel-metasearch unit agreed to consider an initial public offering for Trivago in 2016 but they would pursue other options next year if they didn't pull the trigger on an IPO this year.

The Raymond James firm estimates that Trivago will notch $768 million in revenue in 2016, which would make Trivago 20 percent larger than TripAdvisor before Expedia spun it out in 2011 and three times larger than Kayak was before its 2012 IPO.

If Trivago indeed spends around 75 percent of revenue on sales and marketing in 2016 and Raymond James is accurate about the site's estimated revenue, then Trivago would be spending some $576 million on sales and marketing this year.

Unlike Trivago, in 2011 TripAdvisor hadn't yet embarked on hotel metasearch -- or even Instant Booking -- when Expedia spun it out, but if Expedia is successful in taking Trivago public in 2016 it would be Expedia's second trip to the public markets to monetize a fast-growing asset in five years.

But if, as Raymond James estimates, Trivago is spending such a high percentage of revenue on sales and marketing, how can it make any money?

Marketing spend on that scale obviously isn't sustainable over the long term, but if you look at fast-growing companies such as Uber and Airbnb, it can be a formula for global expansion.

The Raymond James research note argues that Trivago's search and marketing spend will moderate and, coupled with increasing efficiencies in overhead costs, then Trivago could achieve margins of 28 to 35 percent in the next few years.

Until then, however, expect to see a lot more of those Trivago Guy TV ads in the U.S. and by his advertising counterparts in Trivago's key markets around the world.