Europe's Tough Stance Against Google Could Shame the FTC Into Action

Skift Take

One of the repercussions of the European Commission's decision last week to bring charges against Google for its allegedly anticompetitive advertising practices could be that it finally shames the U.S. Federal Trade Commission into cracking down on the search giant.

The FTC declined to sue Google four years ago, the Wall Street Journal reported at the time, despite the fact that key FTC staffers wanted to sue after concluding that Google's search and advertising practices harmed consumers and slowed innovation.

Google has another seven weeks to respond to the new European charges, which call out Google for restricting the ability of third-party websites from displaying advertisements from Google competitors. The European Commission also reinforced previous charges that Google uses its dominant market position to favor its own shopping products over those of competitors such as Amazon and eBay.

The European Commission hasn't yet gone after Google for products such as its hotel metasearch offering, known as Hotel Ads, but the EC -- or perhaps the U.S. Federal Trade Commission or Department of Justice -- could take a look at allegations that its Google Hotel Ads and/or Google Flights are positioned so favorably on search results pages as to severely disadvantage competitors such as TripAdvisor, Yelp, Expedia, Kayak, Skyscanner and smaller companies relying on search engine optimization and organic results.

In fact, at the Skift Global Forum in 2015, then-Priceline.com CEO Paul Hennessy, who earlier had headed Booking.com's digital marketing efforts, summed up Google's search changes, saying “And so I believe it is a paid world.” In other words, Google has severely de-preferenced organic results while touting its own commercial products, from shopping to hotel and flight search, so the only option is to advertise heavily with Google.

In Europe, Google also faces charges from the European Commission that it harms competition by placing restrictions on mobile network operators and mobile device manufacturers related to Google's Android operating system.

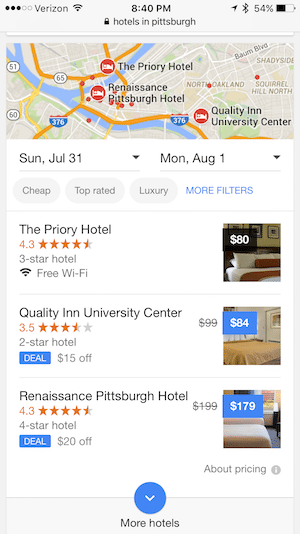

On Google favoring its own products, if you search Google for "hotels in Pittsburgh" on an iPhone there are no organic results on the first screen (just ads from Booking.com and Expedia.com) and it's only on the bottom of the second screen that you can begin to view what Google characterizes as organic results.

Shown in the screenshot, you can see that some organic results are created more equally than other unpaid results found around three screens down the page. With one click on the organic results at right, which are the only ones with a map, room photos, room rates, default search dates and filters, these links serve as a funnel into Google's paid Hotel Ads.

Click on one of the photos and you navigate to a page where you can book a room from one of Google's advertisers such as Booking.com, Expedia, or Priceline — or increasingly you can book it right on Google.

The European Commission says it continued its investigation of Google after initially filing charges in 2015 and uncovered "additional evidence and data that reinforces the Commission's preliminary conclusion that Google has abused its dominant position by systematically favouring its own comparison shopping service in its general search results.

"The additional evidence relates, amongst other things, to the way Google favours its own comparison shopping service over those of competitors, the impact of a website's prominence of display in Google's search results on its traffic, and the evolution of traffic to Google's comparison shopping service compared to its competitors," the European Commission stated. "The Commission is concerned that users do not necessarily see the most relevant results in response to queries — this is to the detriment of consumers, and stifles innovation."

Google Plays A Waiting Game

Google will respond anew to the charges and will likely argue that it is serving the public by providing them with the best possible answers instead of a bunch of links and that competition is robust in the form of Amazon and eBay's own retail-shopping platforms.

Google's strategy, according to one keen observer of the antitrust scene, will be "to play the delay, delay, delay game" as a final decision in Europe could take two to three years to wind through the courts if there is no settlement.

Google argues that it can't be in the untenable position of having to operate one system in Europe and a different system for the rest of the world — although that is a debatable contention. Because of the rapid speed of change in digital commerce, meanwhile, any remedies against Google could be out of date by the time the European Commission formulates them.

No Cooperation

The U.S. Federal Trade Commission investigated Google four to five years ago and declined to take any action despite the fact that key FTC staff members wanted to pursue a case against Google for practices such as allegedly scraping TripAdvisor, Yelp and Amazon content without authorization.

It likely wasn't a coincidence that Google lobbyists had plenty of alone time with Obama Administration officials while the FTC probe was under way.

Perhaps European regulators didn't hand out their mobile phone numbers so freely.

What's clear is that there is no love lost between U.S. and European regulators, who view themselves as intense rivals.

"Currently, they do not have much close coordination or information sharing, practically speaking," the antitrust expert says. "And the Republicans and U.S. government in general has the perception that the European Union uses competition and other laws to target big U.S. companies because EU companies simply cannot compete in the marketplace.

"Furthermore, just like the FTC and DOJ are competitive with each other in terms of who is the best and most important antitrust enforcer, the U.S. and EU view themselves as being in competition to be the most influential and leading antitrust authority in the world. No treaty will ever change that."

But four years after the U.S. Federal Trade Commission stepped back without taking any action against Google, the situation may have reached a tipping point because of the persistence of the European enforcement effort, which hasn't yielded any corrective actions yet, and Google's aggressive actions.

Google could face a whopping penalty of up to 10 percent of its operating revenue in a worst-case scenario in Europe along with mandates of how to change its practices to spur competition for the good of consumers.

It wouldn't be surprising at all if the U.S. Federal Trade Commission steps in, as well, at the behest of Google's rivals.

On the other hand, perhaps it would be the Department of Justice that could take on the investigation instead of the Federal Trade Commission this time around.

"A company's fate in antitrust proceedings by the U.S. government in part has to do with whether the DOJ or FTC takes the case," the antitrust wonk says. "This decision results from the 'clearance' process' - the opaque way by which the DOJ and FTC work out which agency will take control of a specific topic (such as a proposed merger or business practice).

"The DOJ, and many outside legal observers, would argue that DOJ is better equipped to investigate and bring a winning case against a company on antitrust grounds as a result of case law, the primary role of prosecutors in its work, and that a single decision-maker (rather than a five- member FTC) ultimately makes the decision whether to move ahead or not with a legal challenge or threat of one to secure conditions on approval of the deal."

Either way, don't expect any substantial remedies or an end to these probes for at least a couple of years.