Skift Take

While the big chains have tech and marketing people to optimize websites and their cost-per click campaigns, booking sites in transformation such as Booking.com, Trivago and TripAdvisor are squarely directed at making themselves more essential to smaller, independent hotels. It is another sign of the changing role of metasearch sites and online travel agencies in the mobile era.

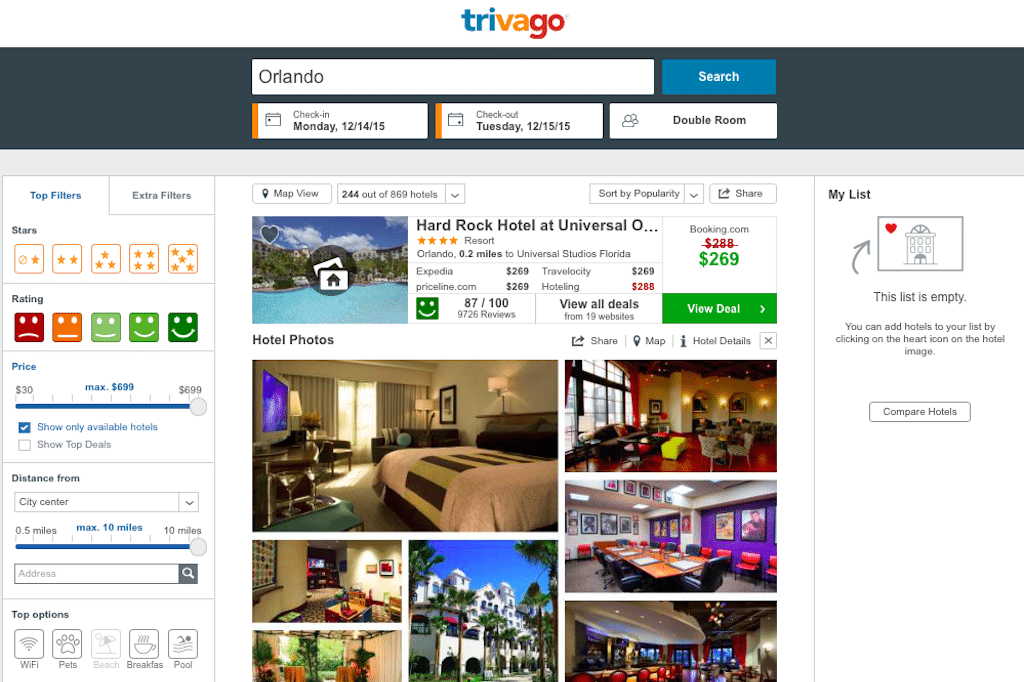

A new Trivago program, which it calls Trivago Direct Connect, highlights the ongoing transformation of online travel agencies and metasearch sites.

While price-comparison platforms such as TripAdvisor and Google are busy turning themselves into hotel (TripAdvisor) or hotel and flight (Google) booking sites, online travel agencies such as Booking.com and now Expedia, through its Trivago unit, are getting into the business-to-business side of the hotel industry by offering hotels booking engines and website help, as well as search engine marketing tools.

TripAdvisor, too, has created a dashboard for hotel partners, offering analytics about the performance of their marketing campaigns.

Trivago, a unit of Expedia Inc., is offering hotels customizable booking engines to improve website conversion and direct sales, as well as analytics and input from Trivago experts to improve their cost-per click campaigns on Trivago.

Touting itself as the largest hotel metasearch site in the world, Trivago operates somewhat independently of parent company Expedia Inc. Nevertheless, it’s easy to imagine other Expedia brands offering similar services to hotels if the Trivago direct-connect campaign, with its B2B services for independent hotels, works out well. Another aim of the campaign is to broaden Trivago’s hotel coverage by signing up more independent hotels to offer their rates on Trivago.

Trivago-Expedia’s entry into business services for hotels is self-serving in some respects because enhanced hotel-booking engines and better hotel websites help Trivago improve conversion when it refers leads to hotel websites. Trivago is also taking steps — somewhat different from TripAdvisor, Google, Kayak, and Hipmunk — to ease bookings on hotel and online travel agency websites instead of processing bookings on Trivago.

The Trivago moves into business services for independent hotels follows Booking.com’s decision earlier this year to launch BookingSuite, a set of services to create websites and booking engines for hotels, and to offer them marketing analytics.

“The way it’s basically working is our account managers will introduce the concept of websites and other technical solutions to partners and then ask them would you like to hear more,” Priceline Group CEO Darren Huston said November 3, describing BookingSuite during the company’s third quarter earnings call. “And then we have a secondary team that will then speak with the partner about the offerings that we have. We started out with websites. We’ve now bought a company called PriceMatch out of France, so we’re developing business intelligence tools.”

“The ultimate goal of BookingSuite is to have a whole suite of products that meets the needs of accommodation partners in the cloud, and that’s what we are building towards,” Huston said.

The aim of Trivago’s new programs is to extend its foothold with independent hotels.

“The booking engine comes at no additional cost to the hotelier,” says Trivago managing director Johannes Thomas, who leads hotel relations. “We are providing a booking funnel that is optimized for conversion continuously. The booking engine is the most essential part to make a marketing campaign perform well and enables hoteliers to compete against OTAs.”

The marketing component of the new services for hotels enables “hoteliers to run direct marketing campaigns on their own,” Thomas says. “We have been focusing on making it very simple for hoteliers to drive guests to their own website.”

While the big chains have tech and marketing people to optimize websites and their cost-per click campaigns, these transformational programs of Booking.com, Trivago and TripAdvisor are squarely directed at making themselves more essential to smaller, independent hotels that don’t have the resources of the larger chains.

It is another sign of the changing role of metasearch sites and online travel agencies in the mobile era.

Have a confidential tip for Skift? Get in touch

Tags: booking.com, expedia, search engine marketing, tripadvisor, trivago

Photo credit: The Trivago website boasts, 'We know everything about hotels.' Now it is turning to independent hotels and telling them we know a lot about building websites and using marketing tools so lets establish closer ties. Trivago