TripAdvisor Is on a Collision Course With Its Two Biggest Customers

Skift Take

TripAdvisor is on pace to handle $3 billion in hotel gross bookings by 2016, according to a new study, and that transition from hotel comparison site to hotel booker may not sit well with its two largest customers, Expedia Inc. and the Priceline Group.

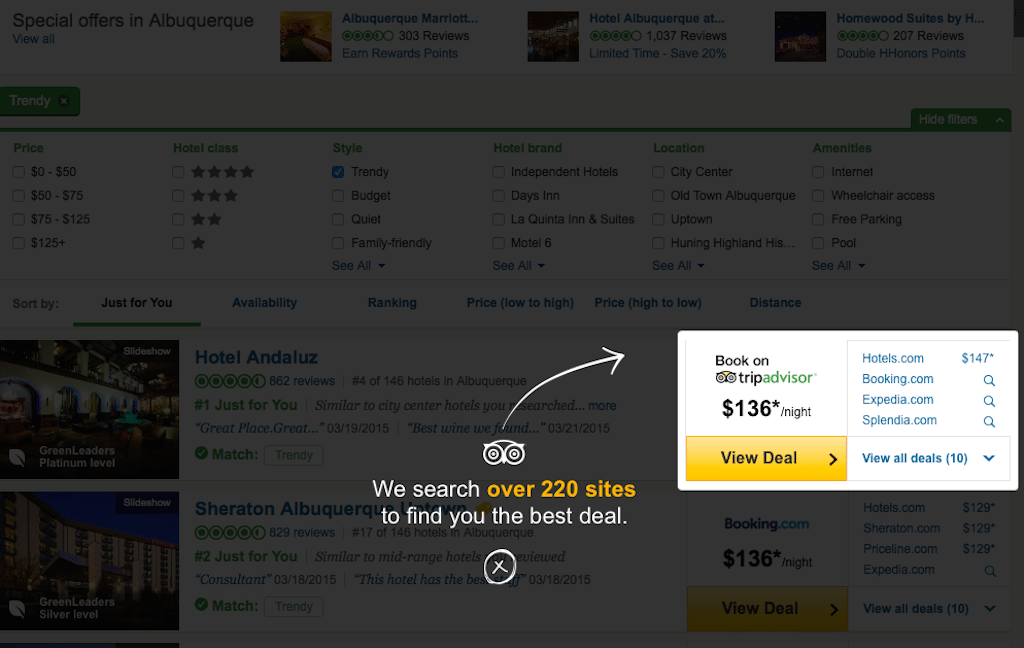

A new UBS study about TripAdvisor Instant Booking, which has TripAdvisor currently partnering with “43 small online travel agencies and chain hoteliers” so consumers can complete their hotel bookings on TripAdvisor, projects that Instant Booking would account for 30 percent of TripAdvisor’s hotel revenue by 2016. That would be an increase from a projected 6 percent of revenue in 2015.

“We note the biggest risk to TripAdvisor in transitioning to Instant Booking relates to their dependence on Expedia and Priceline,” the UBS report states. “Any change in marketing plans by those two companies could present a near-medium term headwind.”

In 2014, Expedia Inc. and Priceline, including their sub-brands, accounted for 46 percent of TripAdvisor revenue. That’s down a tad from 49 percent in 2011, according to TripAdvisor financial filings.

The following chart shows more detail on the trajectory of Expedia’s and Priceline’s contributions to TripAdvisor’s total revenue over the years.

Expedia and Priceline’s Contributions to TripAdvisor Revenue

| Year | TripAdvisor Revenue |

|---|---|

| 2014 | 46% |

| 2013 | 47% |

| 2012 | 48% |

| 2011 | 49% |

Source: TripAdvisor

When you look just at TripAdvisor’s cost-per-click revvenue, UBS estimated for 2013 that Expedia and Priceline contributed about 31 percent and 30 percent, respectively.

It was likely a bit lower in 2014 because they diversified slightly toward other channels, including Expedia’s Trivago and Priceline’s Kayak, UBS states.

Expedia and Priceline continue to view TripAdvisor as an effective marketing platform but they have steadfastly refused to become partners in TripAdvisor Instant Booking, which they may view as a long-term threat.

With Trivago and Kayak, respectively, Expedia and Priceline each own their own metasearch sites where they can market their brands but they obviously see TripAdvisor as providing a lot of value. Expedia officials, in particular, have said in recent months that they are getting increasing volumes and efficiencies out of Trivago, the Germany-based hotel metasearch site.

If TripAdvisor indeed grows its Instant Booking product to $3 billion in gross bookings in 2016, its hotel transactions would still be a fraction of Expedia Inc.’s and the Priceline Group’s. The latter two did $48 billion and $50.3 billion in total gross bookings, respectively, in 2014, including air, car, and hotel etc.

Impact on Expedia and Priceline

UBS has “slightly lowered” its 2016 hotel bookings growth estimates for Expedia and Priceline because of the projected growth in TripAdvisor Instant Booking.

UBS argues that a successful TripAdvisor pivot toward Instant Booking would have more of an adverse effect on the Priceline Group than Expedia Inc. because Expedia would benefit from synergies with recently acquired Travelocity, Wotif and Orbitz Worldwide (pending), and also has Trivago.

“We believe that Priceline could see a greater medium-term impact to future growth (relative to Expedia) and profit margins if TripAdvisor is successful in its pivot toward Instant Booking,” UBS states. “In our view, this was likely one of the reasons for their strategic shift to become a more total travel solutions company (especially for hotel inventory suppliers).”

As TripAdvisor becomes more of a transaction site it is very likely that Expedia and Priceline would alter their marketing strategies toward TripAdvisor over the next few years.

Classic metasearch, where TripAdvisor refers consumers to online travel agency and hotel sites to complete their bookings, would still make up 70 percent of TripAdvisor’s hotel revenue in 2016, UBS projects, and that’s where a change in Expedia or Priceline strategy could be a challenge for TripAdvisor.

As TripAdvisor runs its TV advertising campaigns for Instant Booking, namely urging consumers to use the site to “plan, compare and book,” UBS states that it will monitor “both partner and consumer traction” for Instant Booking before tweaking its estimates.

While TripAdvisor, Expedia and Priceline choreograph their moves, Google is a potential “wild card,” UBS states.

Google’s Hotel Ads, which amount to hotel metasearch right within Google search results, have really begun to take off. Any push by Google to accept hotel transactions basically along the lines that TripAdvisor is doing, without becoming an online travel agency, would really upset the hotel booking hierarchy.