Skift Take

The Priceline Group and OpenTable wanted to sweep away these pesky shareholder lawsuits to get on with the task at hand -- closing the acquisition. In reaching a settlement, OpenTable had to open the curtain a bit more into how it went about conducting the sale process.

The Priceline Group and OpenTable agreed to settle a series of shareholder lawsuits, subject to court approval, that alleged the defendants breached their fiduciary responsibilities in the sales process and agreed to an unfair price leading up to the June 13 acquisition announcement.

As part of the settlement, OpenTable agreed to make a series of additional disclosures [see below] about the background of the sales process leading up to the acquisition, including “The Company Board believed that it was in the best interest of the Company to explore strategic alternatives in light of favorable market conditions.”

Revealed in a couple of Securities and Exchange Commission filings July 14, the defendants stated that the settlement would not impact the $103 share price that OpenTable stockholders would receive, and was reached “solely to eliminate the burden, expense, distraction and uncertainties inherent in further litigation and without admitting any liability or wrongdoing.”

The shareholder lawsuits had been consolidated into OpenTable Inc. Stockholder Litigation in the Delaware Court of Chancery.

Of the settlement itself, the Priceline Group and OpenTable stated: “The MOU (Memorandum of Understanding) contemplates that the parties will seek to enter into a stipulation of settlement providing for the certification of a mandatory non opt-out class, for settlement purposes only, that includes any and all record and beneficial owners of Shares (excluding defendants, their subsidiary companies, affiliates, assigns, and members of their immediate families) who held Shares at any time during the period beginning on June 12, 2014, through the date of consummation or termination of the proposed transaction, including any and all of their respective successors in interest, predecessors, representatives, trustees, executors, administrators, heirs, assigns or transferees, immediate and remote, and any person or entity acting for or on behalf of, or claiming under, any of them, and each of them and a global release of claims relating to the Offer and the Merger Agreement as set forth in the MOU.”

OpenTable agreed to amend its initial account of the background of the sales process, which included expressions of interest from six additional companies beyond Priceline and two bids from one other company.

The amendments, which follow, provide additional information about the actions of the interested parties, financial projections, and how OpenTable and its advisors compared Priceline’s $2.6 billion offer with other acquisitions in other verticals and Internet acquisitions.

Apparently in response to shareholder plaintiffs’ allegations that OpenTable should have been more aggressive about expressions of interest and bids by companies other than Priceline, the new disclosures provide statements about several unidentified companies dropping out of the sale process without their providing additional detail about why they dropped out.

Here are the amendments, as described in an OpenTable SEC filing:

Item 4. The Solicitation or Recommendation.

Item 4 of the Schedule 14D-9 is hereby amended and supplemented as follows:

By adding the following text to the second paragraph of the section entitled “The Solicitation or Recommendation—Background and Reasons for the Company Board’s Recommendation—Background of the Offer”:

“The Company Board believed that it was in the best interest of the Company to explore strategic alternatives in light of favorable market conditions.”

By amending and restating the third paragraph of the section entitled “The Solicitation or Recommendation—Background and Reasons for the Company Board’s Recommendation—Background of the Offer” as follows:

“On March 25, 2014, the Company Board held a telephonic meeting with representatives of the Company’s outside legal counsel, Latham & Watkins LLP (“Latham & Watkins”), present. At such meeting, the Company Board discussed exploring the Company’s strategic alternatives, including a possible sale of the Company. The Company Board authorized the formation of a special committee, consisting of Messrs. Gurley, Layton and Roberts to lead the evaluation of such alternatives and to manage any outreach to third parties in connection with any process related thereto (the “Special Committee”). The members of the Special Committee were selected based upon, among other reasons, their expansive experience, expertise, reputation and knowledge of the business and affairs of the Company and the industry in which it operates. The Special Committee would serve as the day-to-day interface with the Company’s advisors as the exploration of the Company’s strategic alternatives progressed. Representatives of Latham & Watkins reviewed the Company Board’s fiduciary duties in connection with the consideration of the Company’s strategic alternatives, including the Company Board’s duties in connection with a possible sale of the Company.”

By adding the following text to the sixth paragraph of the section entitled “The Solicitation or Recommendation—Background and Reasons for the Company Board’s Recommendation—Background of the Offer”:

“The Special Committee considered the engagement of a financial advisor other than Qatalyst Partners LP (“Qatalyst”), but selected Qatalyst based on Qatalyst’s qualifications, expertise, reputation and knowledge of the business and affairs of the Company and the industry in which it operates.”

By amending and restating the seventh paragraph of the section entitled “The Solicitation or Recommendation—Background and Reasons for the Company Board’s Recommendation—Background of the Offer” as follows:

“On March 27, 2014, Mr. Gurley, at the direction of the Special Committee, contacted representatives of Qatalyst to discuss the Company’s potential engagement of Qatalyst to act as the Company’s financial advisor in connection with the exploration of the Company’s strategic alternatives. During the course of the following several days, representatives of Qatalyst met with Mr. Layton and Mr. Gurley to discuss the terms of such engagement.”

By adding the following text to the fourteenth paragraph of the section entitled “The Solicitation or Recommendation—Background and Reasons for the Company Board’s Recommendation—Background of the Offer”:

“The Chief Executive Officer of Party 3 did not provide further details regarding the decision not to proceed with a potential acquisition of the Company.”

By adding the following text to the twenty-seventh paragraph of the section entitled “The Solicitation or Recommendation—Background and Reasons for the Company Board’s Recommendation—Background of the Offer”:

“Party 2 did not provide further details regarding its decision to no longer pursue a potential acquisition of the Company.”

By adding the following text to the thirty-sixth paragraph of the section entitled “The Solicitation or Recommendation—Background and Reasons for the Company Board’s Recommendation—Background of the Offer”:

“Party 5 did not engage in further discussions with the Company following this meeting or explain why it decided not to engage in further discussions.”

By amending and restating the fifty-fourth paragraph of the section entitled “The Solicitation or Recommendation—Background and Reasons for the Company Board’s Recommendation—Background of the Offer” as follows:

“On May 21, 2014, Party 6 declined to proceed any further in the investigation of a potential acquisition of the Company. Party 6 did not provide further details regarding its decision not to further proceed in the investigation of a potential acquisition of the Company.”

By amending and restating the first paragraph of the section entitled “The Solicitation or Recommendation—Background and Reasons for the Company Board’s Recommendation— Reasons for the Recommendation of the Company Board” as follows:

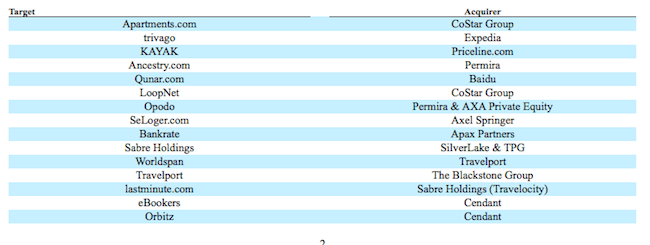

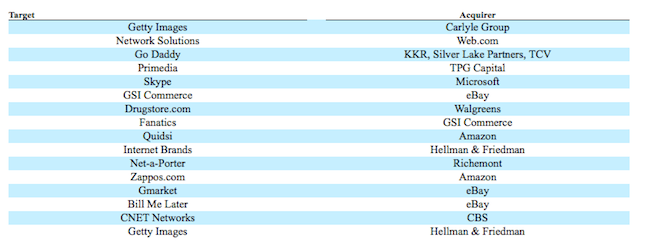

“In evaluating the Merger Agreement and the transactions contemplated thereby, including the Offer and the Merger, and recommending that the stockholders accept the Offer and tender their Shares to Acquisition Sub pursuant to the Offer, the Company Board consulted with the Company’s senior management and representatives of the Company’s outside legal counsel, Latham & Watkins, and the Company’s financial advisor, Qatalyst, respectively, and considered and analyzed a wide and complex range of factors. This included, without limitation, review of information regarding selected precedent transactions consisting of certain travel/other vertical transactions and other Internet transactions announced since 2004 and 2008, respectively, based on publicly available information regarding such transactions. Such information was included in slides provided by Qatalyst to the Company Board.

The selected travel/other vertical transactions were:

The selected other Internet transactions were:

Based on these consultations, considerations and analyses, and the factors discussed below, the Company Board concluded that entering into the Merger Agreement with Parent and Acquisition Sub would yield the highest value reasonably available for the Company’s stockholders and is fair to and in the best interests of the Company’s stockholders.”

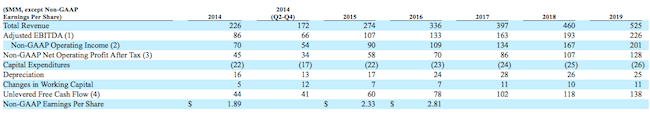

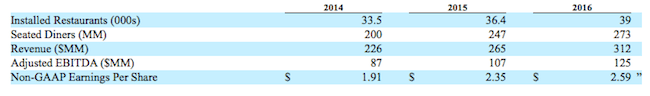

By amending and restating the table set forth in the section entitled “The Solicitation or Recommendation—Certain Financial Forecasts” as follows:

By adding the following text immediately below the table set forth in the section entitled “The Solicitation or Recommendation—Certain Financial Forecasts”:

“(1) Adjusted EBITDA represents earnings before interest, taxes, depreciation, amortization, stock-based compensation and other non-recurring charges.

(2) Non-GAAP Operating Income adjusts GAAP operating income to exclude costs associated with stock-based compensation, amortization of intangibles, and transaction fees and expenses.

(3) Non-GAAP Net Operating Profit After Tax (“Non-GAAP NOPAT”) represents Non-GAAP Operating Income, less cash taxes.

(4) Unlevered Free Cash Flow represents Non-GAAP NOPAT less capital expenditures plus depreciation plus changes in working capital.

In addition, a summary of certain third-party research analysts’ projections regarding the Company is set forth below. Such projections are based upon median consensus estimates as of June 11, 2014.

By amending and restating clause (b) set forth in the section entitled “The Solicitation or Recommendation— Illustrative Discounted Cash Flow Analysis” as follows:

“(b) the implied net present value of a corresponding terminal value of the Company, calculated by multiplying the estimated earnings before interest, taxes, depreciation, amortization, stock-based compensation and other non-recurring charges (“Adjusted EBITDA”) in calendar year 2019, based on the Financial Forecasts, by a range of multiples of enterprise value to next-twelve-months estimated Adjusted EBITDA of 11.0x to 17.0x selected by Qatalyst based on its professional judgment (such multiples corresponding to a range of implied perpetuity growth rates from 4.2% to 9.2% and a range of implied multiples of enterprise value to next-twelve-months revenue of 4.7x to 7.3x) and discounted to March 31, 2014 using the same range of discount rates used in item (a) above;”

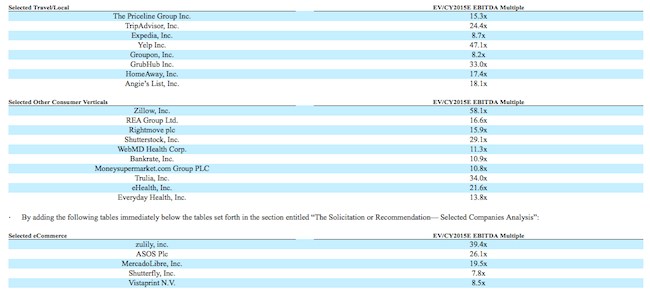

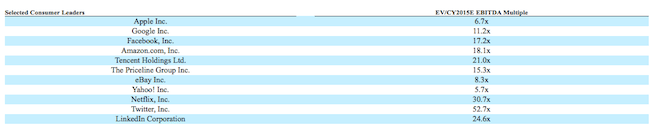

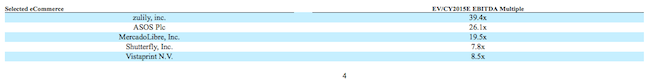

By amending and restating the tables set forth in the section entitled “The Solicitation or Recommendation— Selected Companies Analysis” as follows:

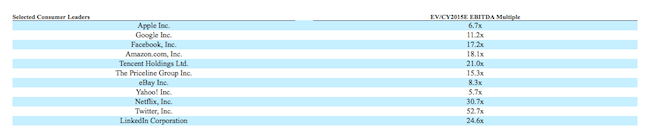

By adding the following tables immediately below the tables set forth in the section entitled “The Solicitation or Recommendation— Selected Companies Analysis”:

By amending and restating the second paragraph of the section entitled “The Solicitation or Recommendation— Selected Companies Analysis” as follows:

“Based upon research analyst consensus estimates for calendar year 2015, and using the closing prices as of June 11, 2014 for shares of the selected companies, Qatalyst calculated, among other things, the implied fully diluted enterprise value divided by the estimated EBITDA for calendar year 2015, which are referred to herein as the “CY2015E EBITDA Multiples,” for each group of the selected companies. The low, high, median and mean CY2015E EBITDA Multiples among the selected travel/local companies analyzed were 8.2x, 47.1x, 17.8x and 21.5x, respectively, among the selected other consumer verticals were 10.8x, 58.1x, 16.2x, and 22.2x, respectively, among the selected eCommerce companies were 7.8x, 39.4x, 19.5x and 20.3x, respectively, and among the selected consumer leader companies were 5.7x, 52.7x, 19.5x and 20.5x, respectively. The implied fully diluted enterprise value divided by the estimated EBITDA for calendar year 2015 for the Company was 15.5x based on the Street Projections and 15.5x based on the Financial Forecasts.”

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: lawsuits, opentable, priceline

Photo credit: OpenTable's Facebook app, Places I've Eaten. OpenTable