Skift Take

Who asked who out? OpenTable kicked off the sale process and approached the Priceline Group about an acquisition via email in mid-April in a process that ultimately involved six other companies. The usual suspects likely expressed interest, and Priceline's initial non-binding bid was first and substantially higher than that of the other bidder.

OpenTable put itself up for sale in late March, and in the run-up to the Priceline Group’s June 13 acquisition announcement, OpenTable attracted expressions of interest from six other companies — including one that submitted two bids — in addition to Priceline’s.

So Priceline was initially the pursued rather than the pursuer, and it moved fast, submitting the first “non-binding expression of interest” at $95 to $105 per share in cash on May 9.

The $103 per share offer that the OpenTable board ultimately accepted June 12 — just one day before the acquisition announcement — bested a $92 offer from the other unnamed company and represented a 46% premium over the closing share price on June 12.

The facts surrounding OpenTable’s sale process, which began March 25 when the board formed a special committee of CEO Matthew Roberts, chairman Thomas Layton, and board member Bill Gurley of Benchmark Capital to explore strategic alternatives, were detailed in an SEC filing June 25.

Although Priceline kicked off the serious bidding with the $95 to $105 non-binding offer May 9, which was just three weeks after OpenTable CEO Roberts emailed Priceline Group CEO Darren Huston to gauge whether Priceline “would be interested in exploring a potential acquisition,” according to the filing, abundant interest by other suitors preceded and followed it.

A company identified as Party 4 submitted a non-binding expression of interest of $80 to $85 per share in cash on May 23, made what it characterized as a “final offer” of $85 per share on June 3, but upped it to $92 two days later.

Three days later, Party 4’s financial advisor contacted OpenTable’s financial advisor, Qatalyst Partners, to say the company might be willing to increase the offer to $95 per share.

The frenzy of discussions and negotiations proceeded to the point that at least three companies, including Priceline, Party 4, and Party 6, were granted access in mid-May to OpenTable’s “electronic data room for the purpose of conducting due diligence,” the SEC filing states.

Eight outside companies actually were involved in some way in the sale process, with seven initially expressing interest in discussing an OpenTable acquisition, and only one stating it wasn’t interested, the SEC filing states.

OpenTable even received an unsolicited expression of interest from Party 7 on June 2 about a “potential transaction or combination,” the SEC filing states.

But, OpenTable’s special committee of Roberts, Layton, and Gurley unanimously decided the next day not to pursue it because of fears that Party 7 didn’t have the means to carry out an all-cash acquisition, and because “Party 7’s current market capitalization suggested that there might not be significant upside to holding shares of Party 7’s capital stock,” according to the SEC filing.

OpenTable’s discussions and negotiations with the six companies and Priceline culminated June 12, the day before the acquisition announcement, when the parties signed the pertinent agreements.

That came after the board unanimously concluded that the merger was advisable based on factors such as the structure, timing, and “non-solicitation provisions that would permit the company to negotiate and accept an unsolicited superior proposal, subject to compliance with the Merger agreement and Parent’s [Priceline Group’s] matching rights, termination provisions and the termination fee…”

The Priceline Group didn’t initially woo OpenTable, but once Priceline got involved it moved quickly and decisively, and perhaps paid more than it needed to.

Here’s more detail from the SEC filing on the interactions between OpenTable [the Company] and the Priceline Group [the Parent]:

On April 16, 2014, Mr. Roberts contacted Darren Huston, President and Chief Executive Officer of Parent via email to determine if Parent would be interested in exploring a potential acquisition of the Company.

Later that day [April 18, 2014], Mr. Roberts contacted Mr. Huston by telephone. Mr. Huston indicated that Parent [Priceline Group] was interested in exploring a potential acquisition of the Company. Both parties agreed to schedule a further in-person meeting with members of management from both parties in order for Parent to receive an overview of the Company and to discuss the strategic benefits of an acquisition of the Company and possible synergies resulting from an acquisition of the Company.

On April 30, 2014, executives from both the Company and Parent [Priceline Group] met to further discuss a potential acquisition of the Company.

On May 1, 2014, Mr. Huston called Mr. Roberts to discuss the previous day’s meeting. Both parties agreed that the meeting was positive and Mr. Huston indicated Parent’s interest in pursuing next steps with respect to a potential acquisition of the Company.

On May 9, 2014, Parent submitted an initial non-binding expression of interest for an acquisition of all of the outstanding Shares at a purchase price of $95 to $105 per share in cash, with the final purchase price to be determined following the completion of due diligence. Parent indicated that its willingness to proceed with an acquisition of the Company was contingent upon an exclusivity period of up to 75 days.

On May 12, 2014, representatives of Qatalyst held a call with Parent. At the direction of the Special Committee, representatives of Qatalyst indicated to members of Parent’s senior management that the Company would be willing to continue working with Parent on a non-exclusive basis. Both parties understood that Parent would firm up its proposed offer price following a period of investigation involving further, more extensive due diligence of the Company.

On May 13, 2014, Party 6 and Parent submitted respective written due diligence request lists. The Company and its advisors worked to address the lists and further the process with Party 6 and Parent.

On May 15, 2014, Parent was provided access to the Company’s electronic data room for the purpose of conducting due diligence on the Company.

In the evening of May 18, 2014, Mr. Roberts and Mr. Huston had dinner in advance of a meeting between the two parties scheduled for the next day.

On May 19, 2014, executive management of both the Company and Parent met to discuss a potential acquisition.

Later on May 21, 2014, at the direction of the Special Committee, representatives of Qatalyst delivered an initial draft of the Merger Agreement to Parent.

Later on May 23, 2014, representatives of Qatalyst instructed each of Parent and Party 4 to deliver their respective revised proposals to acquire the Company the following week. As directed by the Special Committee, representatives of Qatalyst indicated to Parent and Party 4 that the Company Board expected such proposals to reflect a best and final offer and that the Company Board expected to make a decision whether to proceed with an acquisition of the Company and to a definitive agreement providing for such an acquisition based on the proposals received the following week.

On May 28, 2014, representatives of Qatalyst contacted a senior executive of Parent to further discuss a potential acquisition of the Company and to re-iterate that any acquisition proposal submitted by Parent should reflect its best and final offer.

On June 2, 2014, Parent submitted its final proposal to representatives of Qatalyst for the acquisition of all of the outstanding Shares at a purchase price of $103 per share in cash (“Parent’s Final Proposal”). Together with its proposal, Parent also delivered a revised draft of the Merger Agreement.

[On the evening of June 3, 2014] Representatives of Latham & Watkins then reviewed the Company Board’s fiduciary duties in the context of the process of the sale of the Company and the terms of the revised draft of the Merger Agreement submitted by Parent. Following this discussion, the Company Board directed management to pursue an acquisition of the Company by Parent on the terms and conditions outlined in Parent’s Final Proposal.

Following the meeting of the Company Board on the evening of June 3, 2014, representatives of Qatalyst contacted a senior executive of Parent and informed such executive that the Company was interested in pursuing an acquisition of the Company by Parent, subject to the negotiation of an acceptable merger agreement, and that representatives of Latham & Watkins would contact representatives of Sullivan & Cromwell LLP (“Sullivan & Cromwell”), outside legal counsel to Parent, to discuss the negotiation of a definitive Merger Agreement.

Commencing on June 4, 2014, there were a series of calls between the Company and Parent and their respective representatives, including Latham & Watkins and Sullivan & Cromwell LLP regarding due diligence matters. In addition, on June 4, 2014, representatives of Latham & Watkins and Sullivan & Cromwell discussed the revised draft of the Merger Agreement prepared by Sullivan & Cromwell.

On that same evening [June 5, 2014,] Latham & Watkins sent a further revised draft of the Merger Agreement to Sullivan & Cromwell, which draft included revised provisions regarding the conditions to closing, the termination fee to be paid to Parent in the event of termination of the Merger Agreement and the Company’s ability to take certain actions with respect to alternative acquisition proposals after the signing of the Merger Agreement. At the same time, Latham & Watkins sent an initial draft of the form of Tender Support Agreement to Sullivan & Cromwell.

On June 9, 2014, Sullivan & Cromwell sent a further revised draft of the Merger Agreement to Latham & Watkins, which draft revised the transaction structure from a single-step merger to a two-step tender offer and merger pursuant to Section 251(h) of the DGCL, as well as reflecting additional changes with respect to provisions regarding the conditions to closing, the termination fee to be paid to Parent in the event of termination of the Merger Agreement and the Company’s ability to take certain actions with respect to alternative acquisition proposals after the signing of the Merger Agreement. Also on June 9, 2014, Sullivan & Cromwell sent a revised draft of the form of Tender Support Agreement to Latham & Watkins and there was a conference call between executives of the Company and Parent and their respective advisors to discuss due diligence matters.

Also on June 11, 2014, there was a conference call between executives of the Company and Parent and their respective advisors from Latham & Watkins and Sullivan & Cromwell to discuss final due diligence matters.

In the early afternoon of June 12, 2014, Latham & Watkins sent a proposed final draft of the Merger Agreement to Sullivan & Cromwell.

Later that day, on June 12, 2014, the Company Board held a telephonic meeting with the Company’s legal and financial advisors. During the meeting, representatives of Qatalyst presented its financial analysis of the consideration to be received by the holders of Shares pursuant to the Merger Agreement to the Company Board and delivered to the Company Board its oral opinion, which was confirmed by delivery of a written opinion dated June 12, 2014, to the effect that, as of such date and based upon and subject to the considerations, limitations and other matters set forth therein, the consideration to be received by the holders of Shares (other than as specified in such opinion) pursuant to the Merger Agreement was fair, from a financial point of view, to such holders.

In addition, representatives of the Company’s outside legal counsel, Latham & Watkins, reviewed the Company Board’s fiduciary duties in the context of the Company Board’s strategic alternatives process. Latham & Watkins also reviewed the key provisions of the Merger Agreement, including structure and timing considerations, offer conditions, required regulatory approvals, non-solicitation provisions that would permit the Company to negotiate and accept an unsolicited superior proposal, subject to compliance with the Merger Agreement and Parent’s matching rights, termination provisions, the termination fee, and circumstances under which the termination fee would be payable.

The Company Board asked questions and discussed the provisions of the Merger Agreement and related documentation. After further discussion, the Company Board unanimously (i) determined that the Merger Agreement, the Offer, the Merger and the other transactions contemplated therein, are advisable and in the best interests of the Company and its stockholders, (ii) approved the Offer, the Merger and the transactions contemplated by the Merger Agreement in accordance with the DGCL, (iii) approved and declared advisable the Merger Agreement and the transactions contemplated thereby and (iv) resolved to recommend that the stockholders of the Company accept the Offer and tender their Shares into the Offer.

Later on June 12, 2014, the Merger Agreement was executed by the parties. The Tender Support Agreements were executed by Parent, Acquisition Sub and each executive officer and director of the Company.

On June 13, 2014, the Company and Parent issued a joint press release announcing the execution of the Merger Agreement. A copy of the press release has been filed as Exhibit (a)(4) and is incorporated herein by reference.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: booking.com, opentable, priceline

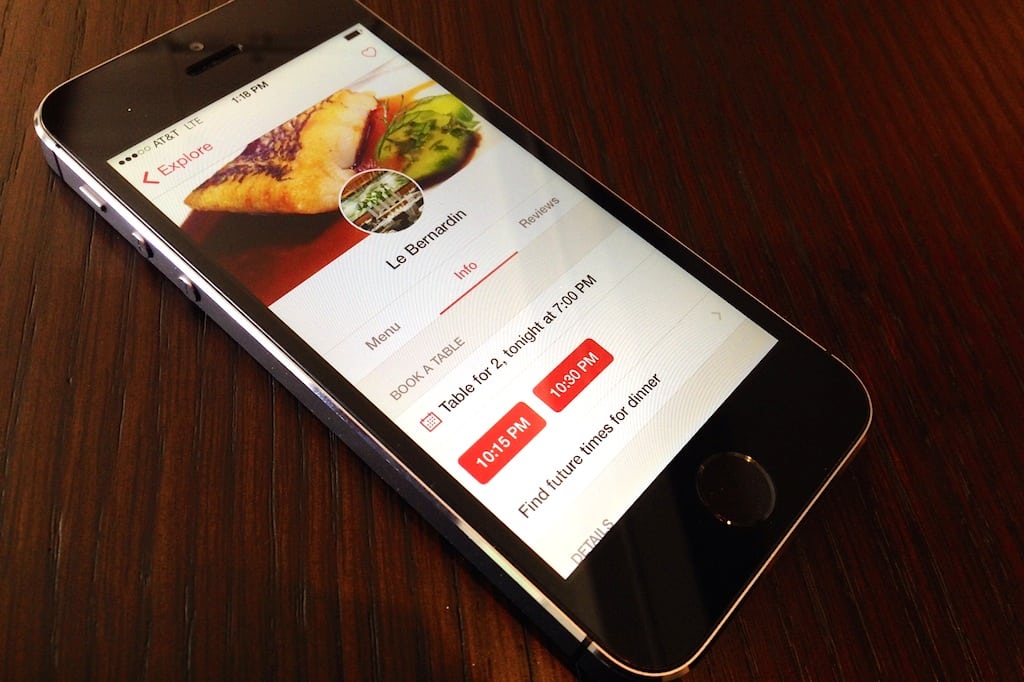

Photo credit: OpenTable's app for iOS. Skift