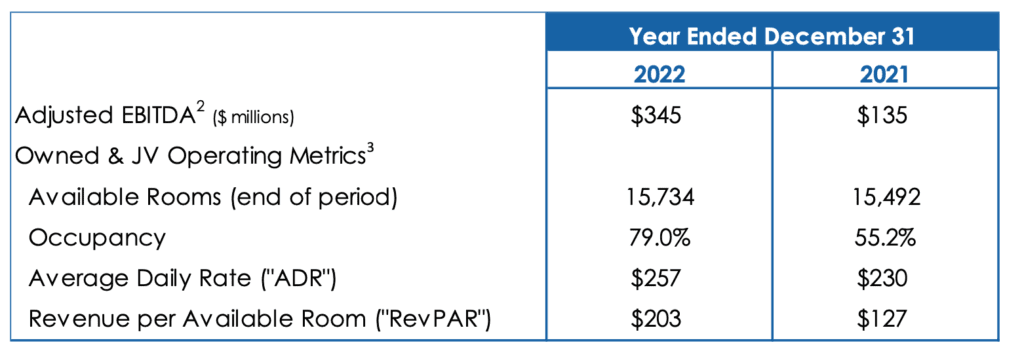

In full-year 2022, the Loews Hotels chain of 25 luxury properties generated $345 million in adjusted earnings before interest, taxes, depreciation, and amortization — a measure of profit — on revenue of $721 million, its parent company reported on Monday.

The hotel unit’s adjusted earnings were roughly 51 percent higher than the pre-pandemic 2019 adjusted earnings before interest, taxes, depreciation, and amortization of $227 million.

CORRECTION: This post originally misstated Loews Hotels’ adjusted earnings before interest, taxes, depreciation, and amortization for 2022 and its relationship to the 2019 figure.

Using a different metric, Loews Hotels’ performance was even more impressive. In full-year 2022, the chain generated $161 million in net income compared to a loss of $28 million in 2019.

For the year, Loews Corp., a New York City-based conglomerate that runs insurance, energy, and hotel business units, generated $1 billion in net income from $14 billion in revenue.

Loews Hotels’ results significantly improved due to higher occupancy of 79 percent and average daily room rates of $257, as travel rebounded from the impacts of the pandemic, the company said.

Here are the 2022 figures:

In 2019, the brand was getting an average nightly rate of $288 and had 84.6 percent occupancy across its system.

In recent months, higher hotel revenues were partially offset by increased operating expenses due to the higher demand levels and resumption of additional pre-pandemic services.

On January 1 Alex Tisch became the president and CEO of Loews Hotels — succeeding his cousin once removed Jon Tisch, who became executive chairman and remains co-chairman of the board. Alex, a fourth-generation family member, joined Loews Hotels in 2017 and was named its president in September 2020.