MakeMyTrip Dominates Travel Search in India - Can it Hold On to Its Lead?

Skift Take

2024 was a good year for MakeMyTrip, India’s leading OTA: It had double-digit revenue growth and rapid margin expansion. And its shares surged 150%, making it one of the best performing stocks in global travel.

Will the gains continue? Skift Research’s latest report – Company Profiles: MakeMyTrip – reveals a strong foundation but also plenty of challenges as competition grows more intense.

As part of our analysis, we ran a proprietary web scrape of roughly 600 hotel listings on Google Hotels in India to understand how MakeMyTrip stands up to both local and global peers.

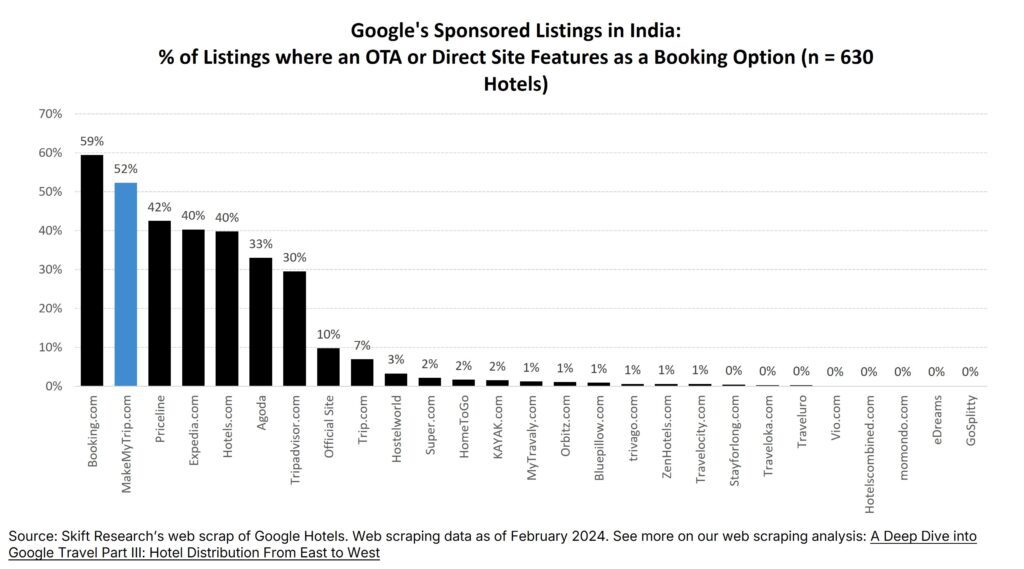

Our web-scraping analysis of Google Hotels’ sponsored results in India showed that MakeMyTrip features in 52% of sponsored hotel listings, second only to Booking.com, which was featured in close to 60% of listings.

MakeMyTrip is clearly investing in advertising to acquire customers through Google, outcompeting Expedia, Agoda, and Trip.com. Notably, no other regional Indian OTA is paying to feature in Google’s sponsored results.

As of fiscal year 2024 (ending March 31, 2024), MakeMyTrip spent more than $120 million on marketing expenses, significantly more than peers Ixigo (around $18 million), EaseMyTrip ($10 million) and Yatra ($6 million).

But MakeMyTrip still has a long way to go to catch up to the giant marketing budgets of Booking and Expedia, which spent $600 - $700 million on marketing last year.

MakeMyTrip invests 1.6% of its total gross bookings on marketing and sales, versus 5.9% for Expedia and 4.5% for Booking (see Marketing Wars: Booking vs. Expedia – Who Spends Smarter?).

It's not surprising that Booking and Expedia outbid local players on paid sponsored results.

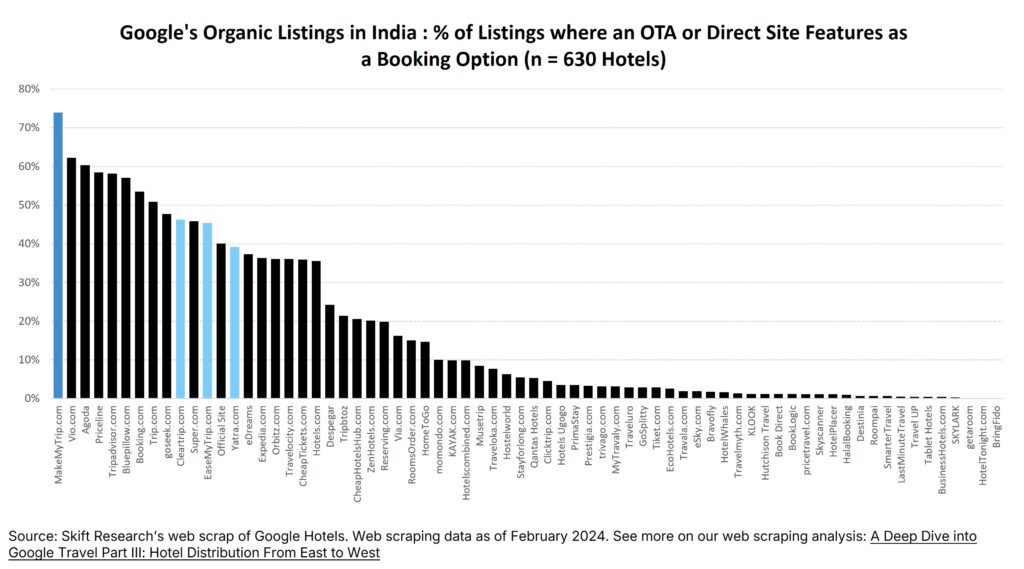

However, further analysis of Google’s organic (free) results in India shows that unlike in the sponsored results, MakeMyTrip features most frequently of any site in the free search – appearing in more than 70% of organic listings. Peers such as Cleartrip, EaseMyTrip and Yatra which didn’t appear in Google paid search are also taking advantage of Google’s free results, appearing in ~40% of results.

The major Indian OTAs are predominantly in the business of selling air tickets, with air making up more than 60% of MakeMyTrip’s total gross bookings. But recent commentary from management at these companies show that they intend to shift toward higher-margin divisions such as hotels and package holidays. For example, Ixigo, which doesn’t yet break out hotels as a revenue line, has recently introduced its own hotel booking platform.

As more OTAs debut on the online hotels market, the marketing war on Google Hotels will only intensify. MakeMyTrip has leading market share for now, but it is still very early days in what is bound to be a fiercely competitive online travel landscape in India.

Read more about MakeMyTrip and the wider Indian OTA market in our latest Skift Research report: Company Profiles: MakeMyTrip

What you’ll learn from this report:

- Overview and market share breakdown of India's OTA market

- MakeMyTrip's key performance indicators

- Comparison of MakeMyTrip's financials with its peers

- Skift Research analysis of Google Hotels in India, based on a proprietary web scrape of more than 600 hotels listing on Google

- Analysis of MakeMyTrip's marketing spend vs peers

- MakeMyTrip's share price and valuation vs peers

This is the latest in a series of research reports, analyst sessions, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision-maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

Subscribe now to Skift Research Reports

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report à la carte at a higher price.