Why Singapore Airlines’ Capacity Growth Comes at a Cost

Skift Take

Singapore Airlines (SIA) has reported a big rise in passenger traffic. On Monday, the carrier said customer numbers were up 13.9% in June compared to the same month last year.

Include SIA’s low-cost subsidiary Scoot, and the combined group carried almost 3.2 million passengers last month.

The company said demand for air travel “remained robust across all route regions,” boosted by school holidays in Singapore and the broader summer travel peak.

The SIA Group added two new routes in June; a five-times weekly service to London Gatwick and a thrice-weekly link to the Malaysian city of Sibu. These are in addition to frequency enhancements elsewhere on the network.

Growing Pains for Singapore Airlines

However, all that extra flying comes at a cost. While group-wide passenger capacity rose by 11% year-on-year, the total number of passengers carried by the group rose by just 7.2%. In essence, this means the company is flying more planes, but on average, they are less full.

Singapore Airlines’ load factor – the percentage of seats occupied on its flights – fell 2.6 percentage points versus June 2023. West Asia and Africa reported the biggest drop, down 5.3 points, while Europe fell 4.2 points. Only South West Pacific, a region that includes Australia and New Zealand, enjoyed a year-on-year rise, up 0.4 points.

At budget operator Scoot, the decline was even more pronounced with an overall drop of 4.9 points. Busy planes are particularly important for the low-cost model, as they maximize ancillary up-selling opportunities.

Looking at the SIA Group more broadly, its air freight business reported a 24.9% year-on-year rise in cargo loads. The company attributed this to “robust e-commerce demand, some demand spillover resulting from disruptions to sea freight, and port congestion.”

Why Does Rising Capacity Matter?

In the post-pandemic period, capacity constraints combined with red-hot demand led to higher average airfares and packed planes. Many major airlines, including SIA, reaped the rewards. All eyes will be on the group in the months ahead to monitor if passenger numbers keep pace with rising capacity. The average prices being paid for tickets will also be a key metric for success.

As of the end of June 2024, the group’s passenger network spanned 125 destinations in 36 countries and territories. Within these, Singapore Airlines served 78 airports, while Scoot served 69.

Last month, SIA signed a commercial deal with Saudi start-up carrier Riyadh Air. The agreement was one of a flurry of recent announcements as Riyadh Air opts to build a “virtual network” rather than an Emirates-sized fleet. It remains to be seen what tangible impact the deal will have on SIA’s business.

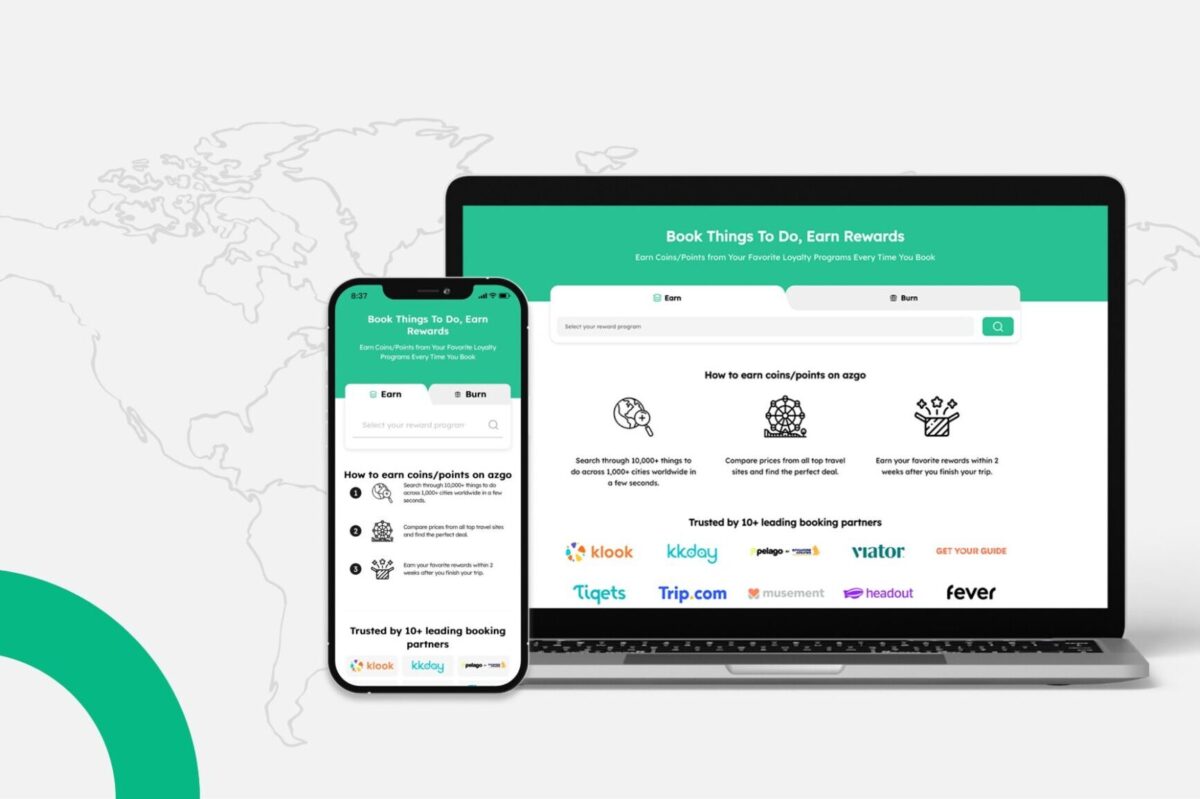

In separate developments on Monday, Pelago, the travel experiences arm of the Singapore Airlines Group, announced a partnership with Primer, a global payments-infrastructure provider.

Payments are an important piece of Pelago’s expansion strategy as it hopes to provide access to local payment methods, which reduces processing costs, and have better fraud prevention.

Airlines Sector Stock Index Performance Year-to-Date

What am I looking at? The performance of airline sector stocks within the ST200. The index includes companies publicly traded across global markets including network carriers, low-cost carriers, and other related companies.

The Skift Travel 200 (ST200) combines the financial performance of nearly 200 travel companies worth more than a trillion dollars into a single number. See more airlines sector financial performance.