5 Charts That Bullish Airline CEOs Need to See on Corporate Travel’s Recovery

Skift Take

Some major U.S. carriers say business travel is back. The U.S. Travel Association disagrees, based on the findings of its latest tracker.

In the third quarter it checked the sentiment among businesses, and the future is a lot less rosy compared to how execs at Delta Air Lines and United Airlines see things panning out.

“Global demand is continuing to ramp as consumers shift spend to experiences, businesses return to travel and international markets continue to reopen,” said Delta’s Ed Bastian during the carrier’s third quarter-earnings call on Thursday.

Its corporate bookings recovered to roughly 80 percent of 2019 levels at the end of September, and are expected to rise to the “low to mid-80s” during the fourth quarter.

United Airlines earlier in the week revealed corporate bookings had recovered to more than 70 percent, compared to before the pandemic. Glenn Hollister, vice-president of sales strategy and effectiveness, said he sees no change in corporate booking activity ahead, which continues to gradually improve.

But the USTA’s latest Business Travel Tracker finds that while American companies are returning to travel, there’s still plenty of hesitation, and many wide-ranging reasons, as the association calls for government intervention to sustain a positive rate of growth.

Here’s what it found, based on surveys of corporate executives and business travelers, carried out with J.D. Power and Tourism Economics.

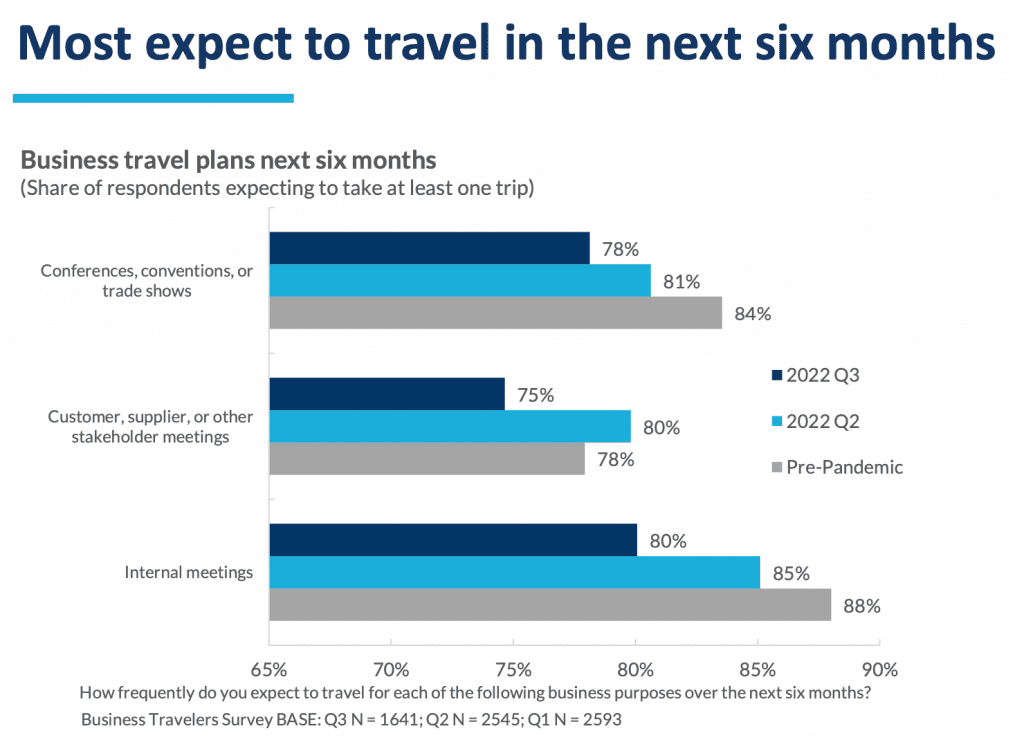

Most People Expect to Travel, But That Percentage Is Declining

Here we see an overall drop off in trips being planned for the next six months, compared to the plans being made in the second quarter, with the exception of customer, supplier or other stakeholder meetings. And those third-quarter expectations remain down on pre-pandemic levels.

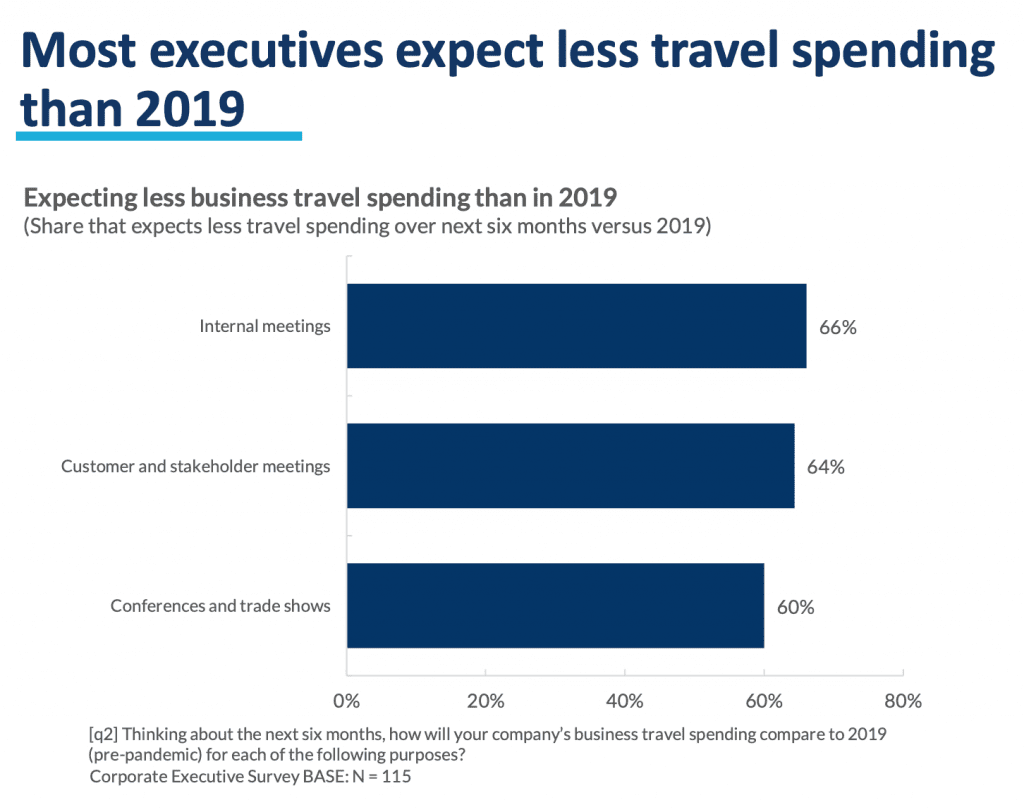

Less Spending in the Next 6 Months

From this chart, internal meetings have the biggest expected drop, because 66 percent of respondents expect less money will be spent on this activity, compared to the amount spent in 2019 before the Covid-19 pandemic. Conference and trade shows aren’t so severe, at 60 percent.

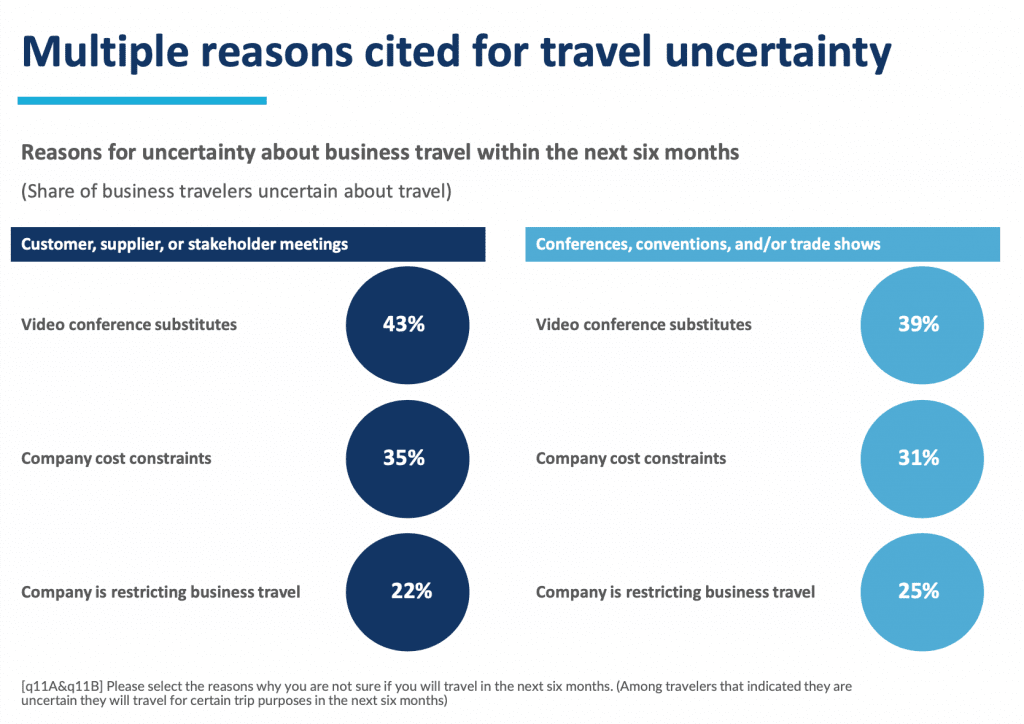

Zoom Isn’t Going Away Anytime Soon

About one-in-four business travelers say they are unsure they will make a trip for purposes such as a customer meeting or trade show over the next six months, with the most frequently cited reason being that a video conference will substitute travel. For a generic business trip, it’s as high as 43 percent.

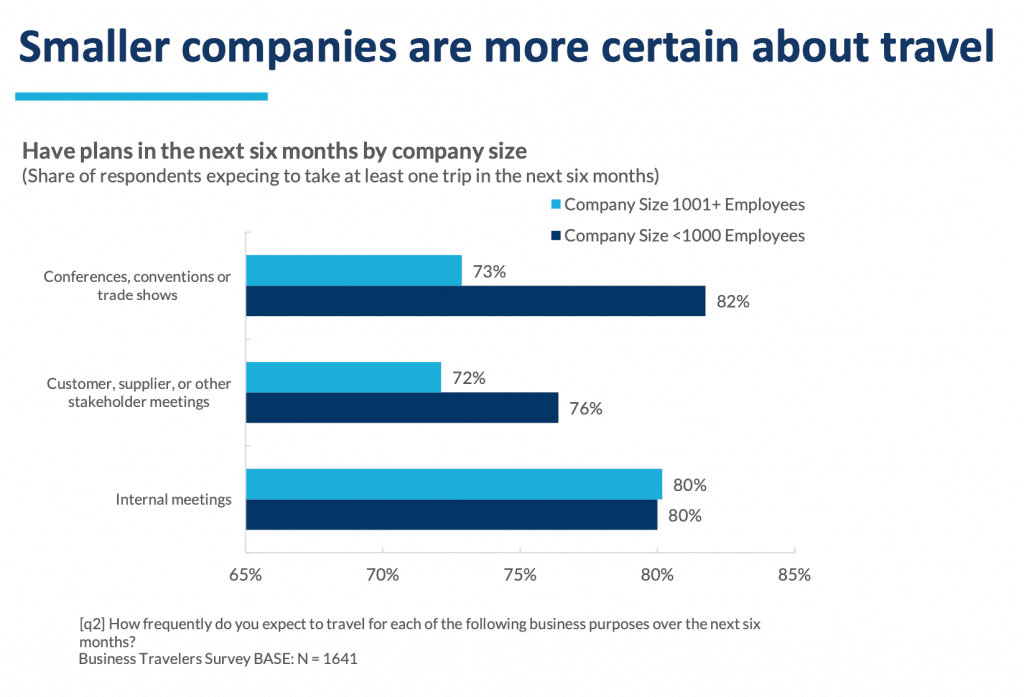

Larger Companies Less Certain

Looking at sizes, smaller companies are more bullish, with more of an appetite to attend conferences and conventions, with four out of five employees expecting to travel at least once for this purpose in the next six months. Just three out of four respondents from companies of 1,000 people or more think they’ll be traveling to meet customers, suppliers or other stakeholders.

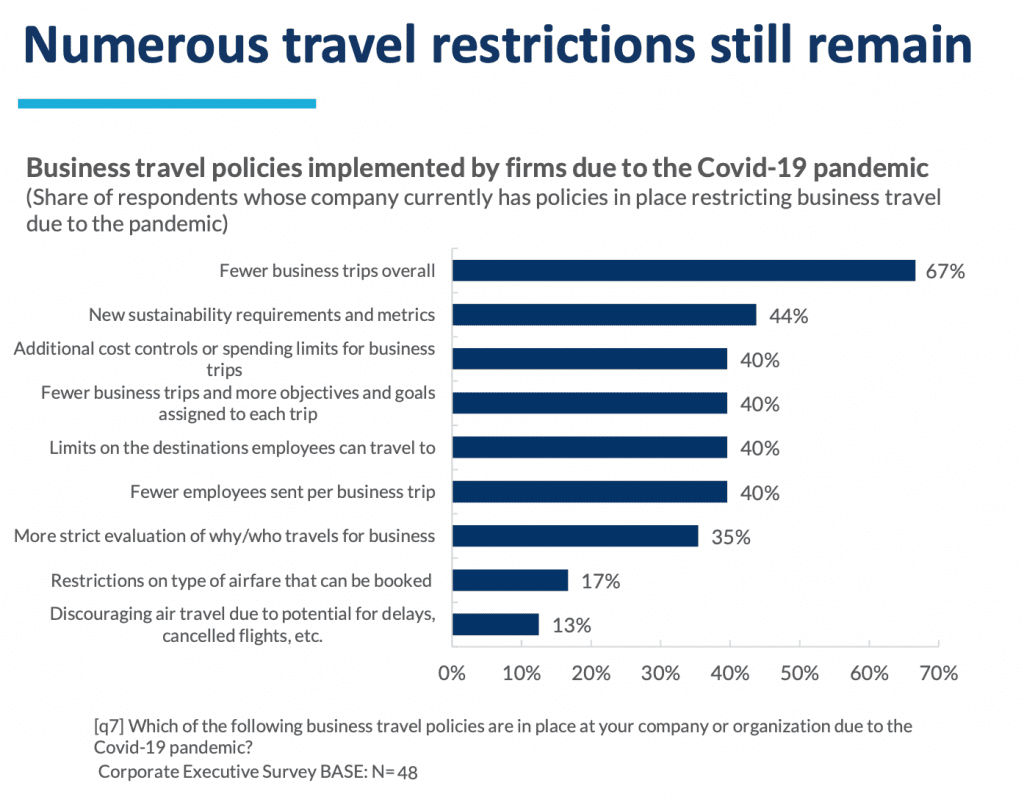

Pandemic-Era Policies Still Holding Back Demand

Numerous travel restrictions still remain, the USTA argues in its report. The most frequently mentioned policy restrictions include fewer business trips overall (67 percent) and new sustainability requirements and metrics (44 percent). But on the brighter side, more than half of corporate executives think existing pandemic-related business travel polices will be reevaluated in the first half of 2023.

The U.S. Travel Association now wants the Department of State to take steps to slash visitor visa interview wait times to facilitate more international business travel, particularly as the strength of the U.S. dollar is posing a hurdle to attracting international meetings and events.

It’s also calling on Congress to support temporary tax provisions that would encourage companies to restore business travel spending, particularly with regard to spending that supports workers in the food service and entertainment sectors.

“Business travel is coming back slowly, and these policies will be essential to keeping employees on the road and helping still-recovering companies weather an oncoming recession,” said Geoff Freeman U.S. Travel Association president and CEO.