New Research Available: Analyst Session + Data Sheet on Ctrip and China Online Travel

Skift Take

Skift recently covered a shake up in the China online travel market, as Priceline Group made a $450 million investment in the Chinese e-commerce platform Meituan-Dianping. Priceline has an existing stake in Ctrip, so the news raised some eyebrows about the future of the China and how Priceline aims to hedge its position in the region.

In last summer’s research report, A Deep Dive Into Ctrip and the China Online Travel Market 2017, we discussed the major industry players in more detail.

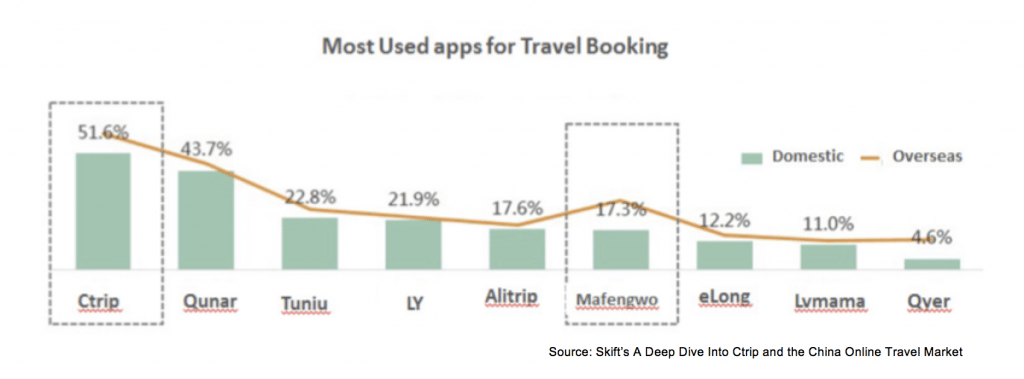

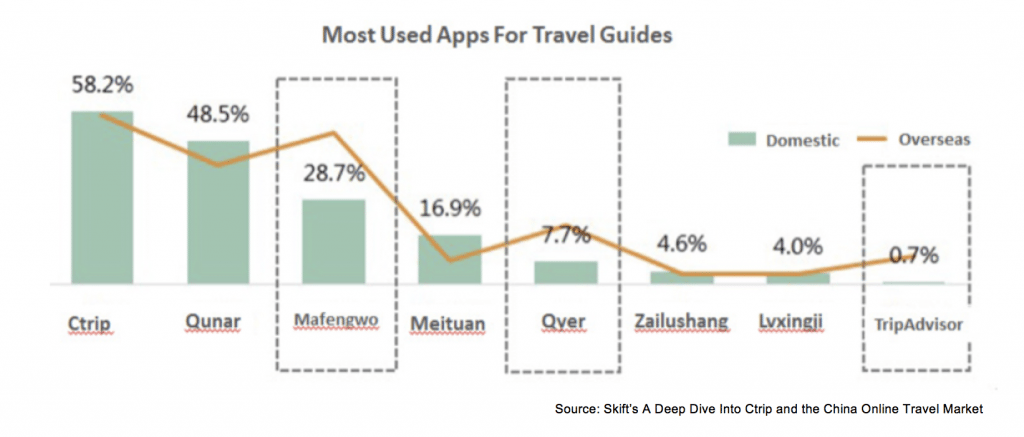

The data featured in the report, based on 2015 and 2016 numbers, show that Meituan-Dianping was not even a contender in the travel booking space in China at the time, while Ctrip captured over half of online bookings.

On the other hand, Meituan-Dianping was one of the top four apps used by travelers to access and read travel guides online.

With this new investment from Priceline Group, Meituan-Dianping will be better-equipped to diversify its offerings and expand its travel booking capabilities, likely lessening Ctrip’s control of this part of the industry. This could mean big changes in China’s travel industry landscape as a whole.

Given these recent developments, Skift Research subscribers now have access to two new research products to supplement A Deep Dive Into Ctrip and the China Online Travel Market 2017. Today, we are releasing our Ctrip and China Online Travel Market Data Sheet and Analyst Session.

The new Data Sheet and Analyst Session parallel the topics covered in the report, providing an in-depth look at Ctrip, as well as an assessment of the Chinese travel market overall. We examine Ctrip from a strategic and financial point of view, using data from partners along with our own estimates. We also take a look at the other major players in China’s online travel market. Additionally, we focus on the trends and dynamics of Chinese domestic, outbound, and inbound travel, along with the unique risks companies and destinations may face in this emerging market.

This is the latest in a series of research reports, analyst calls, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision-maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst calls, and data sheets conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.