Skift Take

With good management, this ultra low-cost airline strategy is profitable just about everywhere. The key? Airlines like Viva Aerobus must be fanatical about costs, and they must provide the cheapest fares, all the time. They also should treat their customers fairly.

If he could, Viva Aerobus CEO Juan Carlos Zuazua might install half-standing, half-sitting seats on his airline’s Airbus A320s. Several manufacturers have shopped them over the past decade, saying there’s no reason passengers must be fully seated for short flights.

Not many airline executives admit they want to cram so many passengers on each plane. But Zuazua, CEO of Mexico’s only true ultra low-cost carrier, said most of his customers — every day about 22 percent fly for the first time — want only the cheapest prices. Comfort, he said, is less of a concern.

“My average stage length is an hour and 30 minutes so perhaps that’s something that passengers may be able to take if the price was right,” Zuazua said in a recent interview.

If Zuazua sounds like Michael O’Leary, the savvy yet loose-lipped CEO of Europe’s Ryanair, it’s for good reason. For a decade, ending late last year, an investment firm controlled by Declan Ryan, a member of the family that founded Ryanair, owned nearly half of Viva Aerobus.

Ryan’s company, called Irelandia Aviation, provides funding and advice to low cost airlines, especially in Latin America, helping them follow Ryanair’s no-frills model. Viva Aerobus is now fully owned by Grupo IAMSA, a Mexican bus company, which knows many of its customers want to trade-up to air travel. It would prefer to control the airline its customers fly.

But like Ryanair’s O’Leary, who has mused about half-standing seats but never adopted them, Zuazua said he knows the unusual configuration is probably not viable. While there’s likely no technical reason seats would not fit, airlines and manufacturers might struggle to certify them, since they would have to persuade safety regulators all those extra passengers could evacuate in an emergency.

“The reality is, it’s going to be very hard to put on more passengers,” Zuazua said.

Instead, Viva Aerobus is focused on the usual discount airline strategy — cutting costs while charging extra for nearly everything it can. Passengers may not like that some seats have as little as 28 inches of pitch, or roughly the same as Spirit Airlines in the United States. But when the alternative is a 12-hour bus ride, many prefer air travel.

Viva Aerobus is not the only Mexican airline offering alternatives to buses. Its biggest competitor is Volaris, a discounter with 68 aircraft, making it roughly three times the size of Viva Aerobus. But Volaris is slightly more full-service than VivaAerobus, and Zuazua claims his airline has a 32 percent cost advantage compared to its closest competitor.

Meanwhile, Zuazua said Viva Aerobus has an almost 70 percent cost advantage over Aeromexico, though given the different models, the two airlines don’t often attract the same customers.

We met with Zuazua recently at the Mexican consulate in Los Angeles to learn more about Viva Aerobus’ model and its future plans.

Note: This interview has been edited for length and clarity.

Skift: Outside of Mexico, few people know Viva Aerobus. What should they know about your airline?

Juan Carlos Zuazua: Viva Aerobus is Mexico’s ultra low cost carrier. We are 10 years old. We are the fastest growing carrier in Mexico. We operate with an ultra low cost business model, very similar to what you’ll see in Europe, in Southeast Asia, and something close to what Allegiant and Spirit are doing in America. Basically, it’s about maximizing the asset utilization of your planes and your staff, with a low cost model that allows you to offer the lowest possible fares. For all the American carriers from Canada to Argentina — the publicly traded airlines — Viva Aerobus has the lowest cost structure … by a big gap.

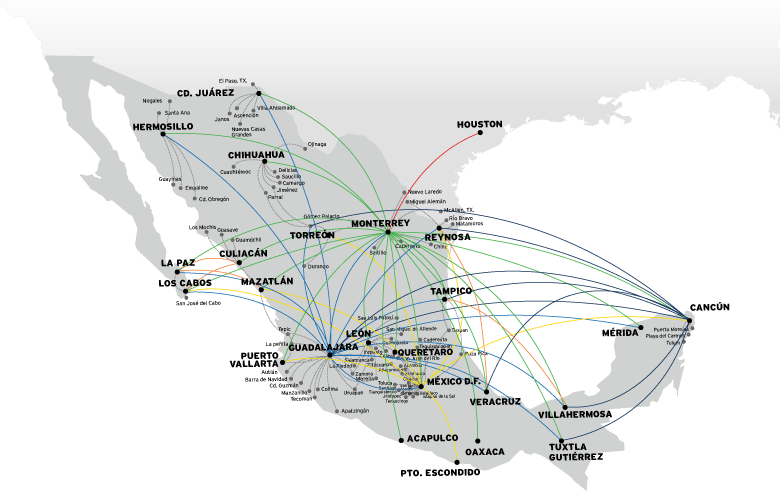

Skift: You’re adding some U.S. routes, including Mexico City to Las Vegas and New York JFK and Guadalajara to Los Angeles, but you’re mostly a domestic airline. Will you add more U.S. flights?

Zuazua: We will continue growing mainly in Mexico because we still foresee a lot of opportunities, and the reason for that is because we have the unique competitive advantage of distributing in the big bus stations because of our shareholder company. But we’re starting important routes, such JFK.

We’re not going go nuts in the U.S. We’re going to pick some important markets, and we’re going to put some decent capacity there, but these are routes that our existing customers in the Mexican market are demanding. They want to go to California and New York and certain parts of Texas, so we’re going to be selecting some key markets, and growing north, but still growing domestically.

Skift: How’d the airline get its name?

Zuazua: The original founder of this airline was the biggest bus operator in Mexico, which is called IAMSA. They were looking for a strategic investor because they knew that the middle class passenger in their business would eventually trade up and move from the bus to the air. They found a strategic partner, which were the founders of Ryanair Europe. [They thought,] it was like a bus with wings, so they called it Aerobus.

And Viva is a very Mexican — like Viva Mexico. That was a combination of two words, which gave birth to this successful airline.

Skift: Is it still like flying a bus?

Zuazua: I can tell you we transport, 26 or 27 thousand daily passengers, and around 22 percent are first-time flyers. Air travel penetration is so small in Mexico that Viva Aerobus is giving the opportunity to passengers to fly for the first time. So for many people, yes, it’s like taking a bus with wings — just cheaper and faster. For many others, it’s just making it easier to fly.

Skift: A lot of your passengers often still use buses, right?

Zuazua: We were the first airline, or even the only airline, that has successfully connected a multi-modal bus-to-air offering. So the bus consumer in Mexico, who has never flown an airline, can arrive at over 400 bus stations in the network of our parent company, [and fly with Viva Aerobus]. They can arrive in Colima which is almost coast of Pacific, which is like [250] kilometers to Guadalajara, and in the bus station of Colima, they go to Omnibus, and they buy a Colima-Los Angeles ticket.

You’ll get a bus from Colima bus station to Guadalajara bus station at a 50 percent discount — everything in one single purchase. And then, from the Guadalajara bus station to the airport, you’ll get a shuttle, which goes every 15 minutes. And also included, the flight from Guadalajara airport to LAX.

Skift: What’s the hardest thing for first-time flyers to get used to?

Zuazua: We have passengers who buy a ticket and arrive to the airport without ID, because when you buy a bus ticket, you don’t need an ID in Mexico. Also, another thing is baggage. In the bus, you can bring all the baggage you want. It’s not regulated.

I think there’s an educational process. We have customers who buy tickets at the bus station, and also customers who buy their tickets on Expedia. You need to ensure you have the proper communication on every different channel, to ensure the customer knows your terms and conditions, or your conditions of carriage, in a simple way.

Skift: What’s your seat pitch?

Zuazua: We were the first operator in Latin America to take what Airbus calls the maximum seat density on an A320. [It meant] going from 180 [seats] to 186, because we made a reconfiguration in the back galleys. We have 31 rows, of which half have 30 inches [of pitch]. Exit rows have 33. The back part of the aircraft has 29, and the last five rows have 28 inches.

People who want to pay for the exit rows, which have 33 inches, are going to pay for the seat assignment. Customers who don’t care are going to take the 28-inch pitch seat.

Skift: If you could put in more than 186 passengers, would you?

Zuazua: Yes, absolutely. But the reality is that it’s going be very hard on an A320 to put more passengers. We already took it to basically to the stretch, because we moved the bathrooms to the back. We needed to sacrifice half of the galleys [to get to 186 seats], so the only other available option is a seat that can get certified in which passengers are not fully seated, but they are inclined.

Skift: You don’t hear many airline executives considering half-standing seats.

Zuazua: Because very few airline executives are focusing on costs. The reality of our business is, 90 precent of our time we’re focusing on how are we going to reduce the cost of flying.

Skift: You think anyone will certify the half-standing seats?

Zuazua: I don’t know if they’re going get it. The big cost innovation for this decade is going to be the brand new engine technology, which is going make an important reduction, but apart from that, it takes decades in this industry for important cost savings. Perhaps in the next couple of decades, hopefully, we’ll get an electric plane, and that’s going be the holy grail for aviation.

Skift: What about more traditional ways to add seats? Perhaps you just shrink pitch a little more on your existing fleet?

Zuazua: Airbus has been fighting for three more seats right now, to 189, to match the Boeing 737-800. So if you ask me, my opinion, I see perhaps three more seats on our aircraft, and that’s it.

Skift: To put in the crazy concept seats, you’d need more exits for evacuations, right?

Zuazua: You will need more exits, and the manufacturer will need to get the program re-certified. That’s something that is very hard to do. Certainly that’s a challenge they have, but if it’s something that will work, Viva is certainly an airline that would be considering packing a little bit more seats. Or perhaps, [we would do it in] half of the airplane, like we’re doing it right now. The fact is that the back part of my airplanes are a little bit more packed.

Skift: You vary the prices for many ancillary items according to demand. That’s similar to how airlines set ticket prices, but often ancillary products have a set price. Why use dynamic pricing?

Zuazua: Traditionally, airlines have been very good at doing revenue management on the fare component — understanding the customer behavior, the customer demand, and moving prices to maximize. But what very few carriers have been able to do is to use revenue management to optimize ancillary revenue offering, according to passenger profiles. That’s where we’re putting big efforts in order to be more relevant in the offers we make to our consumers.

Skift: Is it possible that I will fly on one of your flights, and I will pay more for my baggage than the person sitting next to me?

Zuazua: Absolutely. That’s already happening today.

Skift: Would you charge me more for a good seat because you know my ZIP code?

Zuazua: Not a ZIP code, but if it’s a person who is booking last minute and perhaps has a profile which is a business type of passenger, we can charge you more for our seats.

There are also several seasonal effects. For example,[when] travelers from Tijuana are flying to Mexico City before Christmas, they are highly propensed to bring a lot of luggage, so we will vary fees.

Skift: Let’s say I’m shopping on your website, and I abandon the shopping cart after I see what you’re charging for baggage. You probably monitor that. Might you send me an email later, saying, ‘Come back, and the bag is a new price?’

Zuazua: No, we have a shopping cart program, but right now, it’s mainly focused for a customer who abandons a shopping cart for their seat. We send an email targeted to that customer either to convince him to come back with a special discount, or at least we’ll hold the fare for them to come back within the next 24 hours and complete that purchase. That is working very, very good.

Skift: If a customer abandons a cart, you might offer a special discount to return?

Zuazua: It might be a discount. It depends on the business rules we put on the given route — whether it’s a route in which we’re aiming for volume, or if it’s a route in which we are aiming for yield.

But [no matter what,] we are going to respect the fare you saw. Let’s say that the fare bucket they wanted to buy has already sold out, and the new fare on the website is $10 or $20 or above. That’s how the airlines price. We tell the passengers, ‘We’re going to respect the price 20 minutes ago.’ In other words, it’s still a discount, because a new price is already higher, because perhaps those three seats already sold out.

Skift: Do customers appreciate the personalized emails?

Zuazua: What we’ve seen is that the more relevant you become to your customers, the better chance you have to improve the conversion rates. What customers hate, in my opinion, is to be getting massive advertising of things that are not relevant to you. [I want] specific advertising that is relevant to me.

Skift: Travelers also hate it when they come in the morning to find a good deal, and by night-time, it’s gone. How do you educate them that prices change?

Zuazua: It’s about urgency messaging. If there’s only two seats left at that price, we share that with the customer. Sometimes, our customers, they don’t like it when fares sell out, because they look for a fare in the morning, and it’s $40. Then, they go at night to talk to their husbands, to convince them to take it, and they come back, and they see, suddenly, those fare classes have sold out. When they come back, there’s another fare class. So what we try to tell them is there’s only two seats left at this price.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: airline passenger experience, ceo interviews, low-cost carriers, ryanair, viva aerobus

Photo credit: Viva Aerobus CEO Juan Carlos Zuazua wants to do everything he can to keep his airline's costs low. Viva Aerobus