What’s Holding Back Tourism to India – and How to Fix It

Skift Take

Despite India's rich cultural heritage and booming domestic and outbound travel, inbound tourism remains stuck.

Our latest Skift Research report: How to Grow Inbound Tourism in India: Unlocking Long-Haul Opportunities dives into the key barriers, traveler perceptions, and strategies for reversing the trend.

In a recent survey, Skift Research asked travelers from the U.S. and UK - two key potential source markets – for their views on India.

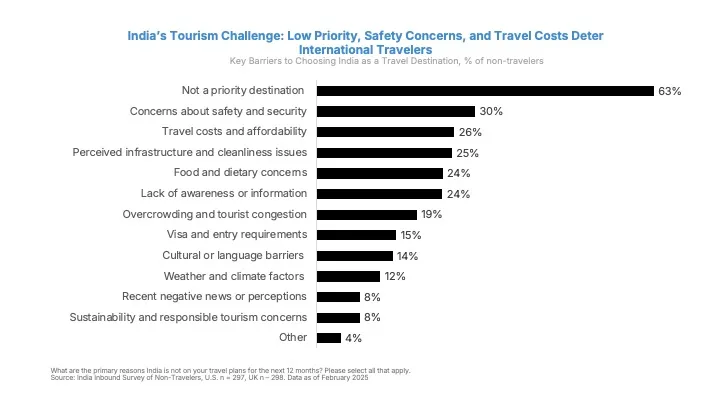

Of those who don't travel to India, 63% said India is "not a priority destination."

Some issues they cited: Safety (30%), cost (26%), and infrastructure concerns (25%). The biggest challenge is perception and marketing. Unlike destinations with strong global branding — like Japan or Thailand — India is missing a cohesive messaging strategy that drives top-of-mind awareness among high-value travelers.

The Power of Cultural & Culinary Tourism

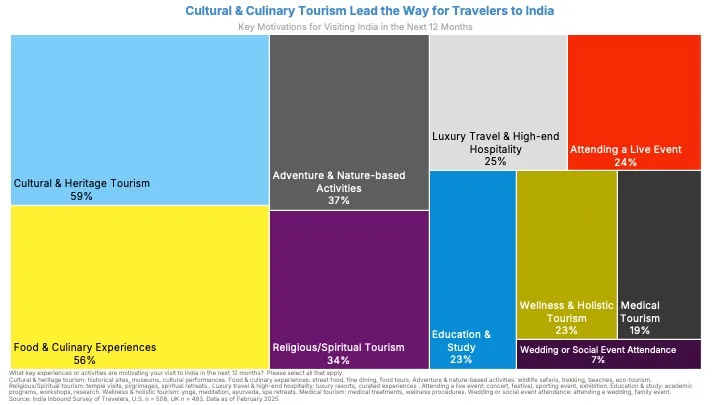

Cultural and culinary tourism are India's biggest inbound revenue drivers, with 59% of travelers prioritizing cultural heritage and 56% drawn by Indian cuisine. The data show that experiences like visiting UNESCO sites, street food tours, and immersive cultural performances drive strong traveler interest.

However, India lags in structured experiences and marketing these segments effectively. Destination storytelling and better itinerary curation can unlock significant spending potential.

Who Are India’s Highest-Spending Travelers?

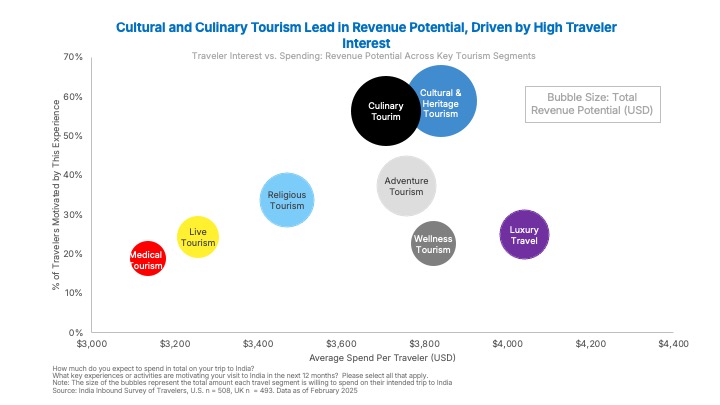

Our analysis of per-trip spending by travel segment reveals a key insight: Luxury travelers spend the most per person ($4,041), but cultural and culinary tourists bring in the highest overall revenue. This is because cultural tourism attracts a larger volume of travelers (59%), making it the biggest economic contributor.

Similarly, wellness and adventure travel show strong per-trip spending but remain niche markets. To maximize growth, India must balance strategies for high-spend and high-volume traveler segments.

India has all the ingredients to become a long-haul tourism powerhouse — but unlocking its full potential requires coordinated action.