U.S. Budget Hotels Feel the Pinch: Is Inflation the Culprit?

Skift Take

Early Check-In

Editor’s Note: Skift Senior Hospitality Editor Sean O’Neill brings readers exclusive reporting and insights into hotel deals and development, and how those trends are making an impact across the travel industry.U.S. budget hotels performed less well in the first few months of the year than they did a year ago. Does that weakness signal some U.S. travelers feel a pinch from inflation?

America’s economy-class hotels had 6% lower revenue per available room in the first quarter than they did a year ago, according to CoStar’s STR, which has received preliminary rate data from tens of thousands of rooms nationwide. Brands like Econo Lodge, Days Inn, Super 8, and SureStay aren’t performing as well as higher-end brands.

| Chain Scale Segment | Year-over-year growth for the first quarter |

|---|---|

| Total U.S. | 0.20% |

| Luxury | -0.30% |

| Upper Upscale | 3.00% |

| Upscale | 0.40% |

| Upper Midscale | -2.00% |

| Midscale | -4.50% |

| Economy | -6.50% |

Source: STR.

Saying that performance is softening isn’t the same thing as saying that budget hotels are empty. For comparison’s sake, revenue per available room is slightly better than in the first months of 2019 before the pandemic set in.

Plus, demand varies by market. Some Sunbelt cities, for example, are enjoying booming demand, particularly from travelers working on infrastructure projects.

Still, economy-class properties had the weakest performance of any hotel segment.

“We see weakness in U.S. Economy/Midscale RevPAR as concerns for Wyndham and Choice Hotels,” wrote Patrick Scholes and Gregory Miller in a report for Truist Securities this week. “Based on STR/CoStar data, we calculate that WH’s domestic RevPAR was down approximately 4.5% year-over-year in the first quarter and Choice Hotels’ was down 3.5%.

The analysts noted that they still like the stocks of these companies for other reasons and they have to wait until the companies share their performance results in the next few weeks to draw firmer conclusions about trends.

Is Inflation the Villain?

Surveys paint a conflicting picture of traveler sentiment. Some demographic groups in the U.S. are facing cost pressures, which may impact their travel decisions this year, while better-off Americans continue to spend big on trips.

A January survey of 2,000 American adults in the general population, conducted by The Harris Poll for NerdWallet, found that only 45% of respondents planned to take a trip that requires a hotel or flight this summer. The survey found that 91% of respondents claimed to be making changes to their trip plans to save money.

More than half of 2,200 travelers surveyed by Morning Consult for the American Hotel & Lodging Association say they are less likely to plan an overnight trip this year due to inflation.

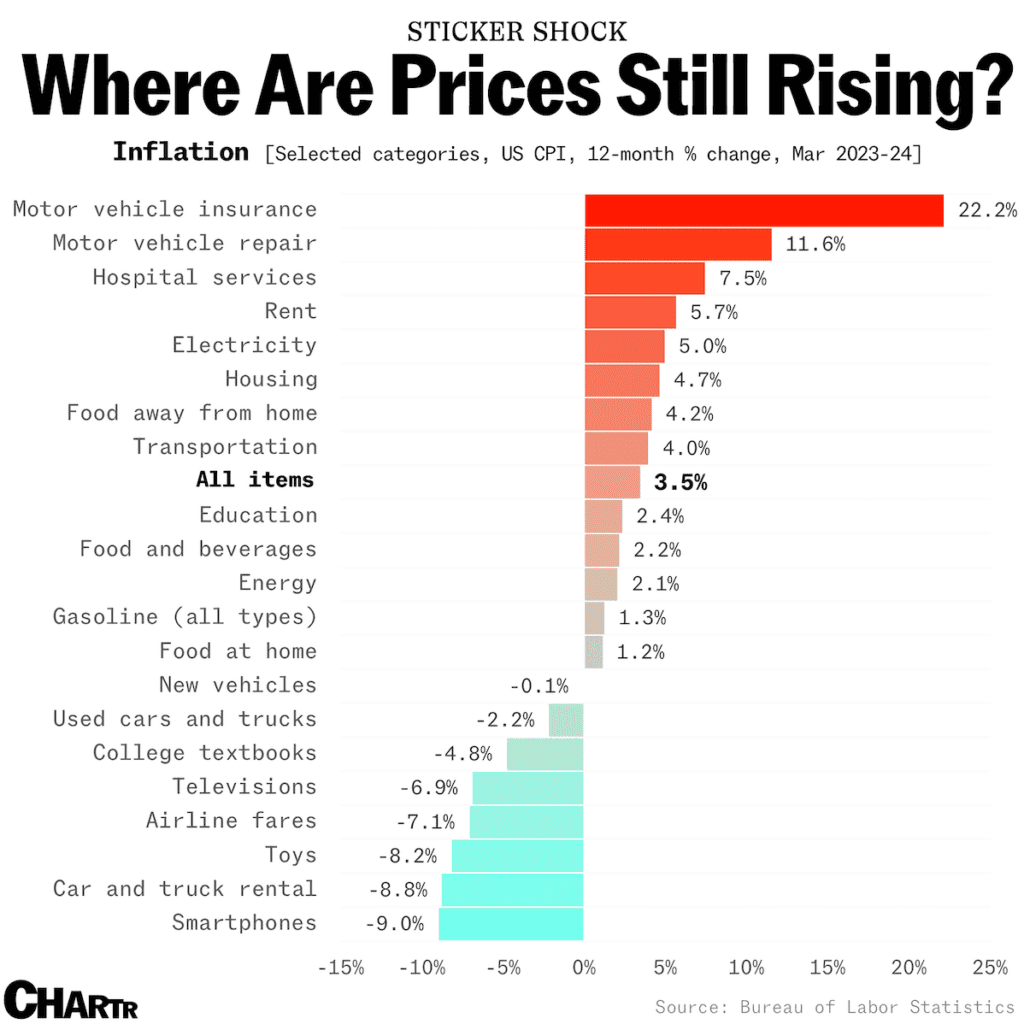

The inflation challenge appears to be from non-travel costs eating into people’s travel budgets. The good news for people with steady incomes is that they may pay less than a year ago for flights. Average fares are down 7%, and rental car rates are down 9%.

You might think that pricing pressure would lead people to “trade down” to cheaper hotels.

Instead, people with lower spending tend to spend less or travel at off-peak times, reducing their patronage of budget hotels.

Meanwhile, people with continued spending power prefer to spend on relatively higher-end lodging — according to trends Deloitte first noted in a survey last year.

Despite the softening at the lower end of the hotel market, the overall demand picture for U.S. hotels continues to remain strong. Well-off Americans appear to be still planning big trips.

Exhibit A: A February survey by MMGY Travel Intelligence found that 76% of respondents who were well-off enough to take a trip last year planned to take a vacation this year — a rise from 70% a year ago.

Accommodations Sector Stock Index Performance Year-to-Date

What am I looking at? The performance of hotels and short-term rental sector stocks within the ST200. The index includes companies publicly traded across global markets, including international and regional hotel brands, hotel REITs, hotel management companies, alternative accommodations, and timeshares.

The Skift Travel 200 (ST200) combines the financial performance of nearly 200 travel companies worth more than a trillion dollars into a single number. See more hotels and short-term rental financial sector performance.

Read the full methodology behind the Skift Travel 200.