Skift Take

Booking and Expedia now face slower growth, stiffer competition and increased pressure on profit margins.

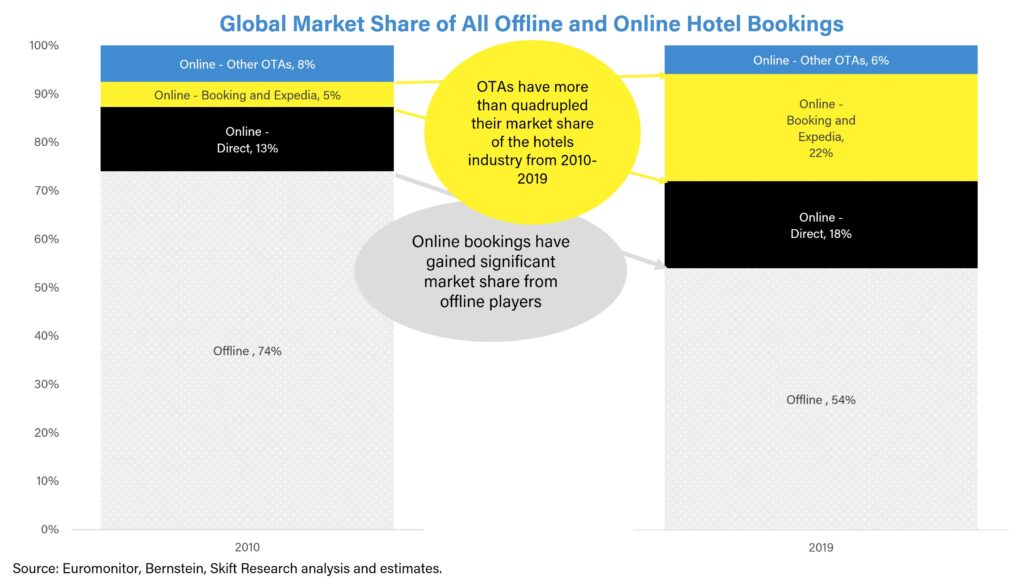

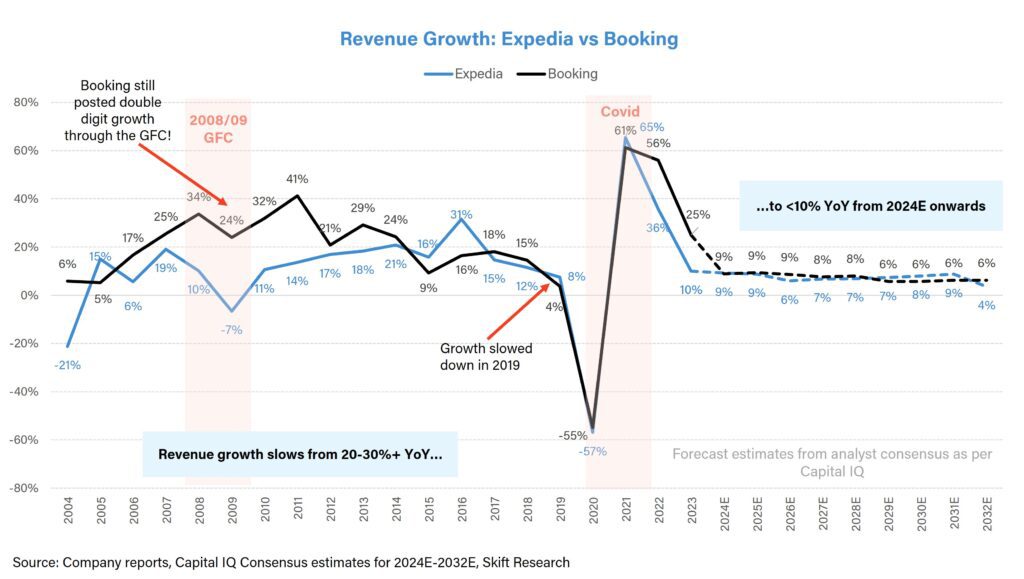

The period after the Great Financial Crisis in 2008-2009 until 2019 was a golden decade for online travel agencies. Booking and Expedia benefitted from the shift to online bookings, a consolidation of the online distribution landscape, and share gains from hotels. They become the most powerful duopoly in online travel.

Are the heydays of Booking and Expedia over?

However, Booking and Expedia now face slower growth, stiffer competition and increased pressure on profit margins.

Booking, which was posting more than 40% growth in 2011, grew just 4% in 2019. Growth may be less than 10% in the next decade.

Why the slowdown? The tailwinds that drove market share gains are now diminishing. There’s increased competition; new entrants into the travel space, such as banks and credit cards; and smarter, more tech-enabled hotel brands are gaining back share.

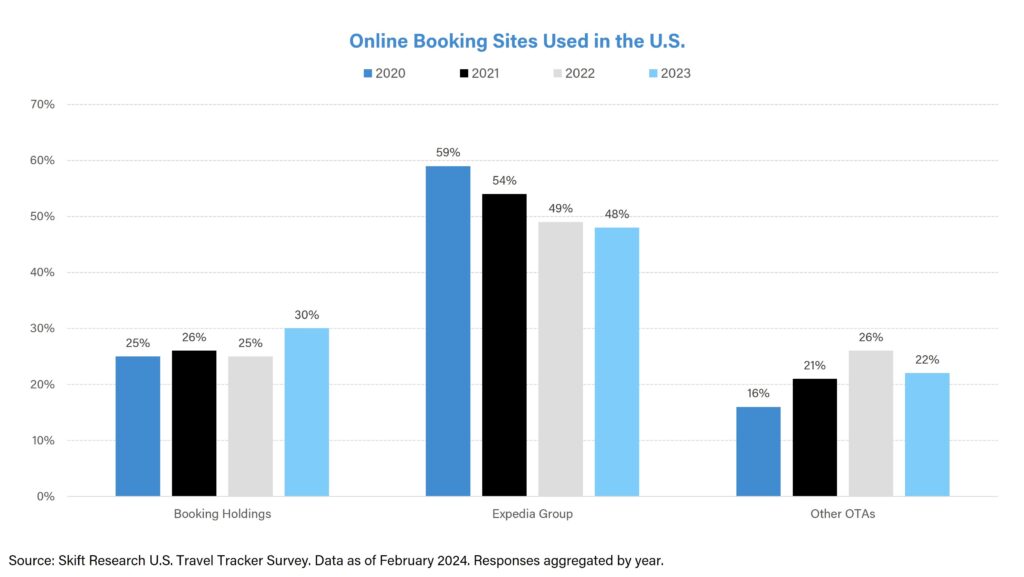

The OTA landscape is filling up with strong new players that won’t be as easily acquired as they were in the past. Our proprietary survey shows that since 2020, Booking and Expedia have lost market share to other OTAs. Expedia in particular has felt the pressure from both new entrants and Booking, which is aggressively expanding into the U.S.

The online distribution landscape has re-fragmented and gotten more competitive

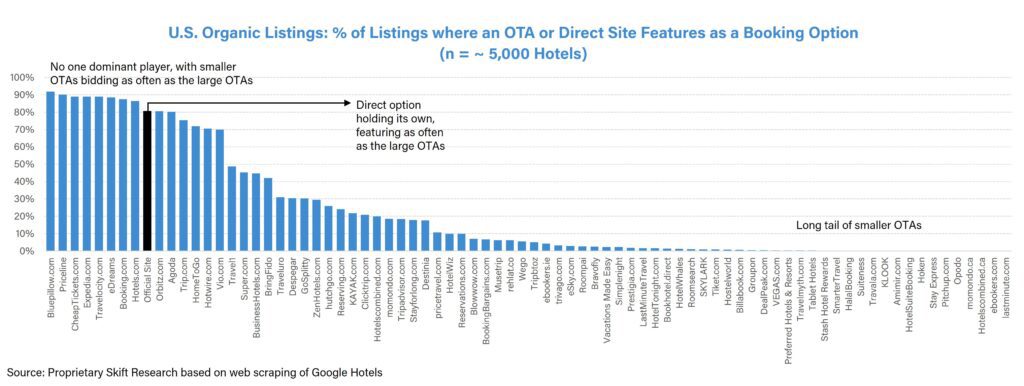

The introduction of free organic listings by Google Hotels in March 2021 has democratized the online distribution landscape: Direct hotels and smaller OTAs are now competing head-on on with Booking and Expedia.

Booking and Expedia still dominate the paid sponsored listings. But for free organic results, there is no one commanding player. Expedia.com and Booking.com are as likely to appear as the direct hotel and smaller OTAs such as cheaptickets.com and bluepillow.com.

For further analysis of our proprietary web-scraping of Google Hotels, refer to our series on Google Travel: A Deep Dive into Google Travel Part I: U.S. Hotel Distribution and A Deep Dive into Google Travel Part II: U.S. vs Europe in 20 Charts

New competition from banks and credit cards powered by B2B partnerships now selling travel

Online travel is increasingly shifting away from direct consumer relationships towards business-to-business (B2B), which has become an important strategy for companies like Expedia and Hopper. B2B makes up more than 25% and 40% of their total sales, respectively.

Why would the OTAs move into the B2B space? B2B partnerships are a lucrative source of revenue growth that allow the OTAs to access roughy 3x the number of loyalty members through a new form of distribution channel that bypasses Google.

Here’s how Expedia CEO Peter Kern put it at Skift’s Global Forum in 2021: “I prefer to spend money on almost anything than spend it with Google.”

However, this comes at a cost. The OTAs only receive half the commission, and they are now actively powering the supply of their competitors, with fintech players such as Chase Travel and Revolut having a large enough customer base to potentially dis-intermediate the OTAs themselves.

Roughly 150 million consumers own a Chase credit card in the U.S. That’s just shy of the 168 million global loyalty members at Expedia and 180 million members at Hilton.

Leeny Oberg, CFO of Marriott, has also voiced concern about the entrance of banks and credit card companies into travel. At the New York University International Hospitality Industry Investment Conference in 2023, she said: “When you ask me about sleepless nights, it’s this topic [of fintech players].The reality is there’s tremendous capital and good digital know-how in these spaces.”

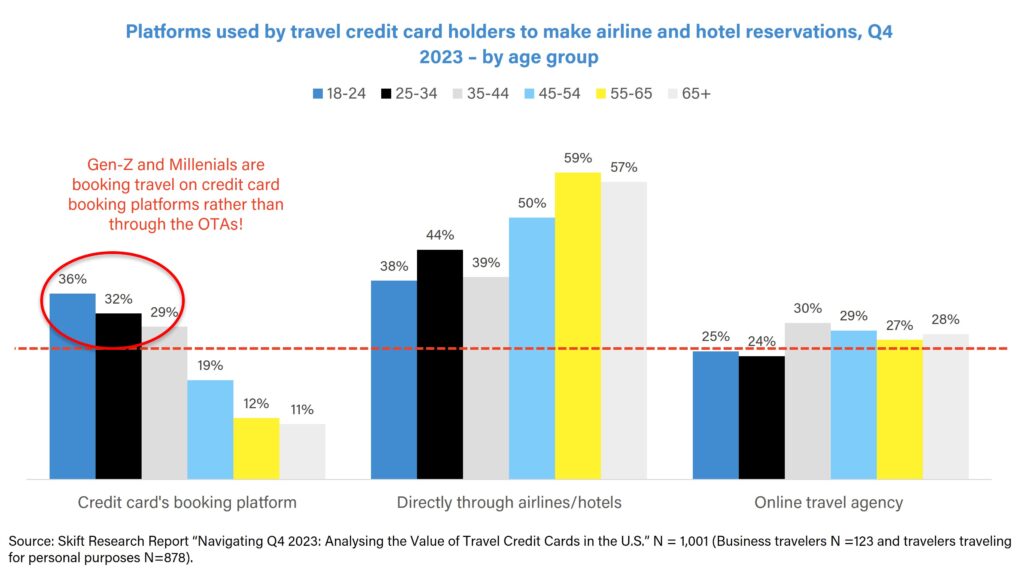

The key chart is shown below. Today, Gen-Zs and Millennials are making travel reservations more frequently through the credit card booking platforms than through the OTAs.

As per our survey, 25% of consumers aged 18-24 use OTAs to make airline and hotel bookings, but more than 35% are booking through the platforms of credit cards, such as Chase Travel or Capital One. Interestingly direct bookings are the most used booking platform among every age group – though only slightly above credit card platforms for the 18-24 age group.

For further analysis on credit card usage by travelers, read Navigating Q4 2023: Analysing the Value of Travel Credit Cards in the U.S.

Direct hotel brands are investing in tech and loyalty programs

In the wake of the Global Financial Crisis, hotel brands faced a harsh reality: Their slow embrace of technology allowed the OTAs to capture a significant market share.

Today, the tide is turning. Hotel brands are actively fighting back by investing heavily in technology and loyalty programs, which incentivize guests to book directly, foster brand loyalty and ultimately regain lost ground in an increasingly competitive hospitality landscape.

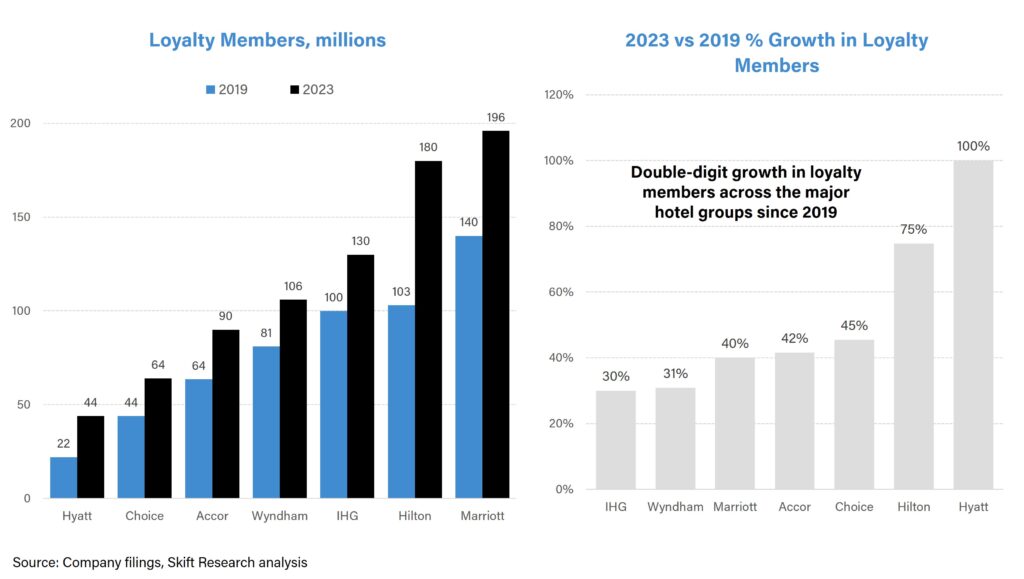

As a result, the major hotel groups have grown their loyalty programs by double-digits since 2019, with brands like Hyatt doubling its members over the past 4 years.

As a result of rapidly growing loyalty programs, investment into digital booking platforms, and an industry-wide shift to direct bookings through the pandemic, the hotel brands such as Marriott have seen direct digital channels gain 5 percentage points of their total distribution mix since 2019. In turn this has boosted owner and franchise profitability and contributed to margin expansion.

The OTAs won’t give up without a fight

In an increasingly competitive landscape, the OTAs aren’t going to simply give up market share without a fight. While share gains in the past decade were dominated by economies of scale, the next decade will be led by innovation and new ventures.

In the face of new competition, Booking and Expedia are increasingly investing in new areas. Booking has expanded its flights business as part of its connected trip vision and invested into merchandising efforts (i.e. discounting and couponing). Expedia is building out its B2B business and investing in a new centralized tech and loyalty system.

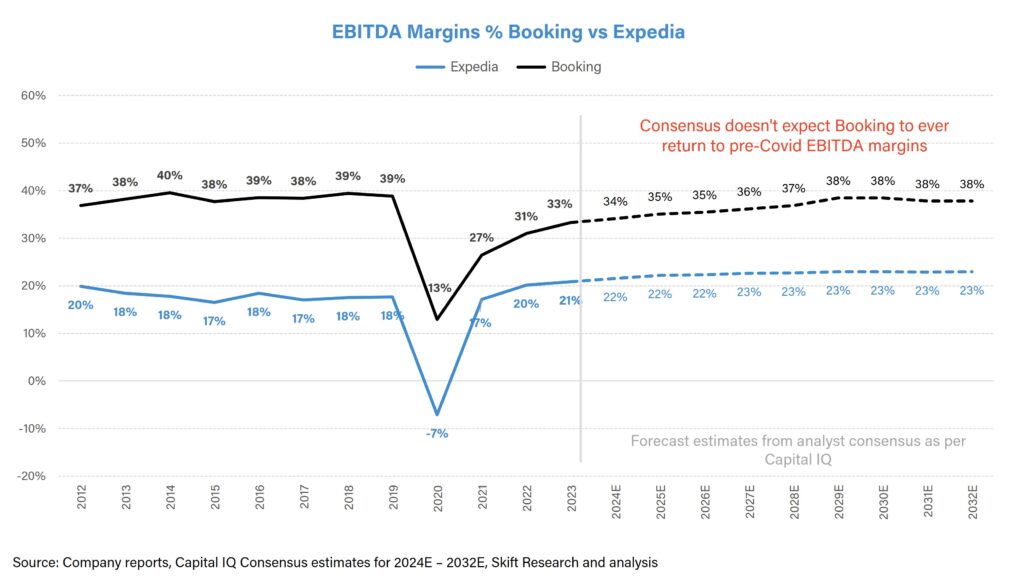

These efforts are necessary to maintain growth and retain market share but crucially come at the expense of lower profit margins.

For example, at Booking Holdings, as a result of investment into lower commission businesses, analyst consensus is that profit margins won’t ever return to pre-Covid levels. We explore Booking as a case study in further detail in our Skift Research report: The Past, Present, and Future of Online Travel

Read the full report for much deeper analysis (40+ charts!) into the dynamics impacting the online travel landscape today.

What you’ll learn from this report:

- The Rise of the OTAs: Understand how Booking and Expedia leveraged industry trends following the Great Financial Crisis to become the dominant players in online travel.

- Challenges to OTA dominance: Gain insights into the ongoing battle for market share and the factors that will shape the future of the online travel industry. Discover how a re-fragmented distribution landscape, resurgent direct hotels, and new entrants into the space such as banks and credit cards, are challenging the market shares of the legacy OTAs

- The Future of online travel: In the face of new competition, explore how the OTAs are adapting through innovation and new ventures, while facing the trade-off of lower profit margins.

This is the latest in a series of research reports, analyst sessions, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision-maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

Subscribe now to Skift Research Reports

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report à la carte at a higher price.

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch

Tags: booking holdings, expedia group, online travel, online travel newsletter, skift research

Photo credit: Unsplash/Atacama Desert Chile