Skift Take

The market has become less skeptical of Choice's hostile takeover bid for Wyndham, despite many roadblocks. The Skift Travel 200 sheds light on the thinking behind this offer.

Choice Hotels created a storm last October when it went public with a hostile takeover bid for Wyndham Hotels & Resorts. It is giving Wyndham stockholders until Friday to tender their shares.

Choice Hotels will use the response to gauge how much traction it has among Wyndham shareholders. It will use that response to decide if it should adjust or withdraw its offer and if it should continue to pursue its slate of nominee members for Wyndham‘s board.

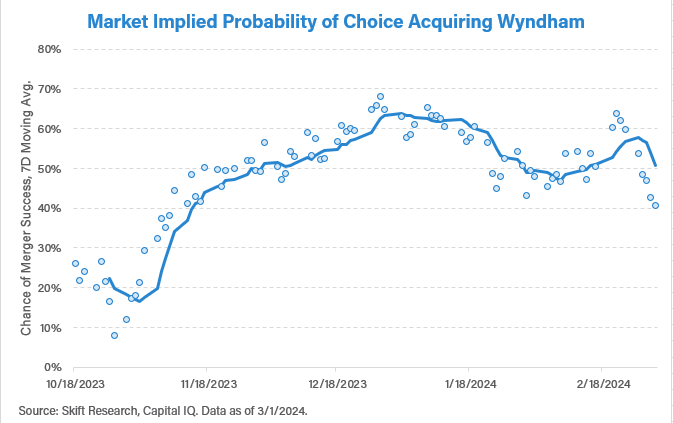

What are the chances of a merger happening as of today? Chances have improved since the deal was announced.

“It’s looking more like a 50/50 bet today,” said Seth Borko, Head of Research, at Skift Research.

Skift Research, using the using the Skift Travel 200 stock index and options data, estimated on October 20 that stock and options markets were assigning Choice only a 20% to 30% probability of success.

Odds Choice-Wyndham Will Happen: March 2024 Update

One big change since October has been that Choice’s stock price has appreciated, and Wyndham’s share price has slightly risen, too — though Wyndham’s price continues to sit below the fair value price of the Choice offer.

Choice Hotels has said the estimated value of its offer is the equivalent of $90 a share in cash and stock.

Wyndham’s closing share price on October 16, before the merger proposal, was $69. The more investors think a deal will happen, the more one would expect the market to bid up Wyndham.

On Tuesday, Wyndham shares were trading above $75. Choice’s share price hovered near $113.

Borko also takes into account the pricing of short-dated and long-dated options to buy Choice shares over the year. For instance, the current state of an option that Choice’s stock will be at least $85 on December 20 is currently implying that investors believe a 47% chance Choice’s stock will be at that level, suggesting implicit positive sentiment in a deal.

“Think of this as a creative benchmark for investor sentiment about a merger deal, though this model is making broad-brush assumptions,” Borko said. “The implied odds are derived from the ‘wisdom of the crowds’ and aren’t a direct, precise read, and the situation remains fluid.”

Hurdles to a Deal?

“We anticipate an announcement by Choice on Monday as to the results of the tender offer which may impact CHH’s next steps on moving forward on the merger,” wrote analysts Patrick Scholes and Gregory Miller at Truist in a report Tuesday. “At this time, we do not expect Choice to give up on the merger especially given the commentary and tonality from the management on our call today, including their description of the interactions with the FTC and seeming ‘normality’ of the second request proceedings.”

Choice executives last month reiterated their confidence that a business combination could be completed within “a one-year timeframe” and that they have seen “progress” on the regulatory review by the U.S. Federal Trade Commission (FTC).

Yet Wyndham executives said they had already faced $15 million in costs to answer FTC questions so far and that they faced additional questions from queries from four state attorneys general. They’ve asked their shareholders not to participate in Choice’s exchange offer.

U.S. Senator Elizabeth Warren sent a letter on February 28 to the FTC’s chairperson calling for the agency to look closely at the merger because of her worries about potential antitrust issues.

“If Choice’s hostile takeover of Wyndham is successful, data presented by Wyndham to its shareholders indicates that the combined company would control 57% of the national market for economy hotel franchises, with its next largest competitor controlling 14% of the market,” Warren wrote. “The same data reveals that the combined company would amass an even larger share of the national midscale hotel franchise market — a staggering 67%.”

Choice executives have countered that a combined company would still face “nine other major competitors, including Marriott, Hilton, and IHG” in the midscale and economy segments.

“A Choice-Wyndham combination would leave the combined company well positioned to compete in this increasingly competitive landscape,” executives said.

Accommodations Sector Stock Index Performance Year-to-Date

What am I looking at? The performance of hotels and short-term rental sector stocks within the ST200. The index includes companies publicly traded across global markets, including international and regional hotel brands, hotel REITs, hotel management companies, alternative accommodations, and timeshares.

The Skift Travel 200 (ST200) combines the financial performance of nearly 200 travel companies worth more than a trillion dollars into a single number. See more hotels and short-term rental financial sector performance.

Have a confidential tip for Skift? Get in touch

Tags: antitrust, choice hotels, choice hotels international, future of lodging, mergers and acquisitions, wyndham, wyndham hotel group

Photo credit: Exterior of the Wyndham Garden Inn Wyndham Garden Orlando Universal. Wyndham