Skift Take

Revenue growth will finally decelerate from red-hot growth. But that's not a sign of weakness. it's a return to normal – and that's a good thing.

Will 2024 be a Goldilocks year for the global travel industry? We’ve gone from “too cold” during the pandemic to “too hot,” as demand for revenge travel outstripped capacity. Could 2024 be “just right?”

Skift Research, in its newly published 2024 Global Travel Outlook, believes that scenario seems likely.

We expect that revenue growth for the travel industry will decelerate: From eye-watering double digits to a more modest rate in the high single digits. This slowdown is not a sign of weakness. Rather, there will be continued strength in the travel industry as business finally gets back to normal.

Economic conditions appear poised to support further consumer spending. And even though there are some clouds on the horizon, there are shifts in consumer behavior that prioritize travel over other spending – that should help support growth even if weak spots emerge.

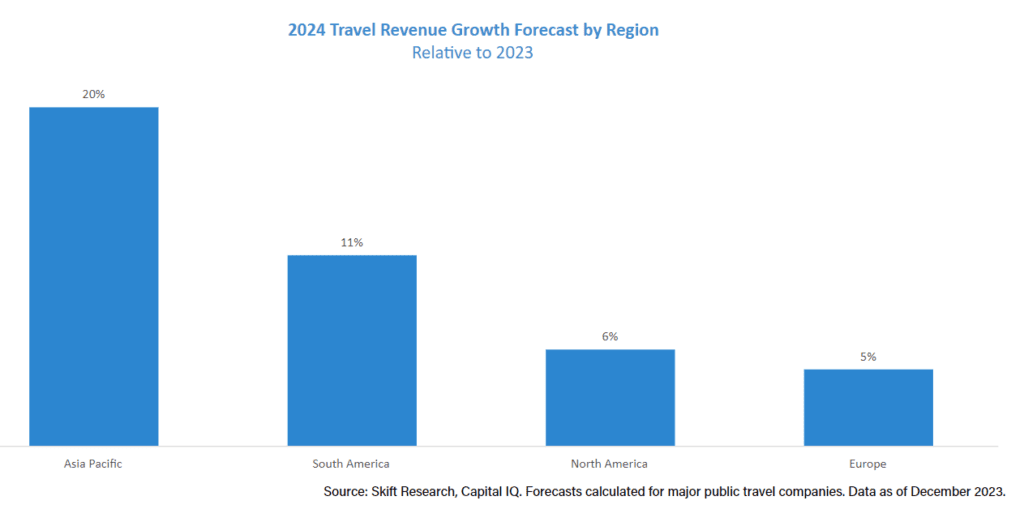

That is the 30,000 foot view. Look more closely, and the story gets more complex and 2024 will be a year of sector and regional de-coupling.

Expect Asia to finally experience strong growth after its prolonged lockdowns. Europe, on the other hand, is likely to moderate as pent-up demand exhausts itself and travelers shift their focus towards the Pacific.

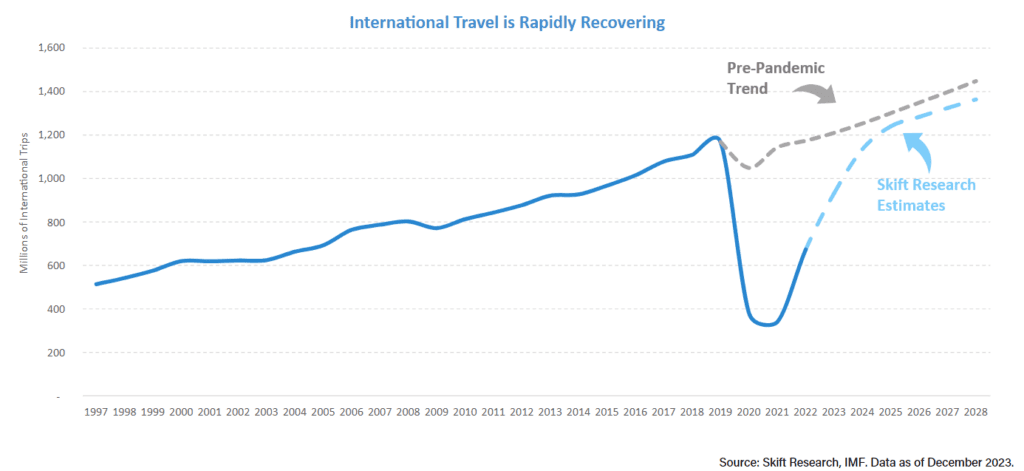

Cross-border trips were one of the primary areas where travel still needed to “catch up” with pre-Covid levels. The long (long!) awaited return of Chinese travelers, coupled with a swell of travel demand out of India, should make that happen in 2024.

Yes, revenge travel may be drawing to a close, but the travel industry still has a gap to fill. Relative to where we would have been without a pandemic, Skift Research estimates that the travel industry will remain 120 million international trips below potential in 2024.

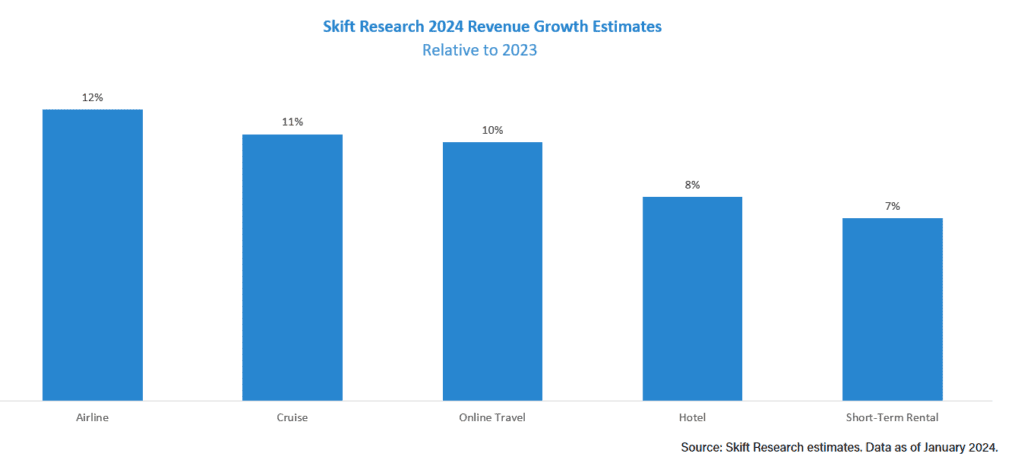

Taking the sector view, we expect a role-reversal of sorts in 2024. Airlines should lead growth as Asia capacity comes back online while short-term rentals may trail after stellar performances in the past three years. Don’t get us wrong, we still expect respectable growth from all major sectors.

Capacity constraints are from over, but can help support pricing power. Much of the hotel recovery has come through pricing power gains, which leaves room for another leg of occupancy-led growth. This is supported by a years-long shortage of new construction and rising short-term rental restrictions.

Online travel returns as a key battlefield. Faced with rising inflation, consumers worldwide have returned to comparison shopping via third-parties. With Google firmly ensconced at the top of the traditional search funnel, booking sites either need massive marketing budgets or to break the mold through new and innovative strategies.

There’s never a dull moment in the travel industry and we can’t wait to see what 2024 will hold. The full Skift Research Global Travel Outlook 2024 includes more data than ever before. The core estimates you will find are for international trips to 2028. And we have revenue forecasts for the hotel, airline, online travel, short-term rental, and cruise industries.

On top of that we have included sector-specific analysis and insights into how economics, demographics, and consumer trends will shape travel into 2024 and beyond. We hope you enjoy.

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch