Skift Take

If you thought that by increasing flight capacity and stabilizing prices, the floodgates would open for Chinese travelers to enter U.S., then you may want to read this…

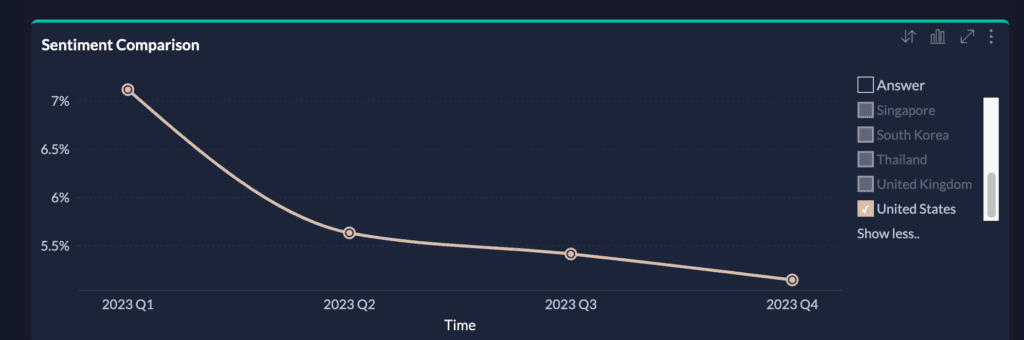

China is addressing the bottlenecks that have restricted outbound travel from the country. But the enthusiasm among Chinese travelers to visit the U.S. is diminishing, according to the latest survey from China Trading Desk, a marketing technology company.

Foreign travel for Chinese citizens remained 41% of pre-pandemic levels last year, and is predicted to reach just 62% of pre-pandemic levels in 2024. The survey predicts 1.3 million Chinese tourists will visit the U.S. in 2024, which would still be 70% below 2019.

Unpacking The Hesitation

Subramania Bhatt, founder and CEO of China Trading Desk, listed several reasons for the declining interest in travel to the U.S.

Limited flight capacity and expensive U.S. tickets are most often cited. Bhatt also pointed to concerns about racial hate crimes, exacerbated by Chinese social media..

Speaking earlier to Skift, Boon Sian Chai, managing director and vice president of international markets at Trip.com Group, said that no matter how alluring outbound travel may be, Chinese travelers prioritize their well-being while making travel decisions.

Another reason given by Bhatt: An apparent preference for flexibility and short-term planning. That means longer holidays and distant destinations are taking a backseat. Destinations catering to last-minute bookings with flexible itineraries could gain popularity, Bhatt said.

“These preferences are increasingly influenced by digital influence, especially through social media and travel apps such as Xiaohongshu (more popular as China’s Instagram) and Douyin (the original version of TikTok),” he said.

Bhatt also expects China to remove visa barriers for more countries. In November, a one-year, visa-free trial for visitors from France, Germany, Italy, the Netherlands Spain and Malaysia was announced. China has also agreed on bilateral visa arrangement with Singapore and Thailand. On Monday, China agreed to provide visa-free entry for Swiss citizens.

What Kept Travelers Away

While travel to Macau, Singapore, UK, the United Arab Emirates, Australia and Hong Kong rose above 50% of 2019 levels, Chinese tourism to several other once-popular destinations remained far below pre-pandemic rates, the survey revealed.

Fears of nuclear contamination following the Fukushima disaster have played a role in dampening Chinese travel to Japan, said Bhatt. While nearly 10 million Chinese visited Japan in 2019, only 3.7 million did in 2023.

Anxiety also suppressed Chinese travel to Thailand last year, but for different reasons. The popularity of Chinese-language movies depicting crime in Southeast Asia was a significant factor in depressing Chinese travel to Thailand and Cambodia. While more than 10 million Chinese visited Thailand in 2019, fewer than 4 million did last year.

More Independent, Digitally-Savvy, Experience-Driven Traveler

The survey also highlighted a new profile of the average Chinese tourist: One who is more independent, digitally savvy and experience-driven.

This traveler, he said, has a penchant for flexibility and a reliance on digital media for inspiration and planning.

According to the survey, about 53% of travelers plan to spend at least 25,000 RMB on their travel, indicating a significant investment into their trips, which means destinations that can offer value and quality experience might be preferred.

“Destinations like Singapore are appealing due to their reputation for safety, cleanliness, and efficiency, particularly to first-time international travelers from China,” Bhatt said.

For China’s Gen-Y and Gen-Z, South Korea is an increasingly popular choice. The popularity of South Korean cultural exports, particularly K-Pop and its movies and TV shows, are a large factor driving younger Chinese interest in traveling there, said Bhatt.

Shift in Gender Dynamics

“The demographic profile of Chinese travelers shows notable changes,” Bhatt said. “While young, urban professionals from Tier 1 cities continue to dominate, female travelers are increasing, highlighting a shift in the gender dynamics of Chinese foreign tourism.”

This development beckons marketers to tailor their strategies to engage this growing segment effectively.

While highlighting that Gen-Y and Gen-Z tourists value eco-friendly, sustainable practices, Bhatt said destinations should also appeal to their desire for adventure and social media-shareable experiences.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: Airline Capacity, asia monthly, china outbound, coronavirus recovery, social media, trip.com group, visa waiver

Photo credit: China Trading Desk’s survey predicts that outbound travel from China will reach 62% of pre-pandemic levels in 2024. tirachardz / Image by tirachardz on Freepik">Freepik