Skift Take

Hopper is under pressure to get profitable, and an IPO may be in its long-range plans. Blowback against some of its fintech products and issues with hotel chains, aren't helping.

After Hopper’s noisy breakups last year with Expedia Group and Booking.com, Hopper has a major hotel chain problem.

If you search the Hopper app for February 2-4 stays in New York City or Chicago, you can scroll screen after screen without seeing a Hilton or Hyatt property.

The first 10 Hopper results in New York City were for Radio Hotel (in the Washington Heights neighborhood, far from midtown); Freehand New York; the Belvedere Hotel; Millennium Downtown New York; Paramount Times Square; Westgate New York Grand Central; LaGuardia Plaza Hotel (in Queens); Hotel 32 32, San Carlos Hotel; and Millennium Premier New York Times Square.

In contrast, if you search Expedia.com for New York City stays on those same dates, there were three Hilton properties and two Marriotts in the top 10.

A similar pattern held for Hopper versus Expedia searches in Chicago for February 2-4.

The Hopper Breakups With Expedia and Booking.com

In July, Expedia stopped supplying hotel inventory to Hopper, and in September Hopper severed its hotel agreement with Booking.com.

That same month, Hopper expanded its relationships with hotel bedbanks HotelBeds and Webbeds, an effort to compensate for the loss of hotel supply. Bedbanks secure wholesale hotel inventory and distribute them to the online and offline travel industry.

One hotel distribution source told Skift that some hotel chains have instructed the two bedbanks not to distribute their inventory to Hopper. HotelBeds and Webbeds declined to comment on the issue, and Hopper didn’t respond to multiple requests for comment.

“Hilton does not have an enterprise agreement with Hopper or provide our hotels’ inventory directly to them,” a Hilton spokesperson said, adding it has never had such an agreement with Hopper.

A Marriott spokesperson said the company had no such block on Hotelbeds or Webbeds distributing its inventory to Hopper. A Hyatt spokesperson declined to comment.

The issue is an important one for any online hotel booking platform, particularly in the U.S., Hopper’s largest market, where hotel chains dominate.

The Impact on Hopper

“If major brands chose to suspend their distribution relationships with Hopper, the most direct impact on Hopper would be an immediate reduction of room supply inventory, which in turn could impact customer loyalty, transaction volumes, and their top line,” said Pranavi Agarwal, a senior analyst at Skift Research. “With relationships with major brands souring, this can also impact Hopper’s negotiations with other key players, having a detrimental knock-on effect, ultimately impacting Hopper’s competitiveness of its offering.”

This is not to say that Hopper does not offer hotels from major chains. In Manhattan, for example, we couldn’t find any Hiltons or Hyatts, but lower in the search results, there were several properties from IHG, Marriott, Wyndham and Best Western. Chicago followed a similar pattern.

Hopper has been establishing direct relationships at the property level — as opposed to the corporate, chain level — with hotels. In September, two months after Expedia terminated its Hopper relationship, Hopper CEO Fred Lalonde stated that 65% of its hotel relationships were direct.

Hotel Distribution Is Complex

An online travel agency such as Hopper has numerous ways of obtaining hotel inventory.

With Expedia and Booking.com gone as sources of hotel inventory, Hopper likely gets inventory for from Hotelbeds, Webbeds, one-on-one relationships it establishes at the property level, global distribution systems and perhaps from other smaller online travel agencies.

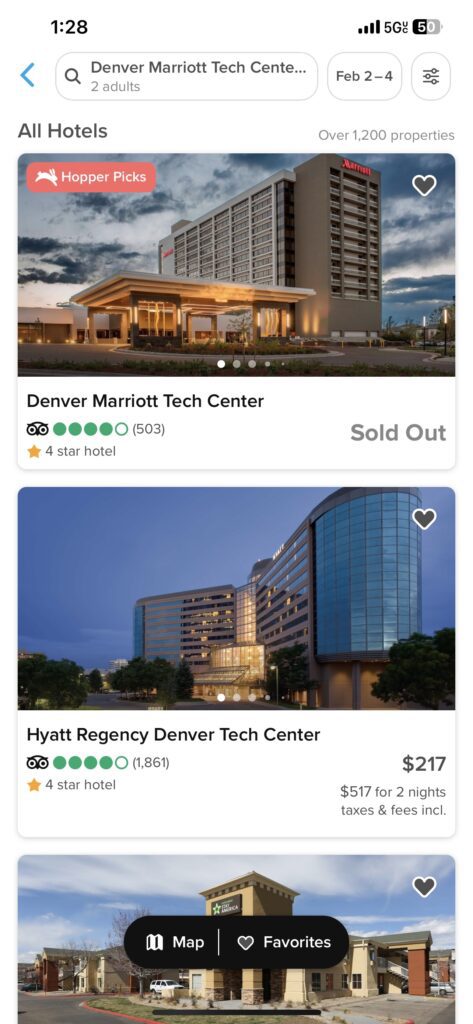

In one example the hotel distribution source noted, a Hopper search for “Marriott Denver” turned up one Marriott marked as ‘Sold Out.’ A few seconds later, it showed up as available with a price.

“What that implies to me is that the price is coming from a very, very, tertiary source of supply,” the hotel distribution source said.

That means that at times Hopper is not accessing a robust supply source, which has real-time availability and accurate prices. It can be a frustrating experience for a customer to try an book a hotel at a certain price, and then find out that it is not available, or perhaps it is available for a higher price than was listed.

Hopper Strategy Change?

Agarwal thinks Hopper’s hotel chain issues may trigger a distribution and marketing strategy change.

“With room inventory reduced to un-branded smaller independent hotels, we may see Hopper reevaluate its distribution strategy, such as begin to list on Google Hotels and other metasearch sites, which is something Hopper, being app-only, has avoided so far,” Agarwal said.

Have a confidential tip for Skift? Get in touch

Tags: best western, booking.com, expedia, hilton, hopper, hotel distribution, hotelbeds, hyatt, ihg, marriott, online travel agencies, otas, WebBeds, wyndham

Photo credit: The Hopper app. Source: Skift