Skift Take

AirDNA is providing a heap of reality to unwitting homebuyers who count on their new vacation rental to instantly covering their mortgage payments. The real numbers may tell a different story.

It’s a tough U.S. real estate market with high mortgage rates and home prices still in the stratosphere. For investors looking to buy a second home as a vacation rental, how can they be sure it won’t be a dud on Airbnb or Vrbo?

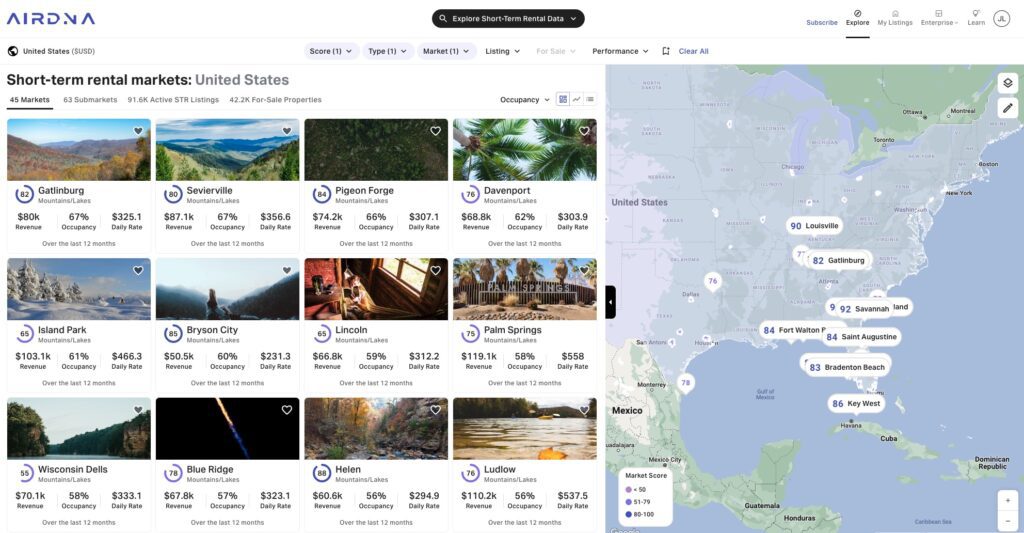

AirDNA, which analyzes short-term rental data scraped from Airbnb and Vrbo, has launched a feature to help with the analysis. Once investors peruse an overview of a short-term rental market, they can view homes that are for sale and AirDNA’s estimates for occupancy, average daily rates, and revenue as a short-term rental property.

Converting a Home Into a Short-Term Rental

For example, you might see a listing for a 5-bedroom, 7-bathroom, 5,300 square-foot home for sale for $2.3 million in Gatlinburg, Tennessee. This particular property did $186,000 in short-term rental revenue over the past 12 months, notched an occupancy rate of 63%, and had an average daily rate of $810, according to AirDNA.

Users can then click on a map and view area comps and take in those metrics for similar properties.

A market overview page details high-level stats, and shows an investment heat map to view comparisons with other markets, and then AirDNA provides investment scores for sub-markets, as well. Users can filter markets via search categories such as urban, suburban, mountain and coastal, for example.

“We get people at the beginning of their journey, looking to find the market that they want to invest in, and we want to keep them within AirDNA for the full length of that journey,” Jamie Lane, AirDNA’s senior vice president and chief economist, told Skift Thursday. “We bring it all into one place to make that whole process easier.”

Lane said competitors provide partial solutions, but none offer this sort of comprehensive market and property-level view.

One potential issue for any company in providing a so-called all-in-one solution is that perhaps competitors might do pieces of it better.

“So we want people to be able to find the market, find the property, and then manage the revenue for that property all within our web app,” Lane said. “The process before was you find your market on AirDNA, then you find your property on Zillow or Redfin or Homes.com. Then you come back to our site to figure out how much you can earn and what comps you should be using. You buy the property and then use one of our competitors to manage the revenues and prices, and you look at forward pacing and all those things.”

Who’s Investing in Vacation Rentals?

Lane said a common use case for prospective buyers using the new feature is “either existing owners of second homes who want to find out what their property could earn as a short-term rental to decide if they want to list it. And then secondarily, people who are looking to buy an investment property, to find where the best place is, and which properties to buy to make that investment in.”

Typical users might own 1-5 homes.

AirDNA announced the launch of the tool this week. It is currently available for homes for sale in the U.S. only. The UK and France would likely be the next countries on tap for expansion, Lane said.

Subscription options for the new tool range from $15 per month to $1,199, depending on the level of data insights provided.

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, airdna, future of lodging, home ownership, online travel newsletter, real estate, redfin, vacation rentals, vrbo, zillow

Photo credit: An exterior view of a vacation rental in the Colorado mountains that was available via property manager and marketer Evolve. Source: Evolve.