Skift Take

While China easing group tour restrictions is a travel industry leap, don't expect a sudden surge of Chinese tourists. The revival might need a little more time to unfold.

China recently announced the easing of restrictions on group tours and would-be travelers immediately started searching for trips. Online travel platform Ctrip reported a 20-fold increase in searches for outbound travel options.

Specifically, there was high interest in trips for the Mid-Autumn Festival and National Day holidays, an eight-day break in late September and early October. There was a significant rise in queries for group travel packages to countries like Japan and Australia, reported Beijing Youth Daily.

Travel demand should also get a boost from an increase in flights between the U.S. and China – the countries have approved doubling the number of passenger flights.

“Within a few days of the announcement, we have already seen new flight connections, policies and business initiatives introduced, and I believe this momentum will only grow stronger. It is a clear signal that the world’s biggest outbound market is coming back,” says Oliver Sedlinger, CEO of tourism marketing consultancy Sedlinger & Associates.

Still, numerous challenges and bottlenecks remain. International flights from China remain at around 50% of pre-pandemic levels. The visa application process is still tangled up. And prices are elevated for many popular tourist destinations after strong demand this summer.

According to Dragon Trail’s summer 2023 survey of outbound Chinese travel agents, the foremost challenges in selling outbound travel are visa-related issues, followed by travel costs.

In 2019, Mainland Chinese tourists embarked on 155 million outbound trips, collectively amounting to $255 billion in travel expenditure. China’s current outbound tourism stands at 40% of pre-Covid levels, according to Steve Saxon, a partner at McKinsey & Company.

Impact of Youth Unemployment on Tourism Recovery

Adding to the challenges is the potential impact of youth unemployment. This week, China ceased the publication of unemployment statistics, which had previously highlighted a surge in the number of unemployed young individuals within the country.

In June, the unemployment rate among urban workers aged 16 to 24 reached a record high of 21.3%.

Michael Jones, co-founder of China Create Consulting, argues that youth unemployment will weigh on the burgeoning Chinese Gen-Z outbound tourism market. Jones suggests that the implications extend beyond young travelers themselves.

“Parents and even grandparents are tightening their budgets due to concerns about financially providing for their children and grandchildren who are facing a challenging employment market,” Jones said.

This cautious approach is exacerbated by the prevailing weakened economy, prompting consumers to be more vigilant about future economic prospects

However, Sienna Parulis Cook, director of marketing and communications for Dragon Trail, noted that this group constitutes a relatively small proportion of outbound travelers. “The driving force behind current outbound travel primarily comes from individuals born in the 1990s and 1980s,” she said.

According to Chinese travel website Mafengwo’s “First Wave Outbound Travel Report” released in April 2023, 57% of Mafengwo users who had already traveled abroad in 2023 were born in the 1990s, with 24% born in the 1980s.

Light at the End of China’s Tourism Tunnel

Despite a cooling Chinese economy, Saxon from McKinsey, said that 40% of Chinese individuals express an intention to increase their travel spending (compared to 15% who plan to reduce it).

Saxon notes, “People want to spend the money they’ve saved during Covid on international travel.” McKinsey’s May report states that Chinese consumers remain eager to invest in travel, and travel expenditure is expected to demonstrate resilience.

The wealthier segment and older age groups (ages 45-65) exhibit the most robustness in terms of travel spending. Approximately 45 to 50% of travelers in these groups plan to spend more on their upcoming leisure trips.

Quoting its tourist attitude survey, McKinsey points out that 87% of respondents affirm their intention to increase or maintain their level of travel spending.

Overseas destinations and hotels that Dragon Trail has engaged with this year report that Chinese travelers in 2023 are extending their stays and spending more than before. Cook affirms, “There are certainly travelers who have been eagerly awaiting the opportunity to travel abroad again and are willing to invest more to obtain the experience they’ve been longing for.”

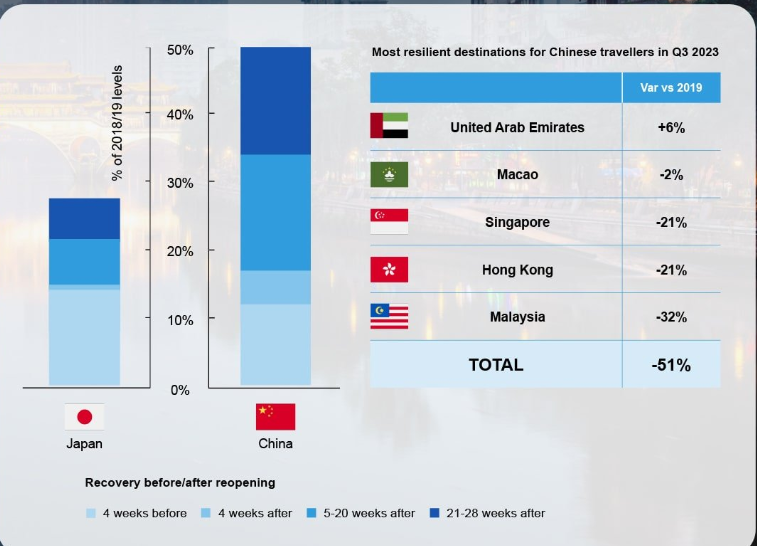

Cook highlights the success of UAE’s visa-free travel approach. Recent data from travel analytics firm ForwardKeys reveals that UAE’s Chinese arrivals in 2023 are 6% ahead of the numbers from 2019.

Moreover, the Philippines plans to introduce e-visas for Chinese citizens from August 24, aiming to address visa-related challenges.

Cook identifies destinations poised to benefit from the lifting of restrictions, including Japan, South Korea, European countries, Morocco, and Tunisia.

And for those big on timelines, Saxon says, “We would expect to see 2024 recovered to 2019 levels overall, but there may be some variations by country.”

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: asia monthly, china outbound, china travel, coronavirus recovery, ctrip, mckinsey and company, outbound tourism, travel restrictions, visa waiver

Photo credit: Chinese tourists in Budapest. zoetnet / Flickr