Skift Take

The major hotels and OTA companies reported strong earnings this month, signaling robust travel demand despite economic uncertainties. The companies most skewed to Asia now offer the greatest potential for growth and share price gains.

Many of the major hotels and online travel agencies have reported financial results for the first half of the year. The common message: Demand for travel remains robust, even as there is worry about an uncertain global economy and recession fears.

While the U.S. led the global travel recovery coming out of the pandemic, the strength in global demand has now shifted to Europe and Asia. In Europe, increasing demand for international travel from U.S. travelers continues to allow expanding prices, while Asia benefits from a surge in demand from the first waves of unrestricted travel in the region.

Asia, which for so long was the laggard in the global recovery, is now posting the strongest year-on-year performance of any region. It’s largely following a similar playbook to what we saw in the U.S. and Europe – where excess consumer savings and huge pent-up demand saw a surge in bookings and prices, particularly for leisure focused luxury resorts.

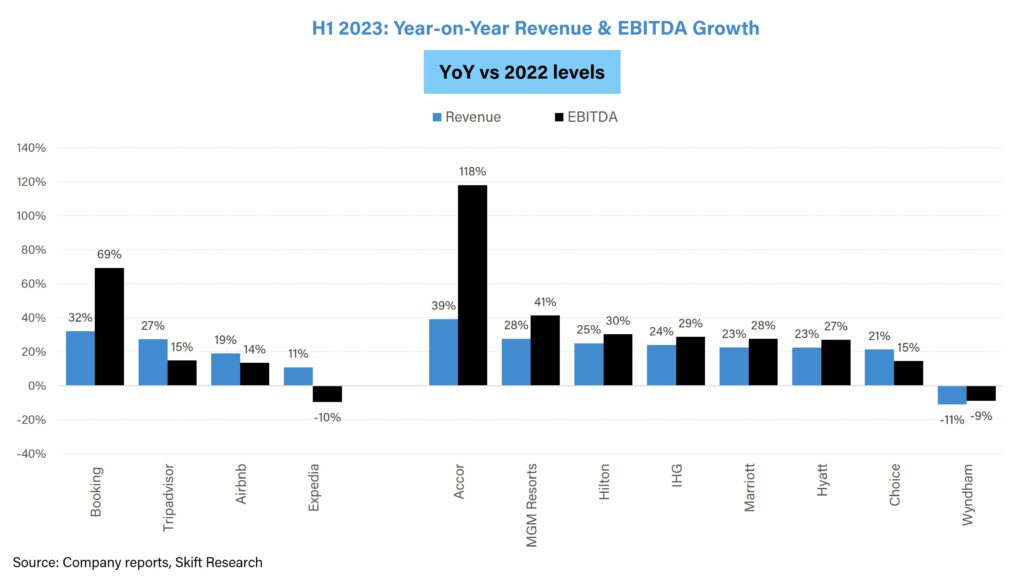

Companies originally hurt by exposure to Asia are now reaping the rewards. Accor (which derives about a third of its revenue from Asia and nearly half from Europe) is outperforming all other major hotels and OTA companies – posting nearly 40% revenue growth and 120% EBITDA growth in the first half of 2023, as seen in the chart below.

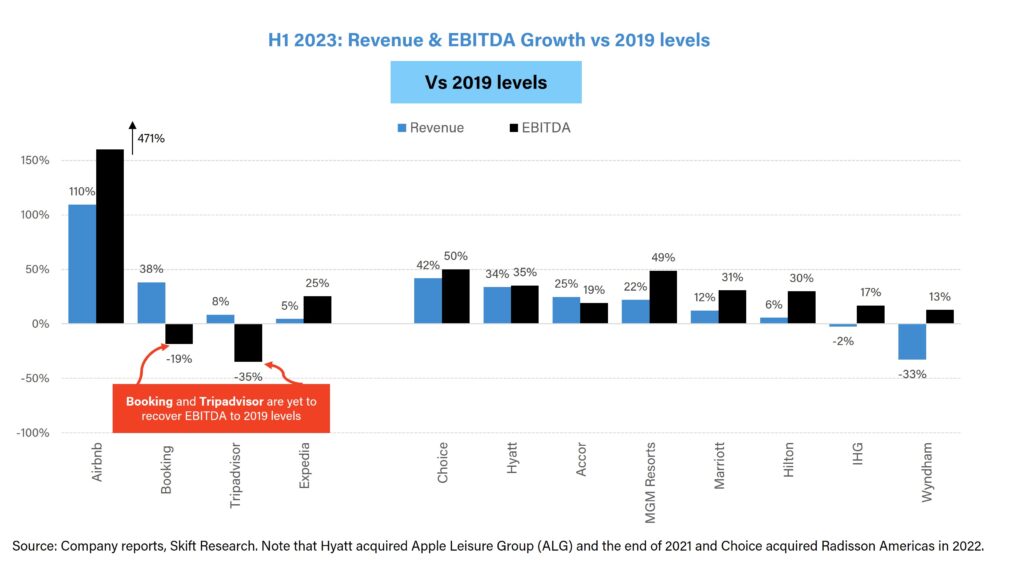

Since 2019, the majority of the major hotel groups have grown both their top and bottom lines by double digits. Increased operational efficiencies through the pandemic are seen in expanding EBITDA margins at Hilton and Marriott in particular over the past four years.

The OTAs too have grown their top line materially versus pre-pandemic levels, with Booking Holdings growing its revenue near 40% in the first half of 2023 vs the first half of 2019.

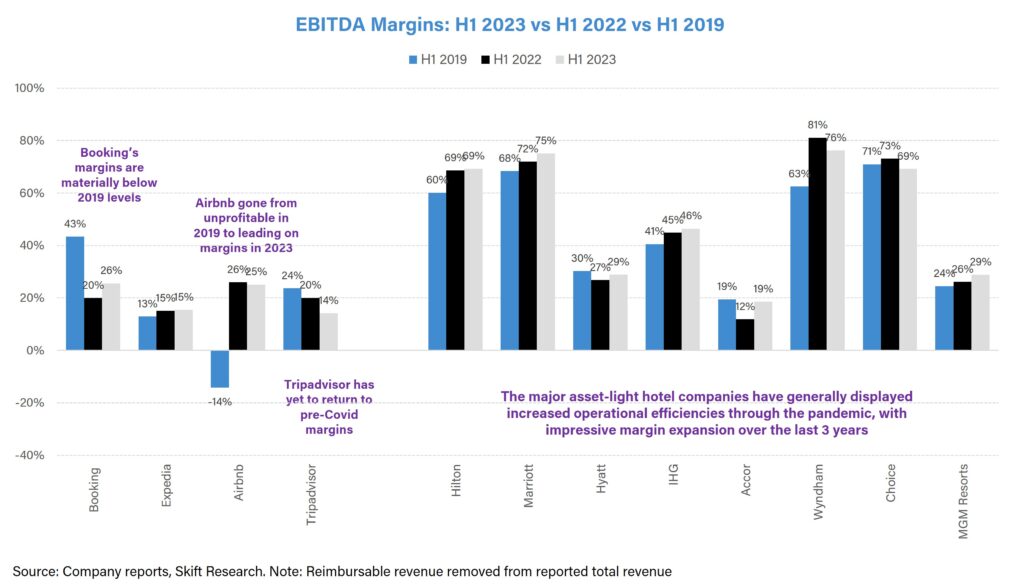

However as a reflection of the increasing competitiveness of the online travel landscape, Booking’s EBITDA is still 20% below 2019 levels, with margins dropping from 43% in the first half of 2019 to just 26% in the first half of 2023, largely due to Booking’s expansion into the U.S. market through low-margin segments such as flights and the development of its connected trips vision through the lower take-rate generating merchant model.

Expedia, being less exposed to the high pricing growth in Europe and the rapid recovery in Asia grew its top line less than its closest competitor Booking, with the majority of its revenue growth stemming from its B2B business rather than a growth in gross bookings in the first half of 2023. However unlike Booking, Expedia has expanded its EBITDA margins since 2019, largely due to stricter cost-cutting practices.

Airbnb has grown its top line versus 2019 levels more than any company, largely aided by the surge in demand for short-term rentals through the pandemic. However, more impressive is its near 500% growth in EBITDA, with the company going from being unprofitable in the first half of 2019 to leading its OTA peers on EBITDA margin in the first half of 2023.

Tripadvisor, like Booking, also had EBITDA below 2019 levels in the first half of 2023. Though its top line is aided by its rapidly expanding tours and activities (Viator) brand, Viator is still unprofitable and its core metasearch business continues to struggle against its main competitor Google.

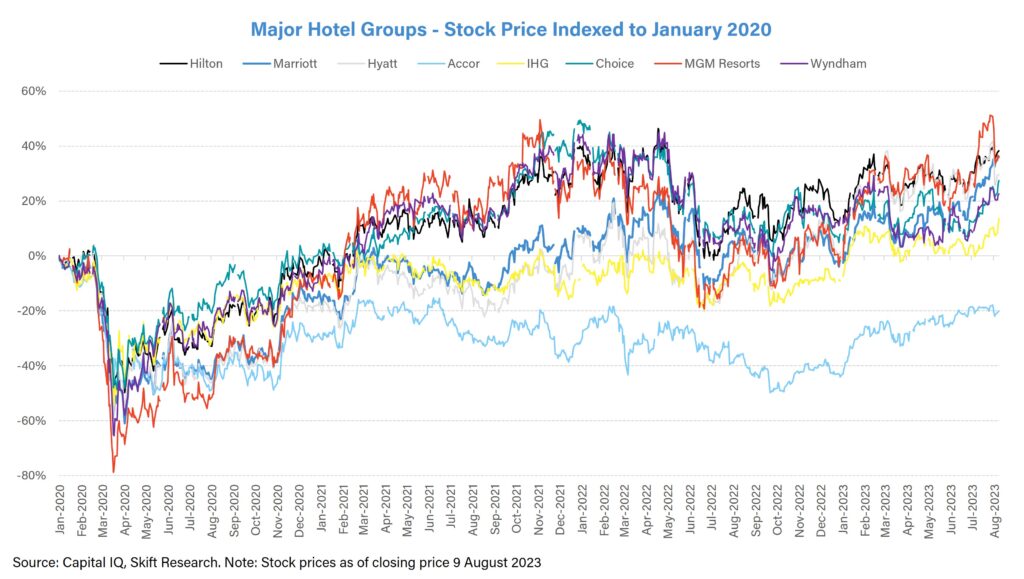

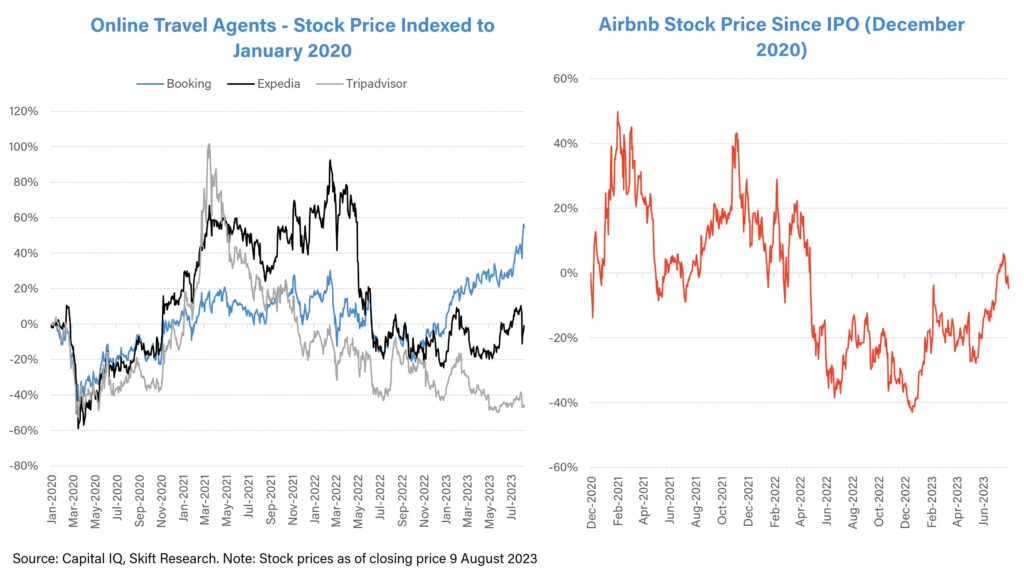

Share Price Performance

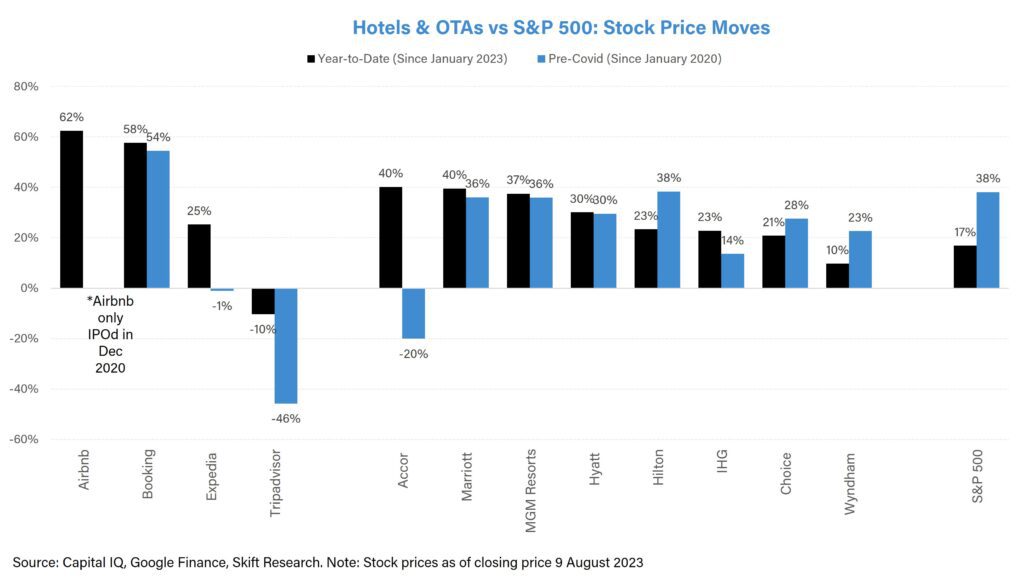

Despite the cautionary headlines depicting dark clouds of macro-economic challenges stifling consumer discretionary spending and pent-up demand for travel fading, nearly all of the major hotel and OTA companies have outperformed the S&P 500 since the start of the year, as shown in the chart below.

In line with financial reporting, the companies most skewed to the opportunistic areas of the global recovery such as Asia have seen the greatest gains in share price – such as Accor, Hyatt and Booking. Accor’s share price is still 20% below pre-Covid levels and offers a rare re-opening trade for investors, with its skew to non-U.S. regions expected to see further re-rating in 2023 and 2024.

Interestingly, companies like Hilton and Marriott, which saw a surge in share price on the back of the U.S. based recovery in 2021, have also risen 20-40% since the start of the year, despite flattening growth in its main U.S. market – going to show that even the most recovered travel stocks can ride the rising tide which lifts all boats.

Pranavi Agarwal is a senior research analyst at Skift Research. Subscribe to Skift Research to read more of her analysis.

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch

Tags: accor, airbnb, booking holdings, choice hotels, earnings, expedia, hilton, hotel prices, hotels, hyatt, ihg, marriott, mgm resorts, otas, recession, revenue, share price, Summer Travel Demand, tripadvisor, U.S. travel demand, wyndham

Photo credit: Tourists around Paris’ Basilica of Sacré Coeur de Montmartre. Skift