Skift Take

Save Now, Buy Later may contribute more to traveler well-being than having to worry about the bills later from a trip that you really couldn't afford. Anyway, it's a novel way in travel to market vacations.

Trendy Buy Now, Pay Later offerings often mean travelers pile up debt and pay high interest rates to fund their vacations, but online travel agency CheapOair began promoting savings accounts with cash rewards as an alternative.

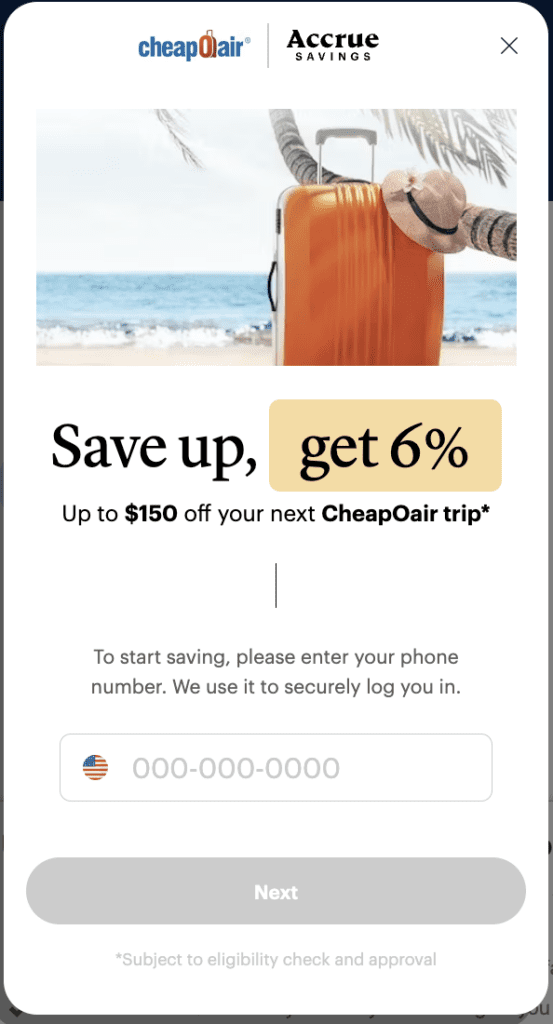

In a partnership with fintech company Accrue Savings, CheapOair is promoting a Save Now, Buy Later program that enables travelers to open savings accounts to be used to buy trips on the platform, and to receive up to 6% in cash rewards as an incentive.

There is no cost for travelers to open these accounts, which are back by FDIC-member Blue Ridge Bank. To take advantage of the cash rewards, travelers would have to use the co-branded debit cards on CheapOair travel. If they don’t want to buy trips on CheapOair, they can withdraw their funds without penalty, although they wouldn’t be able to take the cash rewards with them, the companies said.

Accrue, which offers such plans in other types of businesses, said CheapOair is its first travel partner.

Andrew Stein, vice president of partnerships at CheapOair parent Fareportal, said the Accrue savings partnership is not geared to replace its Buy Now, Pay Later Affirm partnership, which it implemented around five years ago. Instead the Accrue deal is a marketing opportunity and a chance to engage further with travelers.

Michael Hershfield, Accrue founder and CEO, said Save Now, Buy Later enables CheapOair to engage with travelers earlier in the trip-planning cycle, and to win over customers who may be debt-averse.

He added that CheapOair site visitors may see promos for the savings plan if they abandon their shopping carts — input trip details and leave the site before booking — or potentially after other trips.

“Our partnership with Accrue revolutionizes the way Americans save for travel, making it a more inclusive and enjoyable experience,” Stein said in a statement. “Now our travelers have an opportunity to save up to embark on their dream adventures without compromising their budget.”

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: bnpl, cheapoair, fareportal, fintech, marketing

Photo credit: CheapOair launched vacation savings accounts. Source: Accrue/Shutterstock