Skift Take

Guess who's back, back again? It's "Eastward Ho!" for global travelers, as the latest Skyscanner data makes clear.

Travelers are gaining more confidence to book long-haul travel again, and many destinations in the Asia Pacific region are making a comeback. Tokyo’s neon lights and skyscrapers, Phuket’s pristine beaches, and Hanoi’s Old Quarter, with its maze of narrow streets, are among the hotspots.

A report from travel marketplace Skyscanner has looked at flight search and booking data from the Americas, Asia Pacific, Europe, the Middle East, and Africa — studying how travelers are planning and booking travel over the next six months.

People are booking long-haul travel more than 90 days in advance, returning back to pre-pandemic levels. Moreover, the report also stated that search share has reverted to pre-pandemic seasonal norms.

“Globally, we’re seeing more travelers come to Skyscanner than ever before,” said Mike Ferguson, director of destination marketing. The brand, owned by Trip.com Group, has more than 100 million travelers accessing its platform every month on average.

More Signs of Flexible Search Patterns

More than 50 percent of travelers are conducting exploratory searches without any set dates or destinations in mind, Skyscanner said. Many travelers are searching for ideas and comparing dates and locations to find the most favorable deal.

In a conversation earlier with Skift, Airbnb co-founder and CEO Brian Chesky pointed out how millions of customers have used the platform’s flexible date feature, which basically says, “I am willing to go anywhere for a night, a weekend, a week, a month in this date range.”

A Resurgence of Long-Haul Travel

The resurgence of long-haul travel globally presents destinations with a significant opportunity to attract high-value travelers undeterred by the challenging economic conditions, said Nick Hall, CEO of UK-based Digital Tourism Think Tank.

A key driver has been that airlines are adding back flight capacity.

Asia Pacific airlines posted a 376 percent increase in international traffic in January compared to the same period last year reaching 56 percent of January 2019’s level, as witnessed by the International Air Transport Association (IATA).

The January numbers were by far the strongest year-over-year rate among the regions — albeit off a very low base, when much of the region was still closed to travel.

Capacity in the region rose to 167 percent, and the load factor increased 36.6 percentage points to 83 percent — the highest among the world’s regions.

Trending Destinations

Eight of the world’s top 10 trending destinations for travelers worldwide are in Asia, with Taiwan topping the charts, followed by Japan and Laos.

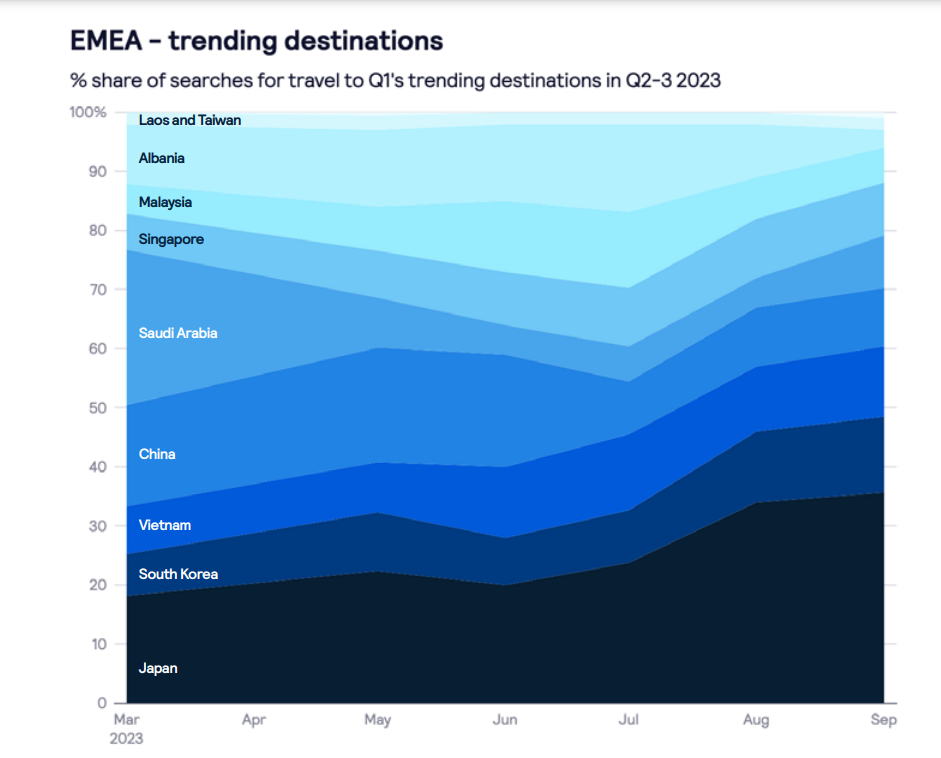

Despite Taiwan being the top trending destination, its relative share of searches is small. Japan takes the largest share, followed by South Korea and Vietnam.

Skyscanner noted that all three countries have benefited from improved non-stop services and air connections.

Saudi Arabia and Albania are the two nations outside Asia with the biggest increase in searches from last year during the first quarter.

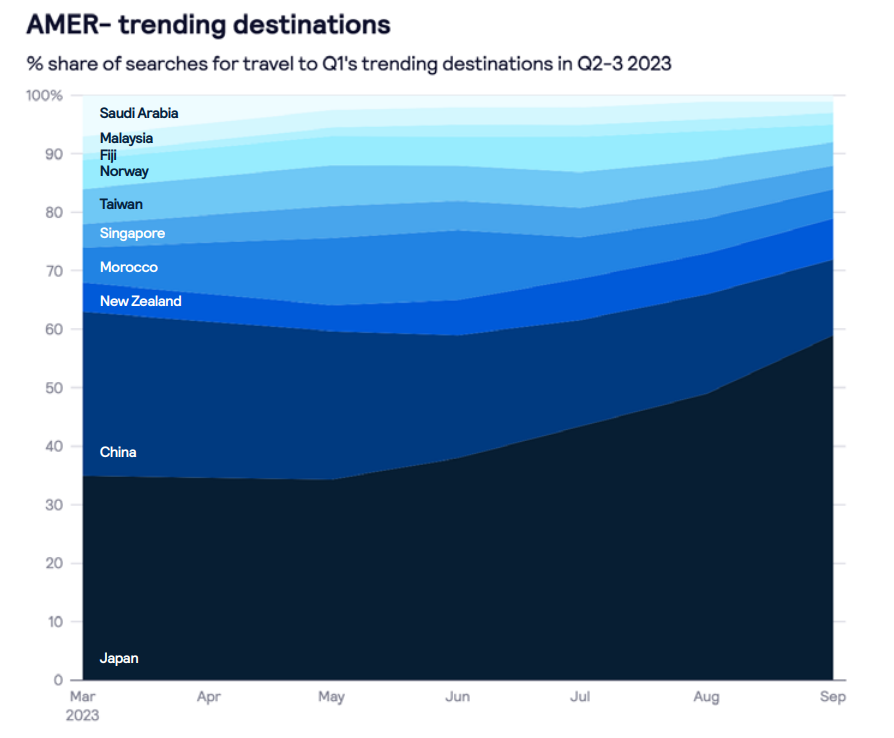

Although Europe remains a popular region for travelers from the Americas, Asia Pacific destinations dominate seven out of the top 10 trending spots, with Asian countries occupying the top five spots.

China is the top trending destination, followed by Japan and Taiwan.

For Asia Pacific travelers, seven out of the top 10 trending destinations are within the region itself, as Taiwan, Laos, and Japan experienced the most significant year-on-year growth in the first quarter.

Laos, in particular, enjoyed a resurgence due to the introduction of new routes from international and regional airlines and an increasing demand from travelers for more unique and off-the-beaten-path destinations.

During the second and third quarters, Japan, Thailand, and Vietnam are the most popular destinations among travelers, accounting for more than two-thirds of the trending search volumes.

Booking Windows Go Up

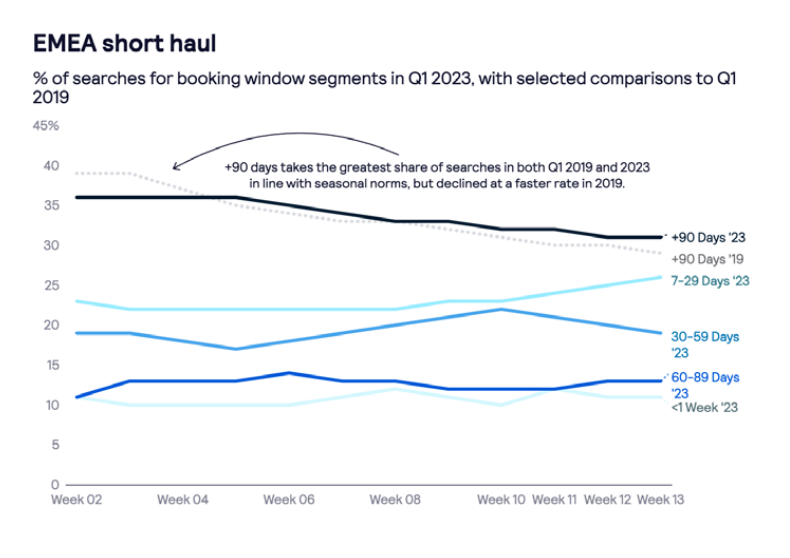

Travelers in Europe, the Middle East, and Africa are booking flights for summer holidays two to three months in advance, while those from Asia Pacific are booking both last minute and much further in advance, the report noted.

In the first quarter of this year, domestic travel bookings within Europe, the Middle East, and Africa were mostly booked in the 7-29 day window. The booking window further went up while planning for summer vacations as holidays booked 60-89 days in advance went up by 50 percent.

At the end of the first quarter, a booking window of more than 90 days still holds the highest share (31 percent) for travel to short-haul destinations from Europe, Middle East, and Africa.

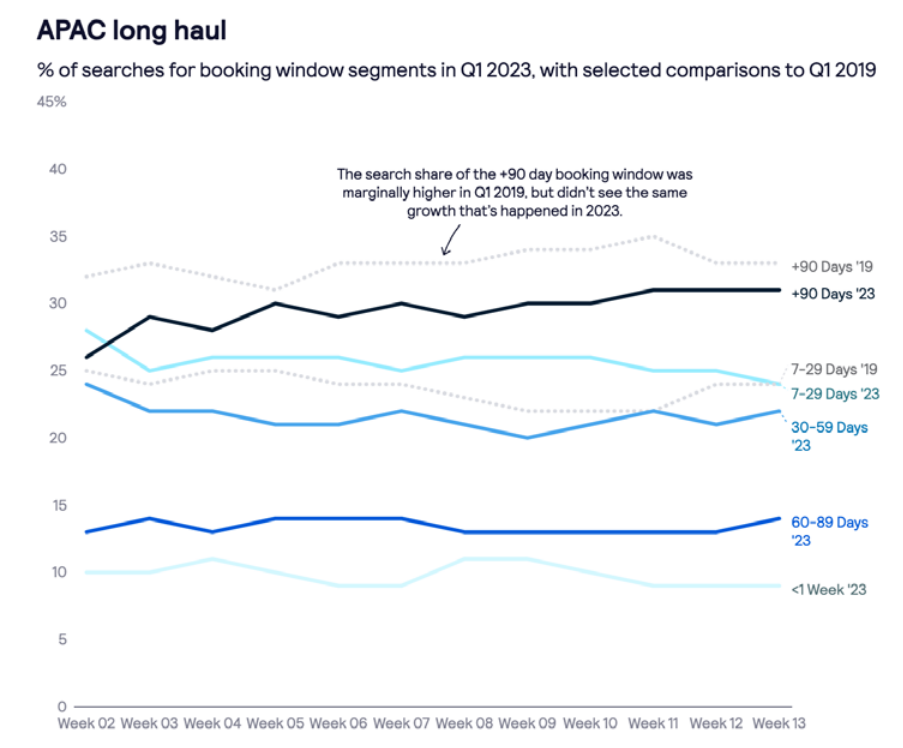

This confidence is also reflected in booking long-haul travel, particularly to Asia-Pacific, as the share of booking windows of over 90 days increased by 11 percent in the first quarter to reach 40 percent.

The travel booking time frame for Asia Pacific remained fairly consistent during the first quarter as travelers preferred shorter booking periods for domestic travel.

However, with the easing of travel restrictions ease, people are booking both last minute and with a longer booking horizon.

The Skyscanner report said that booking windows of over 90 days witnessed an increase of 55 percent for short-haul travel, while bookings of less than a week increased by 22 percent.

And as Asia Pacific travelers become more confident about traveling long-haul and planning, booking windows for long-haul trips have seen significant increases.

For the Americas, booking windows are returning to seasonal norms as travelers plan their domestic and short-haul trips at least two months out.

For more insights, look for Skift Research’s Travel Tracker to release updated results on Tuesday.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: asia monthly, asia pacific, asian travelers, booking windows, coronavirus recovery, iata, middle east, skyscanner, survey data, trip.com

Photo credit: Asia-Pacific destinations feature prominently in travel searches, according to Skyscanner’s latest report. tawatchai07 / Freepik