Skift Take

Three years on from the global pandemic, clearly, the travel sector in the Middle East has transformed. The region didn't let the Covid crisis go to waste.

The Middle East region is expected to outpace all other travel markets in its rate of recovery for travel demand in the April-June quarter, according to India-headquartered travel technology firm Rategain.

Rategain’s latest Pulse report estimates that international arrivals in the region will be 15 percent higher this summer than the all-time high figures of 2019.

The travel tech firm said the region’s capacity to be adaptable and innovative in response to changing circumstances significantly influenced its recovery.

The United Arab Emirates (UAE) is among the countries that have demonstrated a rapid response in adjusting their policies. Notably, the UAE has taken important strides in developing its tourism industry, including allowing Russian tourists affected by sanctions to visit the country and signing the Abraham Accord in September 2020, which led to the opening of borders between the UAE and Israel.

Russia went on to become the second largest tourism source market for Dubai in January. Registering a 63 percent increase over 2022, 115,000 Russians visited Dubai for tourism. Israel is currently Dubai’s fastest growing tourism source market. Around 85,000 Israelis have already visited the emirate in the first two months of the year.

Turkey has also demonstrated a flexible approach in welcoming Russian tourists to its shores. In the first two months of 2023, over 500,000 Russians visited Turkey, representing an increase of more than 100 percent compared to the same period last year when Turkey received 246,000 Russian visitors.

This surge in Russian tourism accounted for 13 percent of all foreign tourist arrivals in Turkey during the first two months of this year.

A policy shift across the Middle East over the last few years has helped it emerge as a hub of activity, becoming a key driver of travel in the post-pandemic world, Bhanu Chopra, Rategain’s founder, told Skift.

Business Travel Spending

Using data from its recently-acquired travel intent data platform Adara, Rategain’s report highlights how business travel to the Middle East and Africa region continues to soar.

“In the upcoming quarter, we estimate that the Middle East and Africa region will maintain its growth pattern and exceed business travel spending levels seen before the pandemic,” the report noted.

Rategain said the growth is apparent from the increased flight prices to Dubai from Asia-Pacific and the relatively higher average daily rate for hotel bookings in Egypt and Saudi Arabia compared to the previous year, driven by the demand during Ramadan.

Business travel in the Middle East and Africa is recovering more rapidly than in any other region, according to the Global Business Travel Association’s most recent Business Travel Index.

Business travel in the region achieved 86 percent of its 2019 levels during 2022, outperforming the recovery in Americas, Asia Pacific and Europe, as per the business travel association’s index, although from a smaller base.

According to the forecast, business travel spending reached $933 billion globally in 2022, with the Middle East and Africa region accounting for $23 billion or approximately 2.5 percent of overall spending within the sector.

Turkey’s Tourism Rise

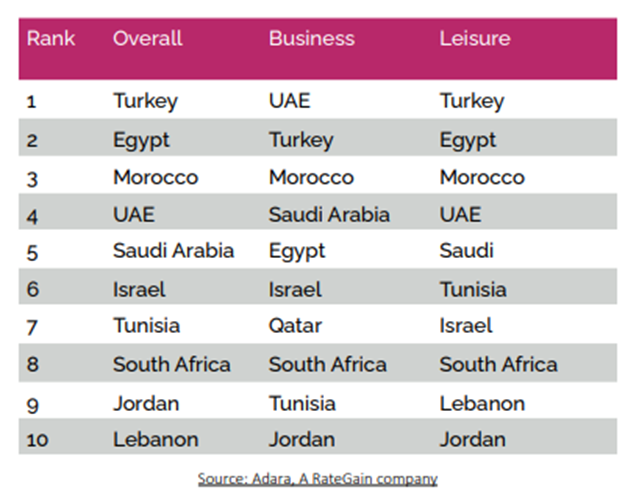

Having received the most bookings for the next quarter, Turkey emerged as the top leisure destination, while United Arab Emirates tops the list for business arrivals.

Way ahead of the global travel recovery, foreign arrivals in Turkey for the April-June quarter are expected to be 40–50 percent above the same period last year, the report noted.

In the April-June quarter last year, Turkey had received 11.9 million tourists.

Turkey’s tourism revenue rose 32 percent year-over-year to $8.69 billion in the first three months of the year, according to the Turkish Statistical Institute.

With 44.5 million tourists visiting the country in 2022, Turkey’s tourism revenues reached a new all-time high of almost $46.3 billion, representing a 53 percent increase from 2021. In 2019, the country’s tourism revenue stood at $34.5 billion even as it welcomed 45.1 million tourists.

Even as this the revenue jump was reflective of post pandemic recovery, Turkey’s tourism surge was also attributed to the influx of Russian arrivals, driven by the Ukraine war fallout and sanctions imposed by Western nations on Russia.

Rategain in its report noted that demand for leisure travel is being driven by travelers from the U.S. and Europe, while business travel demand in the region comes from the Asia Pacific region.

Travelers from the U.S. have been keen on their travel intent as 25-30 percent of searches for hotel bookings in the region originate from the U.S, according to the report.

“While United Arab Emirates and Turkey have been the jewels of the travel industry in the Middle East, we are now seeing new players emerge,” Chopra said.

These destinations have a lot to offer and also help create a healthy competition among destinations across Asia, which in turn helps the travel industry grow more rapidly in the region, Chopra added.

Price and Proximity

The price and proximity of travel destinations from key demand regions have also been significant factors to steer the recovery in the market, Rategain observed in its report.

As the Western region contends with inflationary concerns, the Middle East region has emerged as a profitable market for travel expenses, the report noted.

With the pandemic bringing about a shift in people’s travel preferences, the report noted an increase in group, family and couple vacations with a rise in planned advance bookings and shorter vacations becoming popular.

With travelers now viewing travel as a means of investing in themselves and are being more conscientious about their choices, the report noted that travel organizations need to quickly comprehend and respond to this demand for personalized, independent, and safe travel.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: adara, asia monthly, business travel, coronavirus recovery, gbta, middle east newsletter, RateGain, turkey, uae

Photo credit: Turkey has emerged as the top leisure destination for the upcoming quarter, according to Rategain's Pulse report. Seqoya / Getty