How Russia's War on Ukraine Changed Travel One Year Later

Skift Take

Friday marks the one-year anniversary of the start of the Russian invasion of Ukraine, a cataclysmic act that has significantly impacted travel worldwide. In just 12 months, 19 million refugees have crossed the border out of Ukraine, 7,200 innocent civilians have been killed, including 438 children, and countless lives are still being put at risk day and night by a war that shows no signs of ending.

That is how all of us try to put the tragedy into perspective. Still, our job is to report on the travel industry and how this war has upended business.

Major travel brands in all sectors of the industry have been disrupted. Skift has thoroughly covered the impact of the war on the travel industry, including changes travel brands have had to make in response to the invasion as well as how it has impeded travel's ongoing recovery from the pandemic. Here is a look at major changes in travel brought about by the war.

Airlines Faced Surging Fuel Costs

The airline industry was perhaps the first sector of travel to feel immediate effects of the war. Still largely yet to make a complete recovery from the pandemic, airlines had to quickly encounter surging fuel prices. Ryanair CEO Michael O'Leary predicted the 12 months after the invasion would be difficult for most airlines in large part because of the jump in oil prices. Some carriers either introduced or raised fuel surcharges, which airlines typically pass onto customers in the form of higher airfares.

Russia's Travel Industry Hasn't Recovered

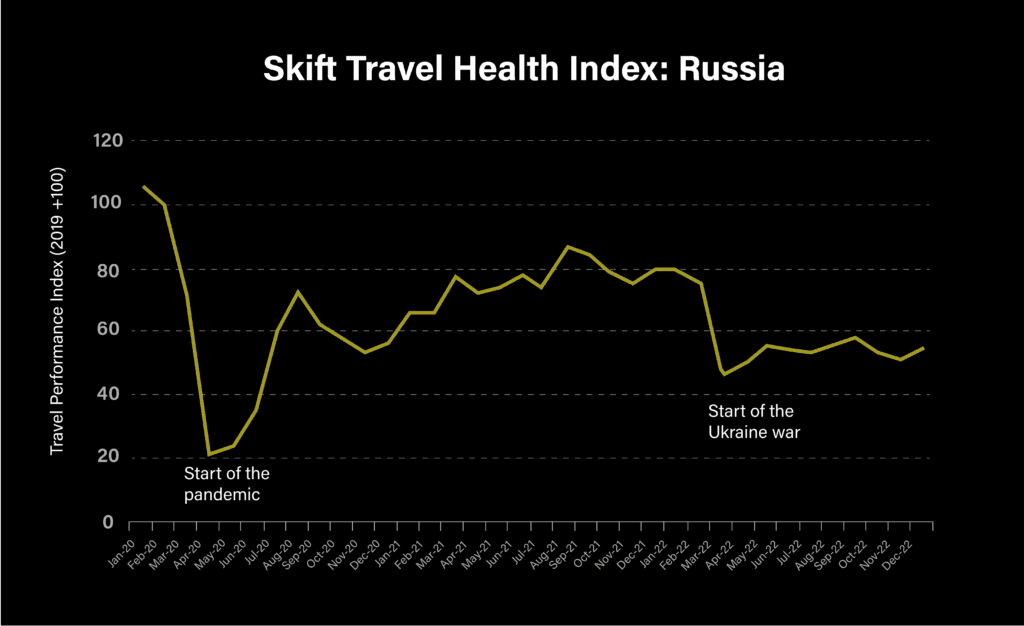

Russian travelers spent $36 billion on international travel and took more than 40 million overseas trips in 2019, making the country one of the world's largest outbound markets. The Russian travel industry had initially been one of the strongest performers according to the according to the Travel Health Index launched by Skift Research, which measures the performance of the global travel industry compared to pre-pandemic levels.

But moves by U.S., Canada, and nations across Europe to close their airspace to Russian planes have pummeled Russia's travel performance as calculated by Skift Research. Russia's score in the Skift Travel Health Index, which reveals the extent of its recovery from the pandemic, decreased roughly 28 points from February 2022 to the following month. The country's December 2022 performance trailed its score from the same month in 2020.

The War Drove Major Travel Brands to Retreat From Russia

Many major Western travel companies announced shortly after Russia invading Ukraine that they were pulling business out of Russia. Travel industry heavyweights like Airbnb, Booking Holdings and Marriott were among the corporations to announce they were pulling operations out of Russia. In addition, several tour operators committed to cancelling trips to Russia for the rest of 2022.

However, some prominent global brands are still doing business in Russia, including Accor. CEO Sebastien Bazin said during last year's Skift Forum Europe that the Paris-based hotel company has never stopped operating in a war-torn country in its history. Bazin added that issues pertaining profitability didn't drive Accor's decision, noting that Russia has been far from a lucrative market from the company. Meanwhile, despite blocking advertising from Russian companies, Google Travel is still listing information about hotels in Russia provided by advertisers from outside of the country.

Skift published this list in March 2022 documenting companies that had announced they were curtailing business from Russia.

| Company | Action |

|---|---|

| Accor | suspended future investments; 55 hotels owned by third parties are still open |

| AerCap | suspended aircraft leasing |

| Airbnb | suspended bookings |

| Airbus | suspended parts and service |

| Alaska Airlines | suspended partnerships |

| Alphabet/Google Travel | turned off Russia advertisers, but has some ads for Russian listings |

| Amadeus IT | suspended Aeroflot bookings but maintains passenger service systems |

| American Airlines | suspended flights over Russian airspace |

| American Express | suspended operations; cards issued by Russian banks won't supported by the Amex network |

| Blacklane | suspended relationships with all Russian-based corporations and travel agencies, including their global subsidiaries |

| Boeing | suspended parts, service, technical support, and titanium purchases |

| Bombardier | restricting new business deals |

| Booking Holdings | suspended operations |

| Carnival | discontinued Russia itineraries |

| Cloudbeds | suspended operations including services to partners and customers who operate in Russia |

| Delta | suspended Aeroflot partnership |

| eDreams Odigeo | suspended its Russia website and removed Russia from its inventory |

| Expedia | suspended sale of travel into and out of Russia |

| GetYourGuide | suspended bookings |

| G Adventures | suspended tours and won't accept bookings from Russian agencies |

| Hilton | suspended new investments; still runs 26 hotels |

| HRS | suspended services in Russia |

| Hyatt | suspended investments and new developments |

| IHG | closed office; suspended future investments; hotels owned by third parties are still open |

| Intrepid Travel | suspended operations in Russia but is still selling for 2023 |

| Kensington Tours | suspended bookings for 2022 |

| Korean Air Lines | no flying over Russian airspace, despite not being subject to Russian airspace ban |

| Marriott | closed office; suspended future investments; 28 hotels owned by third parties are still open |

| Mastercard | cards issued by Russian banks won't be supported by the Mastercard network |

| Norwegian Cruise Lines | discontinued Russia itineraries |

| Regent Seven Seas Cruises | discontinued Russia itineraries |

| Reed & Mackay | has been working with clients that have offices in Russia on evacuations/ repatriations. Presence in Russia was managed through a partnership agreement, which it is now winding down |

| Rick Steves | suspended tours |

| Sabre | suspended Aeroflot bookings but maintains passenger service systems |

| Skyscanner (owned by Trip.com) | turned off Russian content and withdrawn Skyscanner’s transactional platform |

| SmarTours | canceled Russia itineraries |

| Tauck | suspended 2022 tours of Russia and stops in Russia |

| Travelport | suspended Aeroflot bookings |

| The Travel Corporation | suspended 2022 tours of Russia and stops in Russia |

| TripActions | no longer supporting travel to Russia; Tripactions Liquid card stopped for Russia transactions |

| Tripadvisor/Viator | removed "Kremlin-linked propaganda" and Russia ads |

| TUI Group's Musement and GoTui.com | suspended sales of activities to do in Russia |

| Uber | removed "Kremlin-linked propaganda" and Russia ads |

| United Airlines | no flying over Russian airspace |

| Visa | credit cards issued by Russian banks won't supported by the Visa network |

Russian Travelers Forced to Move on From Long-Time Popular Destinations

Countries like Estonia, Latvia and Finland that long relied on Russian travelers took steps to restrict visitors from one of their top source markets. Estonia banned entry to Russian citizens who had previously issued tourist visas while Latvia stopped granting its own tourist visas to Russian travelers. Meanwhile, Finland limited the number of tourist visas it issued to Russian citizens. Skift Global Tourism Reporter Dawit Habtemariam writes those measures were part of a collective strategy to exert pressure on Russia's government to end the invasion of Ukraine. In addition, Poland barred Russian tourists from entering the country.

The war also accelerated Cyprus' plans to diversify its tourism base as the Mediterranean island nation banned flights from Russia. Cypriot Deputy Tourism estimated Savvas Perdios estimated the Russian and Ukrainian markets had represented roughly 22 percent of his country's tourist arrivals, a figure he said went down to zero.

However, Thailand, the Maldives and Dubai have welcomed Russian visitors. The resumption of direct flights from Russia to Thailand sparked a nearly sevenfold increase in Russian visitors from September to November last year, and Thai authorities expect more than 1 million Russian travelers to visit in 2023.

And Dubai and Maldives have grown in popularity for Russian travelers, with Russia serving as among the top source market for both destinations. One Russian national living in the United Arab Emirates said the country was one of the few nations were Russians could travel without difficulty.

Companies and Destinations Hit Hard by the Absence of Russian Travelers

Aleksander Karpetsky, CEO of Dominicana Pro, a Dominican Republic-based tour operator specializing in trips for Russian and Ukrainian travelers, said the lack of visitors from his company's markets had left his workers unemployed. Meanwhile, Vietnam's travel industry and economy took a major hit after the state-owned Vietnam Airlines suspended flights to and from Russia shortly after the start of the war. Less than 40,000 Russians traveled to Vietnam in 2022, a nearly 94 percent drop from roughly 650,000 in 2019. In addition, Russian travelers typically spend more than visitors from other countries, according to data gathered from the Vietnam National Administration of Tourism.

Turkey Becomes Business Travel Hub for Displaced Russian Corporations

Turkey's decision not to issue sanctions against Russia drove a large number of Russian companies to set up shop in the country. Close to 1,400 Russian business opened offices in 2022, more than any other nation. Corporate Travel Editor Matthew Parsons wrote that Russian corporations view Turkey as a neutral trading location because the country enables them to trade with firms prohibited from engaging directly with Russia, especially U.S. businesses. Hundreds of U.S. corporations set up in Turkey after closing their Russian operations.

The number of flights between the two countries has also increased in recent years. Flights from Russia to Turkey rose 45 percent in 2022 compared to the previous year. And Turkish Airlines is upping the number of seats to and from Russia for the upcoming April-to-June quarter 55 percent from 2019 levels.

Foreign Visitation to Ukraine Rendered Impossible

Although domestic tourism has started to rebound, reaching up to 50 percent of pre-invasion levels, the State Agency for Tourism Development of Ukraine is still urging foreign travelers not to visit the country until the end of the war because it can't guarantee their safety.

Mariana Oleskiv, chairperson of the State Agency for Tourism Development of Ukraine, is adamant though that Ukraine will be successful in its efforts to rebuild its tourism industry. She delivered an emotional speech on the subject at Skift Global Forum in New York last September, explaining why she's hopeful about a brighter tourism future for Ukraine. Oleskiv cited Ukraine's plans to use Crimea, a region currently occupied by Russia, as a destination that could spark Ukraine’s tourism recover.

Russia Looks to Fill Tourism Void With Indian Travelers

Seeking ways to rebound from the enormous tourism hit, Russian tourism authorities turned their focus to wooing visitors from what Moscow perceived as friendly nations — one of them being India. Russia increased their efforts to attract Indian tourists, sending officials to events in India such the Outbound Travel Mart in Mumbai in September. Russian President Vladimir Putin had also proposed visa-free travel between the two countries.

Corporate Travel Agency Relationships Made Complicated

Not only did corporate travel agencies have to conduct emergency repatriations of staff based in Ukraine, they had the thorny issue of how to handle relationships with Russian partners. Many corporate travel agencies have long had ties in Russia because they viewed a presence in the world's largest country as crucial. While CWT and FCM Travel said they would continue to maintain ties with their Russian partners, Corporate Travel Management suspended its partnership with Moscow-based Unifest and TripActions, which later rebranded as Navan, said it was is no longer supporting travel to Russia and Belarus.