Skift Take

The travel industry registered one of its strongest months of recovery since the inception of our index, with performance up across all sectors and almost all countries. The war in Ukraine, however, is casting a long shadow over travel's performance moving into March.

While the invasion of Ukraine is understandably taking all the highlights, the overall improvement of the travel industry’s performance was impressive during the month of February.

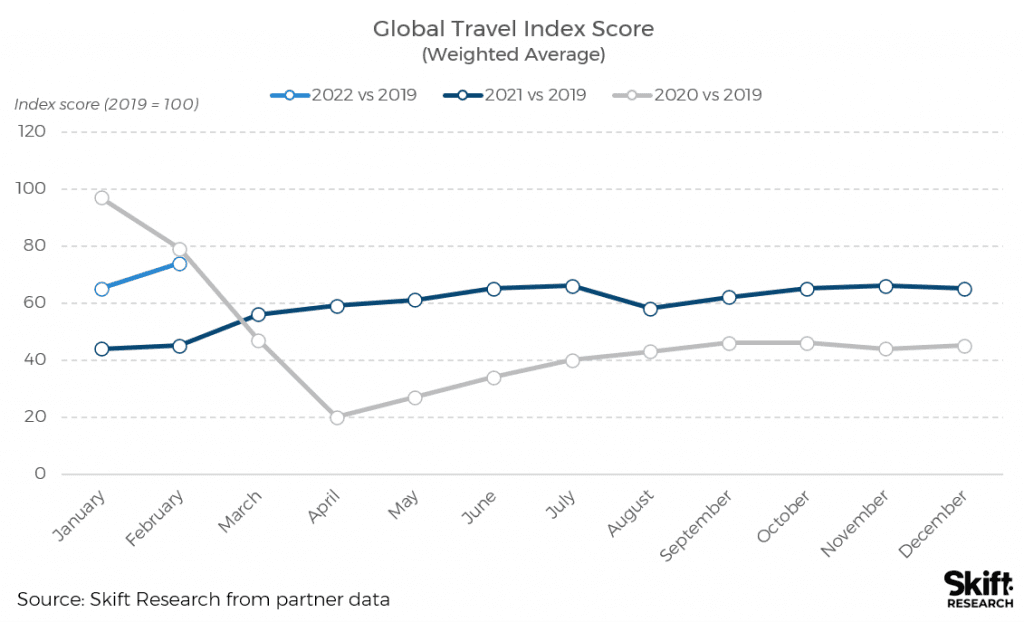

The overall travel performance hasn’t grown this fast month-over-month since March 2021, with the latest Skift Travel Health Index data registering a 9 percentage point increase between January and February 2022. This means that the travel industry performance currently tracks 26 percent below 2019 levels.

The February data is not showing the full force of current circumstances on travel’s performance yet. The Russian invasion of Ukraine started on February 24, with most analysts and officials holding out hope that the invasion would not happen. This means that only four days of February data was impacted by the war. Nevertheless, Russia was only one of two countries that showed a decline in performance during February.

The Russian travel industry has been one of the strongest performers since the inception of the Skift Travel Health Index. The decline in February now pulls Russia close to the global average, and March is likely to see Russian travel performance dive below this average.

Russia’s pandemic travel performance particularly benefited from a strong domestic market. While international seat capacity from flights to and from Russia remains down, domestic airline seat capacity has been above 2019 levels since early 2021, and Russian airports have been seeing some of the highest throughput according to OAG data.

Data from Aviasales, a major Eastern European booking site and one of our data partners, shows that searches for domestic Russian flights were still 88 percent above 2019 levels during February 2022, and domestic bookings 94 percent higher than in 2019.

In January, new bookings made for Russia outperformed the global average in aviation and vacation rentals, while hotel bookings were on par. In February, the situation turned on its head. Aviation and hotel bookings saw strong improvements at a global level, but in Russia, they took a step back, with the negative gap to 2019 levels widening. February flight bookings, however, still performed better in Russia than globally.

A deeper dive into the last week of February data, however, gives us a more accurate outlook into what might unfold for the Russian travel market in the months to come.

According to data from our partner ForwardKeys, on February 25, every booking that was made for travel to Russia was outweighed by six cancellations of pre-existing bookings. The Russian outbound market has also collapsed, with 11 airports completely shuttering operations for now, according to an industry source.

The domestic market will also suffer. Many foreign leasing companies have recalled planes leased to Russian airlines, although the Russian government moved in and impounded many of these before they could be returned. Furthermore, major manufacturers like Boeing and Airbus will no longer provide parts and maintenance to Russian airlines anymore, meaning that an increasing amount of planes will become grounded.

But the rest of the world will feel the impact too.

According to data from ForwardKeys, flight tickets issued during the week after the invasion were down across Europe, with the exception of only a few countries. This is not only due to the closing of borders to Russian travelers, but also travelers to other countries postponing or altering travel plans due to the increased uncertainty.

Olivier Ponti, vice president of insights at ForwardKeys, noted, however, that Western European destinations are not severely hit by the war as of yet. He said: “What I find surprising is that transatlantic travel and western European destinations have been less badly affected than I feared – North Americans can tell the difference between war in Ukraine and war in Europe, and so far, it seems that travelers regard the rest of Europe as relatively safe.”

This does not mean that there are no impacts on future travel plans. Russia’s airspace is now closed to many airlines from Europe and North America, and many others are avoiding it for safety reasons, meaning that long haul flights from Europe and North America to Asia will become longer, and potentially will require a refuelling stop. With oil prices also surging due to the war, some airlines like Malaysian Airlines have already started adding fuel surcharges to their prices.

Two countries in Europe are interesting to watch: Turkey and Serbia.

Turkey has condemned the Russian violence and closed its straits for Russian warships to enter or exit the Black Sea, but its airspace remains open for now. The country will walk a fine line, as Russia is important to the country’s energy supplies, but also as a tourism source market. According to data from the Turkish Ministry of Culture and Tourism, Russia is the country’s largest source market, with 7 million Russians arriving in 2019, 16% of total international arrivals. During the pandemic, the share of Russian tourists even grew to 19% in 2021.

Despite pressure from the EU to rescind their neutrality, Serbia has taken a neutral stance and has remained open to Russian flights, making it a gateway for flights to the rest of Europe from Russia. According to ForwardKeys, “60% more flight tickets were issued for travel from Russia to another destination via Serbia in the week immediately after the invasion than there were in the whole of January.”

The sanctions on Russian outbound travel are also seen as an opportunity by other countries, including the United Arab Emirates. ForwardKeys data shows that airlines including Flydubai, Emirates Airlines, and Etihad Airways did not see a decrease in capacity since the invasion, and actually slightly increased available seats for flight to and from Russia. Russian airlines like Azimuth Airlines are launching new routes to Dubai, with the emirate welcoming the Russian superrich. Russian travelers will increasingly look to the UAE, as well as countries like Egypt and Asian hotspots, like Thailand, if sanctions from the U.S. and EU remain, which seems very likely.

With the Ukraine war raging on, and China now seeing some of its highest infection rates recorded, it is likely that the Skift Travel Health Index for March will be less positive than February, although in many other parts of the world final travel restrictions are being lifted. If nothing else, the travel industry has become accustomed to the fluctuations that come with this choppy recovery.

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch

Tags: coronavirus recovery, covid-19, russia, skift travel health index, ukraine