Skift Take

With three of its four recent acquisitions based in the U.S., RateGain is making gains to acquire scale and dominance in that critical market.

India-headquartered travel tech firm RateGain Travel Technologies is acquiring Adara, a Silicon Valley-based firm in travel martech and predictive consumer intelligence. The cost: a mere $16.1 million, according to RateGain’s filing on the Indian stock market, which puts Adara, long troubled with management and competition issues for the last few years, out of its misery.

RateGain will pay $14.6 million in cash, with $1.5 million in deferred cash next year.

Adara has raised about $67 million in at least four rounds of funding in about 14 years of its existence.

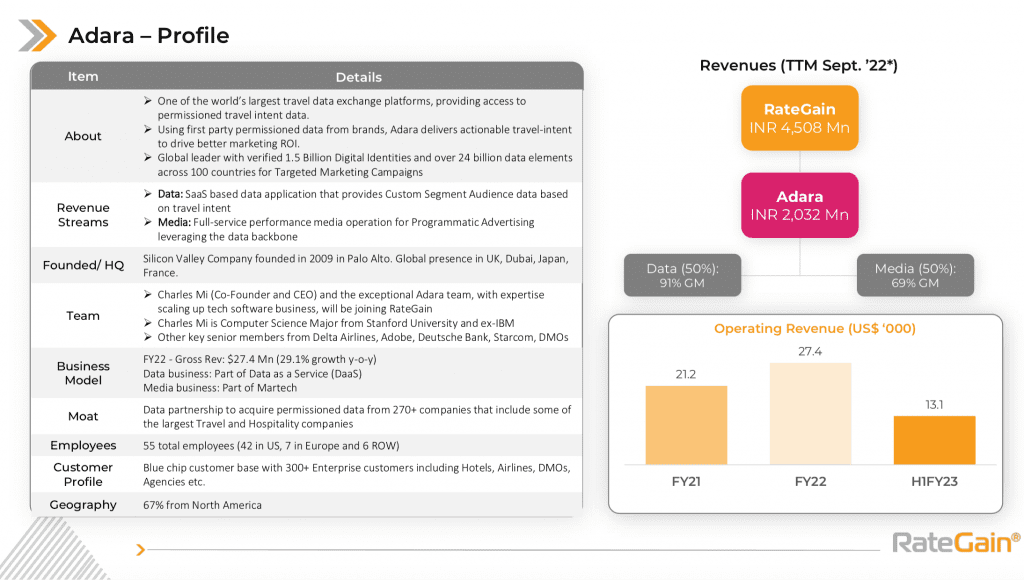

Through the acquisition RateGain is looking to build the most comprehensive travel-intent and data platform powered by artificial intelligence, RateGain said in a statement. This acquisition increases RateGain’s revenue by 50 percent. RateGain did about $54 million in revenue in its fiscal year 2022 which ended in Sept, according to its filings.

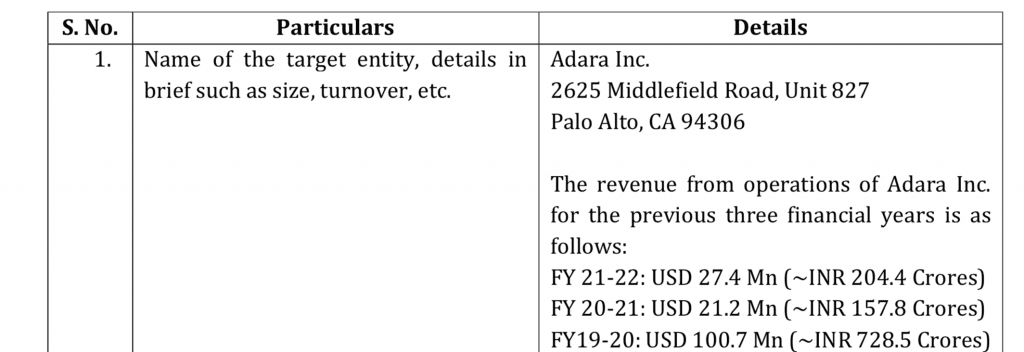

Adara had a precipitous fall in revenues in the Covid era and has not been able to recover from it, as its revenue numbers show in RateGain filings today. Its revenues dropped from around $100 million in 2019 to $27.4 million in 2022.

Adara Acquisition Offers Access to U.S.

Adara has been one of the companies — competing with the likes of much bigger Sojern, for instance –helping consumer brands find new customers using advanced precision-targeting technology powered by big data sourced from travel and hospitality companies.

The acquisition would also help RateGain to strengthen and consolidate its position across commercial teams in leading hotel chains, airlines and car rental companies, which work with both Adara and RateGain as well as give access to over 50 destination marketing organizations in the U.S.

“Together Adara and RateGain will become the most comprehensive travel-intent platform that processes over 200 billion availability, rates and inventory updates, manages close to 30 billion data points and works with over 700 partners across more than 100 countries giving the industry a single source to understand intent, target them and convert them,” RateGain said.

From Rategain’s investor presentation today:

RateGain’s Earlier Acquisitions

Adara would be the fourth acquisition for RateGain and the first one after the company went public in 2021.

The company last acquired Germany-based hotel marketing technology vendor myhotelshop in September 2021.

RateGain also acquired Dallas-based hotel distribution tech company Distribution Hospitality Intelligent Systems Co (DHISCO) in 2018 and BCV, a Chicago-based social media management and strategy company focused on the hotel sector in 2019.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: adara, asia monthly, hotel technology, mergers and acquisitions, RateGain

Photo credit: External view of a hotel with a Grand Bohemian art gallery that belongs to the Kessler Collection, a hotel company that uses RateGain's service. Kessler Collection