Skift Take

For any travel company that leans on a membership model, offering a tiny slice of equity is a cost-effective way to grow an army of loyal guests — but only if the brand is strong enough. If institutional investors continue to shy away, crowdfunding could take off in 2023.

Future of Work

As organizations start to embrace distributed work and virtual meetings, the corporate travel and meetings sectors are preparing for change. Read Skift’s ongoing coverage of this shift in business travel behavior through the lens of both brands and consumers.

Outsite, a membership-based hospitality company that focuses on remote workers, has raised $1 million through an alternative method: crowdfunding.

The Santa Cruz-headquartered startup turned to Wefunder to raise the cash, giving investors a slice of equity in the company from $500. Their investment will convert into equity in a future of round of funding, usually led by an institutional investor, or when there is an exit. The venture exposes about 2.5 percent of Outsite’s $40 million value.

It reached its $1 million goal after launching just a week ago, but CEO Emmanuel Guisset described the decision as a “roll of the dice.”

That’s because investor appetite has waned since the beginning of the year, with many travel companies in particular delaying or pulling out of plans to go public. The buzz around special purpose acquisition companies has subsided too.

Outsite’s fundraising efforts also come as global markets face up to the possibility of recession. To make matters worse, many of Outsite’s guests operate in the crypto world, which has been rocked by the collapse of cryptocurrency exchange FTX.

Capturing the Moment

However, 60 percent of Outsite’s members said they wanted an opportunity to invest, based on a poll it carried out recently. So Guisset took a leap of faith.

“We could have raised $1 million if we’d done it in early 2022, before the crisis,” he said. “Now people are watching their money a bit more, and a lot of people lost money in crypto. We were a bit scared of that. But it shows there’s appetite to invest in brands and products.”

The success could be a precursor to a major 2023 trend: brands that have been courting remote workers could be rewarded next year as travel restrictions further ease, particularly across Asia.

Flatio, another hybrid hospitality company, has seen year-on-year revenue growth of 48 percent, its strongest financial year since it was founded in 2015 — the same year as Outsite.

The monthly housing platform for digital nomads company credits the $1.24 million in revenue to the boom in remote work and the growth of digital nomadism post-pandemic. It also recorded a “generated rental value” — a measurement of how much money the company collects from tenants for its landlords — of $5.4 million

Overall, short-term rentals are generating more revenue than before the pandemic, according to Skift Research.

Perks Play

But the crowdfunding model also encapsulates the hybrid hospitality’s ethos: guests want more than a space to sleep and work, they want to feel part of a community.

In one sense, Outsite has pulled off a marketing coup.

“It’s a way to make our members more a part of our company, and become ambassadors, because if you invest you’re more likely to stay and spread the word,” Guisset said. “We’re also thinking of getting the investor members more involved in the direction of the company, like a members board where they can give us feedback.”

Incentives and perks also made their way into Outsite’s investment strategy. For an investment of $2,500 or more they receive gift cards. The idea of rewarding investors isn’t new, and was discussed in October during Selina’s pre-SPAC merger roadshow.

When asked if Selina was considering offering “any sort of reward or utility exclusivity to future owners or retail investors,” the company revealed it was being considered.

“It’s something we have discussed recently, and find it to be extremely interesting and exciting to be able to leverage our community of guests and travelers, and convert them into stakeholders or shareholders or owners of the company,” said Steven Ohayon, head of strategy at Selina, during a Q&A held on Twitter Spaces on Oct. 20.

“We don’t know how it will play itself out, we will need to be careful and follow the rules of the regulatory bodies in the U.S. But I can say it will make a lot of sense for us to try to reward our community or long-term holders of our shares with some sort of reward in our ecosystem.”

Outsite, which operates 50 properties, will now keep its “end-of-year marketing campaign” open a while longer — to not only generate cash, but also secure new members, with a potential goal of $1.2 million.

“If it keeps bringing more members and exposure, we’ll leave it running a little more,” Gusset added. “I don’t know of any other hotel, co-living or hospitality company that’s done a crowdfunding campaign. It’s pretty unique.”

Sidenotes

Let’s conclude the year with some research from Morgan Stanley that paints a pretty reliable picture for 2023.

Reinforcing statements Skift has been making these past few months, the travel industry does need to switch its focus to “smaller” companies when it comes to capturing business travel spend.

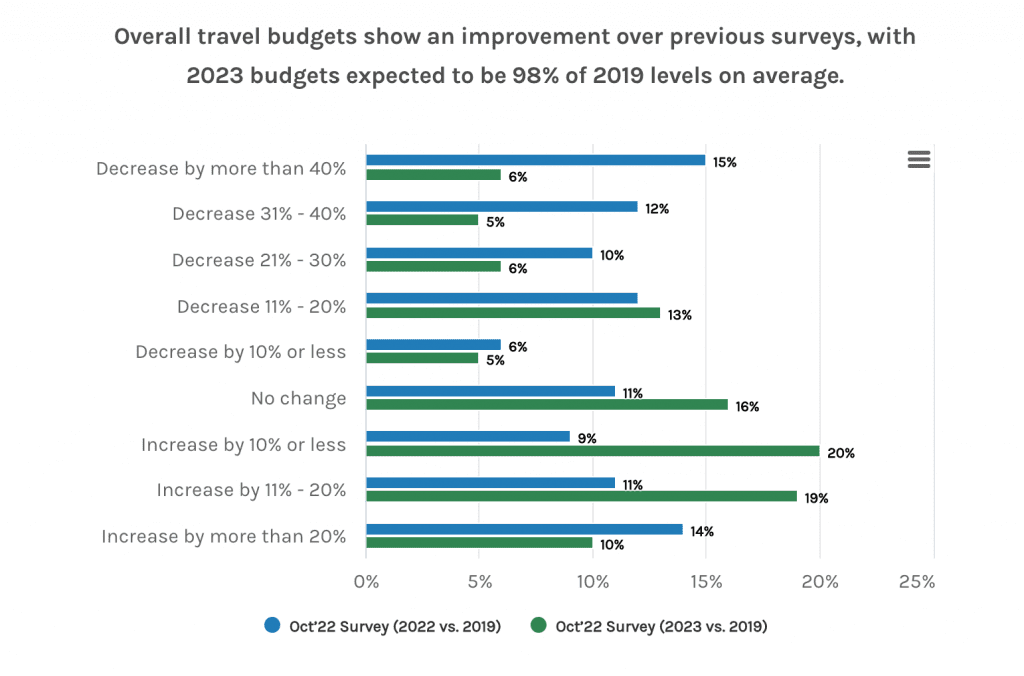

Overall travel budgets show an improvement over previous surveys, with 2023 budgets expected to be 98 percent of 2019 levels on average, Morgan Stanley’s survey of 100 global corporate travel managers has found.

Many respondents also said they believed their company’s travel expenditures would continue to grow.

That’s the surprising part.

Less of a shock is that the biggest demand is coming from small companies (although the financial services giant classifies those as earning less than a $1 billion in annual revenue.)

More than two-thirds (68 percent) of these “smaller” companies expect travel budgets to increase next year, versus just 41 percent of companies with annual revenues over $16 billion.

Similarly, 32 percent of smaller companies said travel budgets had already returned to pre-pandemic levels compared with 23 percent of big firms.

“This trend could likely favor low-cost carriers, as smaller enterprises tend to be more localized and require less long-haul travel,” suggested Ravi Shanker, an equity analyst covering North American transportation.

Bigger picture, 18 percent of corporate travel will be replaced with virtual meetings in 2023, falling slightly to 17 percent in 2024. Which begs the question: is this missing 18 percent simply going towards inflated travel costs?

10-Second Corporate Travel Catch-Up

Who and what Skift has covered over the past week: Airbnb, American Airlines, Delta Air Lines, Inspirato, Los Angeles International Airport, Marriott, United Arab Emirates.

In Brief

India’s Yatra Expands Into UAE Via Partner Program

India’s corporate travel specialist and online agency Yatra has expanded into the United Arab Emirates after launching a “corporate platform partner” program.

It has signed a five-year agreement with Abu-Dhabi-based Nirvana Travel & Tourism, and will look to offer its software to other corporate travel management companies. Nirvana operates in 40 locations and has 600 employees, and is the one of the largest corporate travel service providers in the UAE.

The program allows offline and online travel companies to find “new revenue streams, differentiated offerings, and additional features and functionality for their travel related products and services,” but gives Yatra a new source of revenue as well ahead of its public listing.

“In today’s business environment, every organization is looking to efficiently grow their customer base,” said Dhruv Shringi, CEO of Yatra. “Our program will help corporate travel management companies achieve this in a seamless manner with our best-in-class cloud-based corporate travel platform that caters to all their customer requirements.”

U.S. Corporate Travel Agencies Hit Back at DOT Ticketing Proposal

The Travel Management Coalition, which comprises American Express Global Business Travel, BCD Travel, CTM, CWT, Direct Travel and Internova Travel Group, has submitted comments to the U.S. Department of Transportation’s proposed rulemaking on airline ticket refunds and consumer protections.

The coalition said it supports the department’s goal of strengthening consumer protections and preparing for public health emergencies that could impact a customer’s decision to fly, but is “concerned that the requirements as proposed do not reflect the role of ticket agents, including corporate travel managers, in the marketplace.”

It argues that travel management companies facilitate transactions between a customer and an airline, so requiring them, as ticket agents, to be responsible for a customer’s refund, credit or voucher under this rule when it is the airline that is the party determining flight schedules, evaluating and issuing refunds, credits or voucher requests, would create misplaced liability and uncertainty for travel management businesses where they have no control.

Read the letter in full here.

Skift Future of Briefing is taking a break next Friday, but will be back on Jan. 6, 2023.

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: business travel, corporate travel, digital nomads, fundraising, Future of Work Briefing, puerto rico, remote work, selina, short-term rentals, Skift Pro Columns