Alaska Airlines Debuts Subscription Model for Flights

Skift Take

Alaska Airlines began on Wednesday selling flight passes in a move that hops on the popularity of the subscription model. Travelers who agree to pay a monthly fee will receive credits to fly a fixed number of roundtrips among 16 selected U.S. West Coast airports.

"In our basic plan, we're introducing affordable travel on par with an Uber ride or bar tab," said Alexander Corey, managing director of business development and products.

A basic subscription starts at $49 a month and requires booking tickets at least two weeks before travel. A more flexible subscription starts at $199 a month and allows same-day booking.

Subscribers can fly on routes within California or between California and Reno or Phoenix, covering about 100 daily flights.

"We designed the product by trying to create something our California guests have told us they needed," Corey said. "In our data, 3.5 times more people travel within California than within any other state."

Alaska Airlines is the latest airline to adopt a much-discussed business model across all of travel. One of Skift's recent megatrends was that the subscription model is becoming a staple of travel industry renewal. Researchers at UBS bank expect the subscription economy to reach $1.5 trillion in sales by 2025.

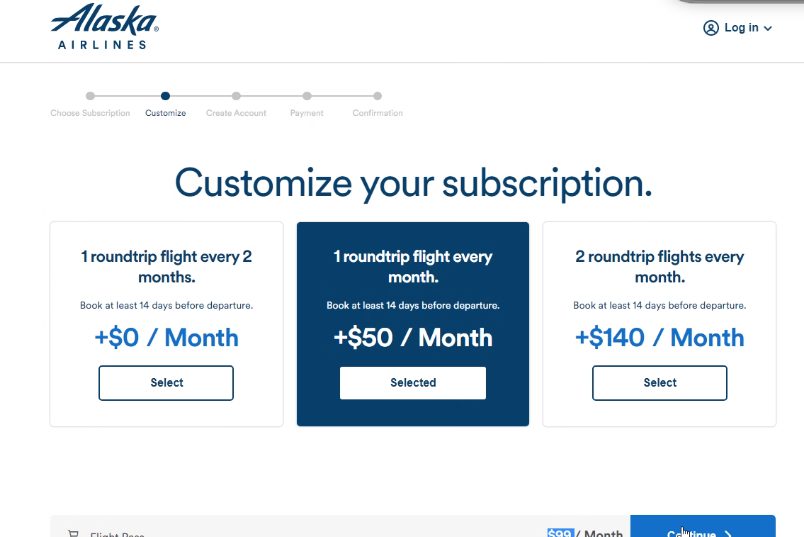

Once consumers have selected a plan, they can choose their volume of flights, such as six, 12, or 24 a year. A basic plan with six flights typically costs $763 a year — after taxes and fees.

A yearlong commitment works out to a total travel expense 20 to 30 percent below average fares across the system, Corey said.

For now, Alaska will only offer subscriptions through its direct channels. That's a natural fit because subscriptions are ultimately about getting a closer relationship with customers. Subscriptions also reduce the money an airline needs to spend to acquire a customer per booking because they encourage repeat usage.

Not the First Flight Subscription

Some airlines have offered membership-based programs for some time, such as United Airlines's long-time offering of subscriptions to access at its lounges and to other products. But Alaska Airlines's program is one of the most sophisticated — or most Netflix-like — of the subscription efforts we've yet seen an airline offer.

Caravelo, a Barcelona-based travel tech vendor, is helping Alaska Airlines on the back-end. It has plugged into the carrier's passenger service system, run by Sabre, to make or amend bookings.

Since 2018 Caravelo has run a subscription offering on behalf of Volaris, the Mexican low-cost carrier. The Volaris VPass lets more than 30,000 consumers fly within Mexico once a month, paying only taxes when you book in return. Plans vary, but the monthly subscription for round-trip tickets is about $35 (699 Mexican pesos) a month.

During the pandemic, Volaris said its subscription revenue remained steady despite the pandemic, meaning people kept paying. However, subscription sales remain a small part of the airline's overall revenue, with the product not mentioned on the carrier's quarterly earnings call earlier this month.

Five months ago, South African low-cost-carrier FlySafair launched a flight subscription program providing a select number of customers with up to 10 free flights per month.

JetBlue and some other airlines have also occasionally run promotions where customers pre-pay for multiple vouchers at a volume discount or buy a pass with "all you can fly" privileges. But some people don't call those true subscription products.

Other airlines looking to specifically add a subscription product may choose to use a subscription platform from a tech vendor that has practice handling recurring payments, billing, and fraud detection.

"Airline subscriptions will usually have restrictions, unlikely Netflix, which doesn't have a quota on how many movies you can see," said Caravelo CEO Iñaki Úriz.

The nuances of the travel sector require a nuanced tech stack.

"The subscription platform an airline uses needs to understand, let's say, that you as a customer are subscribing to this X part of the airline's network and not this Y part of the network," Úriz said. "Maybe your subscription is going to include some ancillaries, such as free checked bags, but not others. Your program will probably also have some revenue management rules, such as that consumers must book all flights by a certain number of days out."

For example, when redeeming, an Alaska Airlines subscriber will pay nominal taxes and fees, such as an airport security fee. Credits for flights are deposited monthly or bi-monthly, depending on the plan, and need to be redeemed within windows of time, typically between one and two months.

To keep things simple, Alaska Airlines is applying its standard practices for traditional tickets to the flights booked via subscription, such as how miles add up in the airline's loyalty program and the use of elite upgrades. Subscribers also get access to main cabin seats rather than basic economy ones.

"We thought about things a little bigger picture, and less transactionally, than is the industry norm," Corey said.