Skift Take

A survey of travel marketers has uncovered a fresh eagerness to experiment with new methods. But the budgets for these new ways to advertise will be slow to return to 2019 levels.

Travel marketers are plotting a return to pre-pandemic levels of digital advertising expenditure in a phased, market-by-market return, according to a survey of 300 travel marketers worldwide that was released this week.

One of the small upsides of the pandemic is that more travelers are booking directly now than they did in the past, according to a survey of senior travel marketers worldwide by WBR (Worldwide Business Research) Insights for travel ad tech firm Sojern.

The shift in behavior is making travel marketers more interested in running “direct response campaigns” in greater proportion to brand campaigns via programmatic display ads.

In contrast, only 39 out of 300 travel marketing executives said that majority of their budgets were on branding or that their budgets were evenly split between branding and performance ads. Those committed to branding are rethinking their approaches, too.

“Hotels will have to reiterate their brand value to consumers through carefully selected marketing campaign themes,” said an executive from Singapore’s Marina Bay Sands.

Travel Marketers Are Pessimistic About the Recovery’s Speed

Companies slashed ad budgets at the onset of the pandemic. Now they’re agonizing about how to push their brands again to position for a recovery.

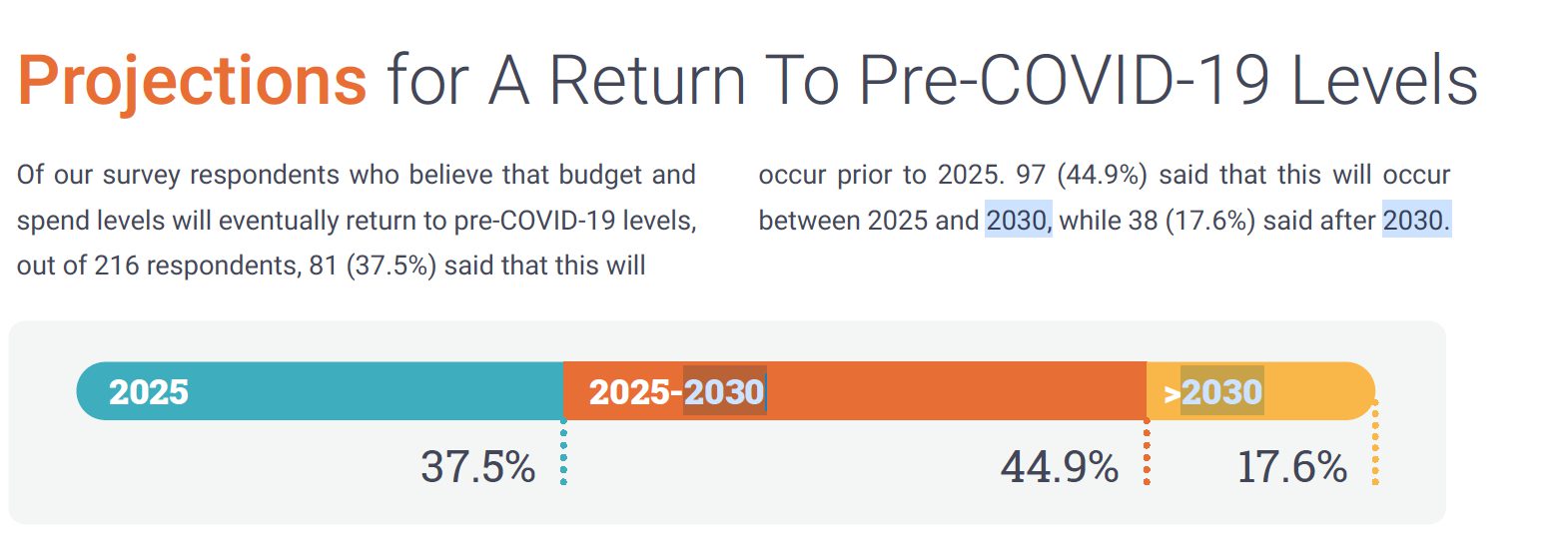

In the survey, many travel marketers were gloomy and cautious. Roughly 81 out of 216 travel marketers surveyed said that budget or ad spend will go “back to” pre-Covid 19 levels before 2025, while a greater number of respondents, 97, said the recover wouldn’t happen until between 2025 and 2030. Another 38 travel marketers thought the recovery wouldn’t happen until “after 2030.”

report titled, “How Travel Marketers Are Activating Digital Advertising in 2021.” Worldwide Business Research (WBR) Insights and Sojern in August 2021.

The report arrived at the end of earnings season for advertising technology companies such as PubMatic, Criteo, and Trade Desk; adjacent tech players such as LiveRamp, Publicis Sapient, and Koddi, and advertising groups such as Publicis and WPP.

“Travel is coming back,” said Diego Panama, chief commercial officer at LiveRamp, a company that specializes in advertising tech and data connectivity.

Trade Desk reported that the travel category in the second quarter showed some of the most improvement overall, along with in-store shopping and automotive.

Travel Marketers Turn to New Tools

The survey results dovetailed with a recent report by analysts at investment bank Bernstein who predicted that travel and hospitality firms would this year spend a greater slice of their digital ad budgets on search paid ads, rather than display ads.

“For travel advertising, there will be more focus on affiliate marketing,” said an executive at Shangri-La Hotels and Resorts. “I would say that the increase in travel bloggers should be useful for our advertising purposes.”

For digital ads and sponsored content, “time spent on ads” and “number of viewers” were the two most commonly cited metrics for measuring ad campaign success by the surveyed travel marketers.

“Content is the most important part of advertising now,” said an executive at Travel Oregon.

Emerging techniques such as connected TV (or running ads via streaming services where users are logged-in), live streaming, and interactive social commerce were also areas of growing experiments.

For connected TV, one unnamed travel brand said that the theme of “fun is a choice” had struck a chord with audiences in one campaign. In contrast, other brands noted that adventure travel and the outdoors were popular topics with consumers currently.

But the survey did reflect some emerging areas of interest for travel marketers generally.

New partnerships were another area of innovation that interested travel marketers.

“Travel advertisers should seek collaboration with non-core participants like insurance companies etc., to make travel more secure,” said an executive at Hilton Worldwide.

A push to digital is clear. In Europe, half of travel organization representatives said they were dedicating between 26 percent and 49 percent of their overall marketing budgets to digital advertising, with 27.7 percent committing roughly half to digital, the report found.

The survey wasn’t a perfect reflection of the travel sector worldwide, with 72 percent of the respondents working in hotels and 21 percent working in attractions and experiences, while 7 percent were in tourism or destination marketing. About 41 percent had annual budgets between $50,000 and $250,000. About 10 percent had budgets between $1 million and $10 million, and 11 percent having budgets above $10 million. Marketers in Asia-Pacific, Europe, North America, the Middle East, and Africa responded.

Data from online travel companies shows that that booking giants are taking different approaches.

But while no survey is perfect, this one did dovetail with broader trends reported elsewhere by public ad tech companies.

“Throughout the pandemic in digital advertising, we saw continued progress in growth as people were spending more and more time online,” said Steve Pantelick, the chief financial officer of PubMatic, in an earnings call on August 10. “We don’t see those factors particularly changing.”

“With respect to CPMs [cost per 1,000 impressions, or the industry’s way of measuring ad rates], we actually saw a very strong recovery on a year-over-year basis in Q2,” Pantelick said. “That is something that is a function of continued ROI [return on investment] for our advertising partners.”

“There is a bright future for digital tools like robotics and AI in advertising, especially in delivering a personalized advertising experience for the travel industry,” said an executive at Sofitel Dubai The Palm.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: digital advertising, Digital Marketing, online marketing, performance marketing, sojern

Photo credit: A landscape of Flores Island near Komodo, Indonesia. Tiket2