Just In Time for an IPO — Airbnb's Hotel Business Is Benefiting From Its House Party Ban

Skift Take

Just in time for Airbnb's roadshow for its pending initial public offering, Airbnb's hotel business is getting a boost from its house party ban.

In a program that started from an initial focus in the U.S. and Canada, but has been expanded to the UK, France and Spain, Airbnb said Friday it is diverting customer bookings of entire homes toward hotels and private rooms.

"This technology has blocked over 770,000 distinct reservation attempts in the U.S. and Canada," Airbnb said.

Over the last few months, when Airbnb's algorithms detected that a raucous — or even lethal — house party might be on the agenda, users have been advised online to "please try a hotel room instead" or "choose another place to stay."

Join Us For Our Skift Short Term Rental and Outdoor Summit Online Conference December 9-10

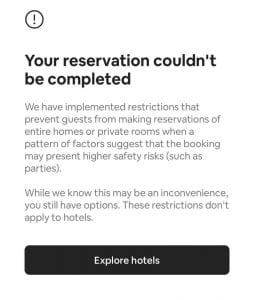

For example, we found this admonishment and link to "Search hotels on Airbnb."

"Airbnb prevents reservations for entire homes when a pattern of factors (like location or reservation time) suggests the booking may be unsafe. This restriction is not related to the coronavirus. For resources on coronavirus , see airbnb.com/covid. Please try a hotel room instead."

Airbnb announced in the spring when it was conducting a mass layoff because of the pandemic that it would be reducing its investments in its hotel business, including HotelTonight, which it acquired for around $400 million a year earlier.

Airbnb, though, raised about $2 billion in private equity funding, and its bookings have recovered in the interim so it wouldn't be surprising if Airbnb has resumed devoting resources to hotels.

Correcting a Competitive Disadvantage

Airbnb reportedly is trying to raise another $3 billion in an initial public offering. It could be attractive to potential investors if Airbnb can show that its hotel business, solidified by its acquisition of HotelTonight, is tracking upwards. Over the long term, a robust hotel business to complement short-term rentals, would place Airbnb in a more competitive position against rivals like Booking Holdings, Expedia Group, and Trip.com Group.

Airbnb is directing would-be whole-home bookers on its platform toward hotels in a variety of ways.

In fact, Airbnb on Friday issued An Update on Trust in which it cites its move toward "redirecting certain local reservations" away from entire homes and toward hotels and private rooms. Airbnb said it expanded this initiative to the UK, France and Spain from its initial U.S. and Canada focus.

In some cases, Airbnb is blocking suspect reservations for private rooms in addition to entire homes, and prompting bookers to "Explore hotels."

When Airbnb's initial public offering registration statement becomes public, it therefore wouldn't be shocking to see its hotel business showing signs of life after initially being neglected because of the Covid downturn.

Correction: Airbnb doesn't hide whole home listings, as we initially reported, when it suspects users want to rent them for house parties. Instead, Airbnb blocks these bookings, and often directs users toward hotels instead.

Register Now For Skift Short-Term Rental and Outdoor Summit, Happening Online December 9-10