Skift Take

Welcome to a more focused Airbnb, one that is about homes, and not hotels and luxury properties. This may not bode well for a public offering.

A new and more-focused Airbnb is emerging out of the coronavirus crisis.

Airbnb announced Tuesday it cut 25 percent of its payroll, around 1,900 employees, will reduce its investment in hotels and Airbnb Luxe, and will “pause” efforts in transportation, including flights, and Airbnb Studios.

“This crisis has sharpened our focus to get back back to our roots, back to the basics, back to what is truly special about Airbnb — everyday people who host their homes and offer experiences,” co-founder and CEO Brian Chesky said in an email to employees that Airbnb released.

In the lead-up to Tuesday’s announcement, one issue for Airbnb was whether it could still pursue a strategy to be a super brand of travel, with a wide range of offerings, or whether it would refocus on the business that got it to this juncture.

Chesky had talked about co-founding Airbnb about a decade ago, and not envisioning becoming a real estate company. That was a reference to real estate plays from companies such as Sonder and Lyric, which counts Airbnb as an investor, and the proliferation of hosts on its platform with dozens of listings, and operating quasi-hotel operations.

Get the Latest on Coronavirus and the Travel Industry on Skift’s Liveblog

With Airbnb now committed to getting back to basics, it appears as though the company will go deeper rather than wider.

Airbnb in the past couple of months has confronted a crisis with its hosts, many of whom felt abandoned when Airbnb opted to provide full guest refunds and credits for bookings made through mid-March, and cancelled because of coronavirus-related issues. Although Airbnb subsequently opted to provide some $250 million in host relief, it hasn’t amount to much for many of them.

In the interim, Chesky, who admitted that Airbnb had become removed from hosts’ concerns over the years, pledged to do better for hosts on an ongoing basis. There is still a lot of doubt among hosts that this will happen, and many have discussed suing Airbnb and abandoning the platform when the travel industry recovers.

Chesky revealed areas that Airbnb is downgrading, such as hotels and luxury properties, although none of these would involve mom-and-pop hosts.

“This means that we will need to reduce our investment in activities that do not directly support the core of our host community,” Chesky wrote.

Not Full-Service

Chesky said Airbnb will reduce investments in hotels, and after acquiring HotelTonight in 2019, it appears as though Airbnb will keep operating HotelTonight, but won’t invest in adding new hotel properties to its platform.

So, for now, at least, Airbnb will not be able to provide as broad an array of lodging offerings as rivals Booking.com and Expedia do, meaning everything from apartments and vacation homes, and boutique hotels to chain properties, but will drill down on apartments and vacation rentals.

It’s interesting that the list of products that Chesky said Airbnb would be paring, everything from flights to ramping up hotels on the platform, did not include Experiences or multi-day tours.

Experiences is said to be generating large losses for Airbnb, although the company stubbornly sticks with it as part of its core people-to-people vision.

Chesky told employees in meetings and in a message (embedded below) that after raising some $2 billion in capital, it still needed to drastically reduce costs because the timing of a recovery is unclear, and “when travel does return, it will look different.”

Going Public Becomes less Attractive

Chesky didn’t specifically mention anything in his email to employees about the prospect of going public, which had earlier been envisioned as on tap for 2020 before Covid-19 changed the world. Chesky has acknowledged recently that those plans are on hold.

A trimmed-down Airbnb, with a reduced focus on hotels or an expansion into flights, may make the company less attractive as a public company in the immediate future. In its most-recent fundraising, Airbnb’s valuation had dropped to around $18 billion, from reports of $31 billion a couple of years ago.

A more-focused company, with fewer revenue streams and prospects for expansion into new areas, may make Airbnb less attractive to Wall Street — at least in the next couple of years.

One reason pre-coronavirus that Airbnb sought to go public was so employees could cash in soon-to-expire stock options.

In addition to recieving severance, departing employees will remain stockholders, Chesky said.

“We are dropping the one-year cliff on equity for everyone we’ve hired in the past year so that everyone departing, regardless of how long they have been here, is a shareholder,” Chesky told employees. “Additionally, everyone leaving is eligible for the May 25 vesting date.”

Chesky apologized to employees being laid off, adding, “Please know this is not your fault. The world will never stop seeking the qualities that you brought to Airbnb, that helped make Airbnb. I want to thank you, from the bottom of my heart, for sharing them with us.”

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, coronavirus, hotels, layoffs

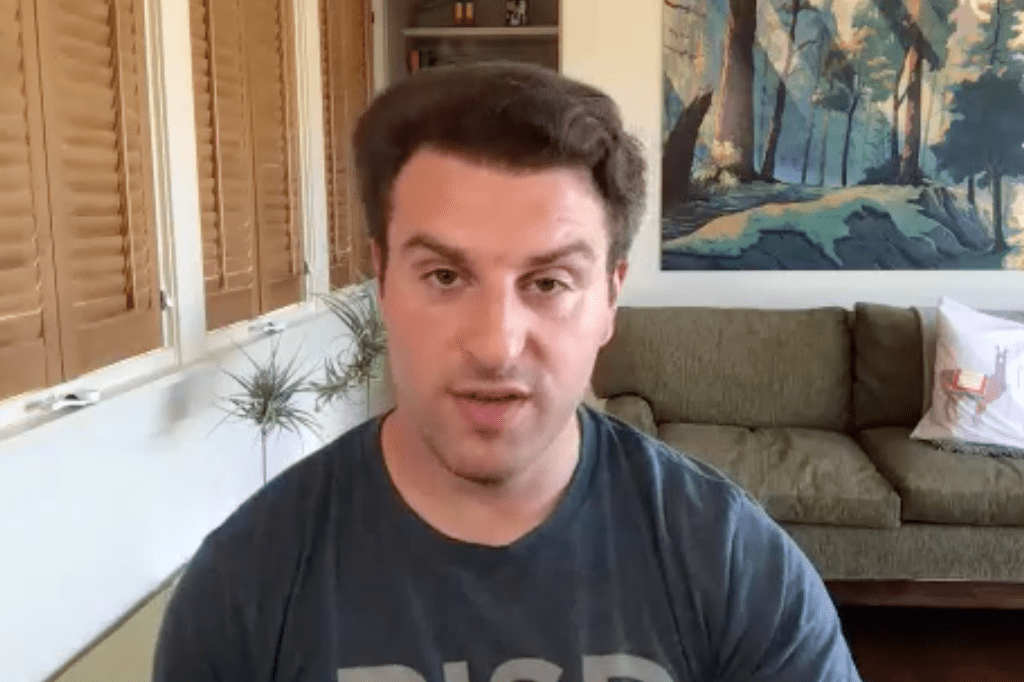

Photo credit: Airbnb CEO Brian Cheskey appeared in Skift's The Long View podcast April 29. The company announced layoffs May 5, 2020, and a refocused vision. Skift