Skift Take

New owner Intelsat will need to invest in Gogo's internet services. Airline customers like Delta are impatient with Gogo's capacity to meet their needs.

A bankruptcy court okayed on Monday satellite communications provider Intelsat’s plan to buy part of in-flight internet provider Gogo for $400 million in cash.

“Gogo’s business is a perfect fit with Intelsat’s expansive satellite network and infrastructure,” said Intelsat CEO Stephen Spengler in a statement.

As part of the deal, Gogo will enter into a 10-year network services deal under which Intelsat will have exclusive access to Gogo’s air-to-ground internet services in North America. Intelsat must guarantee $177.5 million in revenue over the decade.

Gogo revealed in August it was in talks with unnamed companies to sell its unit that provides Wi-Fi to 3,000 commercial airplanes. Its 21 commercial clients include Delta Air Lines, United Airlines, and Alaska Airlines.

Intelsat filed for bankruptcy in May with $14.5 billion in debt. It will fund the acquisition using a debtor-in-possession financing facility and cash on hand. Its lenders have blessed the deal.

Intelsat, which has a direct-to-home television business, has invested in next-generation high throughput satellites, which it said could mesh well with Gogo’s recently rolled out 2Ku antennas.

Intelsat may need to make further investments in Gogo to keep it competitive, some analysts said. For example, Delta Air Lines told Gogo a few months ago that it would break its exclusive contract with Gogo and hire other inflight connectivity providers. It said it was impatient with Gogo’s pace of expanding its satellite capacity across North America to meet the airline’s expectations for high-quality free Wi-Fi service on its desired timeline.

Delta’s move followed American Airlines’s tough haggling with Gogo in recent years.

Gogo in Europe uses SES, Eutelsat, and other operators that compete with Intelsat. So Gogo risks losing satellite supplier contracts on its current terms.

The companies expected the deal to close after regulatory approvals sometime before April 2021. Gogo said that it had separated in July its commercial aviation business from the one serving private jets and other business aviation clients. Gogo’s chief rival for commercial aviation services in North America is ViaSat, based in Carlsbad, California.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: bankruptices, gogo, in-flight, in-flight entertainment, in-flight Wi-Fi, inflight entertainment, inflight internet, inflight Wi-Fi, inflight wifi, intelsat, mergers and acquisitions

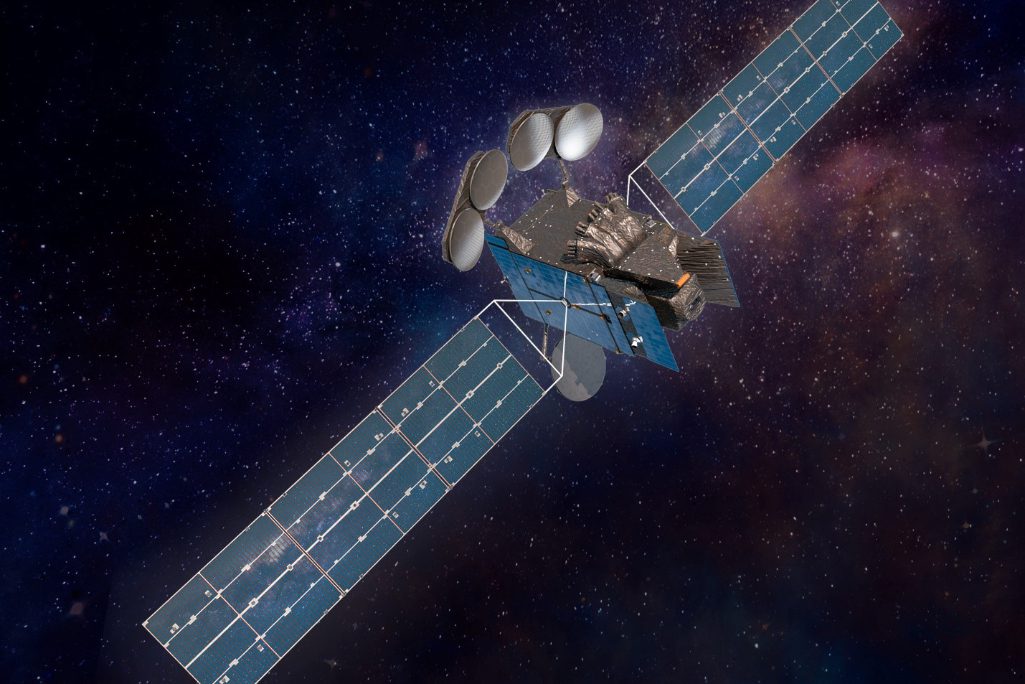

Photo credit: An example of a geostationary communications satellite used by communications provider Intelsat. A bankruptcy court has okayed Intelsat's plan to buy part of in-flight internet provider Gogo for $400 million in cash. Maxar Technologies