Skift Take

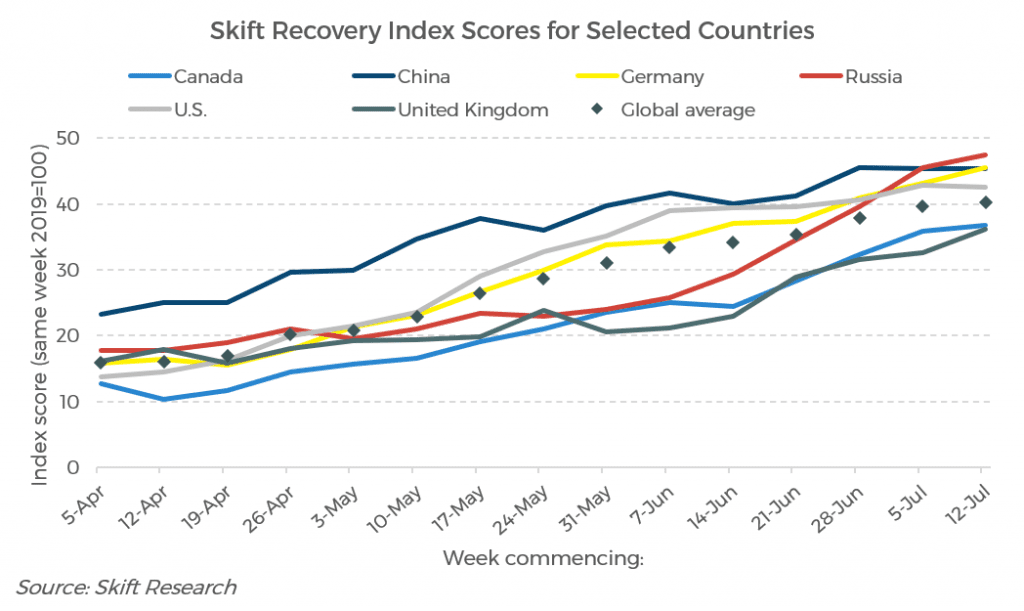

Skift Research keeps analyzing how the travel recovery is shaping up. It’s needed, because demand remains volatile and none of the 22 markets tracked in the Skift Recovery Index is above 50 percent of prior year performance.

Russia, which was newly added to the Skift Recovery Index, is the strongest performer in the index with signs of a steady rebound. The index continues to track how the travel industry is performing throughout this crisis.

In addition to Russia, six countries last week were added to the index — Argentina, Hong Kong, Indonesia, Japan, South Africa, and Turkey. Besides improving the global index scores, the addition helps travel businesses that are trading in these countries see more nuanced local recovery trends.

Russia shows resilience as country starts opening up

Russia continues to have over 5,000 new daily coronavirus cases, but since the beginning of June has started lifting lockdown restrictions, and last week announced that flights to the United Kingdom, Turkey, and Tanzania would resume on August 1.

According to Aviasales, a Russian flight metasearch platform, interest in travel to these countries jumped after the announcement. The company saw search queries to Turkey increase by 300 percent week-over-week, to the United Kingdom by 500 percent, and to Tanzania by 7,000 percent.

Total available seats on flights originating from Russia now stand at 68 percent compared to the same time last year, according to OAG data. Airport lounge visitation data from Collinson, showing how many people visit its airport lounges, is likewise high at 37 percent of prior year performance. With many lounges still shut, this is a strong performance under current circumstances.

Andy Besant, director of travel experiences at Collinson said that Russia accounted for 12 percent of global lounge visits in 2019, but this has increased to 47 percent between April and June 2020.

U.S. performance suffers from rise in coronavirus cases

Meanwhile, in the U.S. the airline industry took a battering last week as earning calls kept providing bad news.

American Airlines saw revenues decline by 86 percent, resulting in a $3.1 billion loss in EBITDA (earnings before interest, taxes, depreciation, and amortization). Southwest Airlines — a strong performer in our recently launched Skift Health Score — also saw revenues dropping by 83 percent, while United Airlines execs said the company was burning through $40 million cash per day in the second quarter.

U.S. flight data from the index shows that flight searches and bookings made by U.S. residents have dropped considerably since mid-June when coronavirus cases started rising rapidly.

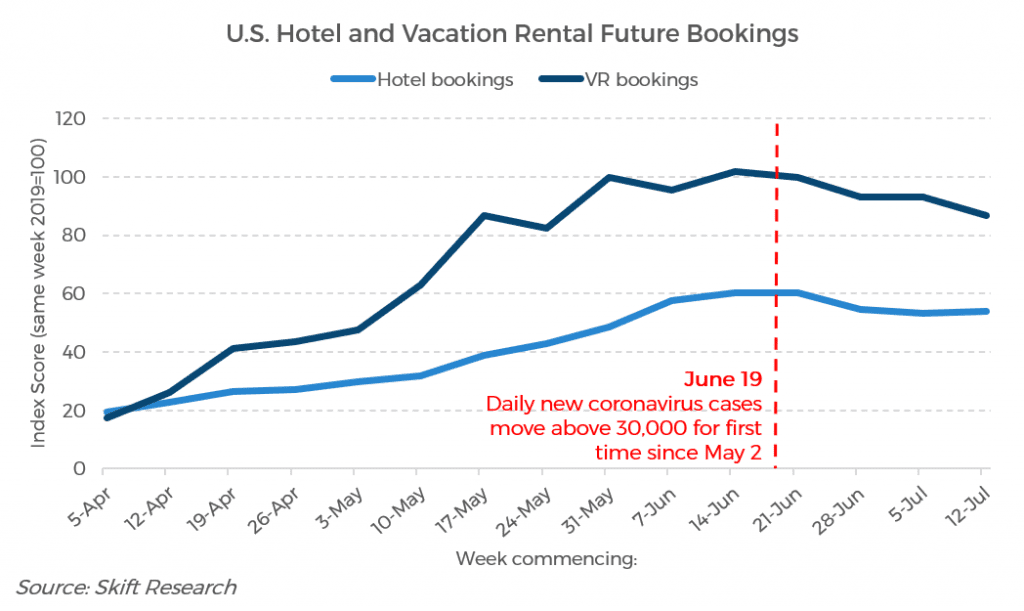

The lodging industry continues to perform much better than the airline industry, but here also there has been a considerable dip in performance since mid-June. Vacation rentals appear to have taken the biggest hit from this decline, although the rental segment continues to track much higher than the hotel sector.

The Skift Recovery Index is a real-time measure of where the travel industry at-large — and the core verticals within it — stands in recovering from the Covid-19 pandemic. It provides the travel industry with a powerful tool for strategic planning, of utmost importance in this uncertain business climate. The Index is available to our Skift Research subscribers.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: coronavirus recovery, russia, skift recovery index, U.S. airlines