Rethinking Skift's 2020 Travel Megatrends in a Pandemic World

Skift Take

Skift started the year excited for the release of Megatrends Defining Travel in 2020, our latest annual team effort identifying and interpreting the key trends for the travel industry. We accompanied the digital and print release of our megatrends with six presentations around the globe in late December and January,

Then our world came to a standstill, paralyzed by the devastation of coronavirus. Nothing was going to be the same.

Six months into this pandemic, we decided to look back on those megatrends to try to offer you some guidance on how Covid-19 upended those trends, or how it simply didn't for some, even creating opportunities.

Here is how we see the future of travel in 2020 now, compared to pre-pandemic (the original trends are linked).

As our founder Rafat Ali noted back in January before this tragedy: "The world has changed as Skift has grown into travel's premier intelligence brand helping companies decipher and define trends. So too has the balance of power shifted among travel's biggest players. These are the Megatrends that will determine the fate of the travel sector in a complex and ever-changing global marketplace."

We will stay committed to that message, covering the evolution of these trends as travel moves forward to find its footing in a world we could not have ever anticipated six months ago.

Subscription Travel Is the Next Frontier of Loyalty

The Pandemic's Effect: Before Covid-19 hit travel, many brands wanted to think seriously about subscription revenue, some weren't sure how. They were racking up big margins selling travel products through traditional means, and some feared they would cannibalize future revenue by selling hotel rooms or airline seats months or years in advance, at a discount.

But that's probably an old problem. Now, airlines, hotels, and other travel companies have significant unfilled inventory, and they probably don't need to need to worry about committing future inventory at cheap prices. In fact, many brands would probably prefer recurring revenue over taking their chances on a robust recovery.

"We see this as being an accelerated trend," said Iñaki Uriz Millan, CEO of Caravelo, a company that builds subscriptions for airlines. "We are getting a lot of traction — much more than I would have expected."

Caravelo recently signed up its second airline customer, a South America low-cost-carrier called Viva Air. "They went for an interesting strategy where they will implement a smart mix of pre-paid flight and real subscription offer," Millan said, declining to share more because offers are not yet public.

EDreams Odigeo, a European online travel company, also has expanded its subscription offerings since Covid-19 changed the travel landscape. When it launched last year, the company's prime program included only discounts on airfare, but in June, it added more than 2.1 million hotels worldwide. In a release, it said it wanted to make "travel more flexible and accessible in the ‘new normal.’" — Brian Sumers

Tourism’s New Competitive Advantage Is Protecting — Not Just Promoting — Destinations

The Pandemic's Effect: It’s fair to say that few might’ve predicted the central challenge that tourism marketers would face in 2020: shifting from overtourism to undertourism in a matter of weeks.

Tourism boards that were squarely focused on how to manage the effects of too many visitors in high season are now settling in for a summer of seeing too few. Due to a reliance on hotel room occupancy taxes, some destination marketing organizations in the U.S. are wondering if they will even exist this time next year.

And sure, there’s been a hearty amount of schadenfreude from groups who have long decried the effects of tourism on popular destinations as uniformly bad. But the disappearance of tourism overnight in March and April also brought with it an opportunity for an enforced reset, one that’s made the idea of protecting destinations — while also promoting them — more relevant than ever. In that way, the pandemic may serve to accelerate the trend we predicted at the outset of this year. Successful destinations in the long term have to work as well for local residents as they do for tourists.

Back in April, Visit Seattle CEO Tom Norwalk candidly told Skift that the last ten years of tourism growth served as almost “an embarrassment of riches” which meant many tourism boards were too focused on the simple task of boosting visitors, perhaps at the expense of their destination. While there will certainly be an impulse for some destinations to get numbers back up as quickly as possible after a prolonged dead period, thanks to Covid-19 it’s likely there will also be a memory that wasn’t there before: Tourism is a fickle mistress, one that can disappear overnight.

That realization may hopefully lead destinations to be more humble, nimble, and diversified in their approach. In a more literal sense, the prospect of importing infections as tourism reopens has also reminded officials where the balance of power in a visitor economy should stand: Tourism should be a boon to local communities, not a drain.

That requires active government involvement in sensible policy-making, accurate (not self-serving) data about how tourism actually affects communities, as well as checks and balances on how tourism can develop and the extent to a which a local economy relies on it. This isn’t any more true in June than it was in January — it's just that the virus made it more obvious. — Rosie Spinks

The Future of Travel Will Be Driven by Urban Living Innovations

The Pandemic's Effect: Some cities saw their sunny tourism marketing messages undermined by chaotic responses to recent health, pandemic, and political crises. So much for decades of talk about smart and responsive cities. Yet in a twist of fate, the cities that are the most likely to see strong tourism rebounds will be the ones that have the comparatively best urban living innovations. The more cities can showcase their amenities, the more visitors will embrace them during a domestic tourism boom.

"We're seeing a lot of research and sentiment analysis coming through that appear to indicate that travelers in the 18- to 35-years-old group may be among the first to begin exploring as the crisis wanes," said Susan Deighan, director of city marketing and external relations at Glasgow Life, the lead agency for tourism and events for the Scottish city.

To woo those young travelers, Glasgow will tout its credentials as an attractive destination for young people, such as by citing a late 2019 survey recognizing it as the best European city for new graduates on a number of indicators including cost of living, health-related facilities, cultural events, and youthful population.

"We need to continue to have a joined-up approach with our universities to produce compelling city narrative and inspirational digital content to get the message out," Deighan said.

Not every city is gliding forward this year. Toronto, for instance, suffered a delay in its smart city project when in May Alphabet's Sidewalk Labs pulled the plug on its role in a waterfront revitalization after facing waves of local skepticism.

More broadly, the crisis has strained the resources and reputations of many cities worldwide. Yet some experts see a silver lining in the sad reality.

"While the crisis has been terrible for so many, it's also exposed longstanding weaknesses that, at least here in New York, are driving proactive awareness and innovation at all levels," said Campbell Hyers, co-founder of one of the companies merged to form Intersection, a smart cities company known for the LinkNYC set of public directory kiosks.

"Every mom and pop, local business, community group, restaurant, every hotel, and city and state agency has had to rework their amenities and service designs," said Hyers. "Many cities feel an added urgency about plans for everything from leveling up cleanliness to expanding bike lanes to even renewing airports."

The crisis has also highlighted the need for notification services geared towards surfacing urban innovations and amenities to visitors, especially ones relevant to safety and health that today tend to remain hidden in apps, websites, and local news stories. This fall several cities will get some help from Apple, which will add a Translate app for the iPhone that can work offline and add travel guides with recommendations from brands like Zagat. — Sean O'Neill

Gen Z Asserts Itself as Travel's Next Big Opportunity

The Pandemic's Effect: The coronavirus pandemic has impacted everyone, and it’s had a unique impact on members of Gen Z. The oldest members of this generation were just starting to graduate college and enter the workforce this year. Now, many of their plans have been turned around, as they face a frightening job market, and a health crisis unlike any ever seen before. These travelers were already beginning to place a bigger footprint in the travel world, and a post-coronavirus world could affect this.

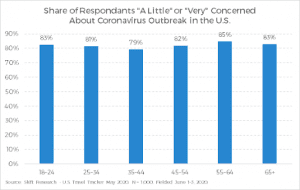

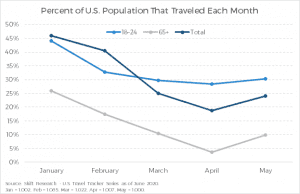

The majority of Gen Z members are as concerned about the virus as other age groups. Prior to the start of the pandemic, Gen Z was traveling slightly less than the U.S. population as a whole. However, since the pandemic, that trend has been reversed, despite the fact that each group has suffered a loss of travel during the pandemic. This change is a reflection of Gen Z’s traveling habits not changing as much as the country’s as a whole during the pandemic.

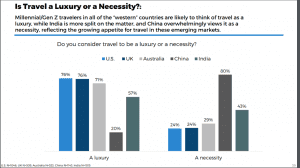

Another interesting note in the post-coronavirus world will be how important travelers view the importance of travel. As consumers around the world look to save money, they may begin to cut out unnecessary spending. Prior to coronavirus, most Gen Z/Millennial travelers in western countries that were surveyed saw travel as a luxury, while an overwhelming majority of these travelers in China saw it as a necessity. Travelers in India had more mixed views.

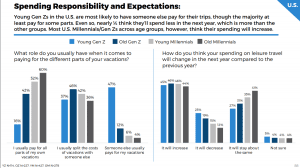

While travelers will be trying to save money, it’s important to remember how they viewed their spending to begin with. While there were some differences in how young Gen Z and older Gen Z members paid for their vacations, nearly half of all Gen Z members felt that their leisure travel expenses would increase in the next year.

With this increase already expected, and with money possibly tighter after the pandemic, travel companies may have to find unique ways to make travel easier for this generation. — Korey Matthews, with Seth Borko.

Wellness Travel Makes Aging Aspirational

The Pandemic's Effect: Going into 2020, it looked as if the midlife crisis was getting an overhaul. Instead of buying a sports car, it was taking a wellness-themed trip to plunge out of routine and into one's inner world.

While that drive may still be there for those in the shifting period known as "midlife," new considerations have emerged for those traveling in this demographic. There's an added dimension of concern for at-risk populations during a pandemic that has been especially hard on older demographics. With that in mind, more people in the aged 50 and above demographic may be staying home for the time being, and rightly so.

However, that doesn't mean the new lease on midlife will go away permanently. With the pandemic normalizing remote work culture, the kinds of long-term sabbaticals that Chip Conley's Modern Elder Academy champion are likely to become more and more mainstream. But a vaccine (or some other form of treatment) will likely have to come first. — Rosie Spinks

Consumer Brands Jump Into Hospitality Mashups

The Pandemic's Effect; We had it right — sort of.

Hotel companies and consumer brands have increasingly partnered in recent years. Watch manufacturer Shinola, designer Giorgio Armani, and crystal company Baccarat are among the many luxury labels to leap from the shopping bag onto a hotel nameplate. Skift envisioned a strengthening of these consumer-hospitality marriages heading into 2020.

A global pandemic may have since upended the world’s hotel industry, but brand mashups are likely here to stay, albeit in a different kind of short-term rollout.

Think more sanitization wipes and less haute couture.

Hilton partnered with Lysol on a heightened cleaning and safety standard aimed to give guests and staff confidence in returning to hotels following the pandemic. Extended Stay America partnered with Procter & Gamble brands like Mr. Clean on its new 10-point cleaning process.

“If safety, sanitation, and security are going to help people get comfortable and restore consumer confidence, that’s a good thing,” said Leora Lanz, the graduate program chair of the Boston University School of Hospitality Administration.

Luxury partnerships aren’t entirely off the table, either.

Health and wellness are expected to remain a leading guest expectation, even when social distancing measures and the mandated use of personal protection equipment in public spaces subsides. That bodes well for partnerships with brands like luxury fitness center Equinox, which opened its first hotel at New York City’s Hudson Yards last year and has additional properties planned for Houston, Los Angeles, and Chicago.

“Wellness was becoming increasingly important pre-Covid, but the pandemic is likely to accelerate brands' efforts in the form of partnerships to have a solid wellness offering that goes beyond ‘the hotel gym,’” said Makarand Mody, a marketing professor at Boston University. “I’m thinking that after consumers have been battered with coronavirus-related physical, emotional, and mental impacts for a year, will wellness become a component of any hospitality and travel brand offering?” — Cameron Sperance

Travel Payments Find Path to Painless

The Pandemic's Effect: One of brutal realities of 2020 for travel companies has been how the surge in mass cancellations revealed the ugly, groaning creakiness of the industry's back-end payment processes. Many companies are still processing cancellations, and many of those delays are due to a lack of automated and properly-synched payment systems.

In the short-term, the crisis will delay progress. Witness how the January plan of payments giant Wex to buy travel sector specialists eNett and Optal for $1.7 billion went sideways in May.

But in the medium-term, the crisis may prod the sector to speed up reforms.

The hotel sector, for example, struggles with a patchwork of systems for processing business-to-business payments. Workers often have to plug gaps by manually entering data into systems, which can introduce the risks of errors and delays.

To address this problem, several industry associations and major brands, including Mastercard, Oracle Hospitality, Voxel, Meliá, and Logitravel, have formed the Open Payment Alliance. The alliance debuted in May a first version of modern technical standards for business-to-business payments in the travel sector.

"Covid has done wonders for our marketing campaign for the alliance, though I obviously would wish the pandemic never happened, given all the suffering it's caused,' said Xavier Ginesta, Voxel's chairman. Volatile times are compelling many companies to reduce the risks they face in transacting with partners, and they're turning to digitizing and automating processes to help with that goal.

Not all of the payment innovations are behind the scenes. The pandemic may drive payments innovation on another front: Contactless tech may gain in popularity, given the heightened concerns about social interactions.

"We're hearing a growing interest from partners in conversational commerce, which can mean payments by chatbot or voice-powered services like Alexa," said Eric Liebman, global head of the travel vertical at Ingenico ePayments, a company that provides one connection to many regional and niche payment capabilities worldwide.

TripActions, a next-gen travel management company, began a push in recent months to mainstream the use of virtual cards for paying business travel expenses, a concept that enables more contactless purchases by business travelers and easier reconciliation by administrators.

Airlines may be the next after corporate travel to push payment innovation, especially by favoring methods where funds flow directly to the carriers. Some airlines like this option because it avoids passing payments through so-called acquiring banks, whose job it is to process credit card payments for carriers while also managing the chargeback risk that could arise from an airline going bankrupt.

"We could see airlines incentivizing travelers to pay for tickets in ways that let them realize the revenue more quickly," said Bart Tompkins, managing director, payments, at travel tech giant Amadeus. Carriers might encourage the use of bank transfer payment methods or new 'instant payment' services, such as Trustly, Klarna, or Sepa, by offering discounts or additional miles and points as incentives, he said.

Key players might even come together and agree on a new framework that reassures acquiring banks while ensuring that airlines can access the liquidity they need in a timely manner.

"We believe increased transparency delivered by real-time data-sharing and new risk frameworks can play a key role in future models," Tompkins said. — Sean O'Neill

Short-Term Rental Winners Emerge

The Pandemic's Effect: Airbnb going public was supposed to be the big news coming out of the short-term rental space this year. But will it still happen?

Airbnb has been hard hit by the crisis and was forced to raise additional funds under far from favorable terms. At the beginning of the year CEO Brian Chesky’s hand was almost certainly ready to push the button to go public, but the situation is now much more uncertain. A move to go public might still be on the books for later this year, but in what form or at what valuation is anyone’s guess.

At the beginning of this year we noted how “branded home managers will find rich pickings in 2020 and beyond. Brand recognition is moving from the online platforms, which will continue to push their brands to attract customers, to on-the-ground branding.” This outlook has certainly received a beating. Many branded property managers did not have the scale or access to cash that Airbnb has, and we have seen many layoffs and some companies closing down.

One business model was always more susceptible to the negative effects of a major economic crisis like this, and that’s the master lease model. Signing 10-year lease contracts while business is booming has come to haunt some players, with Stay Alfred forced to seize trading, and players like Sonder and Lyric forced to downsize their payroll and expansion plans. As markets open up, it will be a land grab for the players that have best dealt with the situation.

With a thinned-out playing field, consolidation will accelerate, and with unemployment at historically high levels, the focus might shift back to the individual host and their properties, rather than multi-property buildings, purpose-built rentals, and second homes.

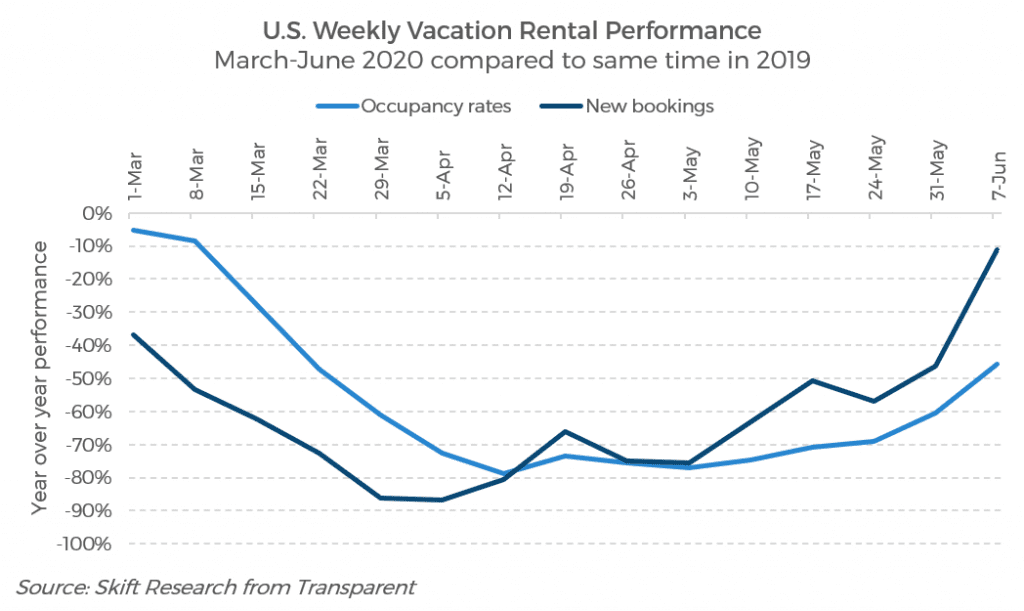

Data shows that the rebuild has already started, at least in the U.S. where domestic tourism remains relatively strong. According to data from vacation rental data provider Transparent, which contributes insights to the Skift Recovery Index, occupancy and bookings are up in the U.S. Key Data Dashboard, another vacation rental data provider connected to property managers with mostly U.S.-based rural properties, has seen new bookings consistently outpacing 2019 levels since early May, although revenue still lags behind last year’s levels by about 10 percent.

As markets reopen, the landscape will have changed, and companies are forced to evaluate how best to move forward. For many players, this is the first major crisis, and while a particularly deep one, it won’t be the last. The sector has proven it has longevity, but some of its more excessive sides might become history. — Wouter Geerts

Smart Design Is Not Just for Luxury Travel Anymore

The Pandemic's Effect: If there’s a sector that can say it is practically built to withstand crises such as Covid-19 that makes contactless travel a virtue, that sector has to be the new-age budget hotel chains. Its smart design has all along centered on a minimalistic concept and a stack of proprietary technology that ensures wide degrees of separation among people.

So not much has changed in this travel megatrend. Except, it’s clear players in the sector have had to raise the bar on the cleanliness and hygiene aspects of smart design, as health safety becomes guests’ number one priority.

RedDoorz for instance, ensures all its hotels in Singapore attain the SG Clean certification. In countries where there isn’t a government-led certification program, it launched HygienePass in collaboration with a local public health organization. Oyo also introduced its own Sanitized Stays tag for properties that clear audit checks for sanitization, hygiene and protective equipment. It has also produced minimal touch procedures for check-in/check-out, and conducted extensive training of on-ground teams on revised ways of working (health screening, disinfecting, distance marking, et cetera).

Room designs of budget hotels are likely to be more minimalistic and functional, if that’s possible, which makes deep cleaning and disinfecting more effective. The challenge will be how to balance a utilitarian space and aesthetics.

A greater use of technology can also be expected. Chains that were contemplating robotics, self check-in/check-out kiosks, no-touch elevators, smart-locking systems, automated temperature regulation and controls, and such will need to accelerate the investment. However, this is Covid-19's biggest setback to budget hotel chains, as they too have been hit by Covid-19. Players like Oyo are also having to prioritize measures to support asset owners in different regions of India, its biggest market.

The one thing that will be wiped off from budget hotel design is the thriving social calendars and communal spaces that are the backbone of some hostels and budget vacation rentals.

For now, silence is golden. — Raini Hamdi

Data’s Breakthrough for Events

The Pandemic's Effect: The meetings and events industry is living through the most significant change it has ever experienced. In February 2020, business events around the world were halted, bringing the whole industry to an unprecedented freeze. With 1.7 billion people under some form of lockdown, many realized the importance of continuing to meet via virtual events.

The event industry is traditionally resistant to the use of technology. In our Skift Megatrend, Data's Breakthrough For Events, we anticipated more event professionals adopting all-in-one event planning software to take a more strategic and data-driven approach to running events.

The rise of virtual events has fast-forwarded the process dramatically, forcing many technology-reluctant planners to delve into the data offered by virtual event platforms.

While the demand for virtual meetings has in fact skyrocketed, many single-vertical event technologies such as event apps have developed integrated tools to run virtual meetings, opening up to better data analysis. End-to-end virtual event platforms now offer an unprecedented array of data that event planners can use to better understand attendees.

The next generation of event professionals is currently being forged. By looking at the incredible wealth of data coming from virtual event platforms, we can expect a seismic shift in mindset that will change the way live events are planned once the industry reopens. Meeting and event planners will be able to spark new ideas and provide better tangibility to sponsors and other key stakeholders by using the data muscles they developed during the pandemic.

Data is also driving the road to recovery for the industry. In a recent interview, Eventbrite CEO Julia Hartz mentioned that the company’s data is pointing to a restart of the live event industry in the form of smaller meetings, such as seminars and workshops.

Announcing the transition to virtual of their annual 5,000 attendee meeting, Reggie Aggarwal, CEO of Cvent, reinforced the company’s commitment to educate event planners on the use of technology and data: ‘We recently made all of our event management and hospitality trainings and certifications available for free to anyone in the industry who could benefit from the opportunity to sharpen their skills, strengthen their resume, and enhance their industry knowledge.” — Julius Solaris

The Rise of Ultra-Long-Haul Flights Is Changing the Way We Travel

The Pandemic's Effect: Six months ago, there was no doubt about this trend. Airlines had invested in new airplanes capable of connecting nearly every major city on the globe, in a profitable way, and they intended to use them to open new routes.

Tech’s Power Grab for Corporate Travel

The Pandemic's Effect: Earlier this year, we explored how startups were piling pressure on the corporate travel agency incumbents, in part backed by extensive venture capital funding.

Since January, Coronavirus has accelerated this trend; the smoking gun a notable shift in corporates switching to these new platforms. There’s admittedly some element of hype as some lay claim to their biggest client wins (TripActions said it has signed up 265 new customers in the past three months), despite the pandemic. To some extent, this kind of marketing hyperbole is nothing new from the startups, but Skift has heard of several companies jumping ship to the younger agencies as they look for more digital and agile ways of working, or in some cases just a breath of fresh air from companies that are eager to please.

The recognition companies will be traveling less in the future is, unfortunately, behind the acceleration of this trend as well. In the short term, there’ll certainly be a need for hand-holding as employees tentatively return to the skies. But medium and long term, businesses will seek lower fees and a lower touch service, even more self-service, and the emerging platforms, including Taptrip and TravelPerk, may be better positioned to cater for this.

In January, we also reported everyone wins; back then, we weren’t counting on a pandemic followed by a recession. The legacy travel management companies won’t see corporate travel return to the dizzy heights of 2019 for a few years, and stand to lose more customers in the downsizing that lies ahead.

With a renewed focus on traveler wellbeing, as well as health and safety, in the post-Covid 19 landscape, the challenge for startups will be convincing travel managers they’ve got a hold of duty of care and traveler tracking.

These technology-focused platforms will also need to keep one eye on the emerging virtual meeting trend. Corporate travel programs could soon incorporate hybrid solutions that blend face-to-face meetings and events with remote technologies. This could arguably be the next megatrend in corporate travel, with the sector poised for yet another tech power grab. — Matthew Parsons